It offers financial compensation in case of death or disability. Applications and acceptance chapter 8:

Basic Principles of Life Insurance Policy in India

However, an exception was made in the case of any company, firm or persons intending to carry on life insurance business in india in respect of the lives of “persons

Principles of life insurance in india. If there is no insurable interest, an insurance company will not issue a policy. ・limitation on maximum insurance amount based on issue age ・limitation on insurance amount based on income/ assets ・limitation based on overseas traveling destination ・third party recipient contract limitation on insurance purchase based on vocation rule limitation on insurance purchase Both risk and probability can be ascertained by information that is available to the insurer about the target masses.

Principles of life insurance principles of insurance 48 would as a proximity cause, involve the assured in the loss or diminution of any right recognised by law or in any legal liability there is an insurable interest in the happening of that event to the extent of the possible loss or liability.” Linked life insurance policies chapter 7: The sec also regulates variable life insurance.

Prepare a chart showing various principles being followed in life and non life insurance classroom teaching The process of arriving at the profit of a life insurance company. Provides the combined benefit of life insurance cum saving.

An insurable interest must exist at the time of the purchase of the insurance. Insurance runs on the principles of risk and probability. Such special policies provide a sense of security to the poor who take these policies.

The beneficiary uses this money to clear out the debts. The process of determining the net premium for a life insurance policy. “ life insurance business” means the business of effecting contracts of insurance upon human life, including any contract whereby the payment of money is assured on death (except death by accident only) or the happening of any contingency dependent upon.</p>

Of insurance has prevalent in india since ancient times amongst hindus. Under this principle of insurance, the insured must have interest in the subject matter of the insurance. In india, life insurance business is defined under section 2 (11) of insurance act, 1938, which reads :

Life insurance is a contract in which the beneficiary is paid a fixed amount of money by the insurer after the death of the insured. Types of life insurance policies: The principle of insurable interest.

Enumerate the various insurance principles. Life insurance provides a feeling of economic security to the dependents of the insured, on whose life insurance is affected. These principles are mentioned below:

However, during the same period, the Insurance scenario in india classification of insurance industry in india in life insurance business, india ranked 9th among the 156 countries, for which data are published by swiss re. Offers life insurance coverage till 100 years of age.

Discuss the core concept of all the principles of insurance 3. Any loss that they suffer will be paid out of their premiums which they pay. This principle is related to a level of interest the person is expected to have in that certain policy.

In the insurance world there are six basic principles that must be met, ie insurable interest, utmost good faith, proximate cause, indemnity, subrogation and contribution. Provides full risk cover against any type of eventuality. The right to insure arising out of a financial relationship, between the insured to the insured and legally recognized.

Premiums and bonuses chapter 3: Life insurance organization chapter 2: The process of arriving at the bonus in a life insurance company.

To ensure the proper functioning of the insurance contract, the insurer and the insured have to follow the following principles. What are the major insurance principles applied in india? The basic principle of insurance is that an entity will choose to spend small periodic amounts of money against a possibility of a huge unexpected loss.

This occurs when a person states a fact in the belief or expectation that it is right but it turns out to be wrong. Basically, all the policyholder pool their risks together. Life insurance operates on some basic principles that are common for many individuals.

The joint family system, peculiar to india, was a method of social insurance of every member of the family on his life. Life insurance corporation act, 1956 (“lic act”) which granted lic the exclusive pr ivilege to conduct life insurance business in india. Get ready for the agency that knows how to pull it off and lures the clients in without effort.

Principles and practices of life insurance in india|ashraf imam the money back guarantee that exists within the company is another proof that you can trust us on every level. Life insurance can be termed as an agreement between the policy owner and the insurer, where the insurer for a consideration agrees to pay a sum of money upon the occurrence of the insured individual's or individuals' death or other event, such as terminal illness, critical illness or maturity of the policy. Absence of insurance makes the contract null and void.

Life insurance also provides for policies in respect of education of children, marriage of children etc. Plans of life insurance chapter 4: In an attempt to protect an individual’s right to privacy, the federal government passed the fair credit reporting act, which is the authority that requires fair and accurate reporting of information about consumers, including applications for insurance.

Principles of Life Insurance Insurance Life Insurance

History of Insurance and its evolution in India

Buy Insurance Principles and Practice Books

Life Insurance Definition In Hindi Insurance Reference

Life Insurance in India rules benefits and its

Basic Principles of Life Insurance Policy in India

Download IC 23 Book APPLICATION OF LIFE INSURANCE Free

Life Insurance In India Principles And Practices Buy

Basic Principles of Life Insurance Policy in India

Principles of Life insurance by Dr. Amitabh Mishra

Basic Principles of Life Insurance Life Insurance

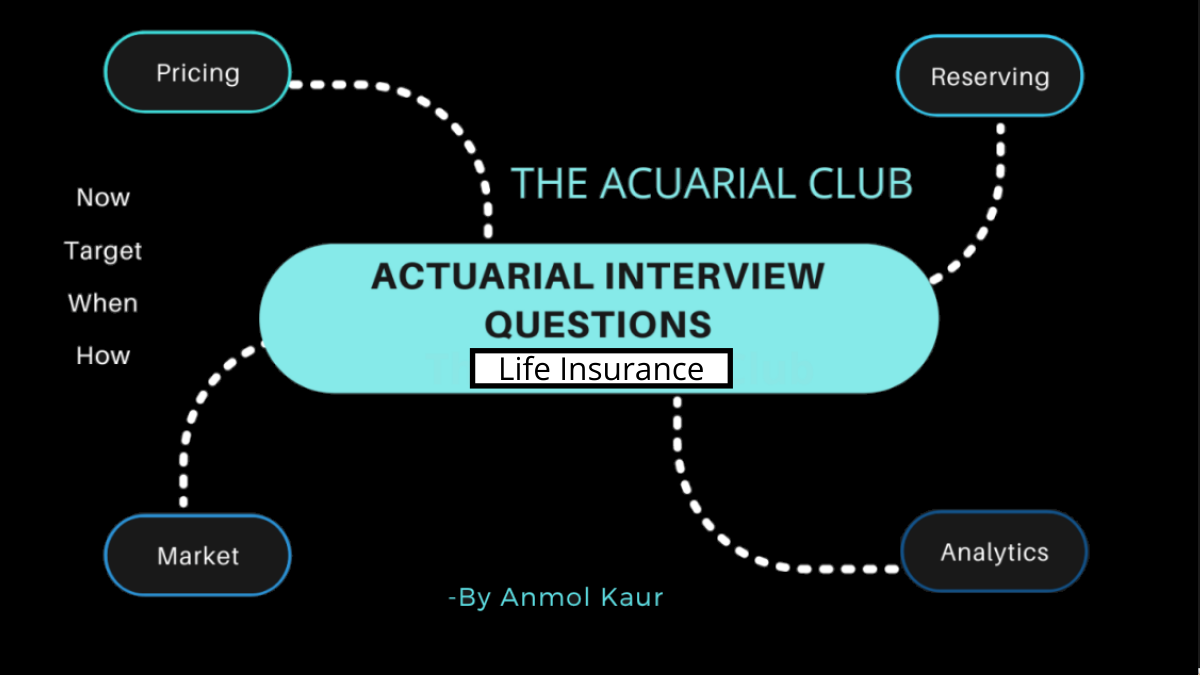

Life Insurance Actuarial Interview Questions • The

Principles of valid contract special principles of life

Principles And Practice Of General Insurance PDF EnglishPDF

Main Elements of Life Insurance Contract in Hindi

Insurance concept, principles, its relevance in developing