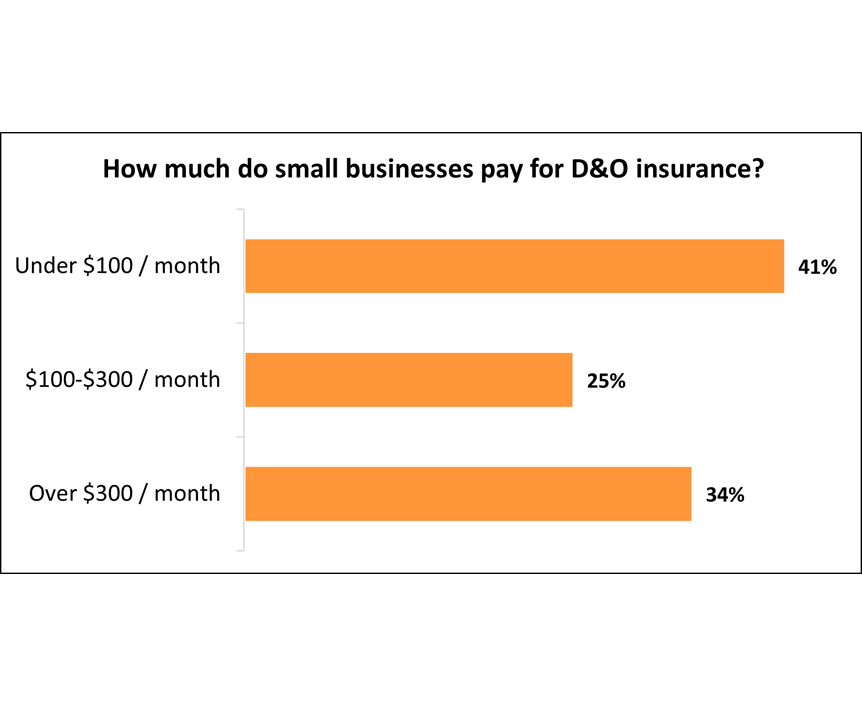

That is where a good broker can come in; The average price of a standard $1,000,000 directors and officers liability insurance policy for small businesses ranges from $87 to $119 per month based on location, financials, industry, payroll, sales and experience.

Directors and Officers Liability Insurance or (D&O

The report shows an upturn in d&o pricing in 2018, and it’s been climbing since.

Average cost of directors and officers insurance. Click here to access the full q3 2021 d&o quarterly report and past reports. They will find the best coverage available, highlight the coverage differences between insurance carriers, and negotiate a price on your behalf. The average premium has reduced by a third over that seven year period.

The protection that directors & officers insurance provides gives investors guarantees that your business is serious about its growth. Many directors’ and officers’ insurance policies are paid as a monthly figure which can cover directors and officers for. According to a price index report by transre, a property and casualty reinsurance company, rates are picking up across the board.

Directors’ and officers’ liability insurance D&o claims can be incredibly expensive and knowing that the startup you’re investing in has coverage and will not be paying legal fees and potential settlements out of pocket shows investors that the company’s leadership is serious about. The average cost of d&o insurance.

The trend in average premiums has shown a consistent reduction from $5939 in 2003 to $3830 in 2009. Directors & officers insurance cost. The average cost of “directors and officers” insurance has almost doubled in the past two years, meaning a basic but essential product that once was a.

Over the past seven years the overall trend of average premiums per policy has been to fall. For the q3 2021 edition of the report, average price per million 4.3 percent in the third quarter. Affordable quotes for directors and officers professional liability insurance rates for d&o insurance are affordably priced.

According to this report from advisen, a provider of information and analytics services to the commercial insurance industry, the average annual cost per million dollars of coverage paid by private companies with revenues up to $50 million falls in the $5,000 to $10,000 range. Also, d&o insurance can cover defense costs for the entity itself as well as the company’s directors and officers. The costs of directors and officers insurance can vary substantially depending on the cover required, the size of your business, your industry, revenue, debt and legal history.

Median directors and officers insurance costs for tech businesses. Therefore, executives in search of coverage should insure themselves to the highest degree to protect the company’s assets. Directors and officers insurance (d&o) is a type of officer’s liability business insurance that protects corporate board members like directors and officers from certain liabilities in the event that someone sues them for wrongful acts conducted in the course of their duties.

It’s no surprise that company size impacts the cost of d&o insurance. How much is average cost of directors and officers insurance? But you may be able to secure sufficient coverage for much less.

Average cost of d&o insurance. In 2016, the average d&o claim was for $387,000, and typical claims might run into the millions of dollars. For insureon customers, the median cost of d&o insurance is $103 per month , or $1,240 annually.

Similarly, the number of employees and operational costs factor into determining the costs of individual policies. How much will d&o insurance cost? Advisorsmith found the average cost of directors and officers liability insurance for small businesses was $1,046 per year.

The average annual cost of $1,000,000 worth of coverage is usually in the range of $5,000 and $10,000. Depending on deductibles and other variables, d&o insurance can cost approximately $60 to $100 per employee per year. The cost of d&o insurance varies according to the circumstances of each business, but you can expect to pay between $5,000 to $10,000 annually for $1 million in coverage.

This cost survey included small businesses with under $500k in revenue in 27 industries, including retail, wholesale, manufacturing, consultants, contractors, and more. Tech businesses pay a median premium of $451 per month or $5,408 per year for directors and officers insurance. Median cost of directors and officers insurance the cost of d&o insurance primarily depends on the size of your business and the number of employees.

Underwriters may ride the pricing wave Cost of d&o insurance by company size. The average annual cost of $1,000,000 worth of coverage typically falls between $5,000 and $10,000 for companies with revenue below $50 million a year.

However, the average cost of directors and officers insurance is around $600 for $1 million in coverage. It costs per million dollars of coverage paid by private companies. The cost of d&o insurance depends on a number of factors, including the size of your business, the makeup of your board of directors, and your prior claims history.

Directors and Officers Insurance is it Mandatory for any

Directors & Officers Liability Aviso Group

Directors & Officers Liability Insurance Corporate Risks

What is Directors and Officers Insurance? AmTrust Financial

Directors And Officers Insurance Cost D O 101 A Holistic

D&O Insurance Coverage, Costs & Exclusions

Insurance Nіne Mile Self Storage Abdi Masa

Directors And Officers Insurance Cost D O 101 A Holistic

Directors & Officers (D&O) Insurance CoverWallet

Directors & Officers Liability Insurance Should you be

Directors and officers liability Insurance Inzurly

Directors and Officers Insurance Cost Insureon

Average Cost Of Directors And Officers Insurance Average

Directors & Officers Liability Quest Insurance The

Cost for Directors & Officers Insurance D&O Insurance

Directors & Officers Insurance Resilium Insurance

How much does Directors and Officers insurance cost UK?

Directors and officers insurance cost insurance

What is Directors and Officers Insurance?