Pensions can be set up to where you pay into. It is written in generic terms

Insured Retirement Plan Pros And Cons inspire ideas 2022

Your pension will vary according to the type you have but typically it involves your employer, if you have one, putting away money each month along with your own contributions that you’ll use in your retirement.

Life insurance vs pension plan. Key benfits regular income for lifetime with return of purchase price. You are planning for your future and the future of your family members. Moneylion can help boost your financial safety net.

Government employees are eligible for nps. A few pension plans may also provide some life cover. Life insurance isn’t for everyone, and neither is survivor benefit plan coverage.

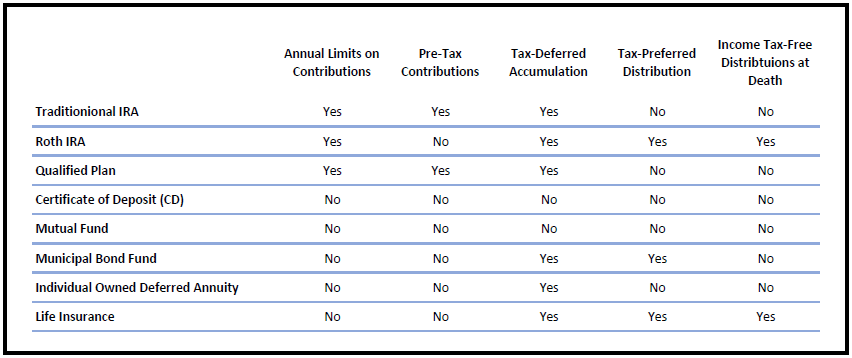

The amount usually depends on the age of the employer and the tenure of their employment. As there is no maturity benefit offered by the policy the premium rate of the term plan is lower: Pension maximization the following chart should help to further illustrate the potential

Retirement plan and pension plan are two sides of the same coin. Employees are supposed to contribute 10% of their basic pay plus dearness allowance to the nps, with the government. (2020), pension and annuity income. accessed dec.

Retirement plans are a personal choice of the individual. Along with the standard pension plan, many insurance companies now sell extra benefits such as life insurance, tax advantages, etc. Both plans make it possible for you to provide money for your loved ones in the event that you die.

The returns are steady but not substantial. They can invest across stocks, government securities, corporate bonds and money. This life insurance policy then creates the “survivor” benefit, and potentially more, once he passes.

An example of a pension plan is the national pension scheme (nps). While pension plans are funded by the employer, retirement plans may or may not be funded by the employer. In pension plans, both the employer as well as the employee regularly contribute to the pension fund which in turn, provides pension to all employers.

Any cash values from the life insurance policy can be utilized heirs receive nothing from the pension plan upon the death of the second spouse beneficiaries of the life insurance policy can be named comparison of joint and survivor option vs. The objective is to offer stable returns, as opposed to high returns marked by volatility. In such cases, the mortality charges will eat into your returns.

For instance, this one has an investment guarantee charge. Here are a few differences between life insurance plans and pension plans. Pension plans a pension is provided by the company that you work for.

The benefits of pension maximization plans The benefits of life insurance come into use once you pass away and it means that your family will be financially looked after. Click here to buy this plan online.

A life insurance retirement plan (lirp) is a cash value life insurance policy that’s used to supplement other retirement funds. While this is how it works across endowment pension schemes in general, the details vary across insurers. Can’t beat nps at costs.

With nps, you can contribute varying amounts. Pros and cons of taking out life insurance and a pension pros: You will provide for your own retirement as well as for your family when you are no longer around.

Thus, life insurance plans find a place in every aspect of your life and give you financial security. This however does not happen with pension plans where you can withdraw up to only one third of the maturity amounts. The national pension scheme is a pension fund provided by the indian government to its employees (nps).

However, in the case of pension plans this tax deduction remains under the section 80ccc and the limit is. The life insurance policy charges a higher premium rate as compared to a term plan: Life insurance comes in many variants which constitute the different types of life insurance plans.

Daniel kurt is an expert on retirement planning, insurance, home ownership, loan basics, and more. Hdfc life guaranteed pension plan. A life insurance plan offers both death benefit and maturity benefit to the life assured:

In summation, a pension plan is where a retiree chooses the maximum benefit from his pension, where a portion of it is earmarked for a life insurance policy. A brief discussion on the similarities and differences in delivering a pension benefit through insurance or a pension fund (or other occupational vehicle) further to earlier discussion in iaa committees, this paper considers in high level terms similarities and differences between life insurance and pensions. Similarly, there are pension plans which create an earmarked retirement fund and promise lifelong incomes.

An investment could be created to. So, before you make your final decision, consider a pension plan that can provide you with additional benefits which can be helpful in the future. If you are not an employee of a company that offers pensions, you will not be able to obtain one on your own.

They offer an extra layer of security and help to fortify your financial safety net. Term life insurance, which doesn’t have a cash value component, cannot be used for a life insurance retirement plan.

401k vs Annuity Top 5 Best Differences To Learn (With

Which Type Of Life Insurance Offers Flexible Premiums A

Insured Retirement Plan Pros And Cons inspire ideas 2022

Fers Survivor Annuity Vs Life Insurance Awesome

Which Type Of Life Insurance Offers Flexible Premiums A

Insured Retirement Plan Pros And Cons inspire ideas 2022

How Does A Flexible Premium Adjustable Life Insurance

Insured Retirement Plan Pros And Cons inspire ideas 2022

Life Insurance Premiums Explained Life Insurance

Insured Retirement Plan Pros And Cons inspire ideas 2022

Which Type Of Life Insurance Offers Flexible Premiums A

IRA vs. Life Insurance coverage for Retirement Saving

Defined Benefit Pension Plans Vs Defined Contribution

Insured Retirement Plan Pros And Cons inspire ideas 2022

Insured Retirement Plan Pros And Cons inspire ideas 2022

Life Insurance Retirement Plan (LIRP) for Supplemental

Annuities Versus Investments (2022)

Single Life Annuity Vs Lump Sum

Life Insurance Vs 401K A Smarter, Safer and More