For example, if you paid $1,000 in policy premiums for 20 years and you cash in the policy and receive $30,000, you'll pay ordinary income tax on $10,000 in earnings. In particular, the rulings address the determination of the owner’s basis in a policy and whether any part of the gain on a surrender or sale of the policy is a capital gain.

PPT Loss of Life Chapter 16 PowerPoint Presentation

Experts opine that this feature makes the policy not held for investment but for personal reasons, and the unless the cost of the insurance feature can be separated from the investment cost, no deduction is allowed.

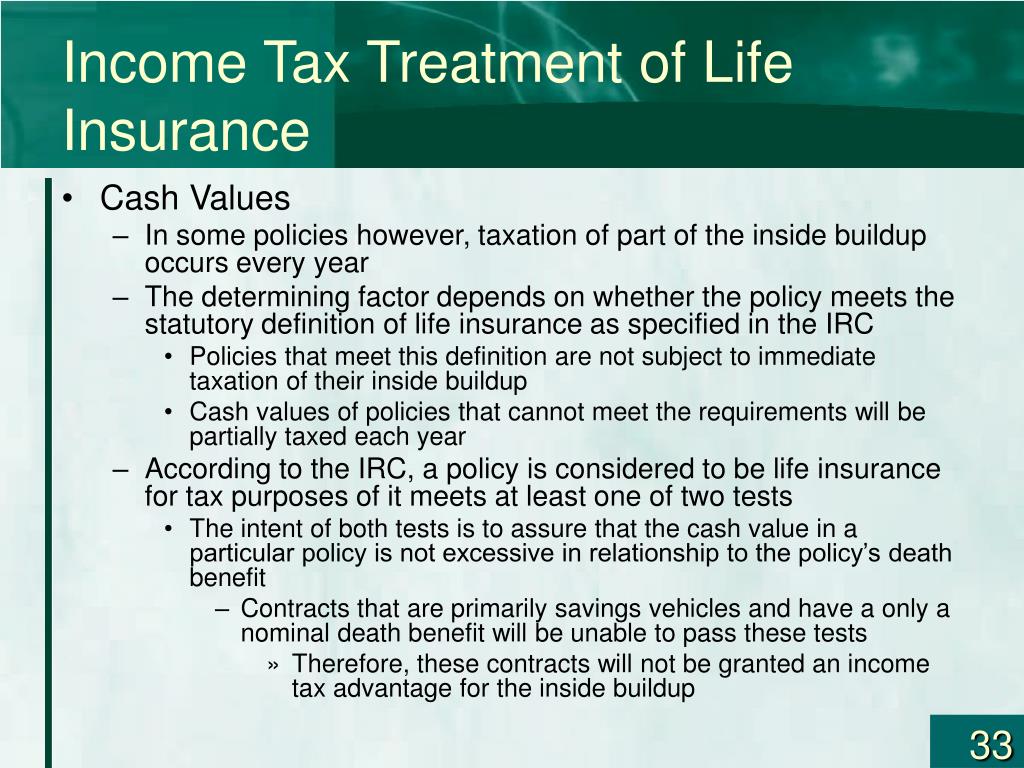

Tax treatment of surrendered life insurance policy. There is a specified provision for tds and tax on surrender and maturity of life insurance policies. Instead they are taxed as income and added to your other income. If the event is a death or the maturity, sale or surrender of the whole of a policy, the gain is treated as income of the tax year in which the death, maturity, sale or surrender occurs.

What are the tax consequences of surrendering a life insurance policy? This is because of the insurance feature of the policy. 15,00,000, the total income will be rs.

Where the policy’s csv exceeds the acb, the insurance company issues a t5 to the policyholder for the difference. Tax on surrender of life insurance policy or ulip: How do you pay the taxes?

Unlike life insurance payouts, gifts are subject to taxes, and the owner of the policy is responsible for that tax payment. Manoj (student) (5193 points) replied 01 january 2013. There can be two tax implications on surrendering of life insurance policy or ulips.

3,00,000 and total income apart from surrender value is rs. For the sake of tax benefits on premium payment for a life insurance policy stipulates the life cover to be 10 times the annual contribution. The amount of your life insurance surrender payout that is taxed as income depends on the premiums you have paid into the policy.

One beneficial tax treatment of life insurance is the first in first out ( fifo ) accounting principle. There are no tax consequences if the policy has no cash surrender value (csv) — in other words, no proceeds — or the policy’s acb is greater than the csv. A common type of disposition is the cancellation or surrender of a policy.

When it comes to buying a life insurance policy, the things that come to our mind are obvious. Get in touch with your insurance advisor for complete details. But what if i say that this isn't the case for every product of life insurance companies?

Life insurance policy issued between 01.04.2003 and 31.03.2012 (both days inclusive) amount of annual (ized) premium is more than 20% of sum assured. For a life insurance policy, your premiums are the deposit. Let’s take the previous example as mentioned above, if surrender value of ulip is rs.

If you surrender the policy and opt out of the annuity scheme, the entire sum received by you from the insurance company will be treated as income. Getty images if you wait till the insurance policy matures, you can withdraw. In general, most cash value surrender sums are treated as income and taxed as such.

The interest is income and is taxed. The surrender value may be taxable &. For example, if you paid $100 monthly for 10 years, the amount of your premium is $12,000.

The total of premiums you have paid into the policy is known as the cash basis. The tax treatment on payment of surrender of a life insurance policy has not been separately mentioned. Section 72(e) does not specify whether income recognized upon the surrender of a life insurance contract is treated as ordinary income or as capital gain.

Fifo allows the policyholder to recoup his/her contributions to the policy before he/she must remove gains from the policy. Amount of annual (ized) premium is more than 10% of sum assured. What are the tax consequences of surrendering a life insurance policy?

Jerry has two children, mike and bob. The same treatment will apply to surrender value, maturity value and death benefit. This is an unclear area of tax law, but the consensus is the loss is not deductible.

As a result, the manner in which the rules apply depends on the date on which an interest in the policy was last acquired and,. Mike takes out a life insurance policy on jerry for $1 million with the understanding that the payout is split between the two siblings. The amount of the cash surrender value above your premium payments is the interest.

Surrendering of policy is always taxable. The tax benefit on premiums paid in earlier years under section 80c can be reversed. Life insurance policy issued on or after 01.04.2012.

Basic rate tax at 20 per cent is deemed to have been paid and so only extra tax. If you surrender the policy and receive a cash value of $13,400, your. Amendments to the rules regarding the tax treatment of life insurance policies also included grandfathering provisions.

If you have taken deduction u/s 80c of the it act for the premium payment, in that case , do not surrender the policy within the three/five years of its purchase. On may 1, 2009 the internal revenue service issued two revenue rulings to clarify the proper income tax treatment relating to the surrender, sale, and purchase of life insurance policies. Your insurance provider may give you the option to have.

Prudential Life Insurance Surrender Form Is From

Do Life Insurance Policies Get Taxed Keikaiookami

Annuity Tax Treatment India PASIVINCO

Should I Sell My Life Insurance Policy? • Legacy Planning

PPT Today’s Lecture 14 Life Insurance PowerPoint

Can You Sell Your Term Life Insurance Policy? Cedar Life

Surrender Life Insurance Policy With Loan inspire ideas 2022

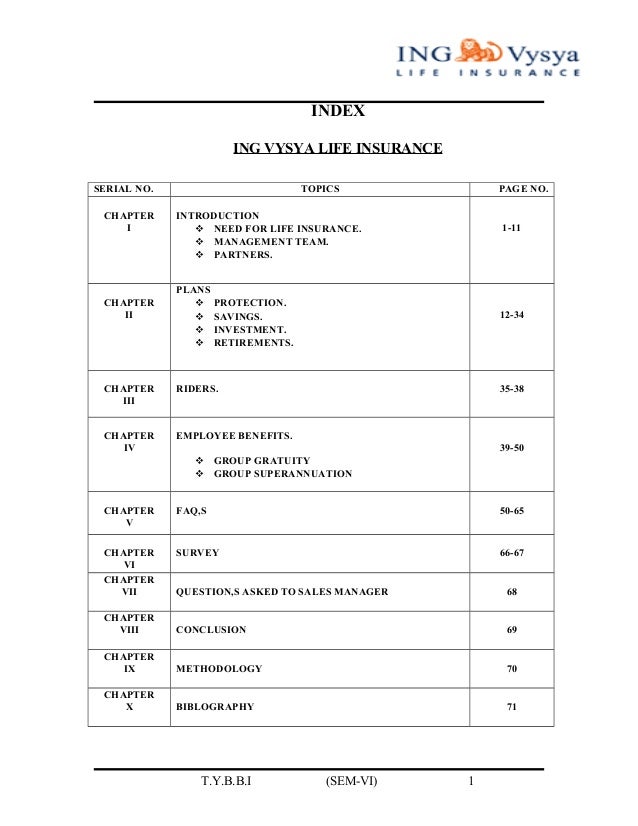

Ing Life Insurance Policy Status kenyachambermines

Surrender Life Insurance Policy Taxable kenyachambermines

Ing Life Insurance Policy Status kenyachambermines

Surrender Life Insurance Policy Taxable kenyachambermines

Mercer Life Insurance Claims Digitalflashnyc

Surrender Life Insurance Policy For Cash Value Taxable

Cash Value Life Insurance Taxable inspire ideas 2022

Annuity Tax Treatment India PASIVINCO

Cash surrender value of term life insurance insurance

Ing Life Insurance Policy Status kenyachambermines

Cash Value Life Insurance Taxable inspire ideas 2022

Prudential Life Insurance Surrender Form Congress Life