A third insurance element is a relationship between the insured and the property insured must be such that property damage will negatively impact the insured's finances. In which kind of policy the insurable interest should exist at the time of claim:

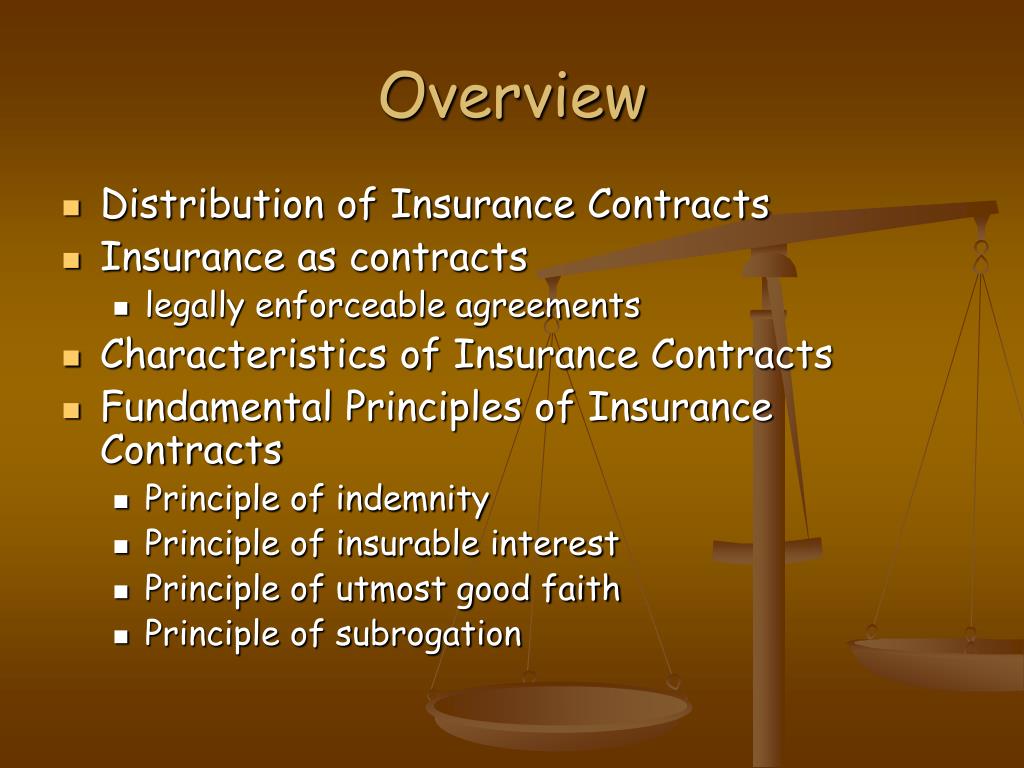

PPT Topic 10. Legal Principles in Insurance Contracts

The elements of general contract and.

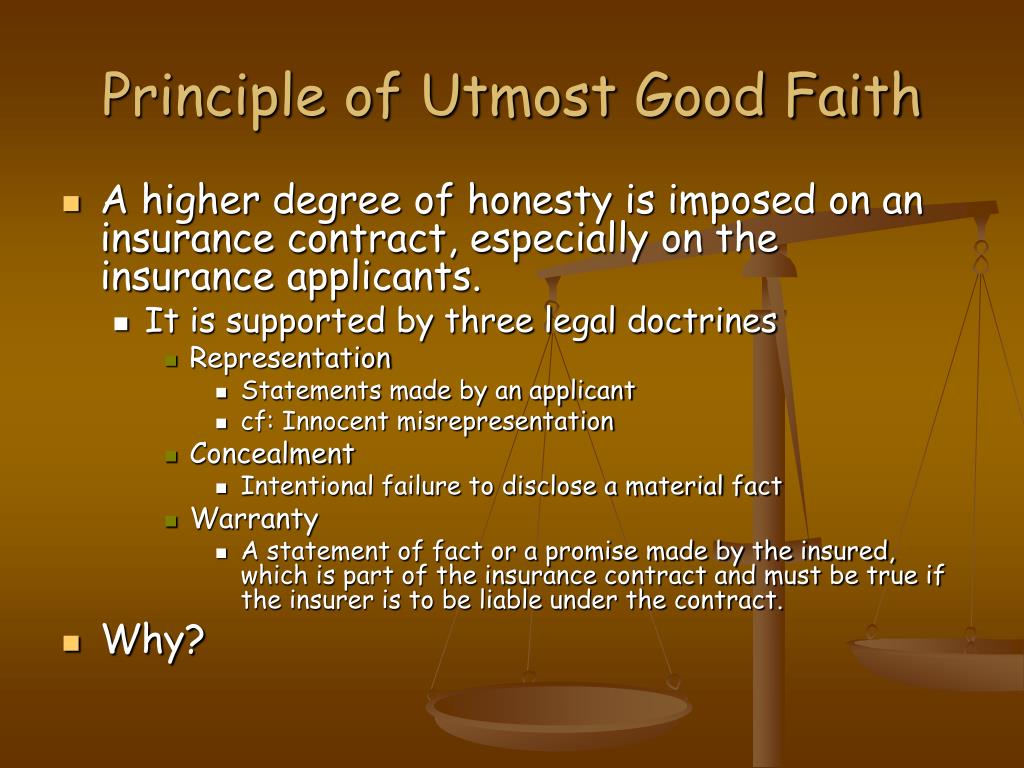

Which contract element is insurable interest a component of. Utmost good faith (uberrima fides) b. Terms in this set (22) 1. In an insurance contract, the insurer is the only party legally obligated to perform.

Only at the inception of the contract. The elements of an insurance contract are further divided into the elements of the general contract and the elements of a special contract. For a life insurance policy to be valid, insurable interest should be present at the time you are purchasing the policy.

Without insurable interest the contract of insurance is void. The insured will then experience a financial loss if the item or person being insured either dies or is damaged or lost. Additional element of an insurance contract.

A contract where only one party makes any kind of enforceable contract a contract that requires certain conditions or acts by the insured individual according to life insurance contract law, insurable interest exists Insurance policies, insurable interest must exist at the time of the clam. This element defines a healthy relationship between the insured and the property that has been insued.

In an insurance contract, the element that shows each party is giving something of value is called. Because of this, an insurance contract is considered. This means that the person acquiring the contract (the applicant) must be subject to loss upon the death, illness, or disability of the person being insured.

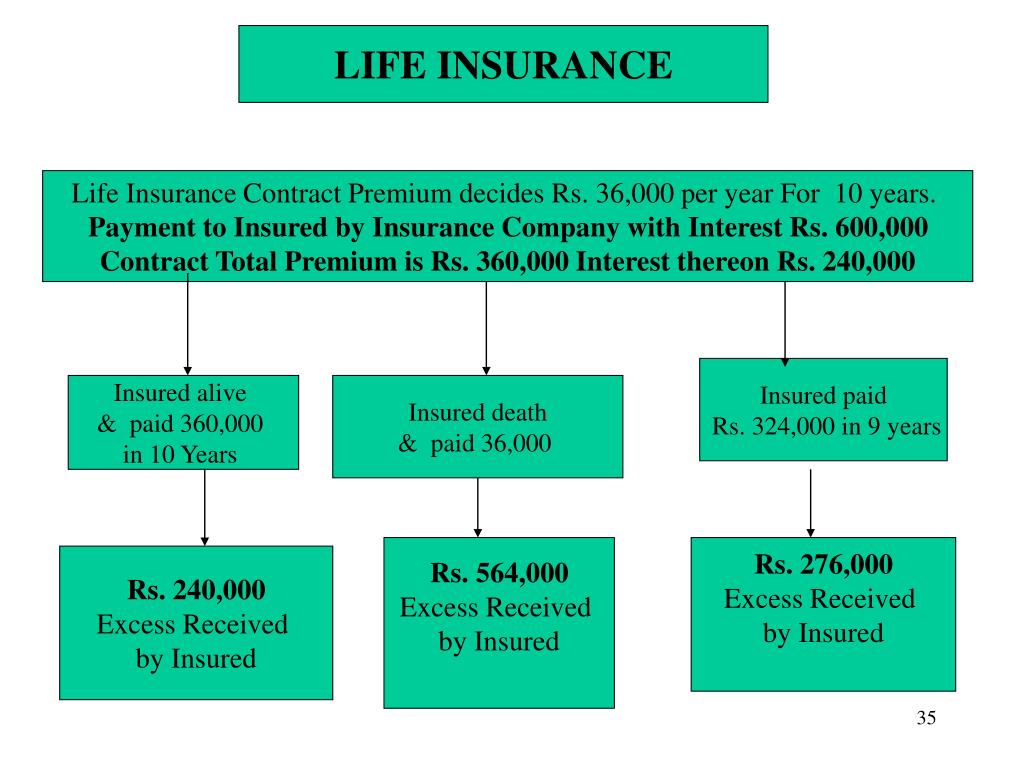

A life insurance policy that is subject to a contract interest rate is referred to as adjustable life group life term life universal life. It is not necessary that the assured should have an insurable interest at the time of. Marine insurance contract enables the ship owner, cargo owner, buyers & sellers, owners of goods to operate their businesses with adequate relief that their businesses have the necessary cover in the event of a financial emergency.

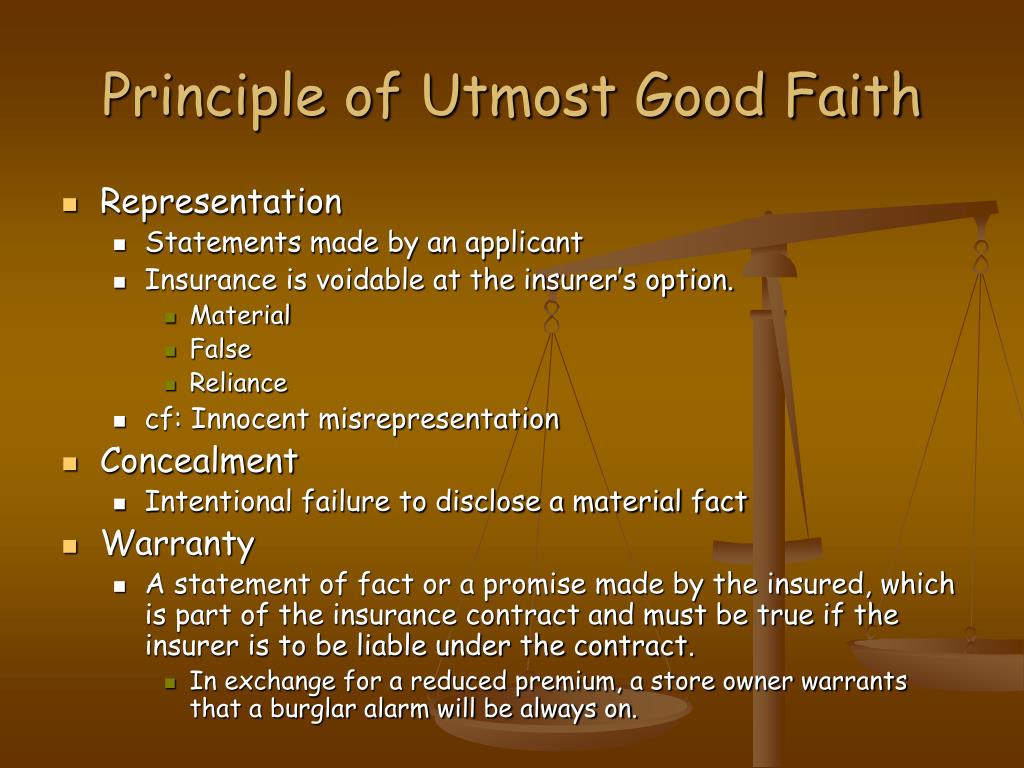

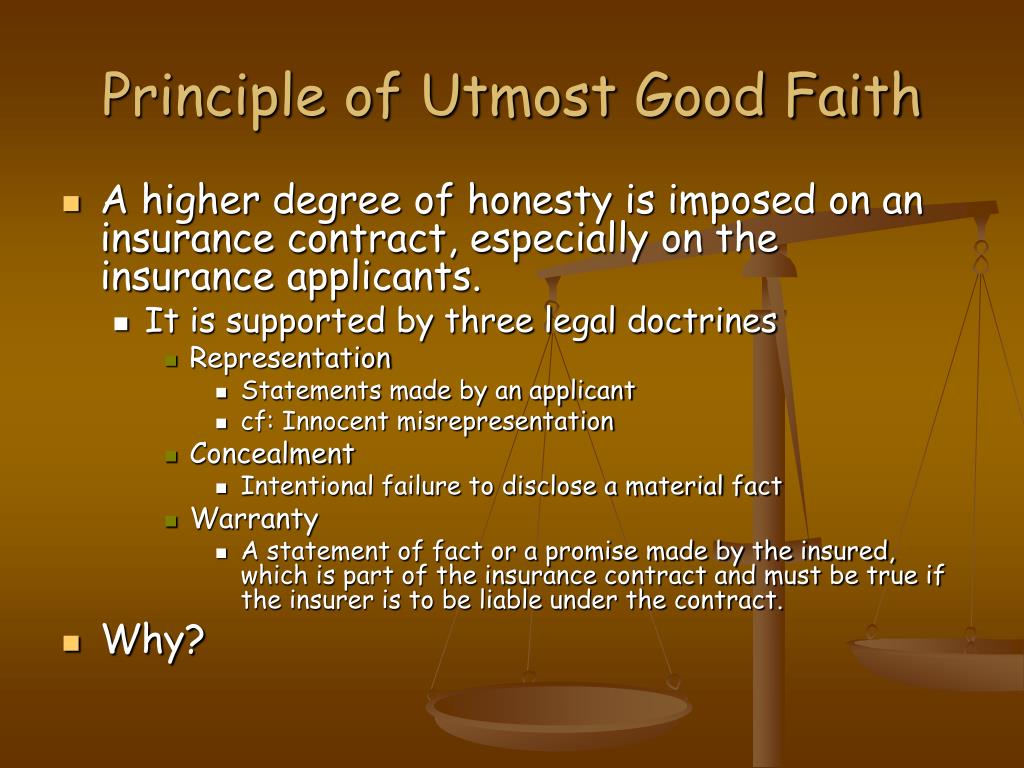

In the case of life insurance, insurable interest must be present at the time when the insurance is affected. Utmost good faith (uberrima fides) b. The principle of insurable interest, in regards to a life insurance contract, is accurately described in which statement insurable interest can be based on the love and affection of individuals related by blood or law

Insurable interest is defined as any “insurable property. The special contract of insurance involves principles: The insured has an insurable interest when they benefit financially from the person or thing being insured.

Insurable interest is the pecuniary interest; In an insurance contract, the element that shows each party is giving something of value is called consideration according to the principle of utmost good faith, the insured will answer questions on the application to the best of their knowledge and pay the required premium, while the insurer will deal fairly with the insured and it's In this case, being a spouse is an acceptable reason.

An insurable interest requires the purchaser to establish a reason of insurability. The insured must have an insurable interest in the life to be insured for a valid contract. Here are the five essential components of insurable interest:

Insurable interest constitutes the legal right to insure arising out of a financial relationship recognised under the law between the insured and the subject matter of insurance. There must be some property, right, interest, life, limb, or potential liability capable of being insured. The object of the contract is the transferring or distributing of the risk of loss, damage, liability or disability from the insured to the insurer.

The other elements required are specific to insurance contracts: Competent parties offer and acceptance consideration legal purpose. Elements of special contract relating to insurance 1.

Major elements of marine insurance contract. Insurable interest is a component of legal purpose. Which contract element is insurable interest a component of?

Another element of a valid insurance contract is insurable interest. Prospective insureds cannot get coverage on something in which they have no insurance interest. Insurable interest is financial interest.

Terms in this set (15) which contract element is insurable interest a component of? In life insurance, an insurable interest in the life of the insured must exist. A contract in which only the insurer would be legally obligated to preform.

This means that the person acquiring the contract (the applicant) must be subject to loss upon the death, illness, or disability of the person being insured. Proximate cause, assignment, and nomination, the return of premium. This relationship is also referred to as insurable interest, an element of insurance that developed over a considerable period of time.

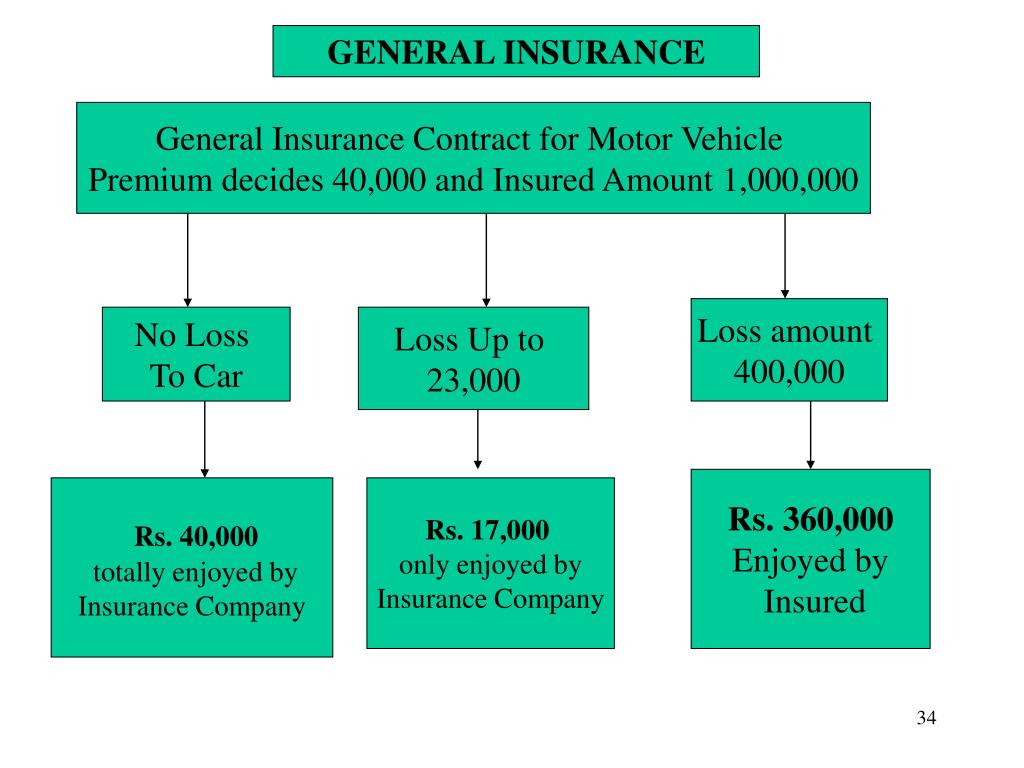

The cause or consideration of the contract is the premium which the insured pays the insurer. Proximate cause the essentials of any insurance contract are discussed as under with reference to the life insurance only. The elements of special contract relating to insurance:

Insurable interest is a component of legal purpose. For example, a contract for the provision of illegal services would not be a legal and valid contract because the course would not enforce it. In sum, the purchaser must have a legal monetary.

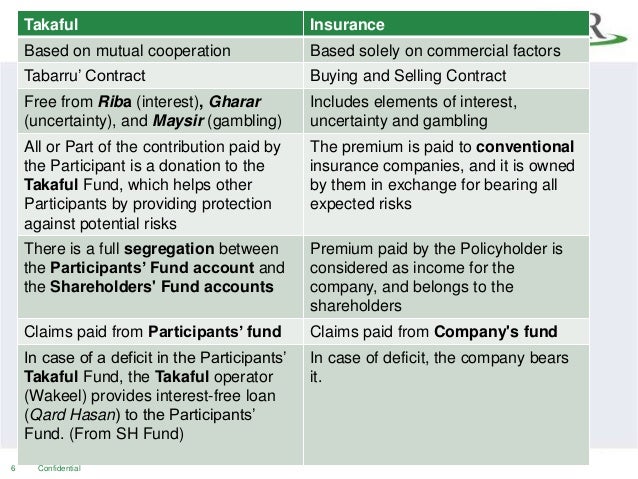

Contain an offer and acceptance. Insurable interest, utmost good faith, indemnity, subrogation, warranties. In order for a contract to be valid, it must.

Another element of a valid insurance contract is insurable interest. To have “an insurable interest” in the life of another person, an individual must have a reasonable.

LGST 44457 Get 24/7 Homework Help Online Study Solutions

When Does Insurable Interest Exist In A Life Insurance

Farm Lease Agreement Sample Template For Free With

Archimate Business Layer Passive Components

IFRS 17 does not spare anyone Willis Towers Watson

Medicare Managed Care Manual Chapter 6

PPT DEFINITION OF INSURANCE PowerPoint Presentation

FREEDOMFIGHTERS FOR AMERICA THIS ORGANIZATIONEXPOSING

PPT Topic 10. Legal Principles in Insurance Contracts

5 Essential Elements of Life insurance Business Consi

When Does Insurable Interest Exist In A Life Insurance

"BRAINDEATH" IS KIDNAP...MEDICAL TERRORISM/MURDER BEGINS

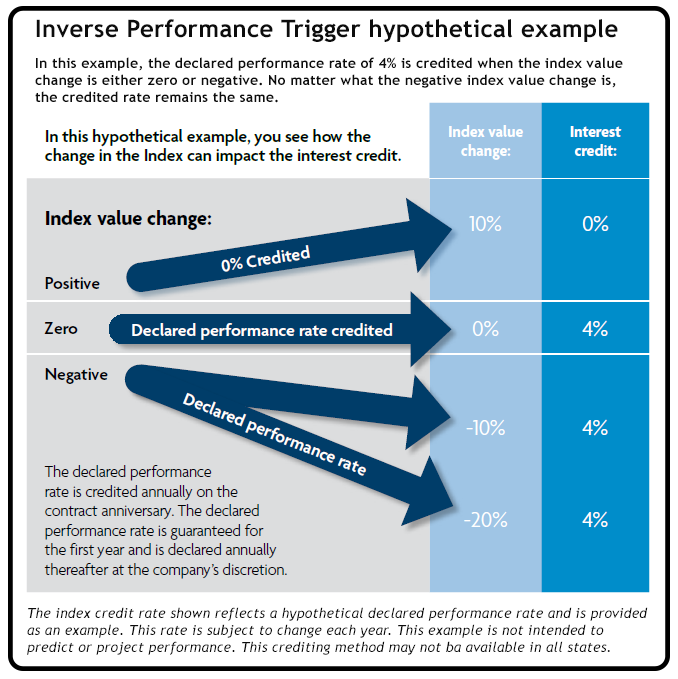

Do you have the ability to leverage a negative market

PPT 6. Legal Principles in Insurance Contracts

PPT DEFINITION OF INSURANCE PowerPoint Presentation

"BRAINDEATH" IS KIDNAP...MEDICAL TERRORISM/MURDER BEGINS

company structure that shows its stake in dozens of

PPT Structured Finance through Collateral Management