Most commonly, this is the legal framework at play when you are sued over mistakes made by your contractors, employees, or agents. An employer is held responsible for the acts of an employee.

What Is Vicarious Liability? a Legal Guide for Dummies

The exceptions to this doctrine are thus:

What is vicarious liability in insurance. You or your entity contract to have professional services provided on your behalf. Vicarious liability refers to a situation where someone is held responsible for the actions or omissions of another person. Let’s explore what the issue of vicarious liability really means for healthcare companies, and how it can be prepared for.

Vicarious liability refers to the liability assigned to one party for the acts of another. The reason most people haven’t heard of the term is because these judgments are much more common in business settings. Vicarious liability exists when one person or organisation is held legally responsible for the acts or omissions of another person or party.

The third party also carries their own share of the liability. When insurance is provided as a contingent only basis, this means that cover applies only when that of the individual healthcare practitioner’s own indemnity insurance would not. The exceptions to this doctrine are thus:

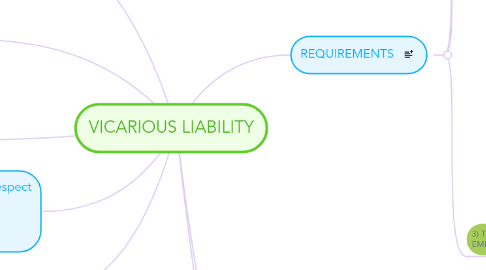

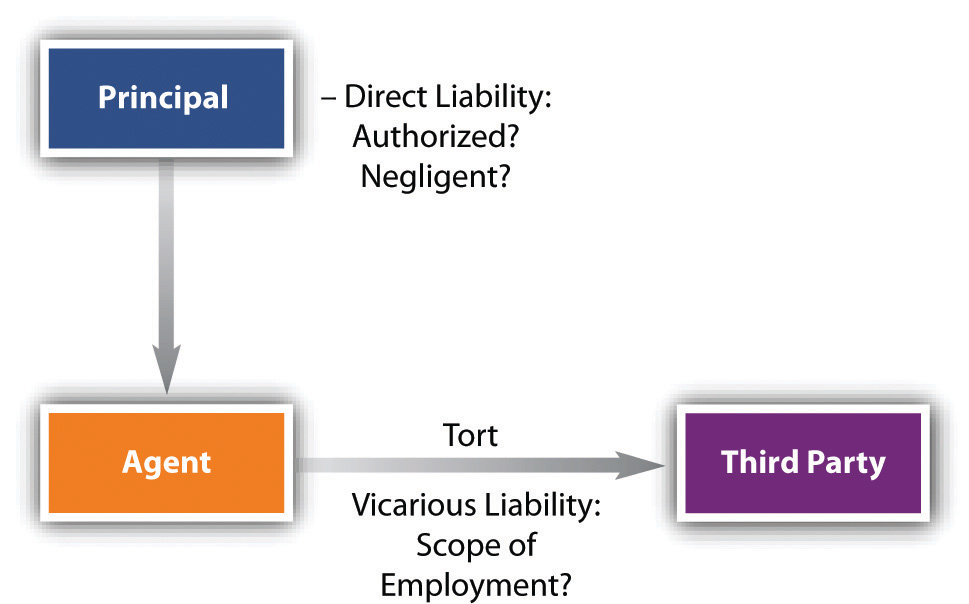

Vicarious liability is a legal doctrine which holds the principal liable for the wrongs of the agent. Vicarious liability is established when an agent of the principal commits a negligent act during the scope of their employment. Vicarious liability can result from the acts of independent agents, partners, independent contractors, employees, and.

“vicarious liability” essentially means that if someone else drives your car with your permission and they are at fault in an accident, you become liable for paying for any resulting damages and injuries. Vicarious liability is legal principle that states that a party can be held liable for the negligent actions of another party with whom they have a special relationship, such as parent and child, employer and employee, and vehicle owner and driver. Vicarious liability — the liability of a principal for the acts of its agents.

Vicarious liability insurance definition in any situation where you have someone else representing you or your business interests in any sort of official capacity, it creates an environment where you could be found to have vicarious liability. Vicarious liability exposures develop when: Vicarious liability of an employer over employee’s actions one of the main legal principles of vicarious liability is respondeat superior , which is latin for “let the master answer.” simply put, this means that an employer may be held financially liable for the actions of an employee who is acting within the scope of his or her employment.

Vicarious liability exists because of the way the law protects victims. To decide the optimal amount and type of insurance needed, you should evaluate the potential for vicarious liability, which is best discussed with your insurance broker and counsel. In most instances, your insurance policy will cover someone if they are borrowing your car, but there are times when an insurance company.

Various types of insurance policies can help cover the expense of defending yourself against a vicarious liability claim. Under the theory of vicarious liability, a party acting in a supervisory position of the. It’s important to understand how your company could be held liable for the actions of others, including employees, volunteers, contractors, partners, and others.

Examples of current statutes limiting lessor vicarious liability and mitigating the need for contingent vicarious liability insurance follow. Vicarious liability is a legal theory that holds a third party liable for your injuries, even if they were not directly involved in the incident that caused your injury. The simplest vicarious liability definition is “liability for the actions of an employee or contractor.” in a medical setting, this may refer to situations when a patient experiences a negative medical outcome by working with one employee and files a lawsuit against the entire hospital.

The tort doctrine that imposes responsibility upon one person for the failure of another, with whom the person has a special relationship (such as parent and child, employer and employee, or owner of vehicle and driver), to exercise such care as a reasonably prudent person would use under similar circumstances. This is what is known as “vicarious liability,” or instances in which your business is held responsible for the actions of an individual. Vicarious liability is established when an agent of the principal commits a negligent act during the scope of their employment.

In the context of insurance, employers or other parties at risk of vicarious liability may need. In general, vicarious liability is the liability of being deemed partly at fault even by an act caused by a third party. Vicarious liability is a legal doctrine which holds the principal liable for the wrongs of the agent.

This is most commonly found within the business and commercial environment when things although previous unsuccessful attempts have been made in the uk to place the responsibility for the actions of minors. Vicarious liability is a legal doctrine that assigns. Vicarious liability insurance protects you and your business from lawsuits resulting from mistakes caused by your employees, the independent contractors you’ve hired or agents that act on behalf of your small business.

Vicarious liability is a common insurance concept that applies in many situations where companies could be sued. Vicarious liability is when you or your business are held financially responsible for the actions of another person or party. In some personal injury cases, there could be more than one party liable for your damages.

For example, a tech company could be held accountable for the actions of an employee. Vicarious liability exists outside of the employee/employer relationship, including in areas such as the medical field and business partnerships joint venture (jv) a joint venture (jv) is a commercial enterprise in which two or more organizations combine their resources to gain a tactical and strategic edge in the market. When you have vicarious liability for something, it means you could be held legally responsible for any resulting harm even though you didn’t directly cause it.

Employers and business owners benefit from vicarious liability cover as part of their aop membership, subject to meeting the terms and conditions of the cover. Vicarious liability is a situation in which one party is held partly responsible for the unlawful actions of a third party.

Vicarious Liability Insurance Company inspire ideas 2022

Vicarious Liability Insurance Examples Digitalflashnyc

Vicarious Liability Insurance Company inspire ideas 2022

Vicarious Liability whose liability is it anyway? 4 New

What Is Tort Law In Insurance An TV News

Vicarious Liability Insurance Company inspire ideas 2022

Vicarious Liability Insurance Company inspire ideas 2022

Vicarious Liability (What Is Vicarious Liability

Apparent Authority Insurance Law Awesome

Vicarious Liability Insurance Company inspire ideas 2022

Vicarious Liability Insurance Canada kenyachambermines

What is Vicarious Liability, And Why Does It Matter

What is Vicarious Liability, And Why Does It Matter

Vicarious Liability Insurance Company inspire ideas 2022

Vicarious Liability What Is It and How Does it Work

Vicarious Liability Insurance Definition Digitalflashnyc

V is for vicarious liability IOSH Magazine

Social Work Liability Insurance Texas kenyachambermines

Vicarious Liability Insurance Company inspire ideas 2022