New york state department of financial services. Youd also have to question the effort your insurance company will make on your behalf if you arent a customer anymore.

Pin by Second Life on car insurance renewal (With images

Even if you don’t make a claim after an accident, you could still see an increase in your insurance premium.

Renewing car insurance whilst claim pending. In that case, you would need to contact your insurance company and file a claim to get reimbursed for the cost of repairs. Most auto insurance companies allow policyholders to cancel coverage at any time, though you may be subject to a cancellation fee. If your auto insurance policy is nonrenewed. accessed aug.

The policy has always been renewed with the insurer as they are not sure. Any injury claims have been paid or payment has been agreed in instalments. When driving slowly in the outside lane, a motorcyclist filtering on the nearside of the car hit the side of his car fell off into the road.

Some insurers offer discounts to drivers with fitted dashcams. Neglecting to tell your insurer about modifications to your vehicle; I was about to renew my insurance for €350 when i reversed to other car breaking her front right light and bending bonnet a bit (€300 would fix it on 02 car) and barely doing any damage to my car, but she later (two weeks) claimed pi against me.

You may cancel your insurance policy any time you want. If you’re unsure whether the claim has been settled, then you need to contact your insurer from the time of the claim to find out. Your premium will go up and it won't come down even if you win the case.

A friend was involved in an accident involving a motorcyclist. There is a pending court case going through and has been for the past 2 years. Until this time, the claim will be classed as being unsettled.

Not disclosing penalty points on your licence. He appeared to have no major damage or injuries, but ambulance and police were called to attend the incident. Despite fact i had fully comp!

This is because certain circumstances surrounding the accident, even if it wasn’t your fault, may lead to more accidents in the future. Should have let the insurance claim from the other party. If you already have this and claim 7 years no claims with your new insurer then you are effectively defrauding them.

By fitting a camera to your dashboard you might be able to cut the cost of cover: After the first 30 days of your grace period, we will pend your claims for services This includes everyone covered by the policy, so make sure you have details handy of.

For more information, read our tips for cheaper car insurance. So, on renewal, ncb needs to be checked that it has been accurately calculated especially if there has been no claim in the previous year and ncb needs to be carried forward. Before your claim is settled, you will be considered to be at fault as your insurer may.

A failure to notify your insurer of a motoring conviction could render your policy invalid and result in your insurer refusing to deal with any claims that may arise. Your old company continues to handle your claim until they settle or deny it. When you are in the first 30 days of your grace period, you will continue to have health insurance coverage and we will pay claims for services you received during this time.

Regardless of who was at fault, and even if you decide not to make a claim, you could see your car insurance costs go up when you renew your policy. Car insurance claims can take a couple of months to process. I think they just assume the claim goes against you then you can claim back the difference if it resolves in your favour.

North carolina department of insurance. Getting new insurance policy for another car, but current claim not yet concluded. Why might an insurance company cancel your policy?

Black box insurance could also be worth looking at if you don’t use your car much and have a low annual mileage. Yes, it will save you time as you won’t have to shop around but, you’re at risk of hikes in insurance prices across the market. Regardless of whose fault it was, making a claim will almost always lead to an increase in your car insurance premium.

Your claim does not switch companies with you, however. While there can be some benefits to automatic renewal, the best prices are almost invariably reserved for new customers, and so it's always a good idea to shop. Even if you have an open claim with your insurance provider, you can cancel or switch your coverage.

In respect of pending prosecutions, most insurers do not specifically require you to disclose this information, although, to err on the side of caution, you should check the terms of your insurance policy. Here are some potential reasons for an insurer to cancel your car insurance: Shouldn't have claim your own insurance.

However, as of april 2013, you don’t have to declare your unspent convictions when applying for or renewing your car insurance, unless an insurer asks you about them. Can i cancel my car insurance with an open claim? Any damage to property has also been paid for.

Faqs about auto insurance, see can a company refuse to renew my policy because of claims that were not my fault? accessed aug. I have found that while insurance companies are happy to accept an excess of â£500 or even more, they all seem to have a cutoff at somewhere around the â£250 to â£300 mark. The motorcyclist is now claiming for major damage to his vehicle.

The effect of claims on homeowner's insurance. Yes — as long as the accident happened when your auto insurance policy was active, canceling it afterward will not affect your ability to file a claim. A pending claim is a claim that has been received by summacare but that we cannot process (pay or deny).

Star Assurance EInsurance Buy, Renew & Claim insurance

Motorists allow car insurance policies autorenew far more

Own Goods Vehicle Campaign Wrightcover.ie

UK Motorists admit they are ‘Clueless’ about their Car

Sylvia Watkins, Author at Rus Auto Page 3 of 5

Insurance for Electric cars Electric Vehicle Charging

How to find cheap car insurance Money tips blog

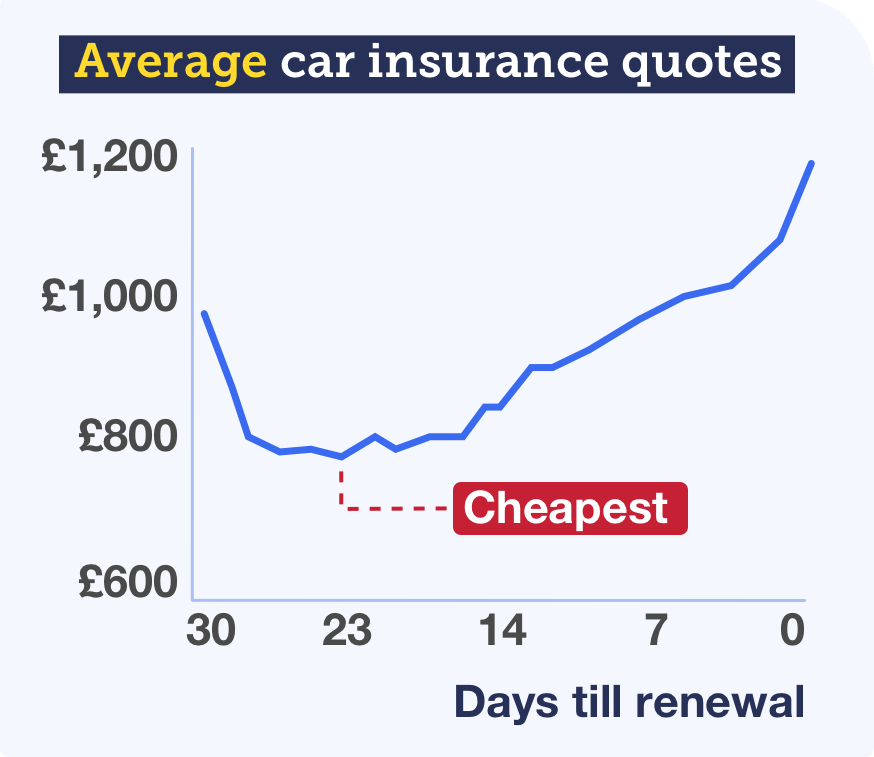

Best time to save money on your car insurance renewal FQ

CarInfo RTO Vehicle Information

Star Assurance EInsurance Buy, Renew & Claim insurance

My Insurance My Insurance Quotes

Renew Online Classicline Insurance

pK0Srcarinsuranceinfographic Light Image Quotes Car

Check & Renew Mulkiya Online in the UAE Registration

Toyota Car Insurance Toyota Insurance Price Buy Or Renew

sSpdPJog Classicline Insurance