However, transferring risk to reinsurers is expensive. Benefits of reinsurance for a sample of u.s.

Insurance Solutions Custom Brokerage & Trading Platform

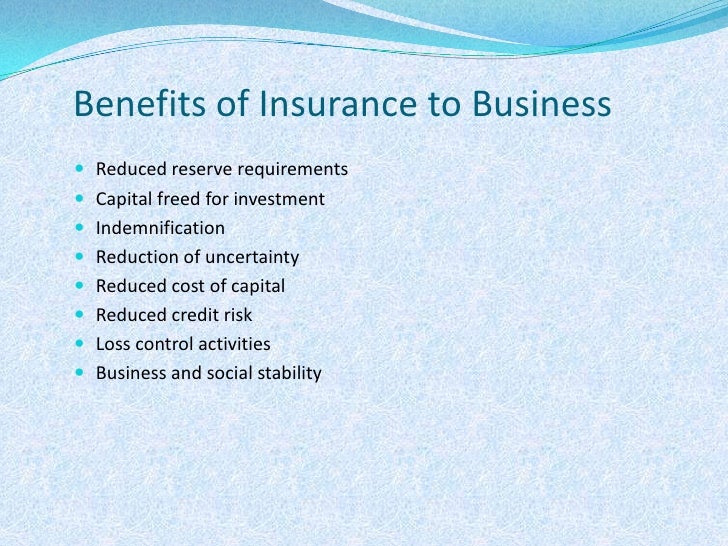

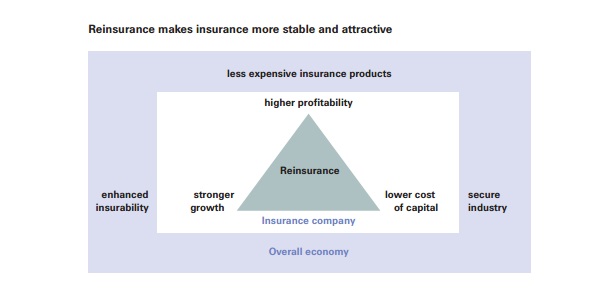

Purchasing reinsurance reduces insurers’ insolvency risk by stabilizing loss experience, increasing capacity, limiting liability on specific risks, and/or protecting against catastrophes.

Benefits of reinsurance to the insurer. With the addition of a reinsurer, profit is stable for insurance companies. The cost of reinsurance for an insurer can. The reinsurance gives the benefit of the greater stability resulting from a widespread of business.

Purchasing reinsurance reduces insurers’ insolvency risk by stabilising loss experience, increasing capacity, limiting liability on specific risks and/or protecting against catastrophes. The better the claim settlement, the better the business in the future as a rule. Purchasing reinsurance reduces insurers insolvency risk by stabilizing loss experience, increasing capacity, limiting liability on specific risks, and/or protecting against catastrophes.

It increases the capacity to assume more risks & to issue to more policies. Consequently, purchasing reinsurance should reduce capital costs. A ceding company (the primary insurer) uses reinsurance mainly to protect itself against losses in individual cases beyond a specified sum (i.e., its retention limit), but competition and the demands of its sales force.

It further increases the goodwill of the main insurer: Reinsurance can also benefit the consumer, too, by helping to cover catastrophic claims, allowing more insurance companies to remain in the market. Reinsurance is a tool used by insurance companies providing them with financial flexibility.

So reinsurance increases goodwill of an insurer. Purchasing reinsurance reduces insurers’ insolvency risk by stabilizing loss experience, increasing capacity, limiting liability on specific risks, and/or protecting against catastrophes. This type of reinsurance is advantageous to ceding company since it can pick and choose as to which risks are to be reinsured and which risks are not.

By covering the insurer against accumulated individual commitments, reinsurance gives the insurer more security for its equity and solvency by increasing its ability to. With purchasing reinsurance, insurers accept to pay higher costs of insurance production to reduce their underwriting risk. In brief reinsurance is a one insurance policy brought by other insurer to spreading and minimizing loss.

A reinsurer helps in building goodwill for the insurance company. However, transferring risk to reinsurers is expensive. By accepting many risks and scaling down, by reinsurance, all those that are larger than the normal carrying capacity of the insurer justifies, certainty in business is substituted for uncertainty through the better application of the law of average.

Reinsurance enables risk to be scattered over a much wider area, and the principle of insurance is taken good care of. What is the importance of reinsurance for iciec, and. Insurance companies must have enough money to pay any claims they’ve agreed to underwrite, which protects consumers but limits how much business the insurer can commit to.

To an insurer, the need for reinsurance protection arises in the same way as the insured needs insurance protection. When the insurer develops confidence, he understands the nature of risks involved beyond his capacity. It protects the main insurer from catastrophe to occur.

Over the course of the month, we spoke to its stakeholders and customers via a variety of channels: Top 12 advantages of reinsurance Reinsurance, therefore, can be seen as shadow capital, extending an insurer's risk appetite and capacity.

Consequently, reinsurance purchase should reduce capital costs. There are two parties where first party is originally commit from insured and provide insurance options this is called ceding company and which company brought again from ceding company is called reinsurer. This really helps in the ultimate viability of the rance operation.

The results show that reinsurance purchase increases significantly the insurers’ costs but reduces significantly the volatility of the loss ratio. Reinsurance helps to boost the overall confidence and goodwill of insurer. Some of the key functions of reinsurance are discussed as below:

It helps the main insurer to grow or multiply in terms of volume of premium. It is advantageous to reinsurers because they can apply underwriting judgment case by case and may accept o reject. Quota share reinsurance is a type of pro rata reinsurance in which the primary insurer and the reinsurer share the amounts of insurance, policy premiums and losses (including loss adjustment.

Consequently, reinsurance purchase should reduce capital costs.

While You're Alive The Unknown Living Benefits of Life

IBM helps Thai Re launch reinsurance smart contract

What Is Term Life Insurance And How Does It Work

Eiopa mulls benefits of a new, crossborder pandemic

Risks Free FullText How Does Reinsurance Create Value

The Advantages and Disadvantages of Facultative

INTERNATIONAL REINSURANCE SEMINAR 2019 Reinsurance

3 ways to use your health plan when you’re feeling well

Zurich Advocacy The Benefits of Global Reinsurance and

Make sure you get the most out of your dental benefits. We

Invest In Your “Healthy Self” (and Post a HealthySelfie

What are the Benefits of Life Insurance in 2020 Benefits

Reinsurance & Dealer Participation Programs Product

What Are The Different Types Of Reinsurance Arrangements

Reinsurance What is Reinsurance Types of Reinsurance

Benefits of Umbrella Insurance SFM Insurance

Life Insurance During COVID19 The Ziff Agency, LLC