This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, you can use the money while you’re still alive. A living benefit is equal to the basic life insurance amount, plus any extra benefit for persons under age 45, that would be in effect nine months after the date of the office of federal employees' group life insurance (ofegli) receives a completed claim for living benefits form.

The Benefits of Insurance to Individuals, Organizations

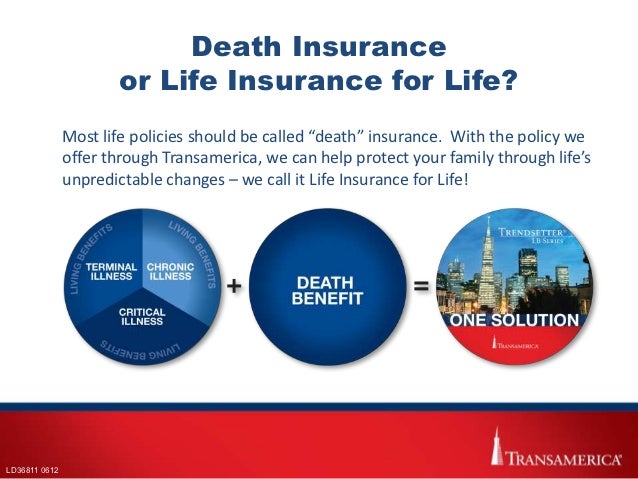

The living benefits of life insurance allow the policy owner to access cash while still living.

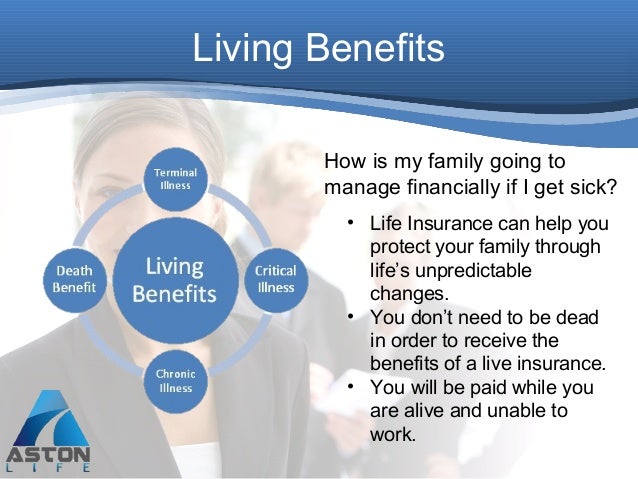

Living benefits insurance. Accelerated benefits, also known as “living benefits,” are life insurance policy proceeds paid to the policyholder before he or she dies. Getting life insurance with living benefits is not complicated, usually you just need a solid company and they will offer it as part of the policy. Life insurance can help ensure your business has a long and healthy life by:

Affordable term life insurance policies with living benefits don’t have to be hard to find. Life insurance with living benefits offers a certain added peace of mind. You can click here or on any of the above buttons to get a quick life insurance quote and get covered.

This could happen in 2 scenarios: Most people who buy life insurance do so to provide financial security to a beneficiary when they die. The insured does not have to die to use the policy.

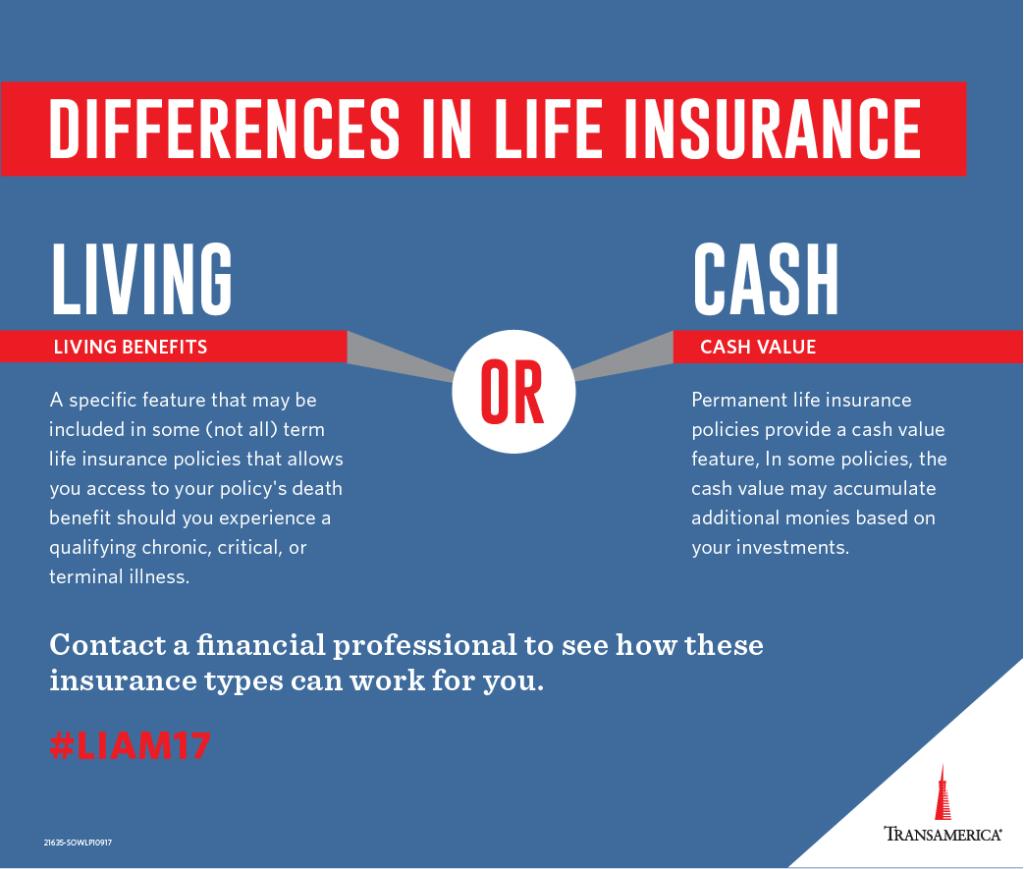

Living benefits are features in your life insurance contract you can use while you’re alive. What is cash value in life. While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career.

Permanent life insurance policies from state farm life insurance company and state farm life and accident assurance company (residents of ny and wi only) offer financial protection in the event of your death. However, using a living benefits rider does have downsides. Life insurance is a valuable benefit to offer key employees.

Your life insurance with living benefits policy riders include living benefits which allow you to access part of your death benefits while still alive. There are rules to determine your eligibility and limits on how much you may receive. Use a life policy as part of your executive compensation package.

Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. Simply put, the living benefits of life insurance is the option for the insured to use his or her life insurance policy while still alive. What does living benefits of life insurance mean?

It’s usually included with most life insurance policies for free. Yes, life insurance can offer the advantages of both death benefits and living benefits. Living benefit plans are insurance policies that provide financial benefits to survivors who face issues due to aging, illness, accidents and dependency.

There is no reason to wait for life insurance coverage for you and your family. Living benefits life insurance is the new, evolved kind of life insurance. Provide the funds your heirs need to make sure the.

Living benefits refer to the cash benefits available to the insured after they have paid premiums over a specific period. It allows you to access funds while you’re still living under certain conditions. Enticing key employees to stay.

And living benefits are the subject of this article. These plans can be tailored to work in tandem with employee benefit plans or recognize the fact that you own and operate a business or work independently. Living benefits may be provided by optional accelerated benefits riders.

The living benefits rider allows you to pay your daily living expenses, and medical expenses, while also allowing you to look after your family after your death. Riders are optional, may require additional premium and may not be available in all states or on all products. Living benefits insurance offers the flexibility to suit your specific needs.

Life insurance with living benefits can help to ensure your loved ones are covered financially, so that your family can focus on what matters most — spending time together. Well, you get the picture. Also known as accelerated death benefits, term life insurance with living benefits is offered as an additional rider in most cases.

There are two kinds of living benefits insurance: * purchase life insurance with living benefits. Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime.

Life insurance with living benefits gives you the option to access your death benefit while you’re still alive. Each insurance company has its own coverage options, rules and limits, so it pays to review policies carefully before buying life insurance. Living benefits are offered before you die, and death benefits are offered.

The cash values and the endowment proceeds of a permanent life insurance policy are considered living benefits since they are made available to the insured while they are alive. Life insurance benefits you can use in your lifetime. What are living benefits in life insurance?

With living benefits, you have the power to accelerate your death benefit while you’ (22). Ensuring an orderly transfer of your business interests. This benefit can be purchased as a rider with term or permanent insurance.

* purchase a policy that builds up cash value.

Need Life Insurance With Living Benefits? Call Susana Zinn

Living benefits of life insurance insurance

Transamerica on Twitter "Two options to consider when

Do You Know What is a Living Benefits Life Insurance Policy?

Why You Need Life Insurance With Living Benefits (In 2019)

Learn the importance of life Insurance with living

Life Insurance Benefits Philippines Updated List Of Gsis

Life Insurance TIG Insurance Services

Living Benefits and Life Insurance Local Life Agents

Life Insurance With Living Benefits Explained YouTube

Life Insurance TIG Insurance Services

Life Insurance With Living Benefits Pros & Cons

Life Insurance with Living Benefits Call 7867081061

Living Benefits of Life Insurance

Cash value vs Living benefits • One Stop Life Insurance

Life insurance for living benefits

What are the “Living Benefits” on Life Insurance Policies