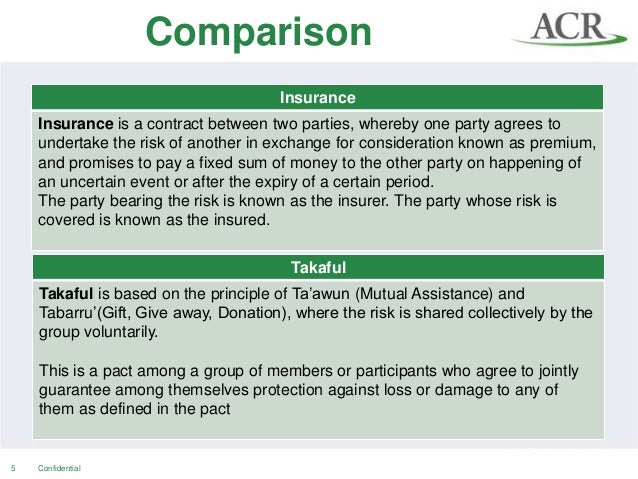

Takaful is void of any elements of gharar, maisir, or riba. Insurance insurance is a contract between two parties one party agrees to undertake the risk of another in exchange for consideration known as premium and promises to pay a fixed sum of money to the other party on happening of an.

This is due to the apparent similarity between the contract of kafalah (guarantee) and that of insurance.

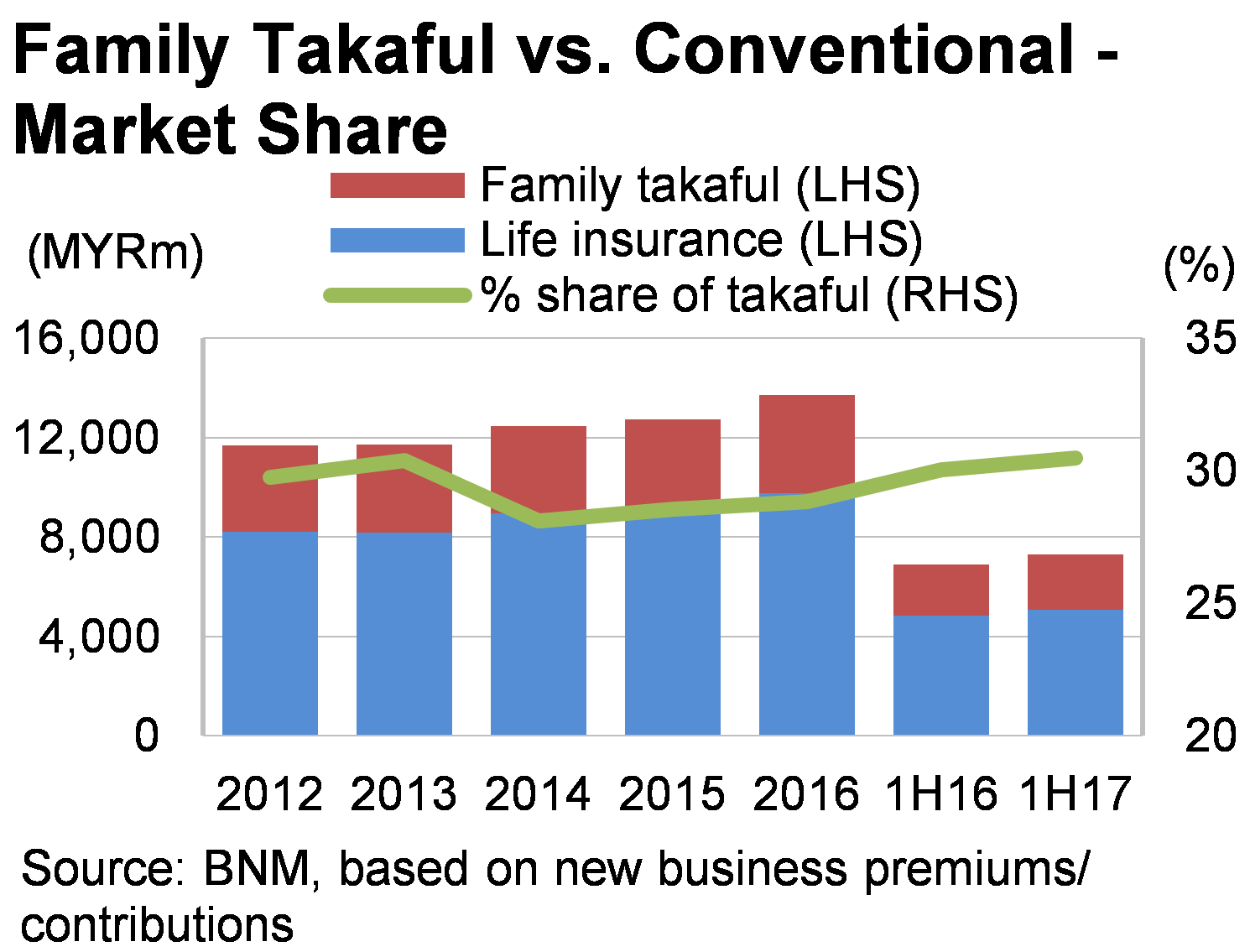

Takaful vs insurance. One isn’t necessarily cheaper than the other, but in terms of ‘extra risk premiums’, takaful insurance may be better in terms of cost. In a takaful policy, if you do not make a claim during that year, you are eligible for a certain percentage of profit sharing depending on the company’s profit. Takaful is a relatively new insurance product that is marketed as an islamic alternative to conventional insurance and is often referred to as “islamic” insurance.

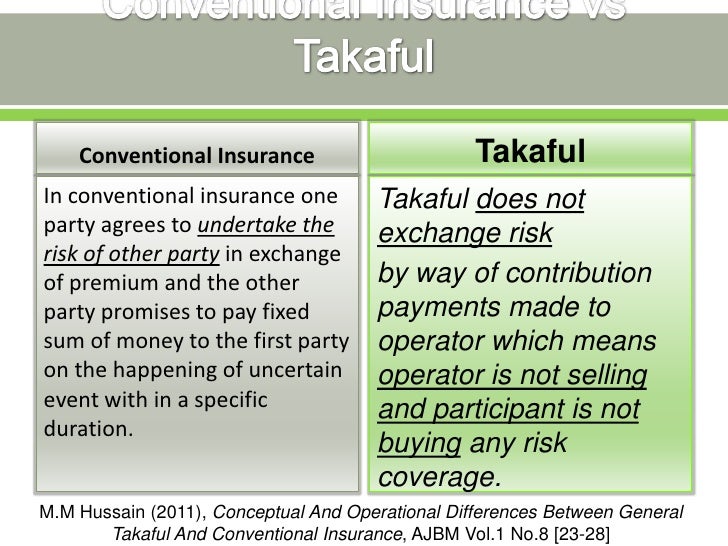

Insurance vs takaful presented by: In arabic, takaful means “guaranteeing each other” and so, takaful insurance is an islamic insurance theory that is compliant with islamic law (sharia) and is a mutual risk transfer arrangement which involves operators and participants. Islamic takaful insurance vs conventional insurance.

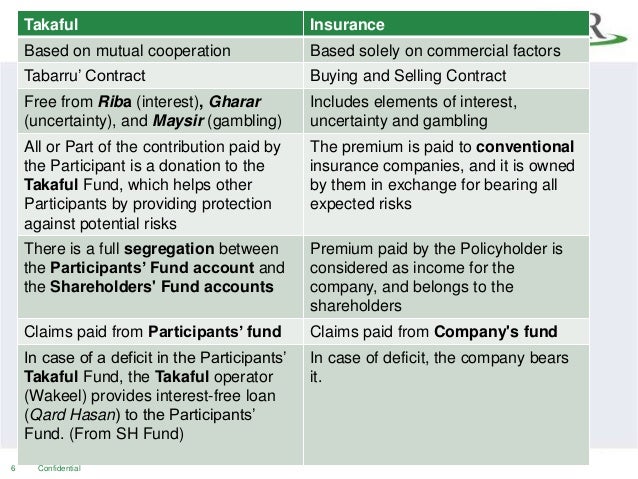

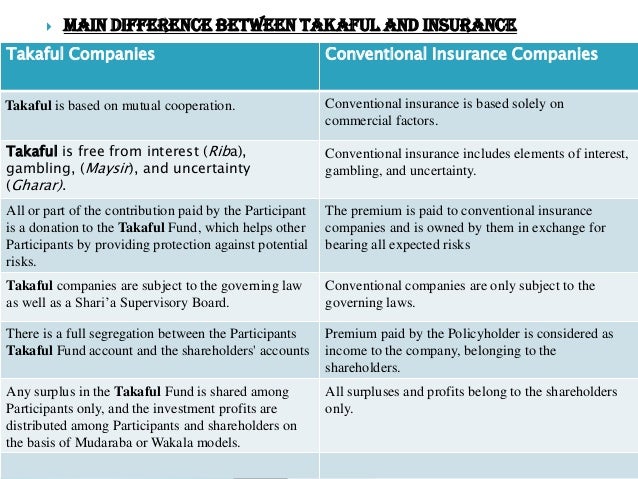

The most glaring difference between takaful and conventional insurance is takaful complies with sharia law. However, takaful is founded on the cooperative principle and on the principle of separation between the funds and operations of shareholders, thus passing the ownership of the takaful (insurance) fund and operations to. 19 full pdfs related to this paper.

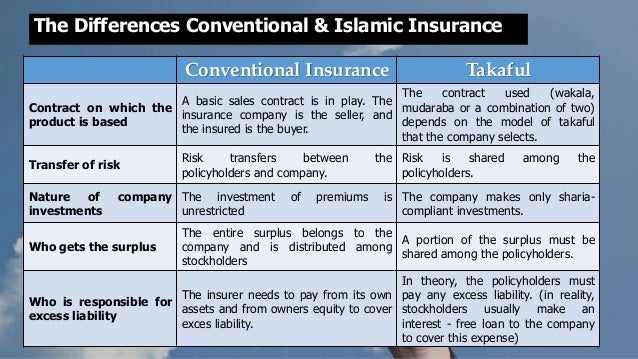

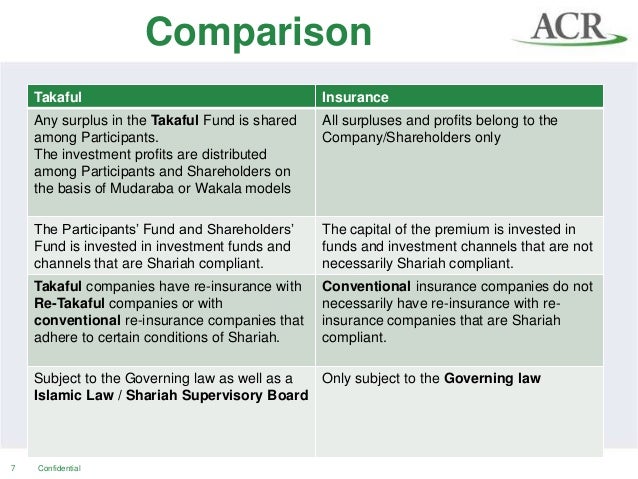

As a cooperative insurance, members or policyholders or participants contribute a certain sum of money to a common pool so as to cooperate among themselves for a common good. Differences between takaful and conventional insurance. Although both takaful and conventional insurance have similar basic principles that provide protection in the event of unforeseen events and contributions must be made to start the coverage, there are some major differences between both.

Although both offer the same purpose which is to protect the insurer, there are some major differences between both. The following table summarizes the main differences between both systems. Asim qaseem uzair nawaz fakhar tayyab m.burhan ali zayed saleem 2.

Always wondered what is the difference between takaful and life insurance? Takaful was created as an alternative to conventional insurance mainly to avoid these prohibited elements. Any surplus that occurs from the invested funds is distributed to the participants and the takaful operator.

Takaful is a relatively new insurance product that is marketed as an islamic alternative to conventional insurance and is often. The other difference between the two types of insurance is profit sharing. The only difference would be that a takaful plan may extend to include islamic obligations such as travel and medical coverage for hajj and umrah.

The intention of the contributor is to help or assist those in need. This is because when you purchase conventional insurance the amount of coverage you’re entitled to isn’t left to chance. But, man always tried hard to get rid of this ‘bad’ companion.

Because of the uncertainty that gave birth to concepts of safety and protection. A short summary of this paper. Takaful is a type of islamic insurance wherein members contribute money into a pool system to guarantee each other.

Conventional insurance takaful and conventional insurance companies share the same objective of providing protection to you, your loved ones and your valuable possessions. A sort of islamic form of insurance. Takaful is described as a cooperative insurance.

The difference between insurance and takaful. Takaful vs conventional insurance in arabic, takaful means ‘solidarity and cooperation among group of people’. The takaful plan is a shariah compliant version of insurance while the conventional insurance is not.

Differences between takaful and conventional insurance: (a) the takaful company exists for reasons other than to profits its stockholders • in conventional insurance, the insurance company exists to maximize profits, that the primary goal. Takaful is commonly referred to as islamic insurance;

This is because takaful fund rates are generally fixed and people deemed to carry extra risk aren’t typically charged more, unless in severe situations that would cause losses to the entire fund. Both insurance policies and takaful cover the same range of products including house, car, life, personal accident, medical and more. What is the most important feature that distinguishes takaful from conventional insurance;

This is a significant difference for muslim customers in malaysia as they might choose the shariah compliant plan as urged by their religious teaching. Despite the remarkable growth in the insurance industry over the past two decades, few studies evaluate the performance of takaful vs. Takaful have other key features that set them apart from conventional insurance products:

In insurance, everything is planned according to the profit that each party will earn, however, earning profits is not the major purpose of takaful concept. However, with takaful insurance, the coverage the customer ultimately receives depends on. This means that from the customer’s point of view, takaful is an inferior insurance product compared to conventional insurance!

Is that “insurance” is a means of indemnity against a future occurrence of an uncertain event and “takaful” is a cooperative system of reimbursement in case of loss; The takaful insurance on the other hand does not include such a benefit. And they even lived together in paradise.

The conventional insurance is a contract between two parties whereas takaful is a relationship in which everything is shared.

TAKAFUL (ISLAMIC INSURANCE) vs CONVENTIONAL INSURANCE

Takaful Vs Conventional Insurance Takaful Bukan Sekadar

Difference Between Insurance And Takaful englshdira

Difference Between Takaful And Conventional Insurance

How Does Takaful Compare To Conventional Insurance?

Takaful Vs Conventional Insurance

EZTakaful Blog Lifestyle and Insurance/Takaful Related

The Best Insurance and Medical Card in Malaysia ASASASAS

Conventional Insurance vs Takaful Apa perbezaannya

Takaful Beside You Takaful vs Insurance

Conventional Insurance vs Takaful Apa perbezaannya

What difference between "Takaful vs Conventional

Insurance Vs Takaful malaycoco

Takaful Insurance vs Conventional Insurance The Money Doctor