We provide the following products from bmo insurance: With term 100 from bmo insurance, you’ll get:

Bmo Life Insurance Company Keijinn

Guaranteed premiums that are payable for 10 years, 20 years or to age 100.

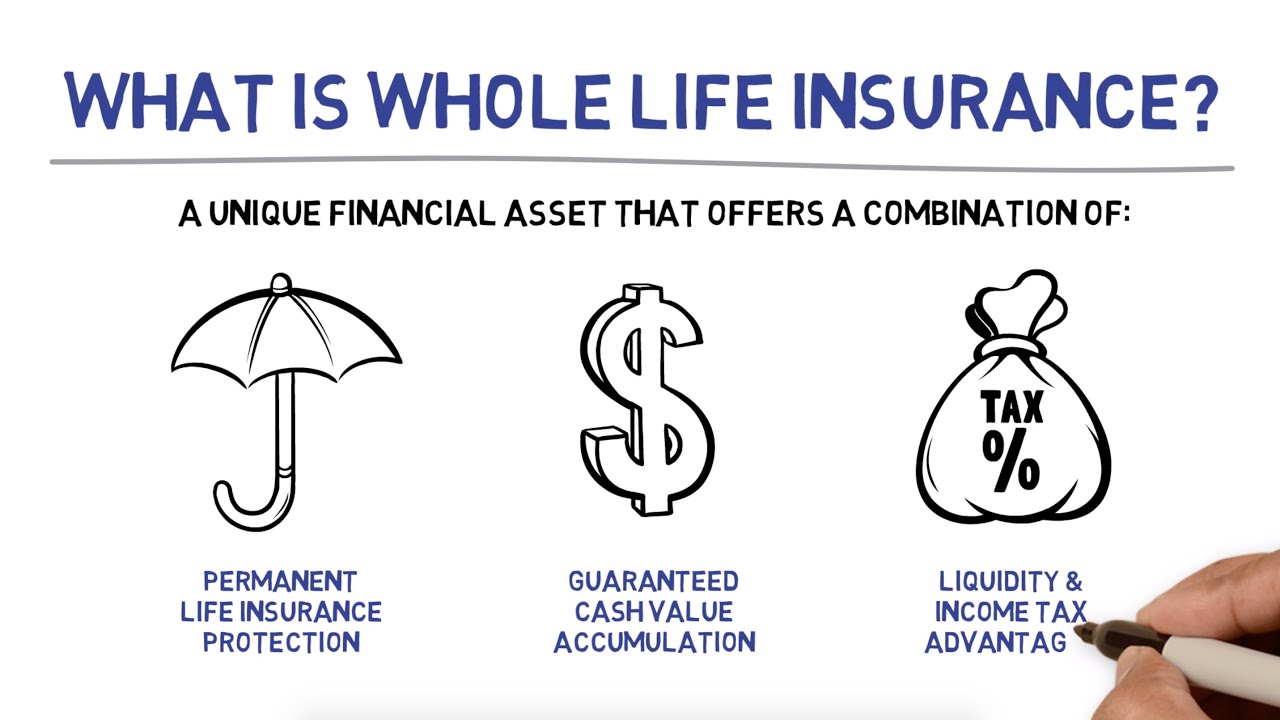

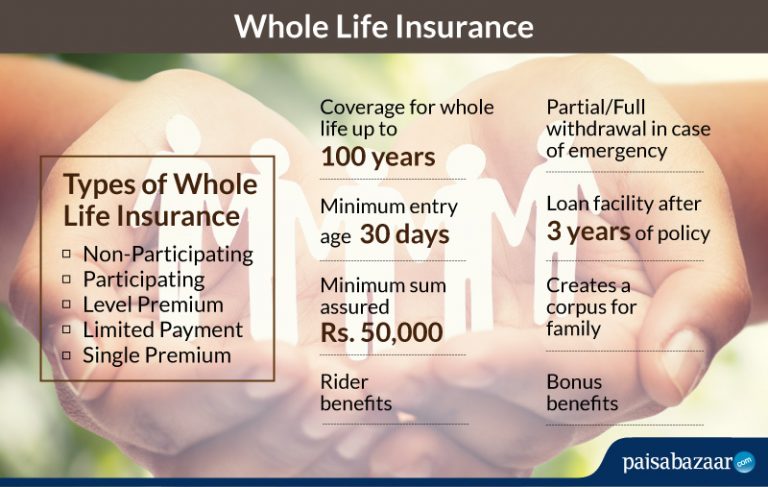

Bmo permanent life insurance. Bmo insurance whole life offers permanent life insurance protection. This is a flexible option where you choose the amount and length of coverage. It can be ideal for individuals who want guaranteed level premiums, a guaranteed death benefit and a guaranteed cash value that increases over time.

Get a permanent life insurance quote today. Bmo life insurance provides flexible coverage options and competitive rates. These are the key features of each policy:

Getting your term life insurance quote today will allow you to benefit from a great rate. Bmo offers term life insurance, as well as a few types of permanent life insurance. Premiums are payable for 10 years, 20 years or until age 100 of the life insured.

A medical exam is likely required; Bmo life insurance doesn’t offer a ton of information. Coverage limits on this policy typically go as high as $25,000.

We work directly with bmo and are able to provide all their latest insurance products. Bmo insurance offers two critically beneficial permanent life plans to help you manage your money according to your wishes. Here are the basics of their term product:

Determine your family’s financial needs. Single trip enhanced travel insurance; We work directly with some of the largest providers of no medical permanent life insurance such as bmo, sun life, ivari and.

This plan also includes the investor maximizer to help maximize tax deferred growth of the. Bmo has five permanent life insurance plans for you to choose from: Bmo insurance complete line of personal protection products includes life, disability and critical illness insurance.

Easyone life, guaranteed life plus, term 100, bmo insurance whole life plan and universal life. You will be automatically approved, as long as you can sign a declaration of health saying you have no serious illnesses. Coverage for the entirety of your life if you keep paying your premiums.

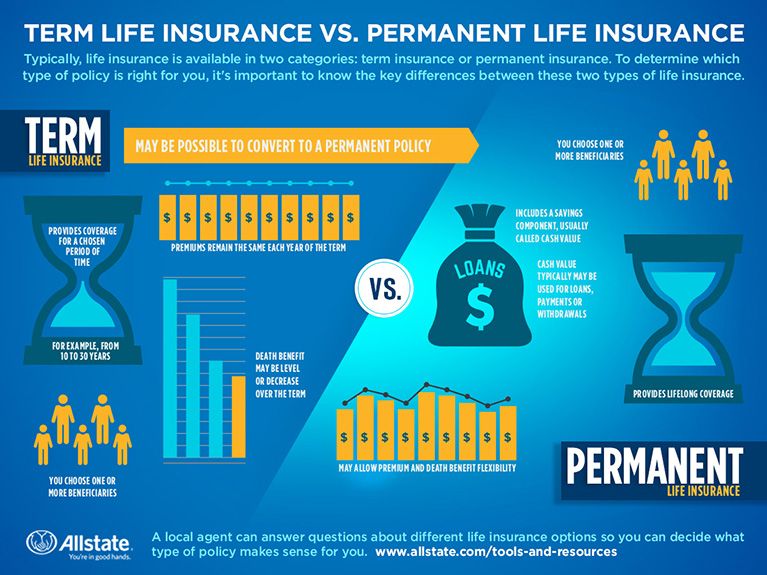

Bmo no medical exam life insurance. Permanent insurance can be a good solution if you simply want the peace of mind that you will always be covered, or you do not have life insurance but want final expenses to be covered. Permanent life insurance is a product whose term is the end of the life of the insured.

Bmo insurance offers several different permanent life insurance policies: Bmo insurance is a member of bmo financial group and offers a wide range of life, accidental & illness insurance. Available to canadians between the ages of 50 and 80 who have no serious illnesses;

Estate protector and wealth accelerator to address distinct markets. Term 100is a permanent life insurance protection policy that provides the policyholder with protection and guaranteed premiums payable until the age of 100. A performance bonus that automatically increases the death benefit and cash value.

Your premiums can be lower when compared to other kinds of permanent life insurance since coverage only lasts for a set period of time (the “term”). No medical exam required and immediate permanent life insurance coverage from the day bmo life insurance receives your application; Bmo life insurance wants you to find the best permanent life insurance plan that meets your needs.

Bmo insurance whole life plan; As one of the largest banks in canada, bmo insurance is well poised to offer a selection of simple and affordable life insurance solutions to its clients. Bmo insurance offers products that are easier to qualify for including easyone life and guaranteed life plus which feature no medical or limited health questions to apply and lower coverage.

& your premiums won't change. As well as your final expenses and debts, you also need to consider how much income your family would need (and for how long) in case of your unexpected death. Bank of montreal (bmo) life insurance.

Bank of montreal (bmo) life insurance. Bmo pureterm 100 life insurance gives you the choice of coverage from $50,000 to $5 mil. It’s designed to help cover those financial obligations that are due over the next several years (i.e.

You may renew or covert your coverage to permanent insurance Term insurance can be one of the most cost effective life insurance options. Bmo insurance is part of bmo financial group and offers a full range of insurance products.

Also offered are a selection of no medical life insurance products that specifically target the hard to insure, retirees, and working families. Single trip medical travel insurance With bmo insurance whole life you'll get:

Please enter an amount less than $10,000,000. Our specialty is life insurance solutions for individuals over 50, including a full range of no medical and guaranteed issue products. Bank of montreal provides simple solutions that are both flexible and affordable to protect you, your loved ones and your business.

The following are the two most common life insurance packages that bmo offers: Coverage for 10, 15, 20, 25 or 30 year terms;

Permanent Life Insurance 101 What You Need to Know Allstate

BMO Life Insurance Review StingyPig.ca

BMO to offer advance payment of death benefit for certain

Bmo Life Insurance Company Keijinn

BMO Life Assurance Company (formerly AIG Life Insurance

A Closer Look BMO Insurance's Direct Term

BMO Life Insurance is VERY Well Known. Is It The Company

The Best Whole Life Insurance You Picked Whole Life

Bmo Insurance / BMO Life Insurance Company Life

Insured Retirement Plan Bmo Awesome

BMO Comm Schedule Life Insurance Insurance Free 30

BMO Life Insurance Company Life Insurance Canada

BMO Life Insurance is VERY Well Known. Is It The Company

Whole Life Insurance Check & Compare Whole Life Insurance