The product is often also known as “private banking insurance” or “insurance wrappers”. “private placement life insurance—often referred to by its initials:

Private Placement Life Insurance Matthew Ledvina

What is private placement life insurance?

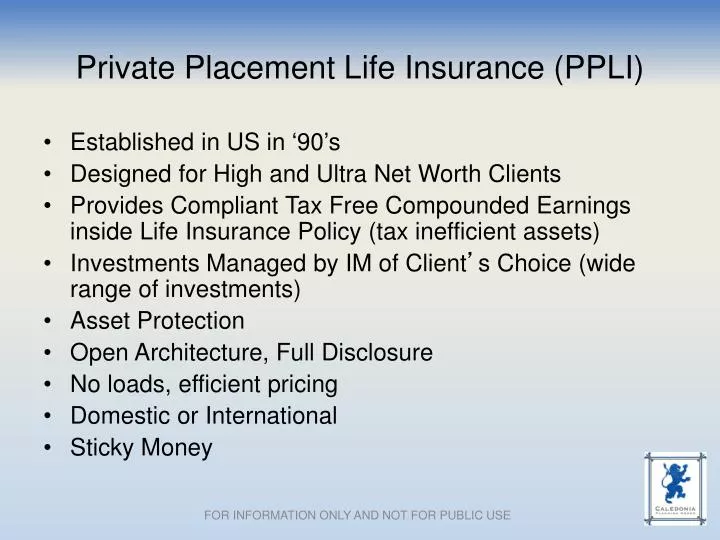

What is private placement life insurance. It combines the financial advantages of hedge funds with the tax benefits of life insurance. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals who want to invest in hedge funds but avoid the associated high tax rates. Historically, insurance companies refer to investments as purchasing “notes,” while banks make “loans.”.

In other words, ppli presents a planning structure,. Private placement life insurance is a variable universal life insurance policy that provides cash value by investing in a broader range of investments, some of which are not available to the general public. Privately placed life insurance (ppli) is generally structured and described as a variable universal life insurance policy.

A strategy called private placement life insurance is a loophole that one policy expert says is ‘entirely legal, easy to exploit, and politically. In ppli, premiums are flexible. Private placement life insurance and variable annuities, also known as ppli and ppva, are variable insurance contracts that allow purchasers to direct the premiums they put in into a number of investment options.

Often shortened to ppli, private placement life insurance was originally designed for those who want to invest in hedge funds, for wealthy investors in a high tax bracket who want to invest their money anyway, it often makes sense to have their money within a privately placed life insurance policy to avoid individual taxes and other fees and penalties. It is based on life insurance and annuity policies that allow for bespoke tailored and internationally diversified investment strategies. Tailored to each client, therefore, it is known as private placement.

Insurance dedicated funds enable hedge funds to manage a separate fund that follows the same strategy as the flagship fund. With lee sleight, head of business development asia for lombard international assurance. What is private placement life insurance (ppli)?

Put private placement life insurance to work and start capturing more of your return. Ppli is an established and internationally recognised tool for wealth preservation it is adaptable to the most complex of situations, and its robustness and flexibility make it highly complementary to other wealth management solutions. Private placement life insurance is a type of variable universal life (vul) insurance1 that allows investments contained within the policy to grow with income and capital gains taxes deferred.

It includes things like alternative investments. Through private placement life insurance (“ppli”) or private placement annuities (“ppva”). Ppli—is a version of variable universal life insurance that has been designed for.

Pplis are structured as variable universal life insurance policies. What is private placement life insurance (ppli)? Unlike traditional life insurance, an investor would buy a ppli policy principally as an income tax free investment vehicle.

A potential tool for tax efficiency and wealth transfer what is private placement life insurance? Remember, ppli is a very niche product. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public.

In time, however, the market migrated to the united states, and applicable irs regulations followed. The market for individual private placement products originated offshore in the 1990s. Private placement insurance products are unique investment vehicles that have steadily gained attention in the affluent marketplace over the past decade.

“private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a. Private placements are relatively unregulated compared to sales of securities on the open market. Only a specific group of wealthy individuals can obtain this policy, mostly because it solves a very particular wealth management issue.

A Private Placement Life Insurance (PPLI) structure

offshore trust Archives Premier Offshore Company Services

What is Private Placement Life Insurance & Variable Annuities?

What is Private Placement Life Insurance? Wealth How

Private Placement Life Insurance Colva

Private Placement Life Insurance YouTube

The Beauty of The Integrated Circuit PPLI The Computer

What is Private Placement Life Insurance (PPLI) and Who Is

![]()

Private Placement Life Insurance

Lombard International What is Private Placement Life

Private Placement Life Insurance Colva

Introducing Private Placement Life Insurance (PPLI

Private Placement Life Insurance, (PPLI) Archives blog

What is Private Placement Life Insurance (PPLI) and Who Is

Global Private Placement Life Insurance (PPLI) Market by

Private Placement Life Insurance and the Tax Code

PPT Private Placement Life Insurance (PPLI) PowerPoint

Private Placement Life Insurance and the Tax Code