Many factors determine its costs. Would your law firm be able to afford a large claim or suit that could result from a simple misinterpretation or piece of information that you were unaware of?

How Much Does Malpractice Insurance Cost For Lawyers How

Get a fast quote and your certificate of insurance now.

Lawyer malpractice insurance cost. The larger the firm, the more costly the coverage. For lawyers, malpractice insurance is sleep insurance. Depending on the severity, a claim can cost you $50,000 to $100,000 after court fees, lawyer fees and any other fines or judgements.

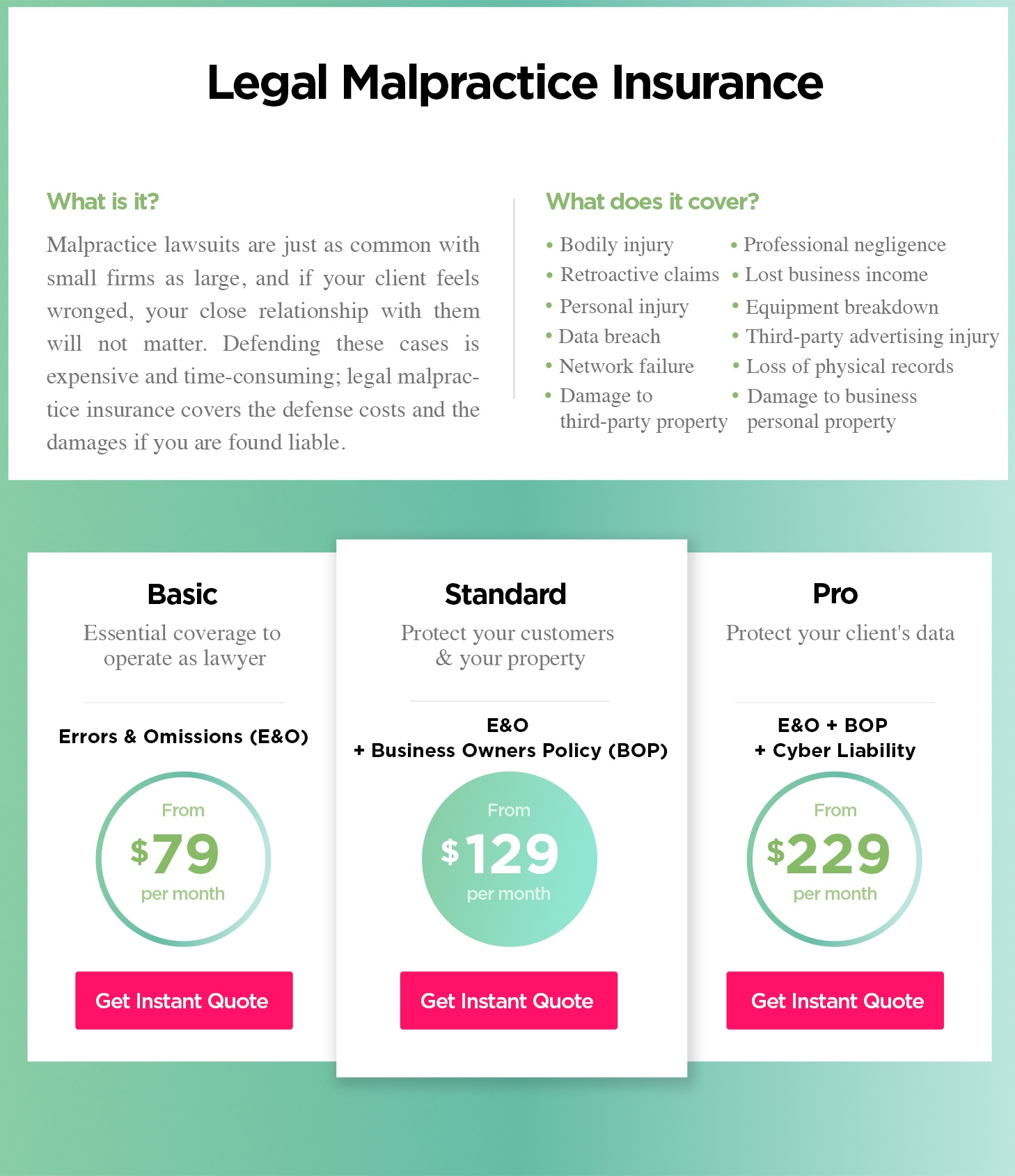

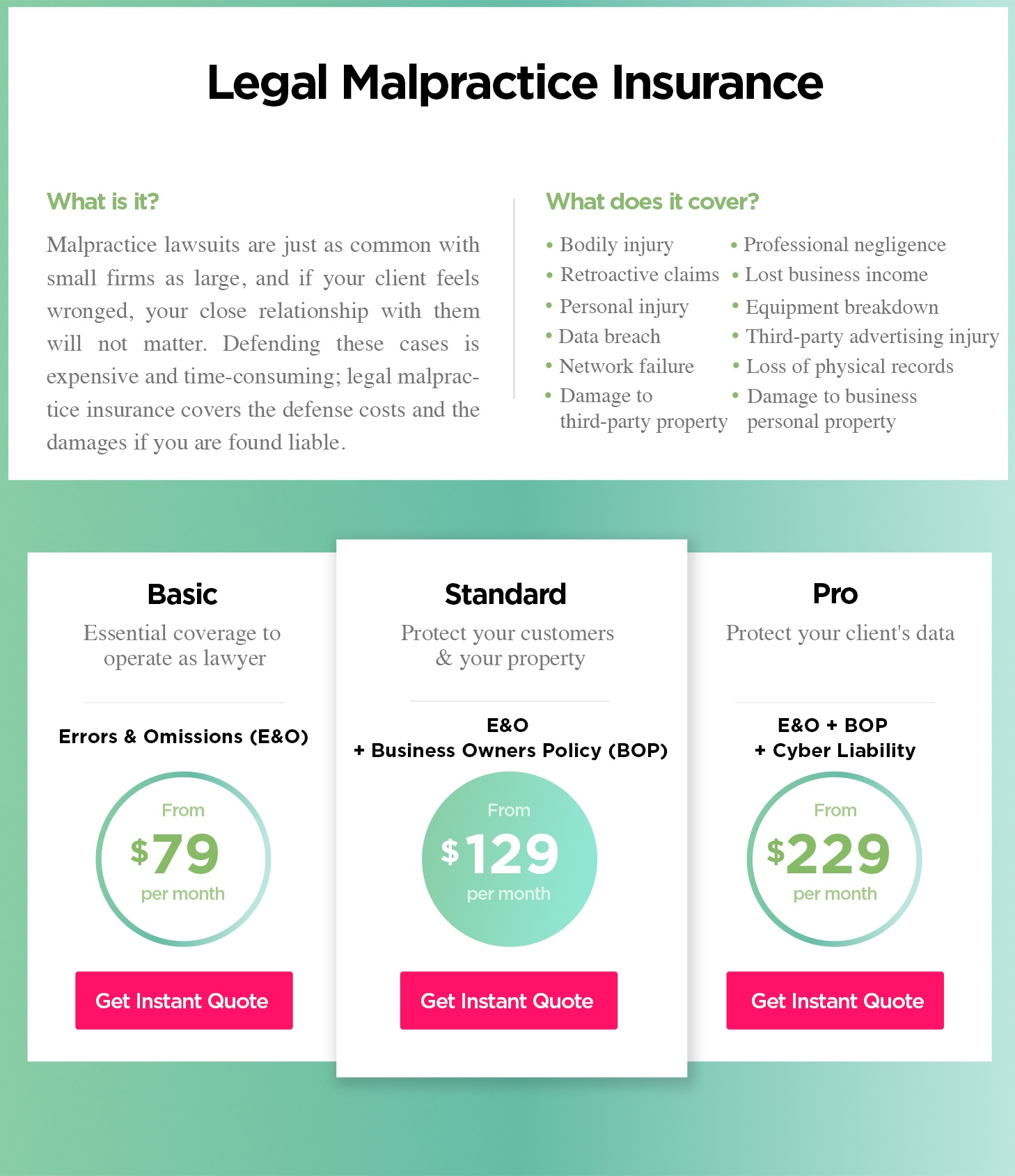

A malpractice insurance policy protects a lawyer by covering negligent advice or mistakes, defense costs for lawsuits and services previously performed by a lawyer. Attorney lawyer insurance protects your practice from lawsuits with rates as low as $27/mo. The first of which is the type of law practiced:

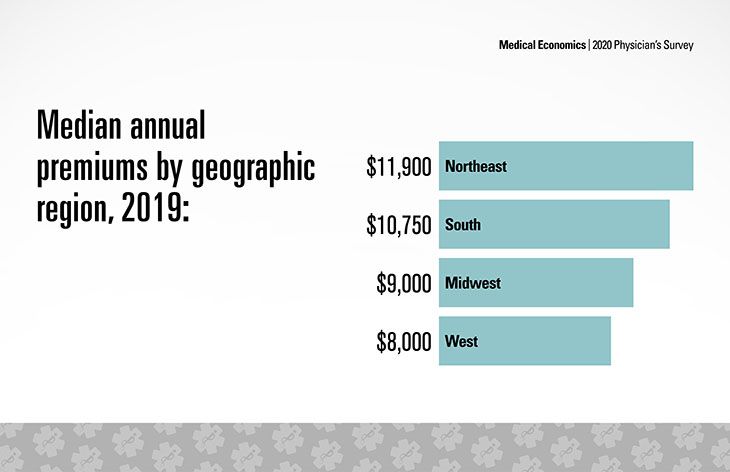

Other medical professionals typically pay between $4k and $12k per year, depending on their specialty and area of expertise. Legal malpractice insurance protects lawyers when they get sued because someone claims damages due to an error or omission on their part. Having a comprehensive malpractice insurance policy can save you a great deal of financial strain and stress when these situations occur.

Your malpractice coverage gives you. All of this can also vary by state and location in the state based on the carriers past claims experience in that state. Malpractice insurance costs work out to about 3.2% of most physicians' incomes.

There is a large range between premiums that solo attorneys potentially pay for their professional liability insurance. Criminal and insurance lawyers have the lowest premiums, while securities placement, class action, and intellectual property attorneys’ premiums are higher. On average, medical malpractice insurance costs $7,500 per year.

However, this limit may not be adequate for your firm, as the cost to defend and the cost of any settlements are combined under the limit. Surgeons tend to pay between $30k and $50k in annual premiums. The higher your policy limit is, the higher the premium will be.

You can choose your own deductible, which can be $0, $1,000, $2,500, $5,000, or $10,000. Most smaller firms would purchase a $1 million limit. Legal malpractice insurance cost depends on a number of factors.

Many factors are evaluated when determining the cost of insurance for a solo attorney. Discuss your particular circumstances with a reputable broker or with the insurance company itself in order to select the best rate for your needs. But numerous factors that impact the cost of malpractice insurance.

The typical maximum limit is $10 million. Malpractice insurance rates depend on a number of factors and vary by company. One of the key questions related to attorney malpractice insurance is that there are many different factors that go into determining the premium a law practice will have to pay in order to secure.

A new attorney can expect to pay around $700 per year for an average malpractice insurance policy. Attorneys that practice in the higher risk areas can expect to pay around $3,000 to $10,000 per year. Get competitive quotes and remember, cheaper isn't necessarily better.

At hire an esquire part of our founding mission has been to provide critical work infrastructure to legal freelancers. Experienced attorneys when an attorney has been practicing for more than 10 years, the risk of a malpractice lawsuit increases due to the complexity of some cases that these type of attorneys handle. A “step rating” is a system that insurers use to determine.

What the cost of legal malpractice provides lawyers. Malpractice insurance for freelance lawyers (and solos and firms) and other malpractice considerations for freelance lawyers. The cost of malpractice insurance for attorneys can come with a high annual premium.

Finally, keep in mind that almost all malpractice policies “deplete,” meaning the fees and costs for your defense are paid from the limit available for the claim. According to alp insurance, the average cost of professional liability insurance for a solo lawyer is $2,800. The premium is based mainly on your firm’s atty.

Premium costs start at $79 per month and can reach $500 per month. The higher the deductible, the lower your monthly premium will be. Average annual malpractice insurance premiums range from $4k to $12k, though surgeons in some states pay as high as $50k and ob/gyns may pay in excess of $200,000.

For most attorneys this cost is small versus the risk to one’s assets. The cost of medical malpractice insurance varies depending on your specialty, the state in which you practice, and the amount of coverage you need. Depending on where you practice law, the area you practice, the years of experience you have, and the size of your firm, these are all factored into the annual insurance price.

If you have a very low limit ($100,000, for example), then it may be possible that you do not even have enough available to defend the case through trial (leaving nothing left to satisfy a potential judgment). How much does legal malpractice insurance cost? However, the one thing that most attorneys come to realize is that.

At tba member insurance solutions, we are. At year 5, this same firm’s premium: The size of your law firm:

How Much Will Your Legal Malpractice Insurance Cost?

4 Overlooked Business Expenses for Startups and Why You

Cost of a Medical Malpractice Lawyer Naperville Medical

How Much Does Legal Malpractice Insurance Cost? Legal

How Much Does Malpractice Insurance Cost For Lawyers How

How Much Does Malpractice Insurance Cost For Lawyers How

Legal Malpractice Insurance Cost Attorney Malpractice

How Much Does Legal Malpractice Insurance Cost?

How Much Does Malpractice Insurance Cost For Lawyers How

How Much Does Malpractice Insurance Cost For Lawyers How

Recent Data Reveals the Cost of Legal Malpractice Huntersure

Liability Insurance For Law Enforcement Law Enforcement

How Much Does Professional Liability Insurance Cost?

How Much Does Malpractice Insurance Cost For Lawyers How

How Much Does Legal Malpractice Insurance Cost?

How Much Does Legal Malpractice Insurance Cost?

Average Cost of Handyman Insurance 2021 NimbleFins

How Much Does Legal Malpractice Insurance Cost

Will The Cost of Legal Malpractice Insurance Increase