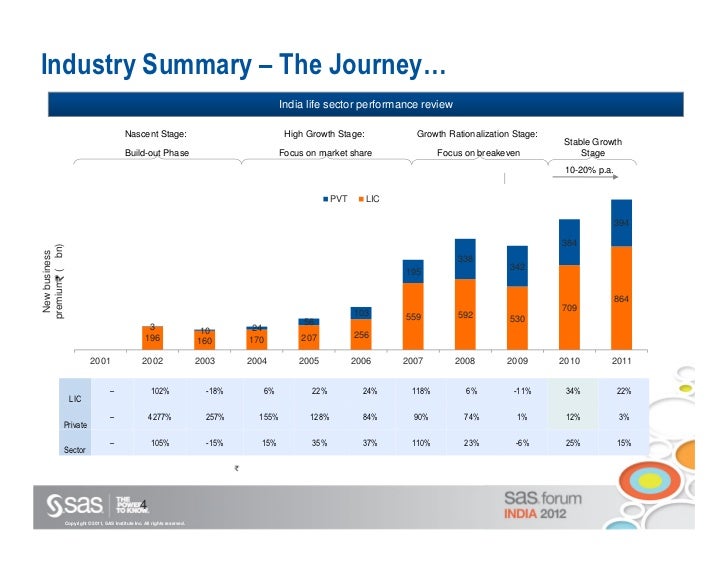

Paths/scenarios for the industry:technology discontinuities (big data, mobility, The life insurance industry in india grew by an impressive 36%, with premium income from new business at rs.

COVID Situation Health Minister Mansukh Mandaviya To Hold

107 insurers integrated and grouped into four companies viz.

Current scenario of insurance industry in india. And the united india insurance company ltd. Changing scenario of indian insurance sector: It alone accounts for around 29% of total general insurance premium income earned in india.

The insurance industry market size in india market share of top companies in terms of gross direct premium. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023. Gic was incorporated as a company.

Hence, the business of insurance has always been closely. Impact on the indian insurance industry Was constituted as an autonomous body in 1999 to regulate and develop the insurance industry.

At the same time, problems in this sector are also many which are. India's share in global life insurance market was 2.73 per cent during 2019. The insurance industry seeks to protect a country’s people, assets and businesses.

253.43 billion, braving stiff competition from private insurers. Too as they will have an edge in the future market scenario, says an industry expert. Current status of insurance sector.

On being asked about the current scenario of the indian insurance industry and whether the sector is innovating enough in comparison with its counterparts, he said: Cigna ttk health insurance co. The national insurance company ltd., the new india assurance company ltd., the oriental insurance company ltd.

Insurance brokers in india, are granted license by insurance regulatory & development authority. Having a look at the current market scenario, we can find that lic has taken over a major part in the overall insurance industry in india. Indian insurance in the global scenario.

Indians, who had always seen life insurance as a tax saving device, are now suddenly turning to the private sector and snapping up the new innovative products on offer. The growth of this sector is important from the perspective of overall growth of general insurance industry. Insurance industry has been expanding at a fast pace.

5.4 insights on the technical advancements that are shaping up the future of health insurance industry in india. Insurance brokers, india & global scenario. In india, the overall market size of the insurance sector is expected to us$ 280 billion in 2020.

I.1 in life insurance business, india is ranked tenth in the world. Furthermore, india’s leading bourse, bombay stock exchange (bse), will set up a joint venture with ebix inc to build a robust insurance distribution network in the country. Both these sectors are governed by insurance regulatory and development authority (irda) of india which is a government body which frames the rules for the.

Current trends of the general insurance market. A study on service to sales method of life insurance companies. 2.59 lakh crore (us$ 36.73 billion) in fy20.

The total first year premium of life insurance companies reached rs. Compared to the previous year, the life insurance premium in india increased by 9.63 per cent whereas global life insurance premium increased by 1.18 per cent. India is the market for insurance which covers both the state and private sector organisations.

Insurance brokers are seen as intermediaries who ensure that both the parties to a contract obtain what they require and a third party who ensures that both the parties to the contract jointly benefit. Indian life insurance industry changing scenario and need for innovation. 5.2 brief on health insurance premiums and study on the effect of medical trend rate on health plans.

India allowed private companies in insurance sector in 2000, setting a limit on fdi to 26%, which was increased to 49% in 2014. And the current situation may lead to lower renewals of employee benefit and life and accident policies. Insurers, who look to india as a major source of growth.

Insurance industry, as on 1.4.2000, comprised mainly two players: Their capabilities, industry conduct and level of continued high bar on “technical excellence” with “winners” pulling away further and capturing disproportionate share of industry value. Three major players of insurance sector 1.

(1999), life insurance business in india: This collaboration with the foreign markets has made the insurance sector in india only grow tremendously with a high current market share. Health insurance is one of the major contributors of growth of general insurance industry in india.

(PDF) A STUDY ON HEALTH INSURANCE SERVICES AMONG POLICY

Current Scenario of Health Insurance in India A Study

Healthcare Insurance Sector in India

How To Start A Mortgage Company In India

List of Top Aviation Companies & International Airports in

Healthcare Scenario in India by Gajendra Nagpal

Suing Insurance Company For Property Damage inspire

🎉 Health insurance in india current scenario. Health

Changing face of indian insurance industry

PPT INDIAN INSURANCE INDUSTRYPOST LIBERELISATION

Business Of Home Do You Need A Home Office Or Separate

Healthcare Insurance Sector in India

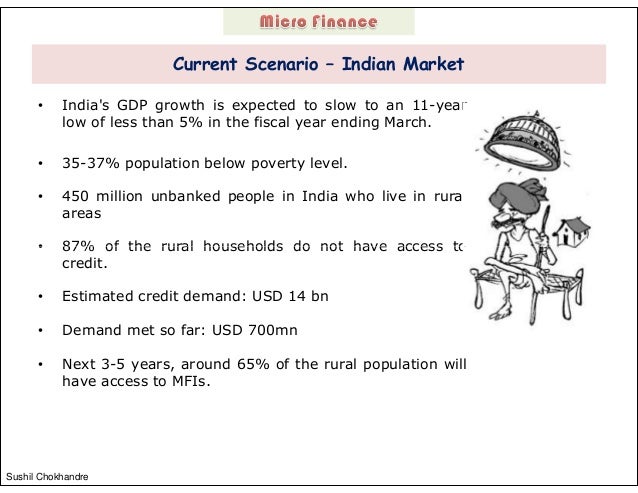

Micro Finance Industry PPT feb 2014 Sushil Chokhandre

Indian EV Revolution Marked with the Launch of EAmrit

What is the current scenario of the Indian Healthcare

(PDF) A STUDY ON HEALTH INSURANCE SERVICES AMONG POLICY

How To Start A Mortgage Company In India inspire ideas 2022

Customer Management in Life Insurance