It’s basic liability protection that guards against things like accidents, injuries, property damage and lawsuits. If you don't have enough coverage, you could be sued by your customers and lose everything you have worked so hard to obtain.

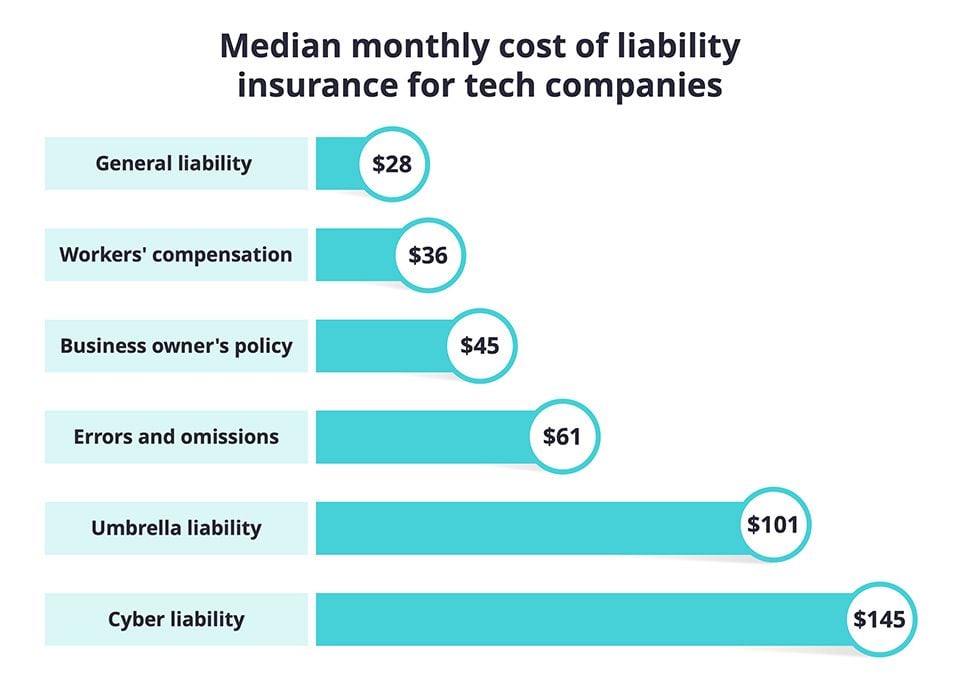

How Much does Professional Liability Insurance Cost

General liability insurance for sole proprietor.

General liability insurance for sole proprietor. When you decide to purchase a car and an auto insurance policy, there is one important factor you need to consider: Ad small business general liability insurance that's affordable & tailored for you! The great news is that these and other essential coverages can be bundled through one insurer to reduce costs further and to make policy management a breeze.

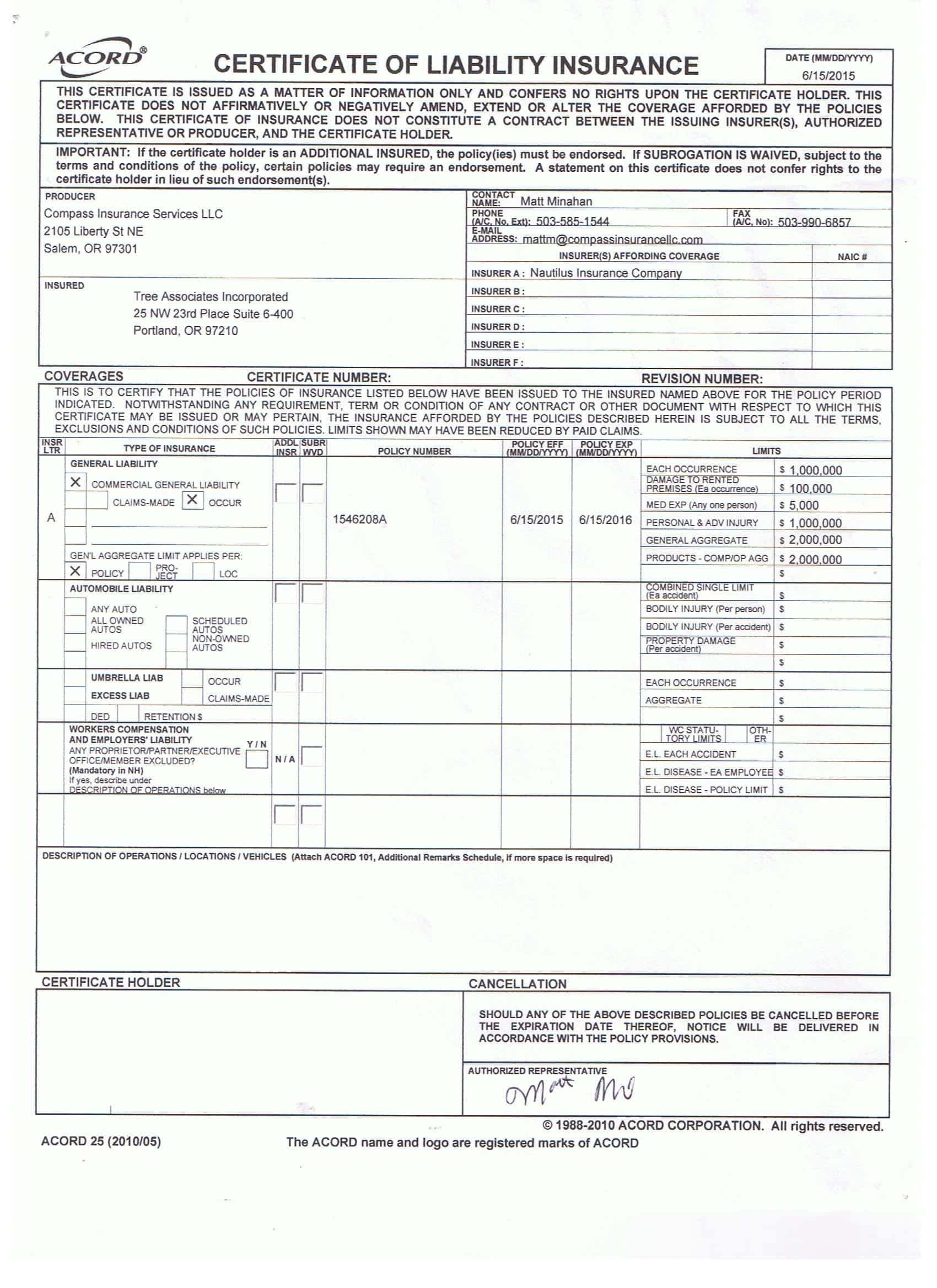

Learn more about this type of sole proprietor insurance, what it helps cover and how. Free, unlimited and instant certificates of insurance online. General liability insurance covers company assets and is often required to sign contracts.

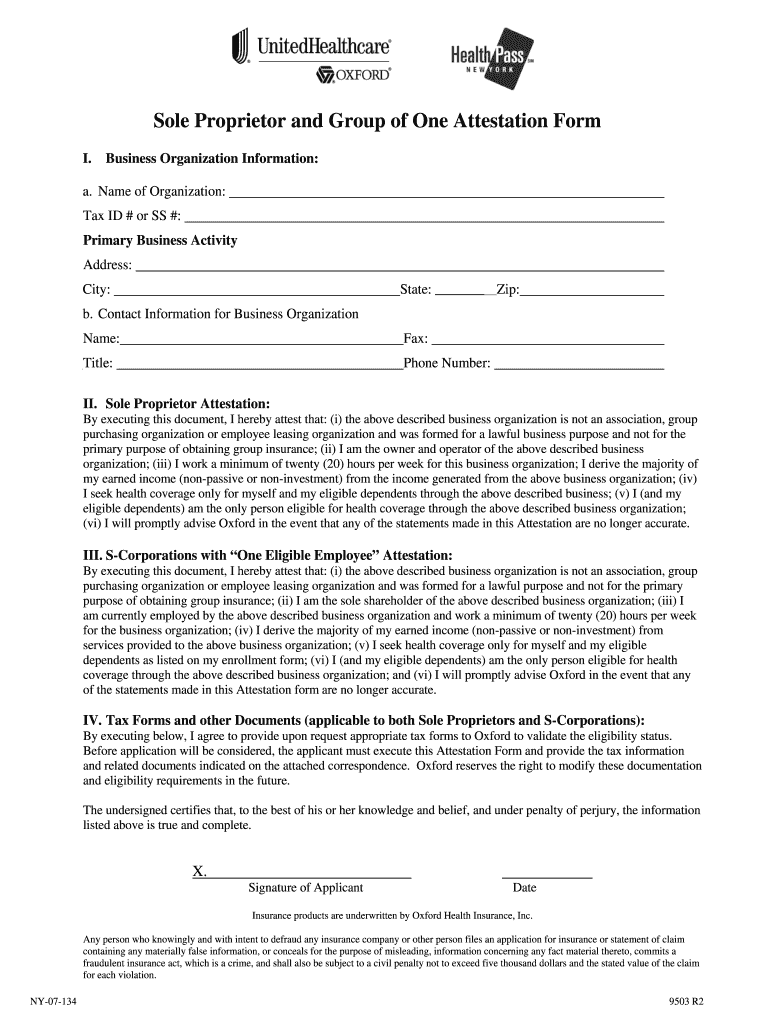

Some sole proprietors may wonder if registering for an llc would protect their business from being sued and incurring expensive legal costs. Take a look at the most common business insurance policies for sole proprietorships: As most small business owners will tell you, some form of liability coverage is required if you want to protect yourself and your employees from potential legal action.

Even if you don’t make a mistake, your customers or clients can still sue you. Free, unlimited and instant certificates of insurance online. There is business liability insurance that can perfectly protect a sole proprietor from liabilities such as lawsuits that would derail the business and deplete personal assets.

Professional liability insurance, or errors and omissions insurance, helps protect your business in case you get sued for mistakes in the professional services you’ve provided. However, for business owners who run a sole proprietorship, purchasing insurance is more than a precaution. With sole proprietor insurance, a company is covered in the event of an accident or injury.

While some types of businesses may find their level of risk to be quite low, individuals who provide direct services to the general public can. But to give you an idea: If you are a sole proprietor, liability policies can also help shield your personal assets if you are held liable for an injury or property damage.

Unless you have small business insurance, the answer is yes. A good general liability insurance policy will boost your confidence and allow you to focus on your business. Get your instant quote now!

General liability insurance all sole proprietors work with customers or clients on some level, making it essential to implement some sort of liability policy in the event of an unforeseen situation. Regardless of what type of sole proprietorship business you own or what products or services you sell, it’s worth the investment to purchase commercial general liability insurance. Look into a sole proprietor insurance policy like general liability insurance for some basic business liability protection.

The cost of sole proprietor insurance varies. As you can see, sole proprietorships can face significant liability risk. Errors and omissions insurance, also known as professional liability insurance for a sole proprietorship, is important for covering mistakes or errors in the professional services you provide your clients.

It can help cover claims of: It depends on things like the industry you’re in, your annual business income and how much coverage you need. Whether you’re a sole proprietor or the owner of an llc, general liability insurance is crucial.

While it may be an expensive option, especially for small business owners, it can protect sole proprietors from many events that would be financially devastating to the business. General liability insurance, also referred to as commercial liability insurance, is sole proprietorship coverage that helps protect business owners. Our general liability policies start from $30 a month.

Find professional liability insurance for sole proprietors professional liability insurance can help sole proprietors protect their business, so they can focus on running it instead. Ad small business general liability insurance that's affordable & tailored for you! General liability for sole proprietor 🟩 jan 2022.

Get your instant quote now! These policies combine general liability insurance with other types of coverage, such as business interruption and business property damage. Sole proprietors general liability insurance all small businesses, old and new, need general liability insurance.

Your sole proprietorship liability insurance. That’s why we’re here to help!

Did You Change Your Business Structure From A Sole

General Liability Insurance For Sole Proprietor Workers

Sole Proprietorship vs. LLC Which Is Best for Freelancers

How To Register Sole Proprietorship Firm In Gst Charles

Why LLCs Need Liability Insurance as Much as Sole

Should You Run Your OnePerson Business as a Sole

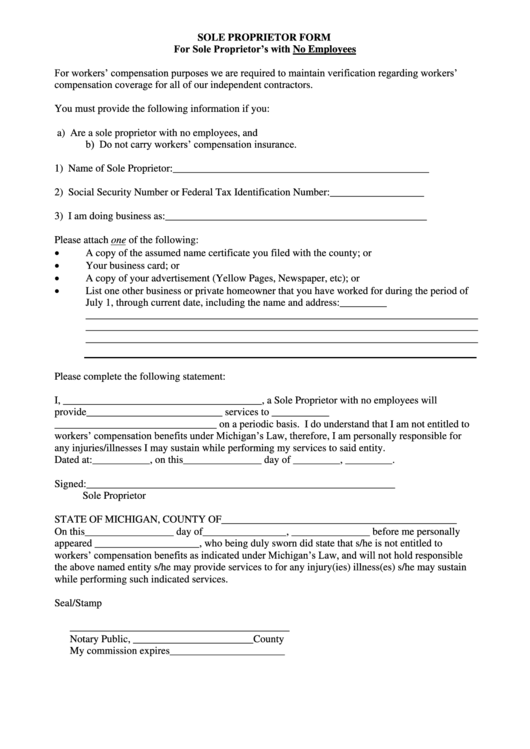

Sole Proprietor Form printable pdf download

Do Sole Proprietors Need Workers’ Compensation Insurance

General Liability Insurance For Sole Proprietor Workers

General Liability Insurance For Sole Proprietor Workers

/a-limited-liability-company-operation-agreement-with-pen-158734256-580788d83df78cbc283d657d.jpg)

Sole Proprietorship Vs. LLC Vs. Corporation

General Liability Insurance For Sole Proprietor Workers

Sole Proprietor Liability Insurance Smart Business Insurance

Sole Proprietorships Guide — Advantages and Disadvantages

General Liability Insurance For Sole Proprietor Workers

Sole proprietorship insurance insurance

General Liability Insurance For Sole Proprietor Workers

Affidavit Of Sole Proprietorship Fill Out and Sign