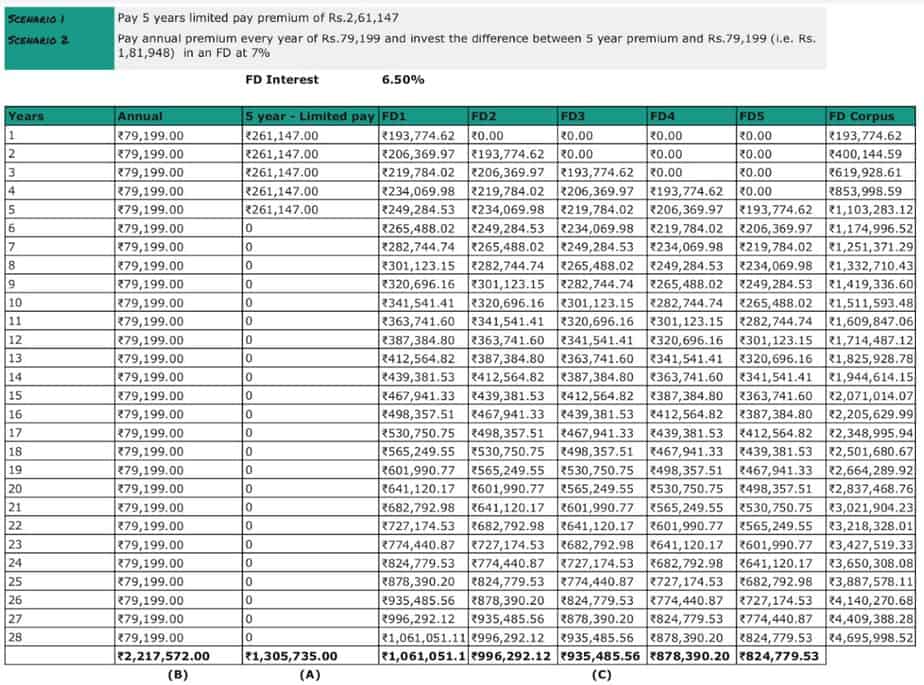

Whole life insurance can offer lifetime protection with no surprises. 20 pay life insurance can be used as an additional source of income for the family or to help cover monthly expenses in the event of your death.

Limited Payment Life Insurance Onlinepayment 20

The premiums are due for 20 years at which point the policy is fully paid up.

20 pay life insurance. Whole life guaranteed 20 pay. 20 payment life insurance is also known as limited payment whole life insurance. Life insurance premiums are paid for 20 years then the policy is paid in full and no futher payments are required.

That means you could do better investing on your own instead of relying on this vehicle to help start growing your portfolio. A 20 pay whole life policy is one where you pay premiums for at most 20 years (if you die before the 20 years are up, the policy pays off the face amount). What is a 20 pay life insurance policy?

It is useful for policy holders who buy insurance during their working years. After 20 years, no additional premiums are payable and the policy will pay the face amount either upon death or at some terminal age (usually age 100). That's the beauty of whole life guaranteed 20 pay coverage.

Whole life insurance can provide you with a return in an uncertain market. Minimum insurance purchase amount is $1,000 Basically you pay the premiums for only 20 years and then you never have to pay life insurance premiums after that.

20 pay life insurance is a type of whole life insurance. 20 year pay life insurance 👪 oct 2021. After 20 years, no additional premiums are payable and the policy will pay the face amount either upon death or at some terminal age (usually age 100).

These policies are very popular with applicants who value guarantees. Under this plan, a person. 20 pay life insurance is a type of limited pay life insurance (typically whole life insurance) that requires payments over 20 annual installments.

What is 20 pay life insurance? The policy remains active until it is paid out or cashed in. Don’t pay too much for life insurance!

The pro with this policy is you stretch out the premiums for 30 years, resulting in more affordable whole life insurance in comparison to the other limited pay life options. The purchase establishes your membership in the fcsla providing access to a variety of fraternal benefits and activities. A 20 pay whole life policy is one where you pay premiums for at most 20 years (if you die before the 20 years are up, the policy pays off the face amount).

Life auto home health business renter disability commercial auto long term care annuity. The 20 pay life insurance certificate is purchased over a period of 20 years. Here are some sample 20 year term rates with $100,000, $250,000, and $500,000 of coverage.

This product is designed for the consumer who wants to pay for life insurance over a short period of time. If purchased early enough in life, it'll help you avoid paying premiums during your retirement. It is a level term policy, meaning the premiums that you pay and the coverage amount (death benefit) does not change during the 20 years.

Some policies might pay up to 7%. *please note all quotes are based on a monthly premium. 20 pay is a permanent solution to life insurance so you will have it for the rest of your life but, as the name suggests you will make the same monthly payment for 20 years and that’s it!

30 pay life provides coverage that lasts your entire life with premiums due for 30 years. Premiums on limited payment life insurance are paid for a limited number of years, but the benefits last a lifetime. This coverage can be completely paid for in 20 years.

Premiums are payable for 10, 15 or 20 years depending on the policy selected. The conventional wisdom of a whole life insurance product is that it will pay about 5% interest before fees occur. 20 °pay life insurance from kskj life this is a whole life policy, which covers the policyholder for his/her entire life.

20 year term life insurance quotes.

10 and 20 Pay Life Insurance ideal for legacy giving

Pay Yourself First Financial Services

Solved The Maybe Pay Life Insurance Co. Is Trying To Sell

Whole Life Insurance Guaranteed death benefit and premiums

Jackson National Life Insurance Must Pay 20.5M In

20 Pay Life Insurance Learn how to get your Life

Best Life Insurance Rates for a 20 Year Old (and a bunch

Life Insurance Are you paying too much? Insurance News

Whole Life Insurance What You Need to Know

Just Pay 20,000/ And Earn 20/ Lac Best Endowment Plans

Term life insurance Is paying for it worth it?

Who Is The Best Life Insurance Provider 20 Pay Life Insurance

20Pay Whole Life Insurance Life Insurance Canada

Limited Payment Life Insurance Onlinepayment 20

Life Insurance Are you paying too much? Insurance News

Jackson National Life Insurance Must Pay 20.5M In

Why buy Life Insurance Infographic USAA

Limited Payment Life Insurance Onlinepayment 20