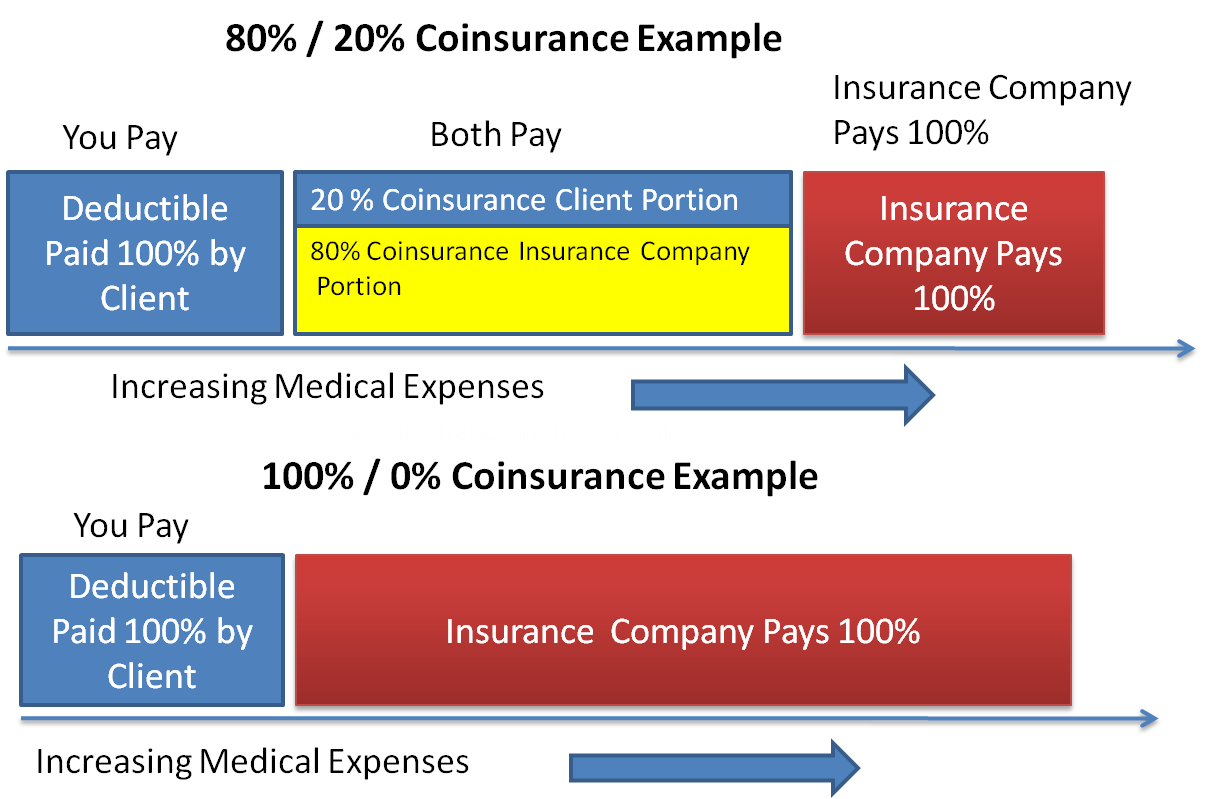

Prior authorization is required for certain services. The insurance provider would be responsible for 80% of the bill and the insured would be responsible for 20% of the medical bill up to $10,000.

No Deductible No Copay Health Insurance

This leaves $1,840 remaining that your insurance will cover.

Health insurance 80 20 deductible. What is coinsurance of 80/20? You pay the second.) coinsurance can be tricky. You are responsible for the.

The individual deductible on the 80/20 plan was reduced by $1,960, which is good news for everyone, but especially single employees with no dependents and families where one person generally uses most of the healthcare dollars on the plan. The 80/20 ppo plan is a preferred provider organization (ppo) plan administered by blue cross and blue shield of north carolina (blue cross nc). //insurequote.info/index.html?src=compare// related dose anyone know any cars with cheap insurance for a.

For example, once your deductible is met, your insurance company may pay 80 percent of your healthcare expenses. The total amount this visit will have cost you is $1,460. What does a 10 000 deductible mean?

The specialist arranges a mri to discover what’s causing the agony. The health plan pays 80% of your covered medical expenses. An insured with a $500 deductible and an 80/20 to $10,000 plan has medical bills totaling $7,000.

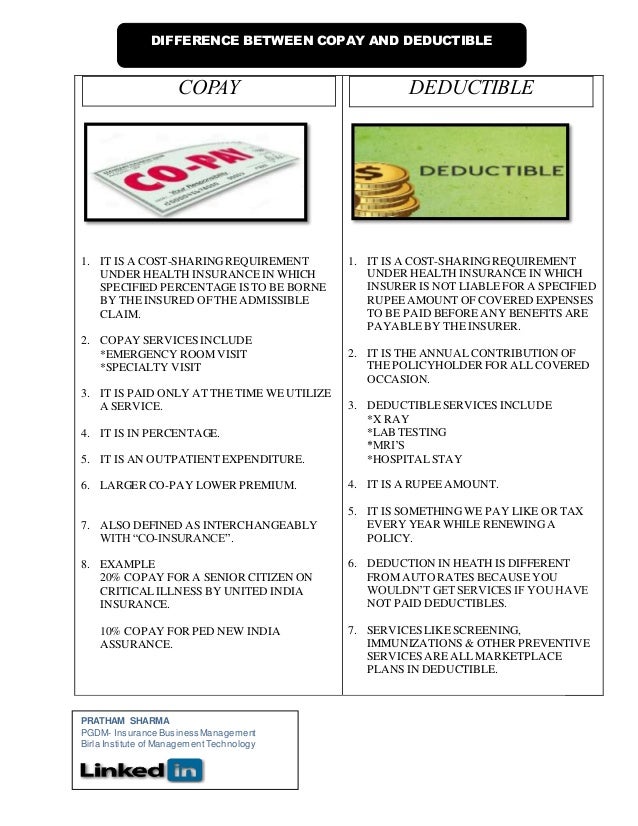

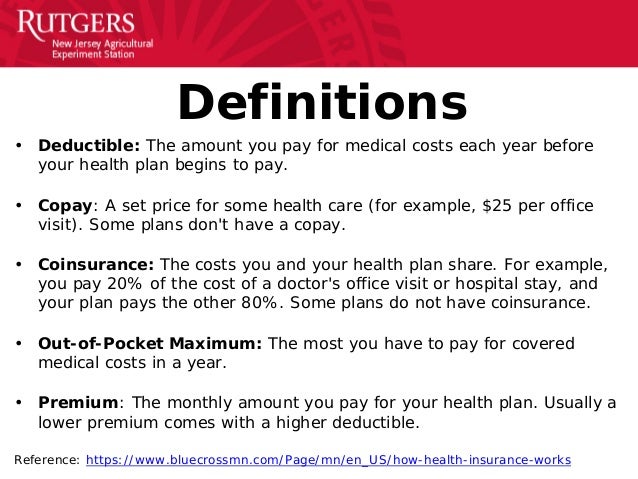

You will usually see your coinsurance represented as a number, like 20%. Once you do, the insurance company will pay 80 percent of your qualified medical expenses. The amount you pay once you meet your deductible—a percentage of costs of a covered health care service in an insurance plan.

For 80/20 insurance, you will have to pay the deductible first. Her first claim of the policy year amounted to $1,000, of which she paid $600. Then, your coinsurance kicks in.

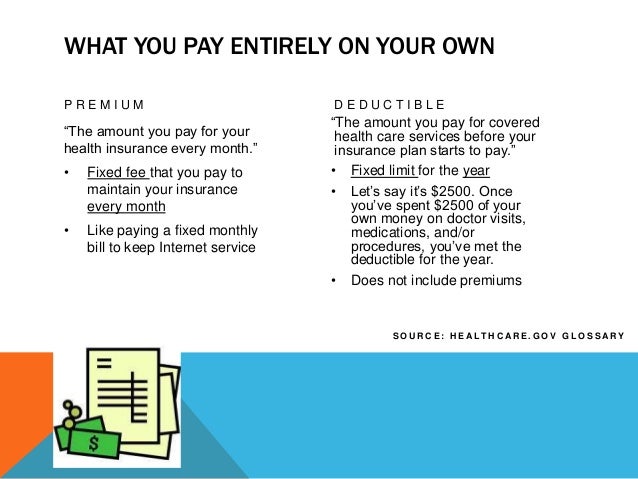

Premiums are determined once you choose a health care plan. (whether it's 80/20 or 90/10, your insurance company pays the first number; A common coinsurance split is 20%/80%, meaning you pay 20%, and the insurer pays 80%.

You visit an orthopedist ($50 copay) in light of the fact that you have hip agony. Afterward, the insurance will start, and your insurance company will cover the 80% of the costs while leaving you with the 20%. In an 80/20 insurance plan, you are expected to pay all of your healthcare costs until you meet your annual deductible.

Assume you have a $2,000 deductible, a $50 copay, 80/20 coinsurance, and a cash based limit of $3,000. If you have 20% coinsurance, you have to pay 20% of the cost of medical care and your insurance will cover the other 80%. An 80/20 insurance policy is a form of coinsurance in which you satisfy your deductible first, and then you pay 20 percent of additional medical costs and your insurer pays the 80 percent balance.

For example, if you went over your deductible by $10 and you had an 80/20 coinsurance plan, then you would pay $2 of the $10 in medical expense, the insurance company would pay $8. Coinsurance = 80/20 (plan pays 80%, you pay 20%) summary You’d then be responsible for the remaining 20 percent.

Ground & air transport 20% 40% $2000 deductible 80/20 $2000 deductible 80/20 covered services and benefit description lovelace insurance company provides the following benefits when medically necessary. Under the terms of an 80/20 coinsurance plan, the insured is responsible for 20% of medical costs, while the insurer pays the remaining 80%. Coinsurance out of pocket max is the maximum amount of coinsurance money you will be responsible for paying in the event of a serious illness or injury.

Your plan’s 80/20 coinsurance leaves you responsible for 20% of what’s remaining, which is $460. Most health insurance plans advertise “80/20” or “70/30” coinsurance with every plan. Health care plans include coinsurance, which means you are still responsible for paying a portion of your medical bills even after you have reached your insurance deductible.

Try this site where you can compare quotes: For this example, you would pay $1,000 (20% of $5,000) and your insurer pays $4,000. It means that when you’ve reached the amount of your deductible, you’re covered by insurance for 80 percent of the expense of the visit/procedure, and you are responsible for 20 percent.

You will pay the first $3,000 of your hospital bill as your deductible. How much you pay for coinsurance depends on your health insurance policy. Some places also list this as 80/20, with the amount your insurer pays listed first.

Eileen's health insurance had a $500 deductible and 80% / 20% coinsurance.

Copay After Deductible Meaning

Health Insurance Terminology and Technology Tools0615

What Is The 80 20 Rule In Insurance inspire ideas 2022

Life insurance premiums tax deduction insurance

Shopping for Health Insurance (SLIDESHOW)

Health Insurance Basics How to understand coverage

Basic Medical Expense Insurance Normally Has A Deductible

Insurances Archives Family Care, PA

What Is The 80 20 Rule In Insurance inspire ideas 2022

Health Care Decoded The Daily Dose CDPHP Blog

Individual Health Insurance Health Insurance Individual

Basic Medical Expense Insurance Normally Has A Deductible

Section 80 Deduction Deduction u/s 80DD, 80DDB, 80U

canonprintermx410 25 Awesome What Is 20 Coinsurance Mean