Cmhc financial institutions client relationship management team. Jurisdiction, or any other requirement having the force of law.

The flip — Greater Fool Authored by Garth Turner The

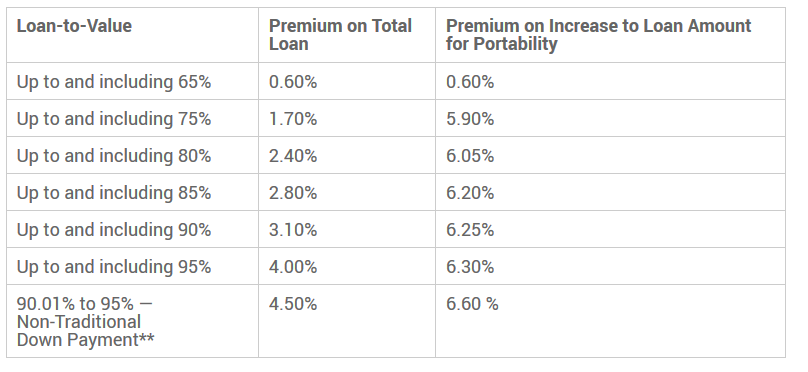

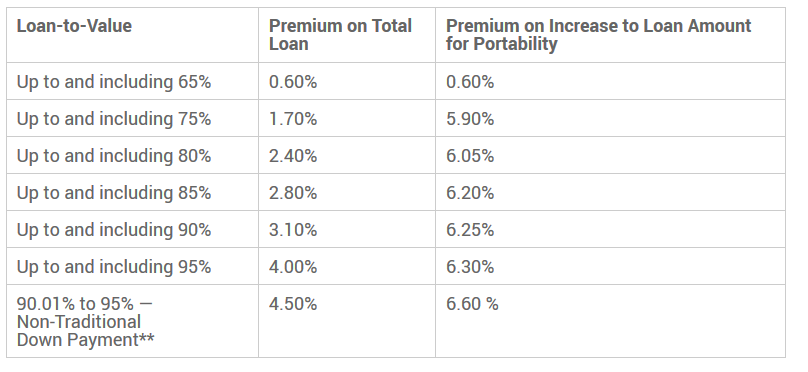

You're essentially paying extra for the privilege of the bank lending you money.

Cmhc insurance in force. Bank of canada rate means the “prime business Share this article in your social network. Canadian residential mortgages with cmhc insurance coverage (%) 23.1%.

National mortgage arrears rate (%) 0.29% Cmhc announced in its 2013 annual report that it expects to have a total of $545 billion worth of insurance in force by the end of the year. Approved lender means a person designated as an approved lender by cmhc in accordance with the act.

Access to information and privacy protection; Summary of the corporate plan; Public safety canada will lead the task force and provide secretariat services throughout the mandate of the task force.

Cmhc follows prudent risk management practices as set out by the offi ce of the superintendent of financial institutions (osfi). The related policy responses by all levels of government, from cmhc and the mortgage insurance industry combined have limited the impacts and supported the recovery. Application means the written request for insurance coverage in respect of a housing loan under the policy in the form required by cmhc.

The task force will bring together experts from federal departments and agencies, provincial and territorial ministries, as well as representatives of the insurance industry, including the insurance bureau of canada. Travel, hospitality and conference expenditures; Just a recommendation, try to avoid cmhc.

During a speech in calgary, cmhc president and ceo evan siddall said the option of requiring lenders to pay a deductible on mortgage insurance claims is still on a table. Wherever possible try to choose a house where you can make the minimum down payment and avoid cmhc, it's a big waste of money better spent building equity. Cmhc says its total insured volume, which refers to.

Travel, hospitality and conference expenditures; Access to information and privacy protection; Cmhc, which controls a majority of the market, has been reviewing its operations since new chief executive evan siddall, a former investment banker, took over last year.

Cmhc believes that these performance measures. Improved economic stability has led to less volatility in third quarter results for canada mortgage and housing corporation (cmhc), as indicated in the q3, 2021 financial report released today. Summary of the corporate plan;

Its legislative maximum is $600 billion, which iti had been approaching in previous years. It protects the banks not the borrower. Cmhc’s capital holding level is set at twice the minimum required by osfi.

September2014 and is intended to help readers better understand cmhc’s insurance activities. This means that taxpayers are potentially on the hook for almost a half trillion dollars if the housing market were to collapse and require the.

Otsego County Behavioral Health inspire ideas 2022

.jpg)

CMHC insured mortgages increase 26 per cent, home equity

CMHC's Housing Exposure Is Steadily Being Hiked Back

When Can I Stop Paying Mortgage Insurance / CMHC Home

CMHC could force banks to pay deductibles on mortgage

The flip — Greater Fool Authored by Garth Turner The

What’s the Difference Between Insured, Insurable and

CMHC reveals condo developer insurance sales were made

Buying and Selling Kevin & Tina Girard Royal LePage

The flip — Greater Fool Authored by Garth Turner The

The not so secret Canadian bank bailout

CMHC mortgage insurance business continues to shrink in

Toronto Market Report August Sept

CMHC Canadian home buyers can still manage debt effectively

Otsego County Behavioral Health inspire ideas 2022

CMHC releases 2016 Annual Report "Innovating for Better

Ksenia Warhol A firsttime homebuyer’s guide to Canadian

The flip — Greater Fool Authored by Garth Turner The

/cloudfront-us-east-1.images.arcpublishing.com/tgam/XKQN3TMVAJA3NB54EHMZZSC5XM)