Third party only (tpo) this is the basic type of courier insurance as required by the law. Read our news stories more than 60 offices worldwide

Top 10 dog breeds that can kill a lion Page 7

It covers theft, collusion damages, and other risks involved in land freight shipping.

Transportation insurance definition. Travelers inland marine provides protection for motor carriers, logistics/broker companies, freight forwards and warehouseman who are responsible for goods from the point of departure until they reach their final destination. We provide 3 main levels of courier insurance. Property transported by truck, rail, or in storage during or at the completion of transit is generally insured on an inland marine policy.

Transportation expenses — additional expenses paid under the personal auto policy (pap) and the commercial auto policies. Insurance for your property while it is in transit on your own vehicles or through a public or contract motor carrier, rail or air carrier. Transportation expenses are a subset of travel expenses that refer specifically to the cost of business transportation by car, plane, train, etc.

Fees for customs clearance, duty, and taxes. Our transportation policy will keep your business operating in the event of a loss while we determine the extent of the carrier's legal liability. Means of conveyance or travel from one place to another.

This coverage provides protection against loss, theft or damage for goods in transit. Motor truck cargo liability insurance provides coverage for liability against the risks of direct physical loss to covered motor truck cargo while in transit (4). This type insures cargo that is moved by land transportation, which includes trucks and small utility vehicles.

Any charges or fees for shipping and loading the goods to the seller's port. As a courier, this insurance is highly necessary. The cost of the premium is decided based on the goods in transit insurance and the risk the policyholder is bearing during that policy term.

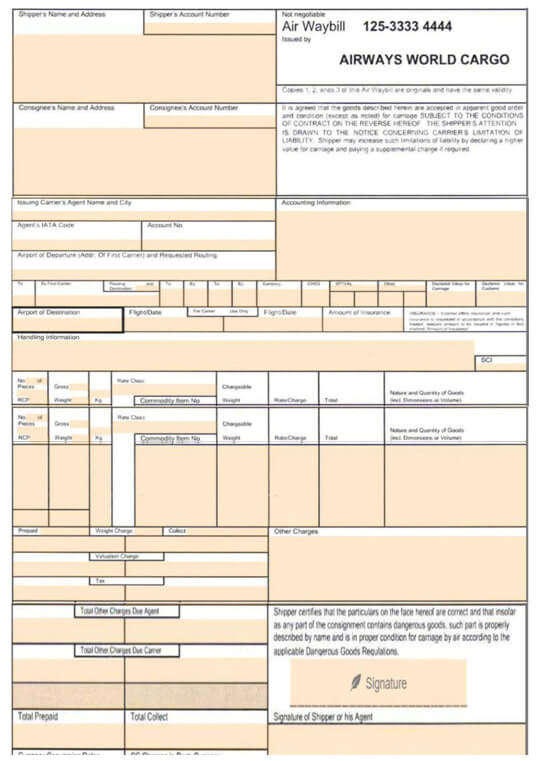

Alternative accommodation expenses, if required. Marine insurance covers the loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. A transportation document that services of the contract of carriage along with any other conditions between a shipper and a transportation provider.

Marine insurance covers the loss/damage of ships, cargo, terminals, and includes any other means of transport by which goods are transferred, acquired, or held between the points of. This is a large and critical industry that provides a foundation for global economic production and quality of life.the following are the basic components of the transportation industry with a few related industries (in grey). Loss or damage to your goods while in transit (e.g.

It is also typically used for domestic. It is an assurance that the goods dispatched from the country of origin to the land of destination are insured. Goods in transit insurance covers inventory or other merchandise shipped by the seller, but not yet received and accepted by the purchaser.

Marine insurance refers to a contract of indemnity. Transit insurance or transportation insurance policy is a safe and secured way of covering the risk arising due to loss or damage caused to goods or personal belongings while in transit. It is intended to protect buyers and sellers who are exposed to financial loss if this property is lost, damaged, or destroyed while off premises and in transit.

The transportation industry is economic activity that creates value by moving people and goods. An act, process, or instance of transporting or being transported. Motor truck cargo coverage is liability insurance that covers cargo up to a set monetary limit the trucker determines when he buys a policy.

Cargo insurance is mainly categorized into land and marine cargo insurance (which also covers air cargo). Property insurance for property in transit over land, certain types of moveable property, instrumentalities of transportation (such as bridges, roads, and piers), instrumentalities of communication (such as television and radio towers), and legal liability exposures of bailees. Caused by road accidents, fires, derailment, theft, impact or malicious damage, as well as grounding of vessels and crashes or forced landings for aircraft) loss or damage to your goods caused by removalist mishandling.

The insurance provided by us in general, covers all risks of loss of or damage to the cargo during transport. For the pap, transportation expenses, such as rental car charges, incurred in connection with a covered comprehensive or collision loss are payable, up to a specified amount. Packaging costs for exporting the cargo.

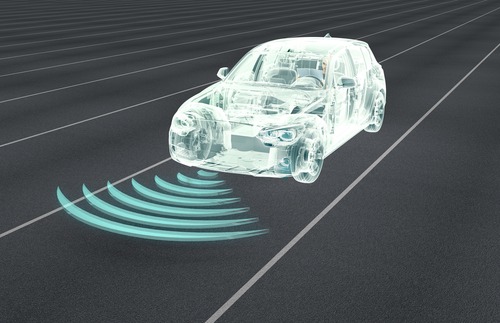

High definition vehicle insurance delivers more value to fleets for the same insurance premium. We’re not just another insurance company.

Non Trucking Liability Insurance Definition Awesome

Through Transport Mutual Insurance Association Limited

Non Trucking Liability Insurance Definition Awesome

Non Trucking Liability Insurance Meaning Awesome

Sea Harbor Insurance Agency Llc Payment inspire ideas 2022

Employee Fringe Benefits Definition and Examples

Personal Care Services Medicaid Definition and Similar

Non Trucking Liability Insurance Meaning Awesome

Non Trucking Liability Insurance Meaning Awesome

Air Waybill (AWB) Definition, Uses, Format, How it Works?

Not easy being green China's health codes' define Covid

Pennsylvania legislation authorizes testing, research of

/image%2F6671607%2F20220126%2Fob_240be1_gapinsurancetypes-01-medium.jpg)

A Biased View of How Much Is Travel Insurance Not known

Hot Shot Trucking Insurance Cost Leonardsolowaysbroadway

Hotshot Trucking Insurance Cost Awesome

Non Trucking Liability Insurance Definition Awesome

Non Trucking Liability Insurance Definition Digitalflashnyc

Non Trucking Liability Insurance Definition Digitalflashnyc

Ocean cargo insurance glossary of terms Canada tutorials