And third party only cover. Taxi insurance is specialized because as a taxi driver, you become explicitly responsible for the safety of passengers.

Does American Family Insurance Cover Mobile Homes

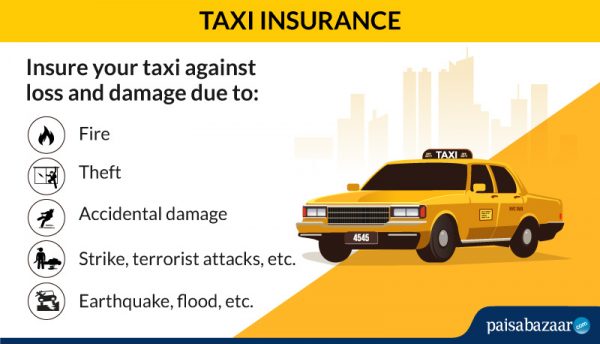

It is important to get commercial taxi insurance that covers your vehicle against damage and theft, as well personal injury to you and your customers.

What does taxi insurance cover. Public and private hire insurance will cover you when carrying passengers in exchange for payment. Taxi insurance policies come with a range of different options including: Designed to cover damage or injury to members of the public and their property, it is unlikely to offer any protection against.

Get my quote call me back. You may extend cover to provide personal accident insurance on a 24 hour / 7 day basis. Not all problems were resolved.

Most drivers pay around $5,000 to $10,000 per year, or $430 to $830 per month. Taxi insurance covers more than traditional taxi cab operations. Some of the types of business auto insurance you.

Taxi insurance offers the same three levels of protection as standard motor cover: Bear in mind that without the correct hire and. Even if you don’t have proof of ownership for every piece, you’ll need to include a list of your damaged belongings when filing a claim.

Taxi insurance is a specialist insurance policy designed to cover you and your vehicle. It is optional insurance coverage and is used in addition to collision or comprehensive coverage. 'normal' car insurance is called social, domestic and pleasure insurance (sd&p).

Before you can start working as a taxi driver, you will first need to ensure you have the correct insurance in place. Unlike private hire insurance, courier insurance covers goods in transit coverage up to a predetermined sum, protecting the items you deliver if they are lost, damaged (food. However, there are other cover options specific to taxi insurance you should also consider, including:

Comprehensive taxi insurance offers the same as tpft but includes protection for you and your vehicle with the most complete level of cover. The short answer is—no—you can't use normal car insurance for a taxi. The general liability policy covers all parties involved in the management and.

You can find out which level is right for you in our guide. In such cases, your insurance company will normally compensate you based on the estimated replacement cost of a comparable product. Your insurance company and the state you work in may have taxi insurance requirements you must meet.

It also includes other businesses such as airport shuttle services, sightseeing tours and certain rideshare risks. You will need to buy specialist taxi insurance that includes hire and reward cover. Alternatively you can quote and buy your hire and reward insurance policy online.

Third party, fire and theft; Taxi driving usually involves covering a far higher mileage than a standard car driver, often at unsociable. If your driver is 76 to 80 years old, cover is only available while they are on shift.

As with personal motor insurance, taxi insurance provides cover for windscreens for anything from a small chip that needs filling to a large fracture that requires a full windscreen replacement. Public hire taxi insurance, also known as ‘black cab’ insurance, is a type of policy specifically designed to cover taxi cabs licensed to be flagged down by the public. It varies slightly from private hire taxi insurance because there are different risks for public hire cab drivers.

Sd&p covers regular driving like going to the shops, taking your kids on the school run, visiting friends, going to the beach, and more. What does taxi insurance cover? If you decide to switch from a private hire taxi job to food delivery courier work, you’ll need to make sure you have the right insurance in place to protect yourself from the risks you’ll face.

Comprehensive insurance, cover for both the taxi and third parties was not compulsory and remains expensive or unaffordable for many owners. Third party or third party, fire and theft. Who is covered under the general & products liability policy?

As a taxi driver your car is essentially your business and so comprehensive insurance is crucial in order to protect your livelihood. Anything from a small chip that needs filling to large fractures and full windscreen replacements are all usually covered in both car and taxi insurance. This in turn made the insurance of taxis more viable for both the insurance and taxi industries.

The auto insurance you choose for your taxi cab needs to protect you from the largest financial losses that you may enquire, therefore allowing your company to continuously prosper even when unexpected events arise. Do i need taxi insurance? We much prefer to speak to our customers so call us for a quotation on.

A taxi fleet insurance takes into account the increased risk for taxis and can also offer specialist cover features for carrying passengers. What does taxi insurance cover? Additional premium is payable if you choose to take this option.

“you need insurance providers that understand the industry, and also offer the right kind of insurance, whether that’s private or public hire cover, as well as all the other additional insurance cover we. What can taxi insurance cover? It helps you pay off an auto loan if a car has been totaled or stolen, and you owe more than its worth.

What cover do you need? “taxi insurance is a ‘niche’ insurance, and as such not every provider is going to offer cover for commercial use,” comments marc. Light goods fleet insurance light goods vehicles, sometimes known as light commercial vehicles, are typically commercial carrier vehicles with a gross weight below 3.5 tonnes.

This is a legal requirement and attempting to complete taxi work without it can have some serious consequences. Taxi companies are not required by law to take out public liability insurance, however some local authorities do insist upon it and many taxi drivers choose to take it out to protect themselves against claims from members of the public. But the exact cost of your insurance will depend on where you live, how much coverage you have and your driving record.

How much does taxi insurance cost?

The Best Ways to Insure Your Taxi My Blog

Cheap Taxi Service London All information about Service

Taxi Insurance Coverage YouTube

How does AXA cover taxis insurance? Best Auto Insurance

Taxi Insurance Coverage, Claim and Exclusions

Benefits Of Using A Taxi Service Architects Of Control

Does Landlords Insurance Cover Fire Damage All

Does Insurance Cover Nutritionist Awesome

Does Taxi Insurance Cover Coronavirus?

Creative Producer insurance cost and coverage

How to make a car insurance complaint

What Does Taxi Insurance Cover Taxi Insurance Home

Does Taxi Insurance Cover Food Delivery

Taxi Insurance Cover Alternative Insurance Brokers

Physician Liaison insurance cost and coverage

Instrument Engineer insurance cost and coverage

Do Taxi Drivers Need Public Liability Insurance

Does Insurance Cover Tb Test Aetna All information about

Does Pet Insurance Cover Dental Extractions All