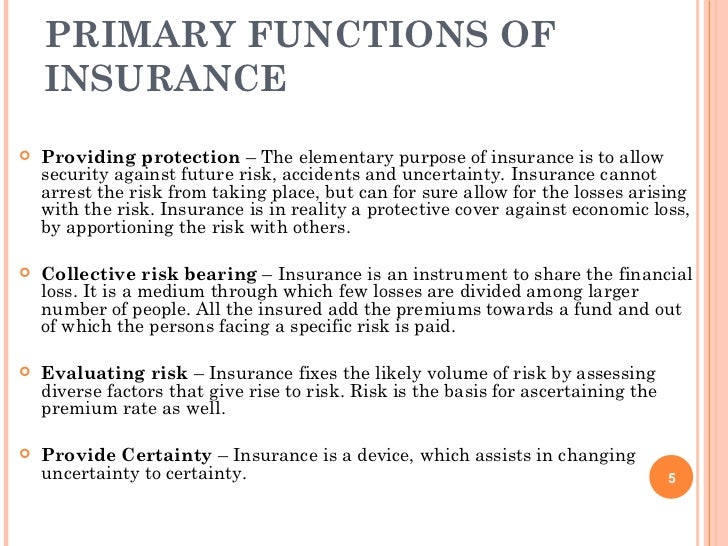

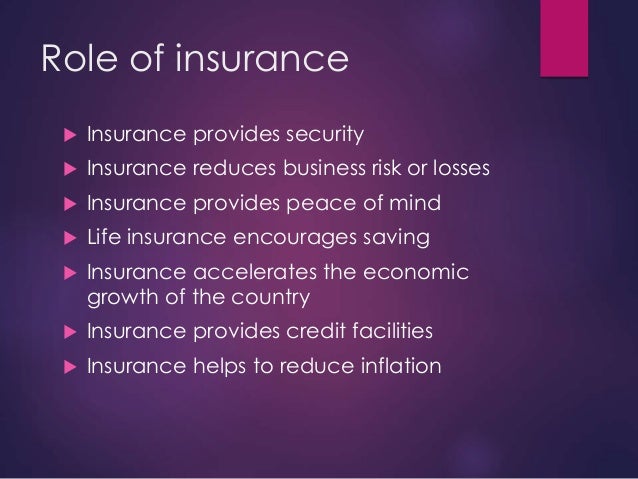

It is therefore primary function of insurance to provide protection against future risks, accidents and uncertainty. Control and regulations of rates, terms and conditions by insurance company to policy holders.

canonprintermx410 25 New Function Of Insurance Company

The insurance agent, paul, asks cregg to tell him more about the business.

Explain the function of insurance. The main function of insurance is that eliminates the uncertainty of an unexpected and sudden financial loss. To ensure speedy settlement of genuine claims, to prevent insurance frauds and other malpractices and put in place effective grievance redressal machinery; Represented in a form of policy, insurance is a contract in which the individual or an entity gets the financial protection, in other words, reimbursement from the insurance company for the damage (big or small) caused to their property.

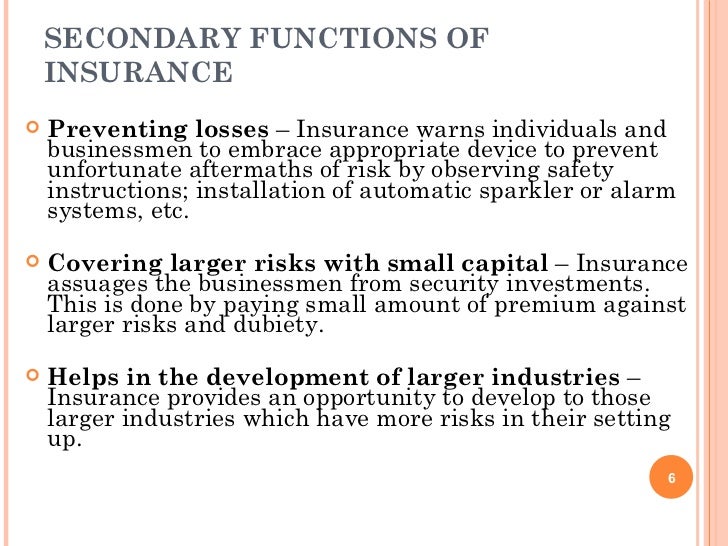

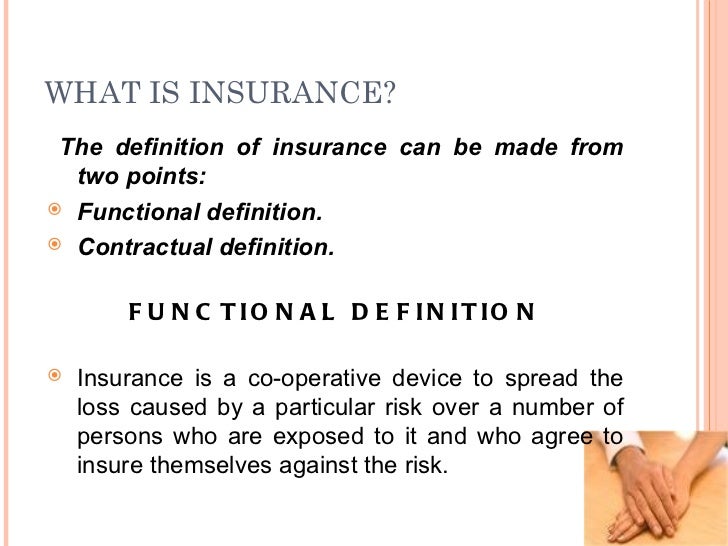

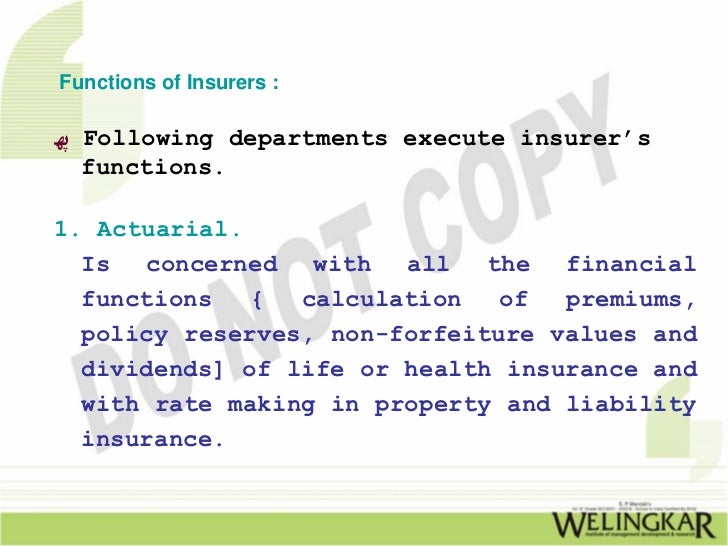

The premium to be paid. B) the system to spread the risk over a number of persons who are insured against the risk. The most important function of insurance is to spread the risk over a number of persons who are insured against the risk, share the loss of each member of the society on the basis of the probability of loss to their risk and provide security against losses to the insured.

The time and amount of loss are uncertain and at the happening of risk, the person will suffer loss in absence of insurance. Fixing the percentage of insurance business to rural and social sectors. The role of a tpa is to approve the claim based on coverage and exclusion.

This is one of the biggest worries of a business. Insurance may be described as a social device to reduce or eliminate risks of loss to life and property. The insurance guarantees the payment of loss and thus protects the assured from sufferings.

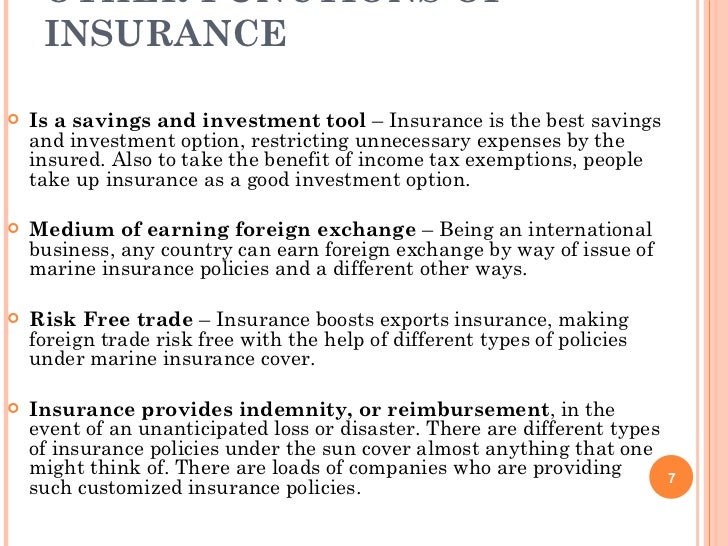

Marine insurance protects against business losses incurred during water transport operations. C) the principle to share the loss of each member of the society on the basis of probability of loss to their risk. Adjudication of disputes between insurance company and others in the insurance business.

Instead of this uncertainty, it provides the certainty of regular payment i.e. Tpa obtains a license from irda in order to function in the insurance industry. To promote fairness, transparency and orderly conduct in financial markets dealing with insurance and build a reliable management information system to enforce high standards of financial soundness amongst.

Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. Some cases the insurance company canceled the agreement, because the find health facts that are not in. The tpa administrator knows all the aspects of health insurance.

But nothing is more important than your life and your ability to make a living. Insured should provide all the information that impacts the subject matter. The main function of insurcen is to provides protection against the risk of loss.

One feels insured and contended about future risks only because one is sure to be compensated for any loss of future. Undertaking inspection, conducting enquiries etc., on insurance companies. The main function of the insurance is to provide protection against the probable chances of loss.

The function of insurance is to safeguard against financial loss by having the losses of few paid by the contributions of many who are exposed to the same risk. You insure your car and your home. The primary function of insurance is as we think about any insurance.

Families purchase life insurance primarily as a hedge against future loss, although some buy whole life plans that accumulate cash value that can be used. According to this principle, both insurer and insured should enter into a contract in good faith. In business, it plays a major role in strategic planning for future operations.

The insurer acts as a middleman between all the members of the society who are exposed to the fire risk on the one hand and the members who will be the actual victims of the fire losses on the other. Insurance companies will accept the transfer of the risk with the principles of goodwill, for example, we give the data are true and honest, and does not cover the facts of health at the time of fillingthe form letter filing life insurance. The insurance policy covers the risk.

The insurer should provide all the details regarding the insurance contract. Life insurance has important functions in business and in family and personal life. The insurer charges the premium from all the insured members and makes good the losses when they occur to any of them.

As we move through life, find a partner, raise a family, and maybe start a business, the importance of insurance in a long term plan increases.

PPT Functions of the Agents & Insurance underwriting

FUNCTIONS OF INSURANCE INSURANCE SCHOLAR YouTube

canonprintermx410 25 New Function Of Insurance Company

What is the purpose of insurance insurance

What Is The Purpose Of Insurance? EruptingMind

Functions of Insurance.What is insurance? Functional

Role of insurance and derivatives

PPT Chapter 20 Basics of Health Insurance PowerPoint

INTRODUCTION & FUNCTIONS OF INSURANCE YouTube

Know About Functions of Insurance and Legal Billing Software

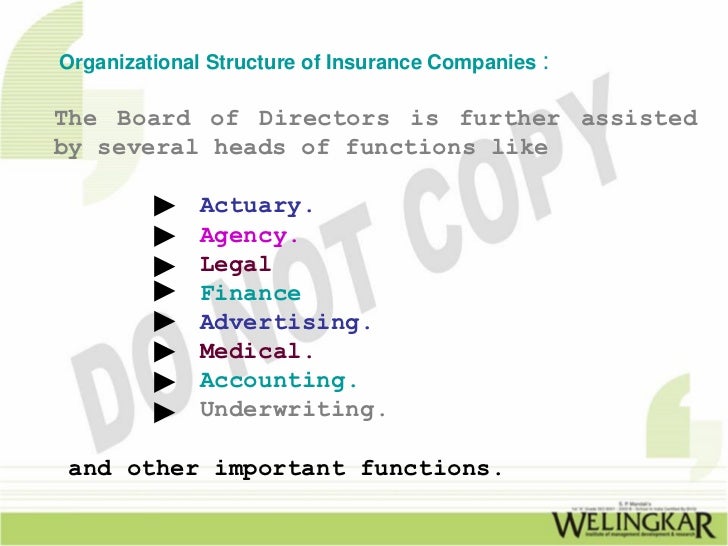

Functions and Organisations of Insurance

Functions and Organisations of Insurance

Role of Insurance Agent Life Insurance Insurance Broker