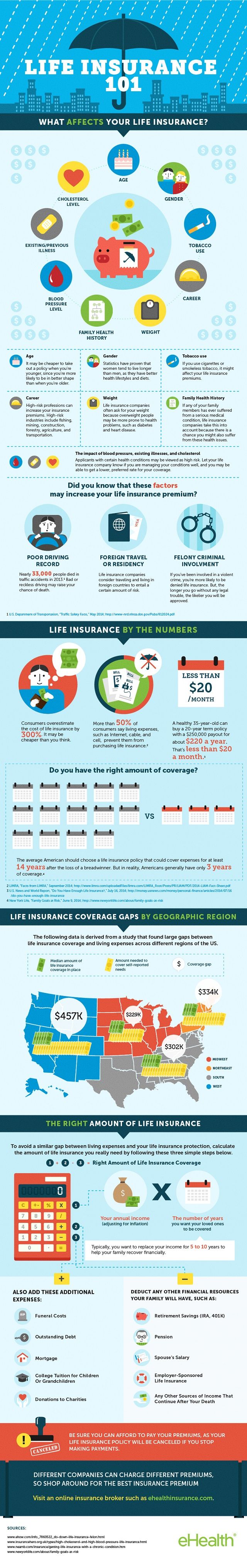

In estate planning, life insurance is purchased for two primary reasons: At the time the insured purchased her life insurance policy, she added a rider that will allow her to purchase additional insurance in the future without having to prove insurability.

Annual Renewable Term Life Insurance Has Which Of The

Person who collects the death benefit when the insured person dies.

At the time the insured purchased her life. For example, if the life of a key person in a firm is insured, and the firm has an insurable interest in that key person’s life because his or her death would cause a loss to the firm, the policy may be continued in force by the firm even after the person leaves the firm. Adjustment in the amount of death benefit 4. 1) to provide cash to the insured's family members for daily living expenses;

Waiver of cost of insurance b. In this article, quotacy focuses on. Both at the time the policy is purchased and at the time the loss is sustained.

The policy owner is the individual who has purchased the coverage on the insured’s life. The beneficiary is the person (or people) who will receive the death benefits (the money that is paid out by the life insurance company) when the insured dies. For instance, a husband might purchase an insurance policy on his own life to protect his wife and children in case of his death.

The proceeds may be collected when he or she dies. Life insurance purchased to insure the life of another can have the unintended effect of tempting a murderous beneficiary to kill the insured to obtain the insurance proceeds. Jane wants the death benefit paid to cheryl in monthly installments over 20 years.

At the time the insured purchased her life insurance policy, she added a rider that will allow her to purchase additional insurance in the future without having to prove insurability. When you get life insurance, the policy covers one person’s life, called the insured. His wife contacted the insurance company to file her claim for the death benefit on september 5th, after john's burial, and after she had time to collect her emotions to deal with her personal loss.

If the applicant has misstated his or her age or gender on the application, the insurer, in the event of a claim, is allowed under this provision to adjust the benefits to an amount that the premium at the correct age or gender would have otherwise purchased. The insurance agent filed the papers to process the claim with his supervisor, and the death benefit was settled on october 30th. C adjustment in the amount of death benefit.

Although the insurer rarely anticipates these situations, it nonetheless may bear some responsibility for its insured's safety?and indeed holds the power And 2) to provide cash for death taxes and estate expenses. Insurable interest is established when there is a reasonable expectation of monetary benefits from either the continued existence of the insured person or entity or from the loss of the insured person or entity.

Estate planning goals of life insurance. At the time the insured purchased her life insurance policy, she added a rider that will allow her to purchase additional insurance in the future without having to. They have to pay the death benefitexplanation:a life insurance purpose is to provide financial protection to surviving dependents after death.

This rider is called a. The policyholder may also be the insured. An insured misstates her age at the time the life insurance application is taken.

Cheryl has a history of not managing money well. Parents and grandparents can buy these policies on their minor children and grandchildren. At the time the policy is purchased.

Jane purchased a life insurance policy on her own life and named her daughter, cheryl, as beneficiary. In that case, the husband is the policy owner. This misstatement may result in.

At the time the insured purchased her life insurance policy, she added a rider that will allow her to purchase additional insurance in the future without having to prove insurability. Their purpose is to protect the insured's accumulated cash values in case the whole life or endowment policy lapses. The policyowner must have a valid financial interest in the person or item being insured at the time of contract purchase, not necessarily at the time.

Another important part of the insurable interest rule is that it does not apply if the person buys insurance on his or her own life. The insured was severely injured in an auto accident, and after 10. Carol and joe, unrelated business partners, began operating a drug store in southern florida.

Carol purchased a life insurance policy with joe as the insured, and joe purchased a life insurance policy with carol as the insured. At the time of the loss. There are many reasons why parents and grandparents may choose to buy a child’s whole life insurance policy.

Person whose life is insured. In order to ensure that your beneficiaries receive the maximum benefit from life insurance. Some benefits of buying children’s whole life insurance include:

Recession of the policy 3. For at least thirty (30) days before the loss is sustaine. The policy contained an accidental death rider, offering a double indemnity benefit.

At the time the insured purchased her life insurance policy || answer:the correct answer is : Children’s whole life insurance is a commonly purchased life insurance product. Adjustment in the amount of death benefit

As long as the beneficiary had an insurable interest in the life of the insured at the time the policy was purchased, the policy will remain valid even if that insurable interest disappears. If a man names his wife as beneficiary of his life insurance and the two are thereafter divorced, the insurance policy:

Why Buy Life Insurance?जीवन बीमा कैसे काम करता है?In

Should You Buy Disability Insurance at Work? Haven Life

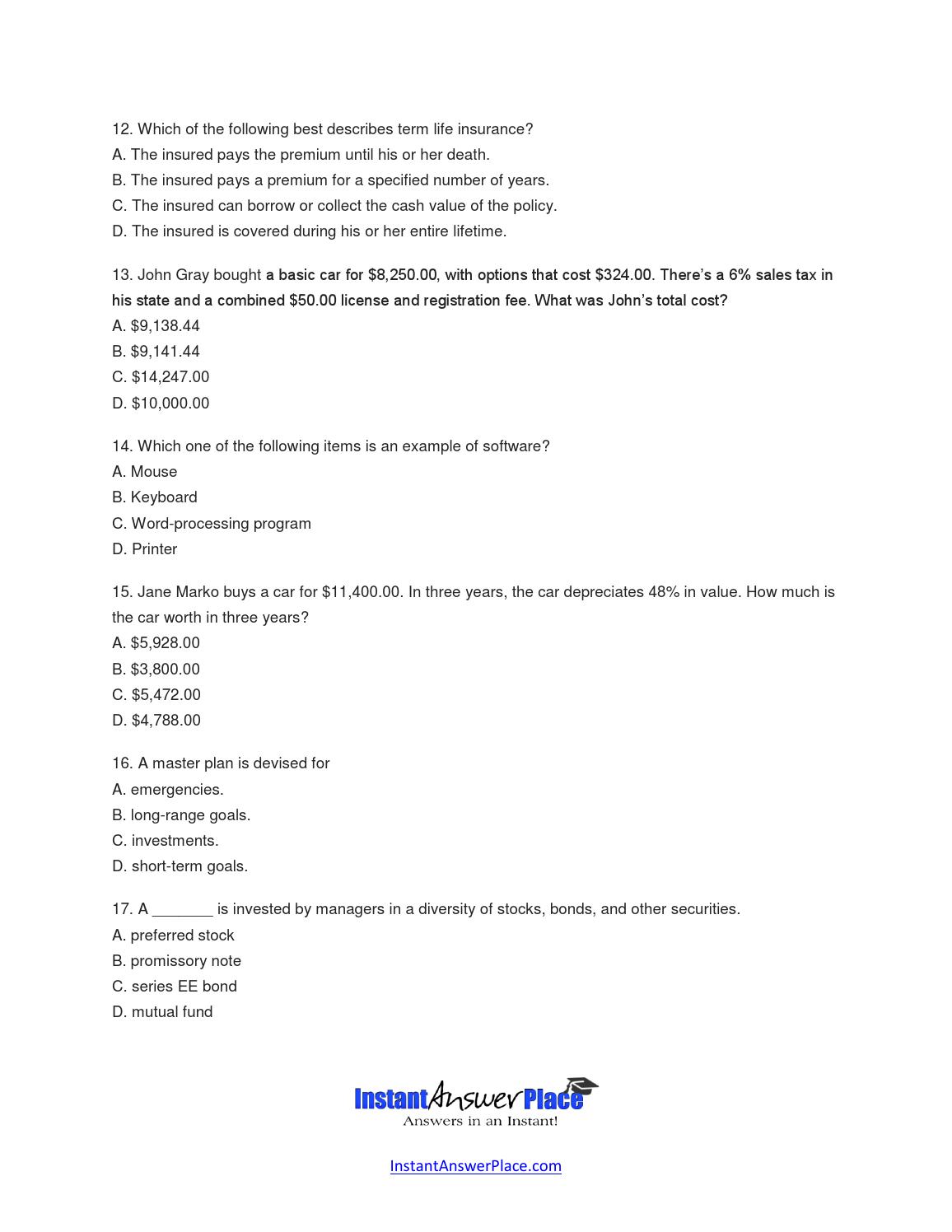

Which Of The Following Best Describes Term Life Insurance

Free Dental Exam No Insurance Leonardsolowaysbroadway

Which Of The Following Best Describes Term Life Insurance

Can You Have Two Life Insurance Policies At The Same Time

Life Insurance For Us Citizens Living Abroad Life Insurance

Life Insurance Monthly Cost Calculator inspire ideas 2022

Time to Clean Up those Beneficiaries? Herlihy Insurance

When is the Right Time to Purchase Life Insurance

Which Of The Following Best Describes Term Life Insurance

Can You Have Two Life Insurance Policies At The Same Time

Which Of The Following Best Describes Term Life Insurance

einsured.ca Tips to Buy Life Insurance Online the Smart Way

Which Of The Following Best Describes Term Life Insurance

Don’t stressed over market decline, here stocks to

Which Of The Following Best Describes Term Life Insurance

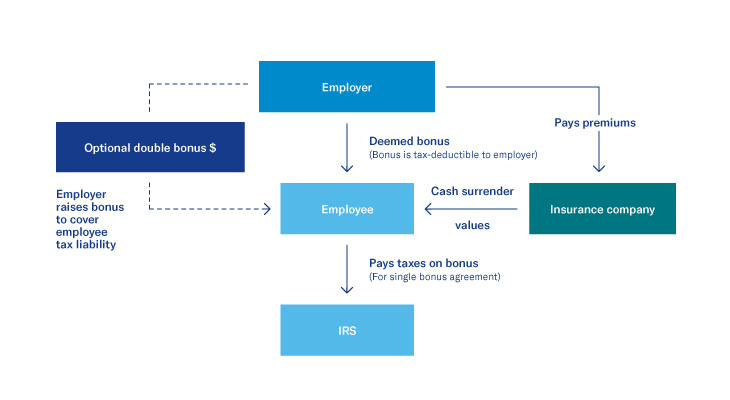

Executive Bonus Arrangement Life Insurance inspire ideas

Instant Life Insurance Buy Life Insurance Online Now