What is insured retirement plan? Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan.

Pension Plan Retirement planning, How to plan, Pension plan

Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan.

What is an insured retirement plan. What are the best types of insured retire. Irp (insured retirement plan) is a legitimate product. An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal life is utilized as a vehicle to save up and build wealth for retirement.

One of our readers named hank wrote in to ask clark with the following question: In the past, the irp was only available to clients who owned manulife life. I am an insurance broker myself.

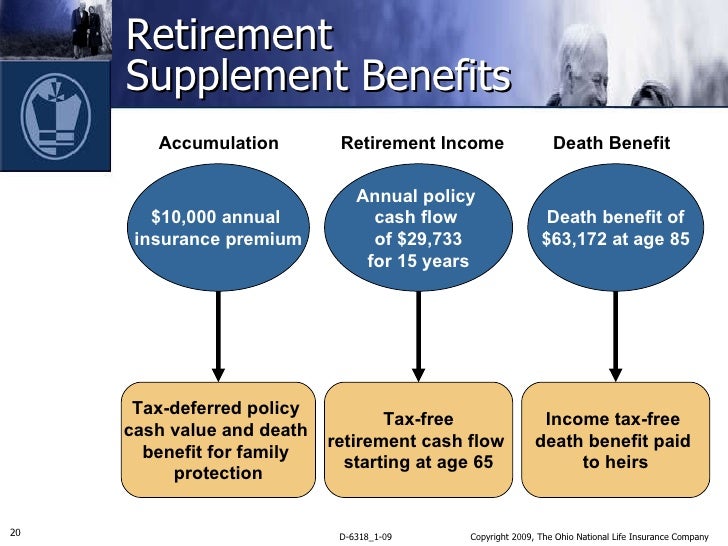

You will incur interest risk. The insured retirement plan allows you to pay an insurance company a premium and then eventually borrow against the policy cash value. Like any investment strategy, there’s pros and cons that need to be weighed and considered.

The insured retirement plan allows you to pay an insurance company a premium and then eventually borrow against the policy cash value. However, before investing in any retirement plan, it is suggested to calculate retirement corpus with the help of a retirement calculator. Employers take on the investment risk of a defined benefit plan, though benefits are insured by the pension benefit.

Insured retirement plan is a retirement tax planning strategy using life insurance. While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. An insurance retirement plan allows permanent policy owners to fund their life insurance policies over their initial base premium (cost of insurance, charges, and fees) with the intention of.

Leveraging strategies allows you to access it tax favourably. An insured retirement plan (irp) is simply a process combined with a product. An insured retirement plan allows business owners to get money out of their business.

Insured retirement program (irp) this program is now available to whole life insurance clients at all major providers! Most irps have a yrt (yearly renewable term) cost of insurance. “my wife and i recently signed up for a retirement planning class.

When you retire, instead of withdrawing these funds directly from the life insurance policy, you. What is an insured retirement plan? The corporate insured retirement plan:

Who should consider insured retirement plan? An irp allows individuals to fund a permanent life insurance policy over its base premium. An insurance retirement plan allows permanent policy owners to fund their life insurance policies over their initial base premium (cost of insurance,.

What is a corporate insured retirement plan 10 ways to build wealth in your business to fund your exit strategy tips for business wealth management business owners work hard at perfecting their business to make a living, earn a profit and ultimately sell or transition the business to another group of owners or family members. First steps • assess insurance needs • determine deposit stream • select a ul policy from bmo life assurance company including an investment portfolio best suited to the client’s risk tolerance over 400 investment options visit investmentpro at www.bmoinvestpro.ca But at least the clients have insurance coverage immediately, they can always lower their contribution momentarily while establishing their economic stability in canada, then later on increased the contribution once.

This class was based upon the book ‘the power of zero.’. Provide you more income) but you should be aware of the potential risks and drawbacks. There is absolutely nothing wrong with this strategy, but it can have a lot of moving parts and is certainly not for everybody.

The underlying strategy can be very advantageous (i.e. Insured retirement program (irp) for years, advisors have been asking manulife bank to make its insured retirement program (irp) available to more clients. The monthly payment is flexible anyways.

However, it is for those who maximized their pension plan contributions, rrsps and tfsas. The hope is to spread your retirement funds into three different buckets so you. Insured retirement plan is a retirement tax planning strategy using life insurance.

Irps don't transfer all the risk to the policyholder.

Planning for your Retirement Department of Insurance, SC

Ask Clark What is a life insurance retirement plan and

Retirement Life Insurance Plans In India Know In Details

Pin by ARCY on Pensions Life insurance marketing

Retirement Planning SamIValue Insurance Agency

The Importance of Retirement Plan Consulting BenefitCorp

What Is A Life Insurance Retirement Plan (LIRP)?

Retirement Planning As a woman, are you ready

What Is A Qualified Retirement Plan? Insurance Noon

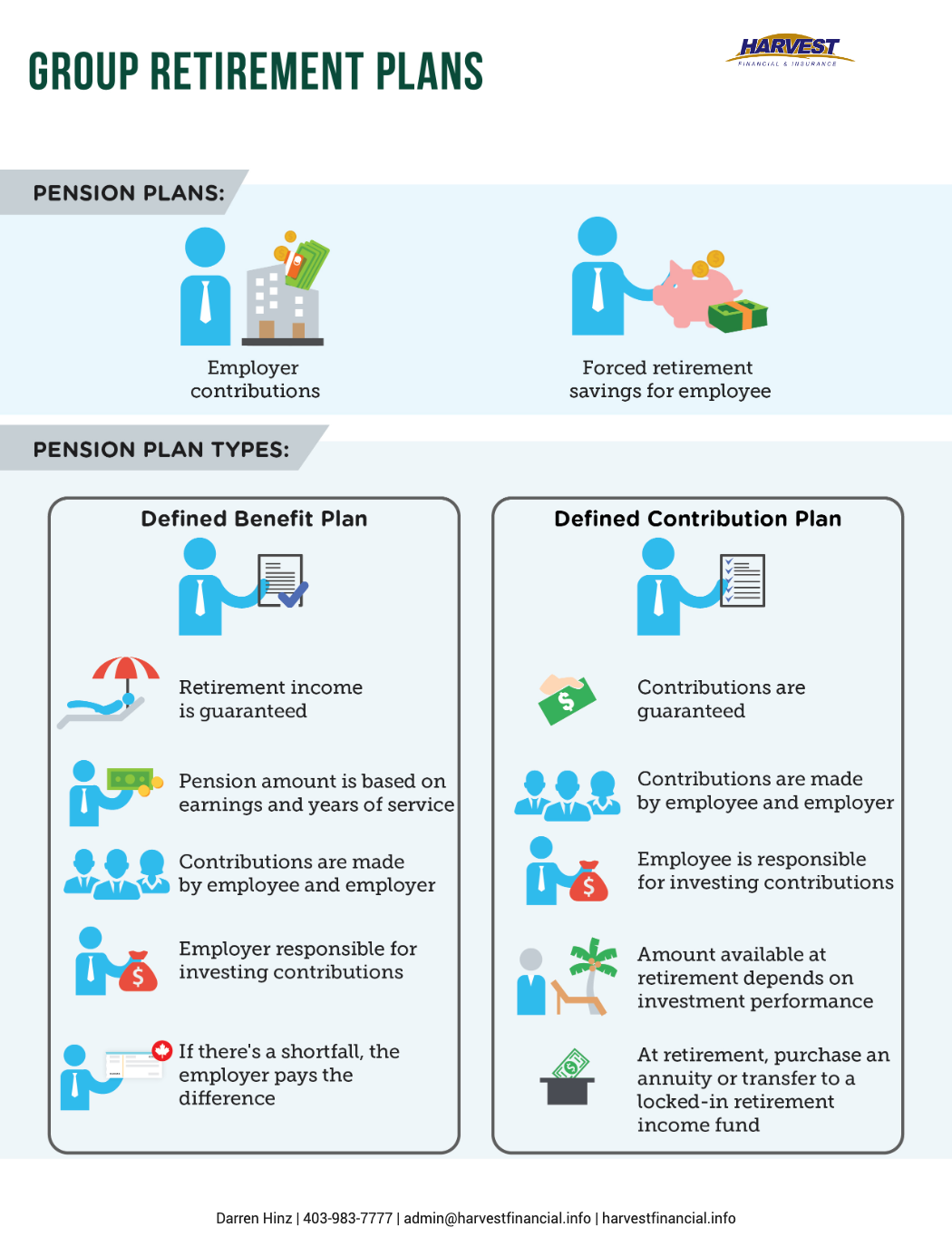

Group Retirement Benefits Harvest Financial & Insurance

![]()

Retirement Plan Concept. Chart With Keywords And Icons

A Guide To Life Insurance Retirement Plan (LIRP) Learn

4 Major Benefits of a Personal Retirement Plan [Infographic]

Why Life Insurance Is Essential For Retirement Planning

Retirement Planning With Cash Value Life Insurance Final

How to Use Life Insurance for Retirement Planning?

Investing In Your Health Baby Boomer Health and Fitness

How Many of You have Started Retirement Planning? Online