Captive management general management services The company's filing status is listed as forfeited and its file number is f05673686.

Debunking SRS myths Insurance OCBC Singapore

1) manulife retireready plus iii, 2) ntuc income gro retire flex, and.

Srs insurance. There are many approved schemes under srs: • srs wholesale (re)insurance brokers s.a., which places business in the open market, as a wholesale broker. Our staff delivers excellent, honest and efficient work while providing the best customer care possible.

To participate, all you have to do is open an account and make a contribution. Srs is the first insurance manager to complete ssae 18 reviews on its insurance management services across all domiciles. From unit trusts to stocks and etfs.

Srs is a domicile neutral, privately owned firm full of experienced staff that brings an unmatched technical expertise. Srs insurance offers commercial coverage including, but not limited to: Commercial auto, business owners’ policies, workers compensation, directors and officers, civic associations, special events and much more.

Simply submit policies from a case inside your srs software using data you've already entered for the deceased, family and invoice. For more than 25 years srs has been providing management and consulting services to the insurance and alternative risk financing industry, and we are continuously working to improve our services and provide expert advice, utilizing innovative custom solutions for our client’s benefit. If you are looking to invest your srs money in single premium insurance plan, we have summarised the solutions for you to make an informed decision.

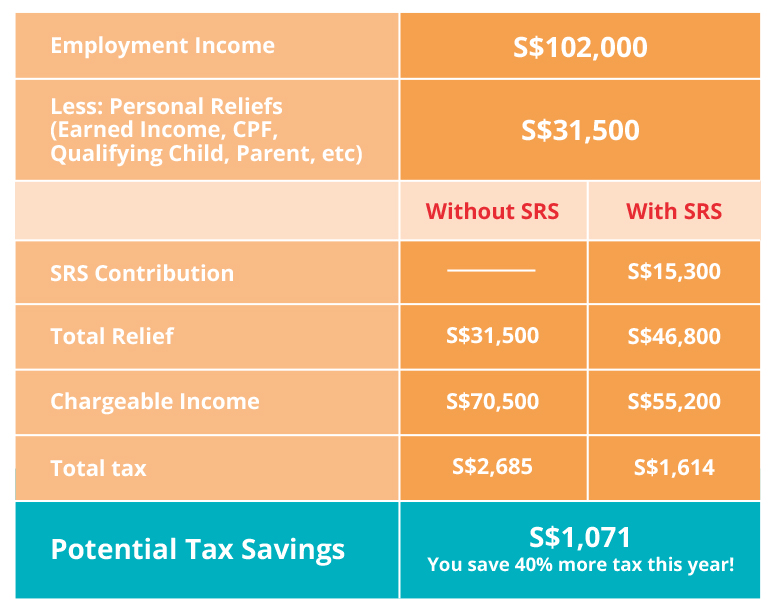

Based on the 2020 mof srs statistics, insurance is the second most invested class of approved products after “shares, reits, etfs”. However, unlike cpf, srs completely voluntary and its main draw is letting you enjoy tax benefits on your contributions. Policies have an extra layer of protection.

This video briefly explains what are the key components that you should be aware of when requesting an insurance binder for your business insurance coverage. • special risk solutions (srs) underwriting agency mga s.a., which underwrites on the behalf of. The registered agent on file for this company is the corporation trust incorporated and is located at 300 e lombard st., baltimore, md 21202.

What are srs investment options? Required forms for insurance assignment claims are automatically generated with existing and provided information. Insurancequotes term life insurance quotes life insurance quotes insurance broker.

According to srs statistics, there are 116,466 srs accounts with a total contribution of 5.97 billion singapore dollars. Our group consists of two companies: We are committed to maintaining and improving our control environment with the ongoing use of ssae 18 reviews and the implementation of other total quality management initiatives.

Above all, it gives a better chance to counter the inflation while providing some level of certainty. An aor is a document that you use to move a policy from one age. Is a maryland foreign corporation filed on february 8, 2000.

Investing your srs funds gives you the opportunity to optimise them, as the current interest rate on uninvested balances in srs accounts is at 0.050% p.a. In the event that a life insurer were to fail,. Contributions to srs are eligible for tax relief subject to a maximum of $80,000 for all tax reliefs claimed.

Special risk solutions (srs) group of companies is an independent group based in athens, greece. Withdrawals after the legal retirement age (currently 62) enjoy a 50% tax concession. Srs) is not strange to most singaporeans.

And scotiamcleod a division of scotia capital inc. Aviation liability coverage to a business for bodily injury, personal injury, and property damage caused by the business’ operations, products, or injury that occurs on the business’ premises. There are insurance products designed for the srs scheme which helps to organize the withdrawals into regular income from age 62 onwards.

The supplementary retirement scheme (srs) is a national scheme, like cpf, that aims to help singaporeans save for their retirement. Watch this brief video that explains the basic steps to completing an agent of record letter. Srs has built a solid reputation based off of quality work completed correctly and on schedule.

Srs is highly recommended by insurance companies and we work with them from beginning to end, allowing you to carry on with your daily life. From bonds to endowment insurance plans; Yet there are still $1.91 billion left in the srs account as cash.

In next sections, we give an overview of different single premium insurance plan allowed for srs investment and a simple guide on choosing one for yourself. This is probably because most average investors usually find insurance products suitable. Insurance products bought with supplementary retirement scheme (or with cash) are usually protected by the policy owners’ protection scheme which is administered by the singapore deposit insurance corporation (sdic).

It is a deferred tax scheme which helps you save for the future while reducing your tax expenses now. 3) singlife with aviva mylifeincome iii. 26% of total srs monies are invested in insurance products.

Srs contributions come with tax reliefs. We can help you build and protect your business, large or small, through customized and affordable insurance plans. Provided by srs wholesale (re)insurance brokers s.a.

Although all 3 have similar features and benefits, such as allowing your single lump sum srs premium to accumulate and pay out a steady stream of. Insurance products bought with srs funds are protected. Please visit the mybenefits website to make enrollment decisions, view/change current coverage, and find plan administrator information.

The limit on contributions is s$15,300 for singaporeans and permanent residents and s$35,700 for foreigners. The trust 111 rockville pike suite 700 rockville md 20850 voice.

SRS Insurance Guide How to use SRS to buy Insurance?

SRS Insurance Guide How to use SRS to buy Insurance?

A Guide to How SRS Accounts Can Work for You DBS Singapore

10 Investments You Can Make With Your Supplementary

SRS Insurance Guide How to use SRS to buy Insurance?

Debunking SRS myths Insurance OCBC Singapore

Complete Funeral Home Management Software & Websites SRS

Supplementary Retirement Scheme (SRS) DBS Singapore

AK O SRs Life Insurance Agent career in PK

SRS Ungrossed FTSE 100 Insurance Companies Office for

SRS Academy on the topic News at the turn of the year in

SRS Insurance Guide How to use SRS to buy Insurance?

The SRS Group Insurance Journal

Supplementary Retirement Scheme (SRS) What Can You Invest

Debunking SRS myths Insurance OCBC Singapore

If you ever wondered what an SRS Insurance approval letter

![]()

SRS names head of new Guernsey operation Business Insurance