How is nursing malpractice insurance different from malpractice insurance for doctors? In maine (34%), missouri (31%), and nevada (38%), about a third of medical malpractice claims were closed with a payout.

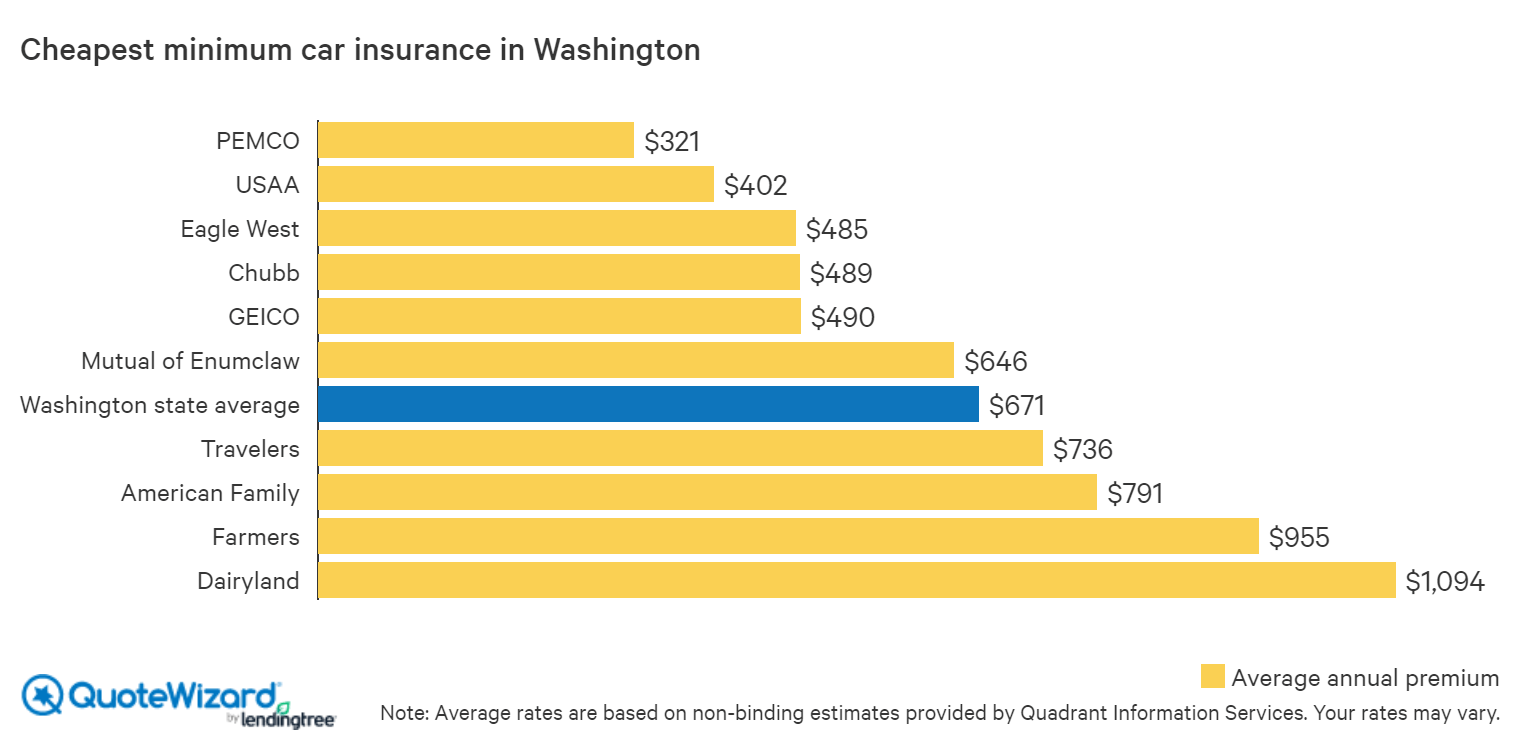

Cheap Car Insurance in Washington 2019

Through the most expansive and effective network of relationships in the medical malpractice insurance market, equotemd is able to provide solutions for any medical practice in all 50 states.

States with lowest malpractice insurance. A doctor in new york can expect to pay at least five times more than the same doctor in california, ohio, or tennessee would pay for the same level of coverage. Firm, slightly less than triple that, etc. Up to 35% lower in.

In illinois about 12% of closed claims resulted in a payout. Wisconsin tops the list, while minnesota follows closely behind. Full weight (~3.75 points) physician burnout:

For solo attorneys in need of malpractice insurance, 360 coverage pros offers coverage at a relatively low cost, backed by one of the world’s biggest and most respected insurance companies, with. The ama has identified 26 states that are showing problem signs. Indiana, louisiana, new mexico, and wisconsin are among six states the american medical association (ama) has identified as not exhibiting any problems with respect to the cost or availability of malpractice insurance.

Malpractice suits per 100,000 residents: Most medical malpractice insurance claims were closed without a payout to the person seeking compensation for the alleged medical injury. The worst states include illinois and a cluster of states on the east coast:

Firm will pay slightly less than double that; Medical malpractice insurance in the u.s. The majority of these states have some of the lowest medical malpractice payouts per capita.

That premium increases to $704.45 per year for the same chiropractor who was licensed five years ago. Malpractice suits per 100,000 residents: A medical malpractice insurance policy is often carried by physicians, nurses, physical therapists, and other medical professionals as a way to be protected from certain liability claims and damages.

New jersey comes in second to last with one of the highest malpractice payout levels in the country, while oregon ranks third to last and claims one of the lowest wage disparities for physicians. Cunningham group created this premium estimation tool by drawing from its database of thousands of physician clients. Annual malpractice liability insurance rate:

Malpractice insurance for counselors as a counselor, you work hard to form meaningful client relationships and give your clients the attention and care they need. The empire state was on the top of the list of states with the largest number of medical malpractice reports during this decade. And doubts about your competence and the value of your work.”

The most affordable states for medical malpractice insurance tend to be located in the midwest. Three of these have funds—kansas, nebraska, and south carolina. Full weight (~3.75 points) note:

Medical malpractice insurance is a type of professional liability insurance that helps protect healthcare professionals against claims of injury and medical negligence. Best 5 providers of nursing malpractice insurance the american association of colleges of nursing reports that there are more than 3.8 million nurses in the united states, making them the largest sector of the healthcare industry. Doctors in north dakota pay the least.

New york, dc, pennsylvania, new jersey, and delaware. The initial quote for a yearly premium on a chiropractor who was licensed on 1/1/2020 in ohio with a liability limit of $1/$3 million was $188.36. Obtain a lower medical malpractice insurance premium.

Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly. Washington state office of the insurance commissioner, direct premiums earned by the medical professional liability insurance market in the united states in 2019, by state (in million u.s.

Commonly referred to as the medical malpractice insurance limits by state, these limits are the maximum amount that will be paid out for the policy under the contract. This work requires a keen focus on the boundaries between personal and professional relationships with your clients and has the potential to result in exposure to a malpractice. Coming next were california (13,157) and florida (10,788).

However, west virginia juries have historically favored the plaintiff and awarded payouts more than most other states, which inflates insurance premiums. Physicians in rhode island, pennsylvania, and new jersey round out the top four states for malpractice insurance costs. Physician burnout is defined as “a feeling of physical, emotional, or mental exhaustion, as well as frustration and cynicism related to work;

In contrast, the state with the lowest number of reports of medical malpractice was north dakota , with only 126 reports. Can range from $50,000 to $200,000 a year; Costs vary widely depending on the coverage levels, type of practice, and even the state where the health care professional practices.

If a limit is set at $1,000,000 for general liability but there are defense costs that are charging over $200,000, it’s worthwhile to not that those expenses would be deducted from the overall set amount for the. Both iowa and minnesota were among the least expensive states for medical liability insurance, while north dakota was number one on the list of states with the lowest malpractice award payouts per capita. $7.5 million (4.28 percent decrease) 5.

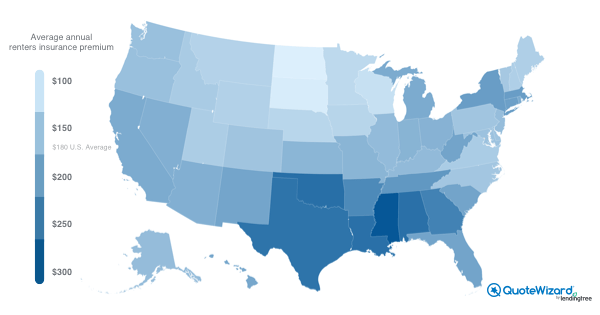

How Much Does Renters Insurance Cost? QuoteWizard

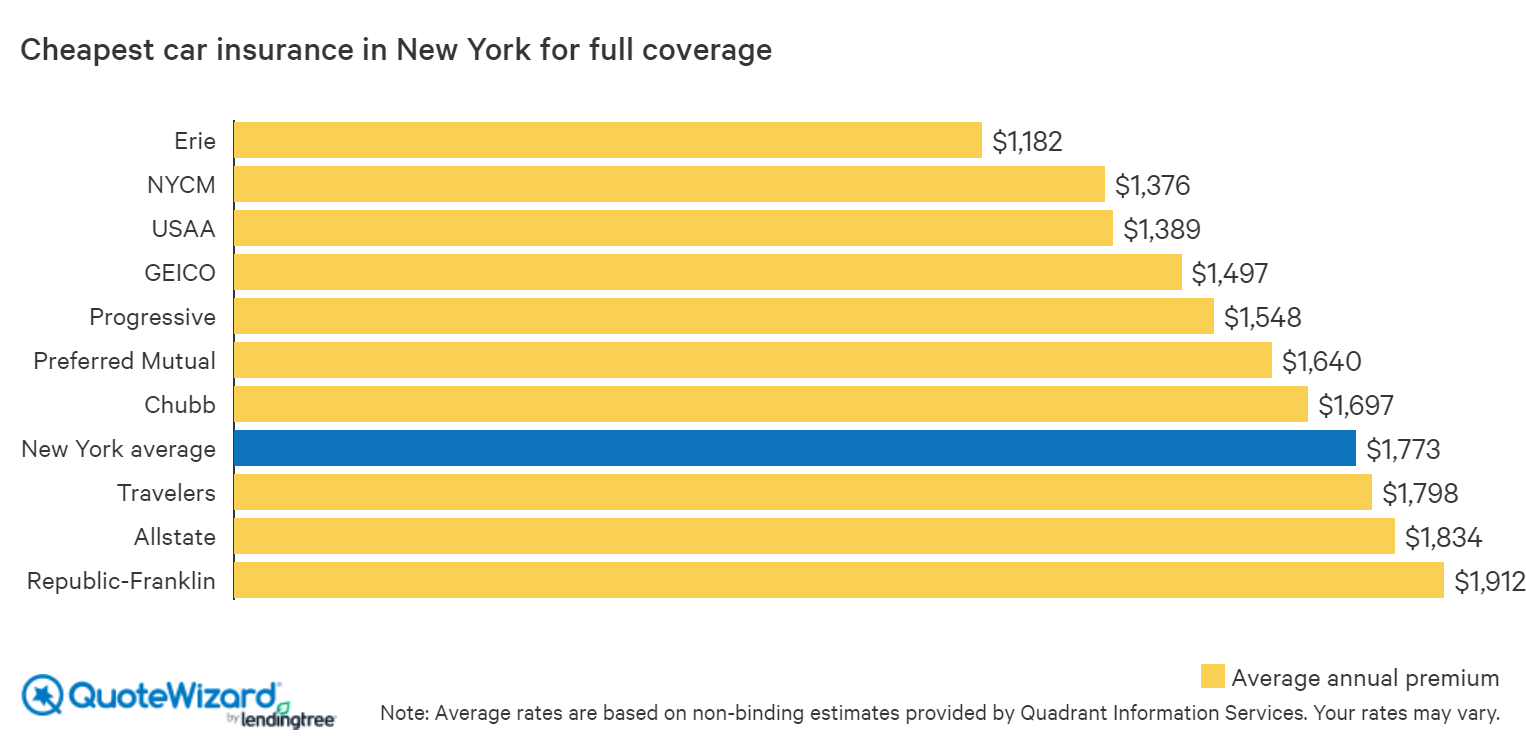

The Cheapest Car Insurance in New York QuoteWizard

Texas State Low Cost Insurance Discount Good to go insurance

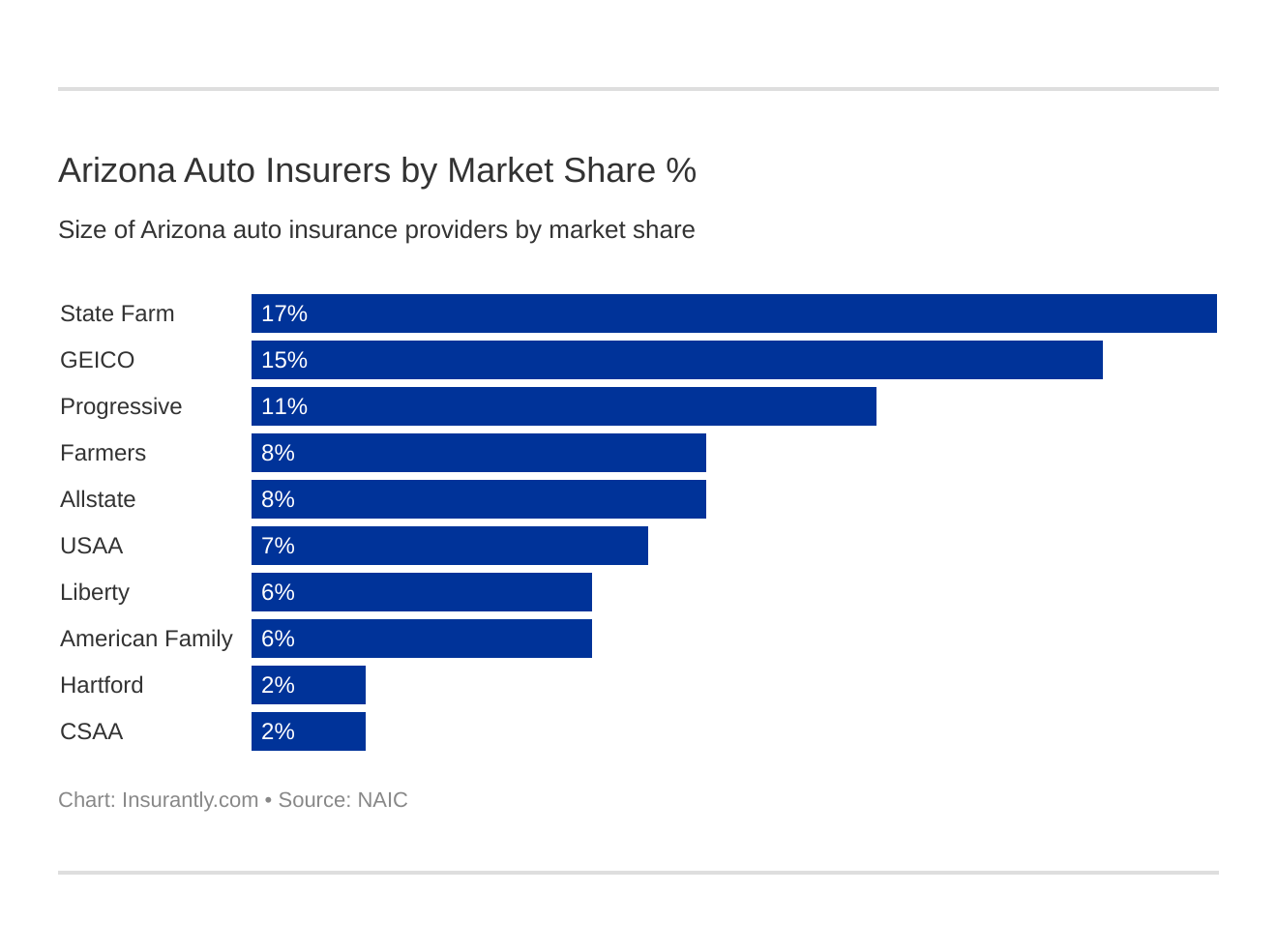

Lowest Insurance Rates In Arizona / Car Insurance Rates By

Why is Underinsured Motorist (UM) coverage so expensive

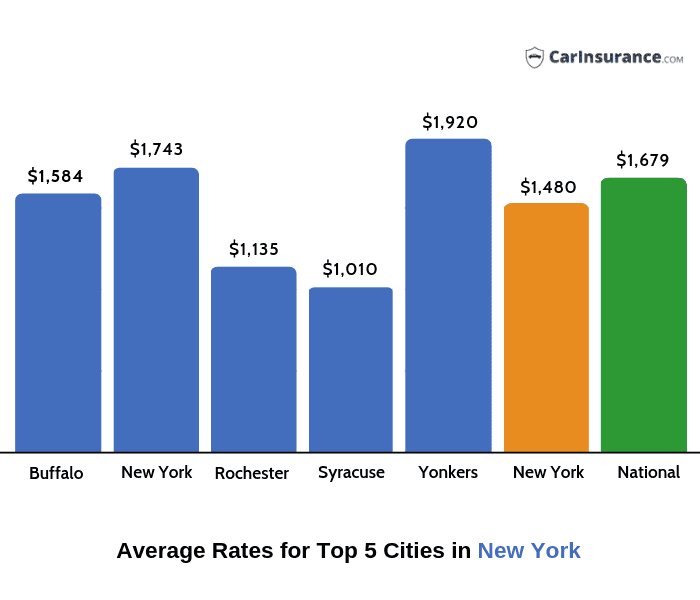

Car Insurance in New York Find Best & Cheapest Car

Find Cheap Car Insurance in Washington QuoteWizard

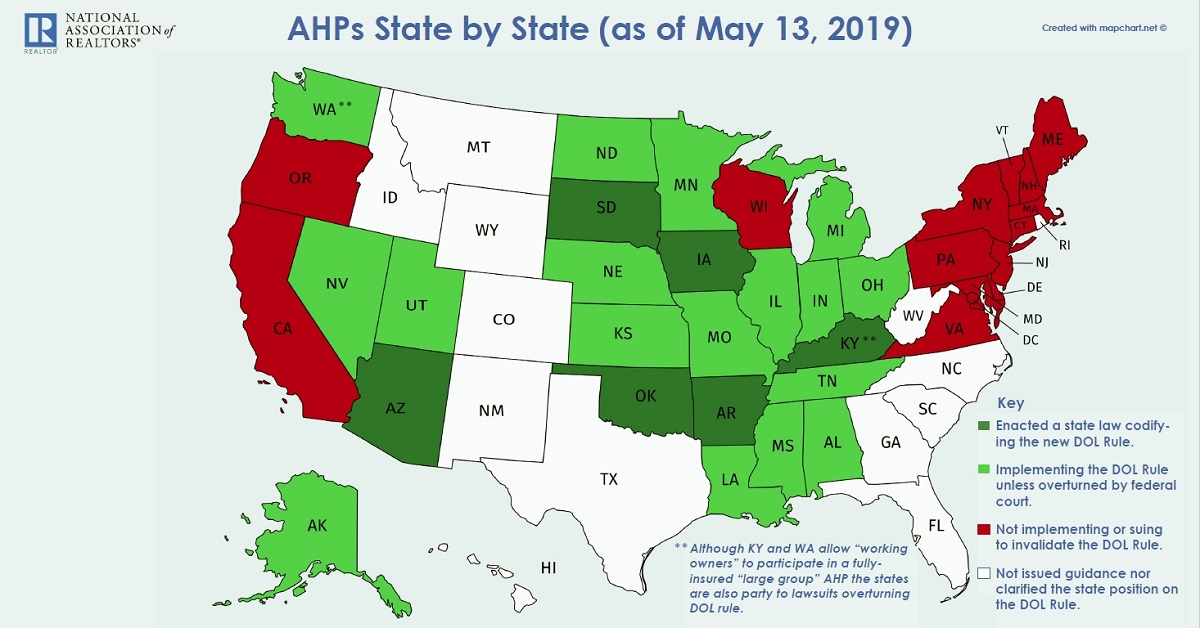

AHPs State by State www.nar.realtor

Why State Minimum Liability Auto Insurance Coverage Sucks

Average Home Insurance Rates By State chrissmithdesigns

Protect yourself with Esthetician Liability Insurance NACAMS

2012 malpractice payouts concentrated in 5 states The

THE PLACE FOR ONE IN FOUR FLORIDA DRIVERS UNINSURED

offer letter Archives Blue Signal Search

Why are mandatory auto liability limits so low in the

Medical Malpractice Insurance in Minnesota Free Quote

Cheap Liability Only Car Insurance Texas

How Much Does Medical Malpractice Insurance Cost?

Obamacare price change for every state in US Business