The government requires that employees hired by contractors and subcontractors who work. This special type of workers’ compensation insurance protects the employer and the contract employee when working on public sector projects outside the continental u.s.

Defense Base Act Insurance in 60 seconds YouTube

Government contractors working outside the continental united states.

Defense base act insurance coverage. Upon any lands occupied or used by u.s. Government for public works or for national defense. This description of coverage is not an insurance contract.

With the significant growth of overseas government work, and military actions in afghanistan and iraq, many employers and contractors offer defense base act insurance to those that fall under its coverage. Your policy is the contract that specifies and fully describes your coverage. Defense base act insurance is a mandatory coverage for any employees working on any project performed outside the united states on behalf of the united states.

Military bases, or on any lands used by the u.s. What is defense base act (dba)? Any employee working on a military base or reservation outside the u.s.

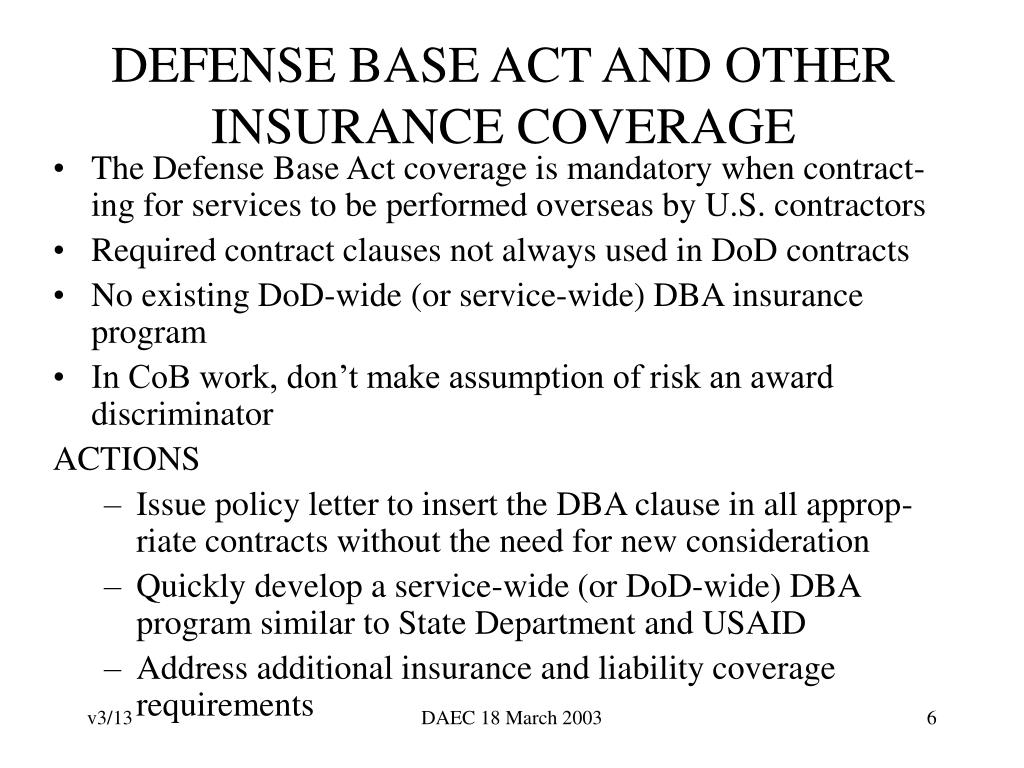

Government for military purposes or in any territory or possession outside continental u.s. According to sections 1 (a)(4) and (5) of the defense base act, every contractor that comes within the purview of this act shall take out the insurance policy in question on behalf of its employees and maintain the policy for the duration of the said contract. Federal workers’ compensation benefits for employers of all sizes requiring coverage under a government contract;

That means you’re covered under the dba in the event of any injury you sustain while on contract until you arrive back home in the united states or. Defense base act insurance is federally mandated workers compensation coverage for u.s. Working for private employers on u.s.

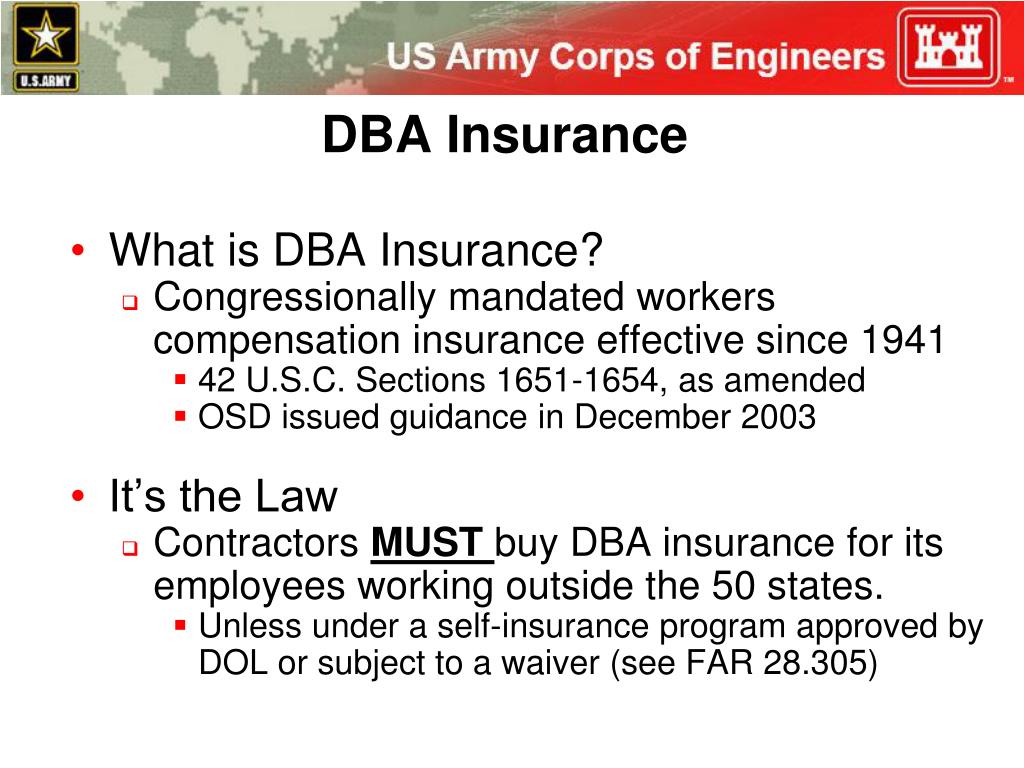

4 keys to defense base act coverage spring 2016 market update lockton® companies lockton companies the defense base act (dba) marketplace has become an increasingly tumultuous line of property and casualty insurance during the past several years. At any military, air or naval base. This coverage offers statutory federal workers compensation and employers' liability insurance;

Defense base act insurance is a legal requirement for any person working outside of the united states who is employed under the u.s. Defense base act insurance is a form of workers’ compensation, protecting employers and contractor employees working on public sector projects outside of the (20). Starr wright usa has been protecting federal workers for over 50 years.

If you’ve been on a us government contract, you’ll find that in your contract you have something called defense base act insurance. Government contractors working outside the continental united states. Moody offers periodic seminars and can provide information to qualified individuals and companies on the topic of defense base act insurance.

The dba does apply to the u.s. The defense base act provides workers' compensation protection to civilian employees working outside the united states on u.s. The defense base act applies to contracts awarded for work in these employment related categories:

Dba coverage triggers the defense base act covers employees: The defense base act does not apply to guam. Civilian contractors no matter where their job takes them by working with our team of dba insurance specialists.

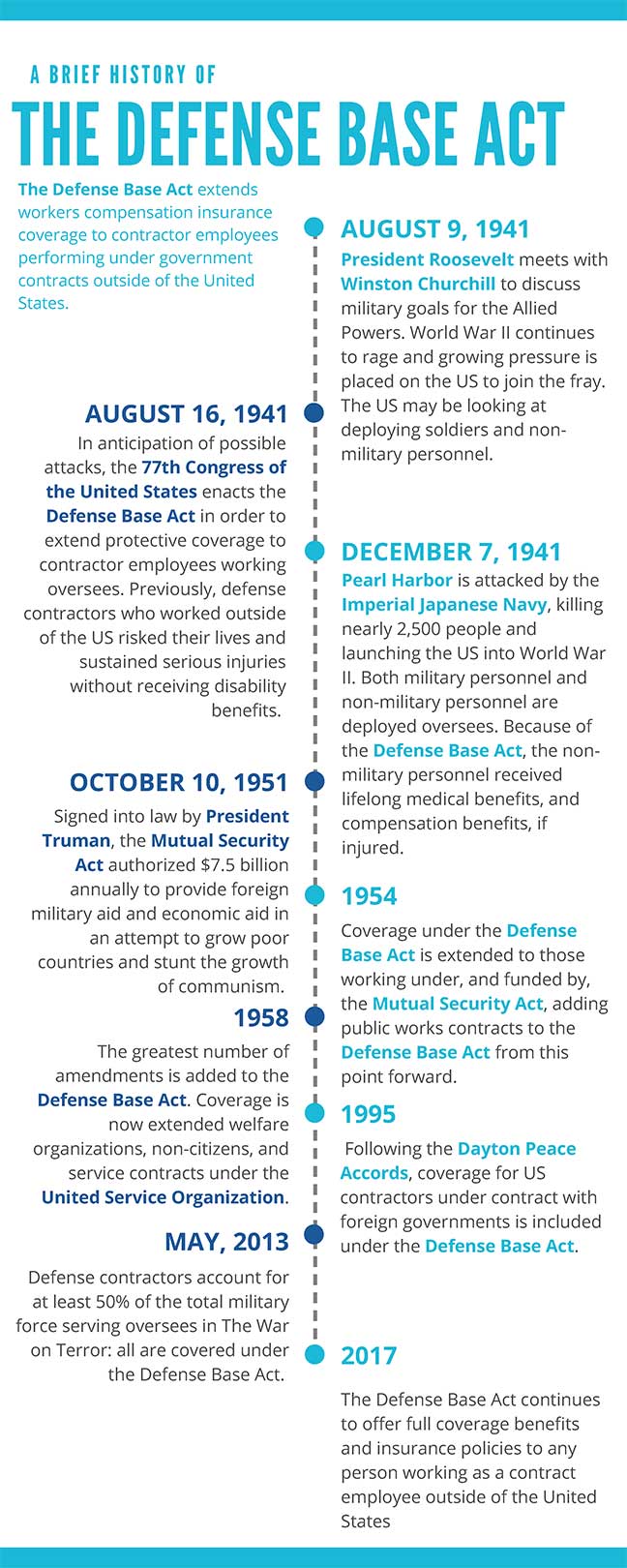

Dba insurance, or defense base act insurance, is a law that requires insurance coverage for employees working on a us government contract outside of the united states. When it was first enacted in 1941, the dba only extended the coverage eligibility of the longshore and. Review needed of cost and implementation issues government of insurance coverage purchased under dba and to assess the act’s (19).

Government funded public works business outside the. The u.s., whether military in nature or not, will likely require defense base act coverage. Us troop draw downs in iraq and afghanistan have caused significant changes in contractor

Federally mandated workers compensation for any u.s. Who does defense base act coverage extend to? Any employee engaged in u.s.

Defense base act insurance provides coverage for work related injuries, disabilities, dismemberments, and it also provides life benefits to spouses and dependents in the event of an untimely death. Military bases or under a contract with the u.s. Defense base act insurance is federally mandated workers compensation coverage for u.s.

Benefits workers can get from dba include disability compensation,. It is important to understand defense base act insurance requirements and dba insurance rates clearly. Defense base act insurance covers civilian employees working in foreign countries in support of the military.

The defense base act (42 u.s.c. Government contractor (s) working outside the continental united states. It's a type of workers' compensation insurance, and it applies to employees regardless of their nationality.

For military purposes, outside of the united states. Available through either retail or. Now, we're offering another essential product:

For more information about defense base act insurance:

Defense Base Act Insurance Report

PPT Defense Base Act (DBA) Insurance PowerPoint

PPT DEFENSE BASE ACT PowerPoint Presentation, free

PPT Defense Base Act (DBA) Insurance PowerPoint

5 Myths of Defense Base Act Insurance YouTube

Defense Base Act Insurance Assistant, Acting, Playbill

PPT USACE Defense Base Act Insurance Program PowerPoint

Recorded Statements in Defense Base Act Claims Defense

A Brief History of the Defense Base Act Business

PPT “CONTRACTOR SUPPORT ON THE BATTLEFIELD” AN

Defense base act insurance insurance

PPT Defense Base Act (DBA) Insurance PowerPoint

Defense Base Act Insurance Report

PPT USACE Defense Base Act Insurance Program PowerPoint

PPT Defense Base Act (DBA) Insurance PowerPoint

Defense Base Act Lawyers DBA Attorney Mara Law Firm