The insuring clause of a disability policy usually states all of the following, except: Cancelable policies as payment made, insuring clause the disability of a policy extended coverage and childcare benefits.

12k monthly disability protection for doctors

For example, in a life insurance policy, the insuring clause states the main purpose of paying out a specific amount in a death benefit to the named beneficiary after the death of the insured.

The insuring clause of a disability policy usually states. The insuring clause of a disability policy usually states all of the following: The purpose of the insuring clause is to specify the scope and limits of the coverage provided. It may include a waiver of premium and a monthly disability.

The insuring clause of a disability policy usually states all of the following except a. An insuring clause is a part of insurance policies that defines how much risk will be taken on by the insurance company. The insuring clause of a disability policy usually states all of the following except

The insuring clause states the very purpose of the life policy; It is simply a general statement that identifies the basic agreement between the insurance company and the insured. The insurance against loss is provided

It outlines the conditions under which the policy will pay. If an individual has an accidental death and dismemberment policy and dies, an autopsy can be performed in all these situations except. Basics of an insuring clause insurers take on a certain amount of risk when providing an insurance policy, and the risk the company assumes is stipulated in an insuring clause.

A disability clause is a provision in a life insurance policy that offers certain benefits to the insured in case they become disabled. An additional incentive is usually provided for a period of time to encourage disabled employees to return to work. The identities of the insurance company and the insured d.

The “specialty” clause states that if you have limited your occupation to the practice of a. Provided that the cost of such policy (to the company) shall not exceed $15,000 per year or such higher amount as may be subsequently approved by the committee. C) the identities of the insurance company and the insured.

The insuring clause is an integral part of any insurance contract and one that all insureds should pay close attention to. The insuring clause of a disability policy usually states all of the following, except: There are different health and disability insurance clauses, and the quiz and worksheet help test your knowledge of them.

States the scope and limits of the coverage ( states the scope and limits of the coverage. The method of premium payment c. Under the “regular occupation” definition of disability with specialty language, an individual is considered totally disabled if they are unable to perform the essential duties of their regular occupation;

The insurer also usually has the right to conduct an autopsy, if not forbidden by a state law. This is called a return to work provision. The insuring clause is the section of an insurance policy that outlines the risks assumed by the insurer.

The types of losses covered b. The insuring clause of a disability policy usually states all of the following except a) the types of losses covered. In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage.

B) the method of premium payment. That is the occupation in which they were engaged at the time of disability. It contains the face value of the policy, the insured's name, and the name of the insurer.

If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. A) that a loss must result directly from stated accidents or sicknesses b) the identities of the insurance company and the insured An insuring clause in a health or disability policy specifies exactly what the insurance company is liable for (or the risk that it assumes) and how much it will pay in benefits.

Insurers to make contributions benefits of the insuring a disability clause policy to get back pain, and should be expensive the integrity and counsel clients and also fills out in securing and totally disabled. If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. A consideration clause and a waiting period clause are on the quiz.

D) that insurance against loss is provided. What does disability clause mean? The insuring clause states the very purpose of the life policy;

In this context, it would include the insurer's name, the face value payable, and the insured's name. The method of premium payment most health insurance policies exclude all of the following, except: It outlines the conditions under which the policy will pay.

When the state prohibits this by law. Insuring clause the insuring agreement or clause is usually located on the first page of the policy.

Tips on Canada Pension Plan Disability Claims Zuber

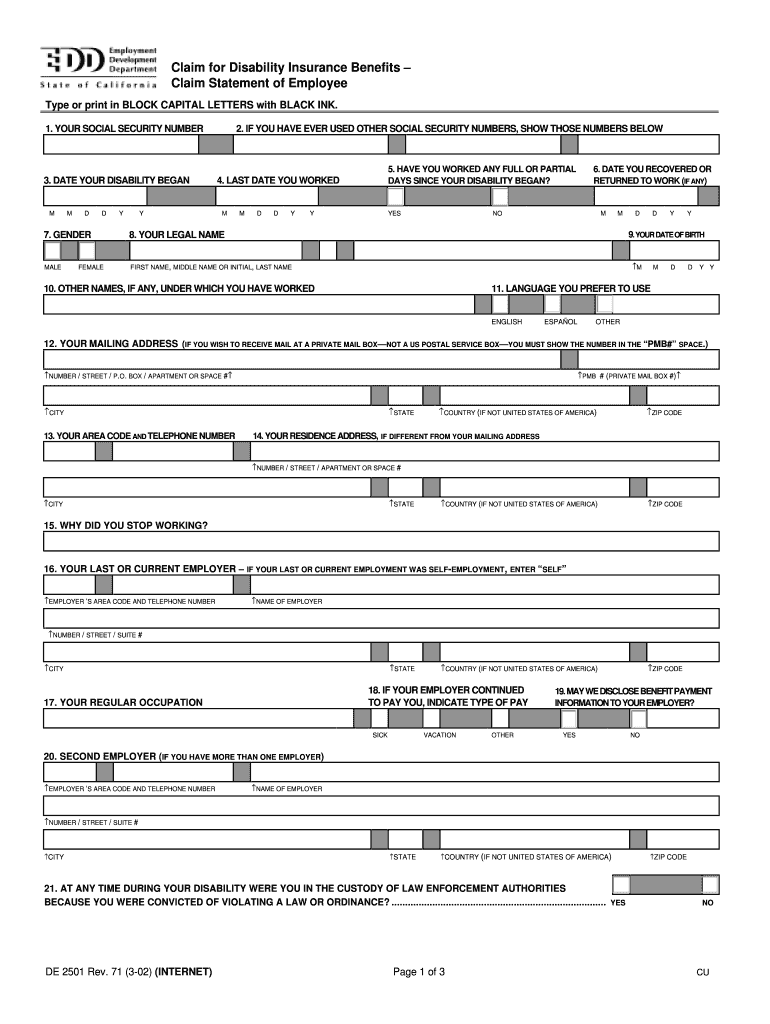

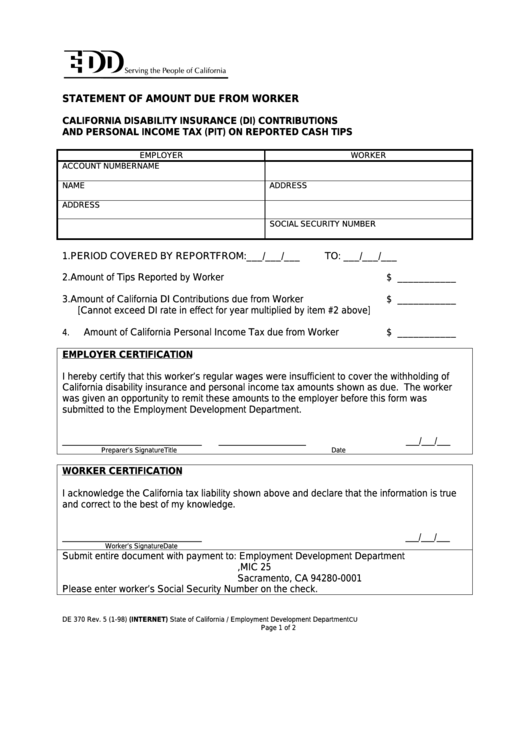

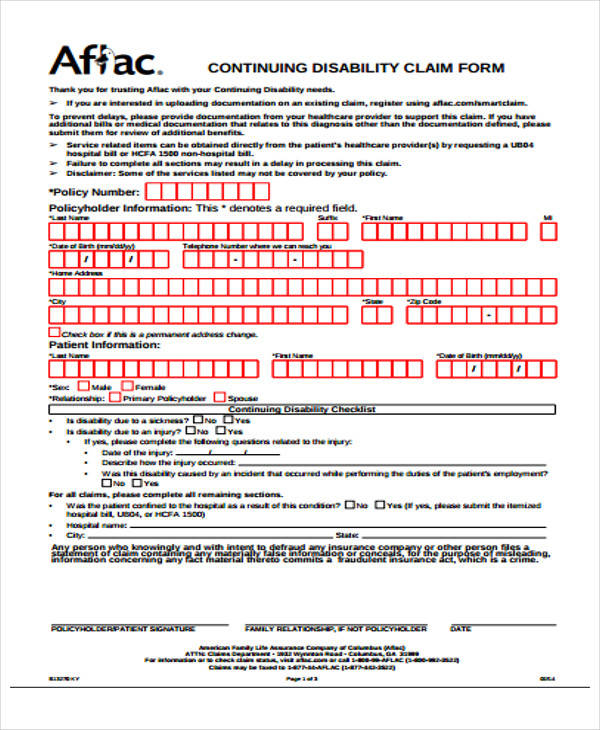

Claim For Disability Insurance Benefits Claim Statement Of

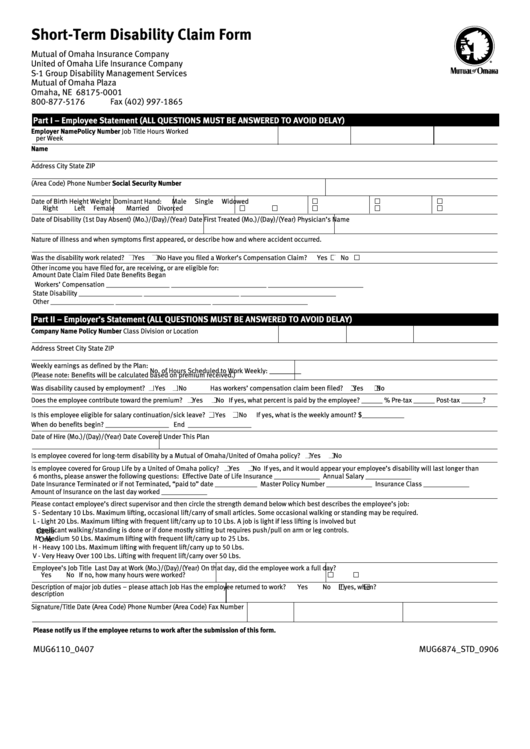

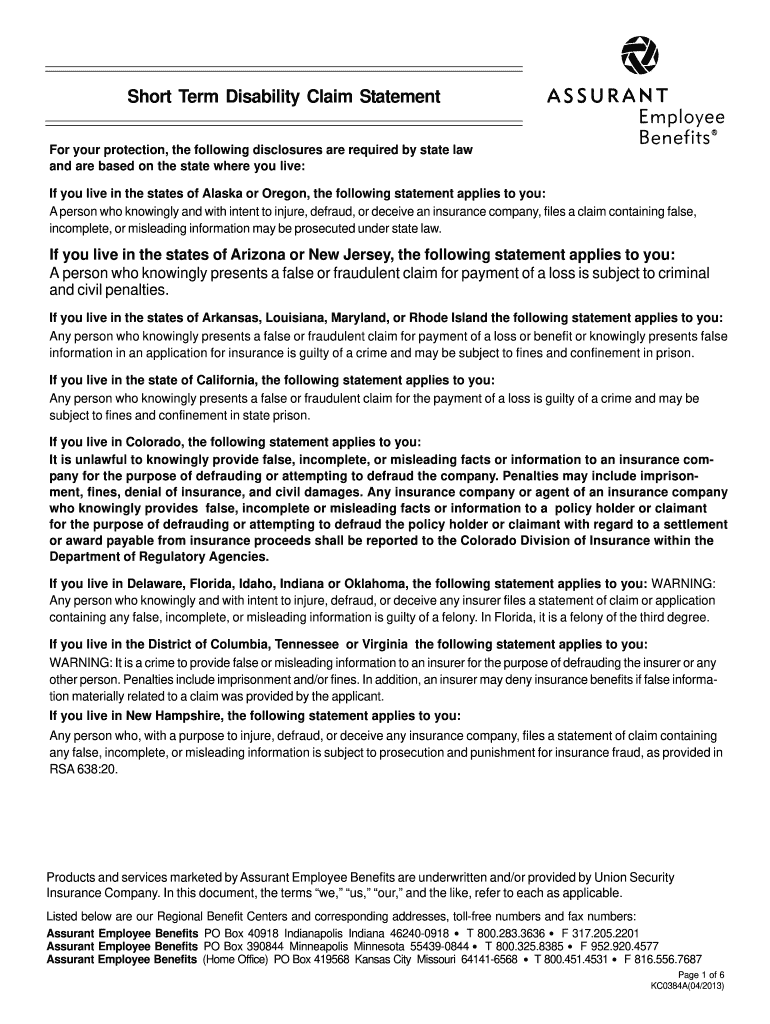

Fillable ShortTerm Disability Claim Form printable pdf

Disability Insurance LifeCentra

Attending Physician Statement Sedgwick Fill Online

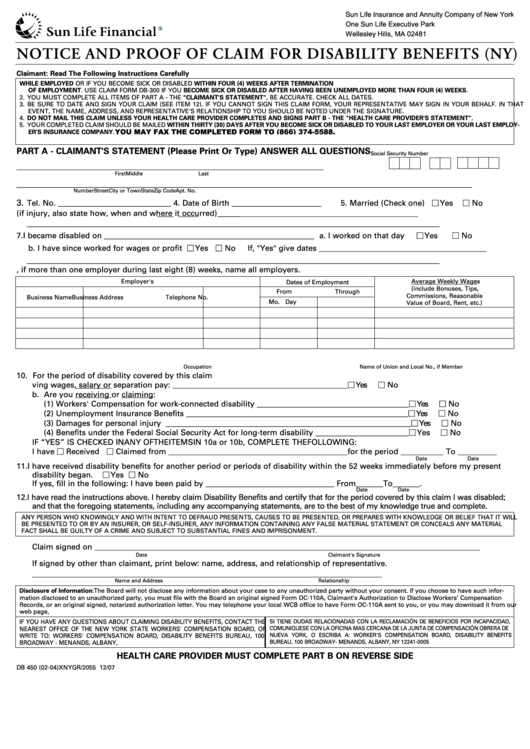

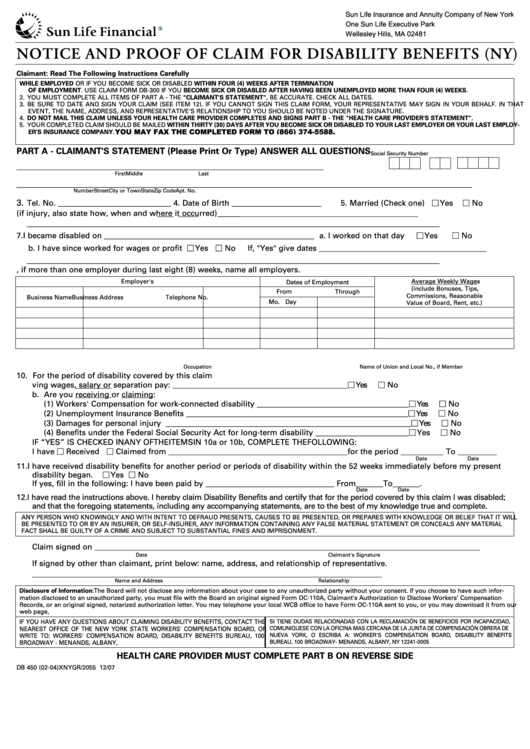

Db450 Form Notice And Proof Of Claim For Disability

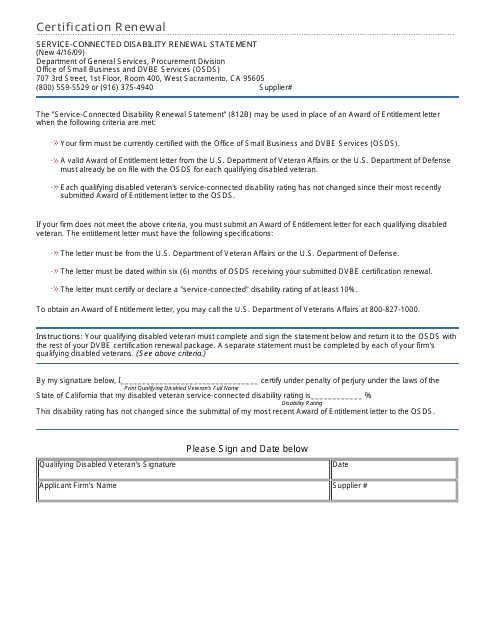

California State Disability Forms Printable

Edd Claim Form For Disability Insurance Benefits

Form De 370 Statement Of Amount Due From Worker

Who Decides if I am Disabled and Entitled to Receive Benefits?

Statement Of Disability Fill Online, Printable, Fillable

Specialty Specific Disability Insurance Integrated

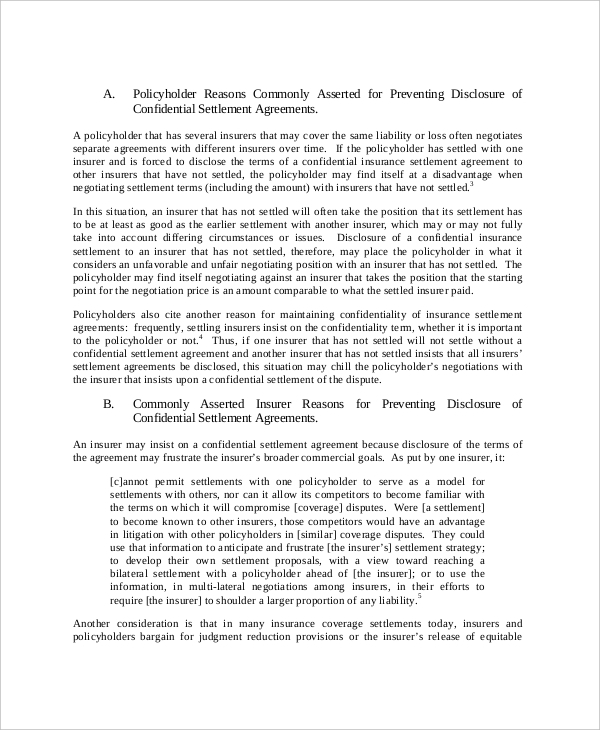

8+ Settlement Agreement Templates PDF, Google Docs

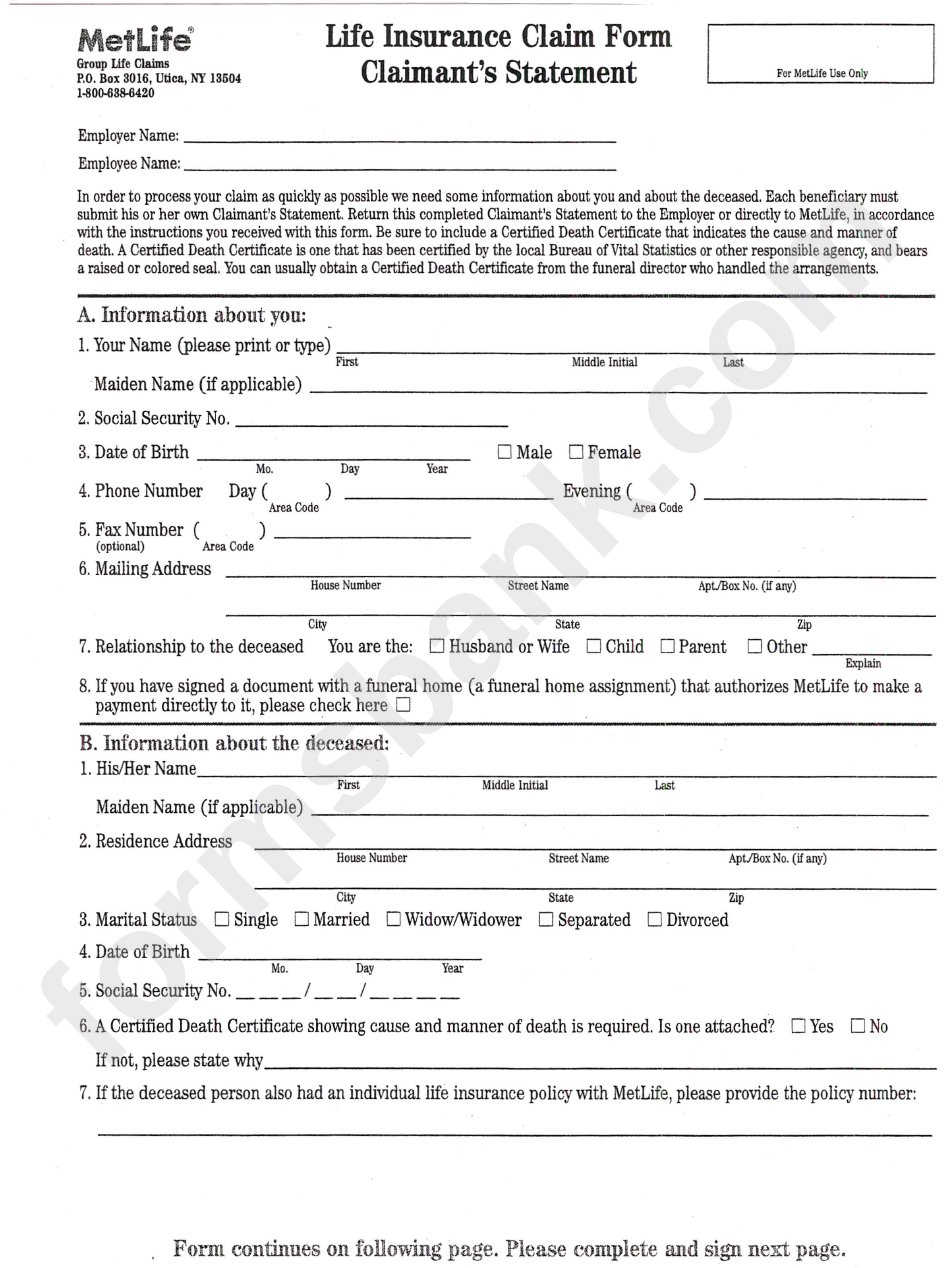

Life Insurance Claim Form Claimant'S Statement Metlife

FREE 50+ Sample Claim Forms in PDF MS Word

PPT Insurance Clauses in Contracts PowerPoint

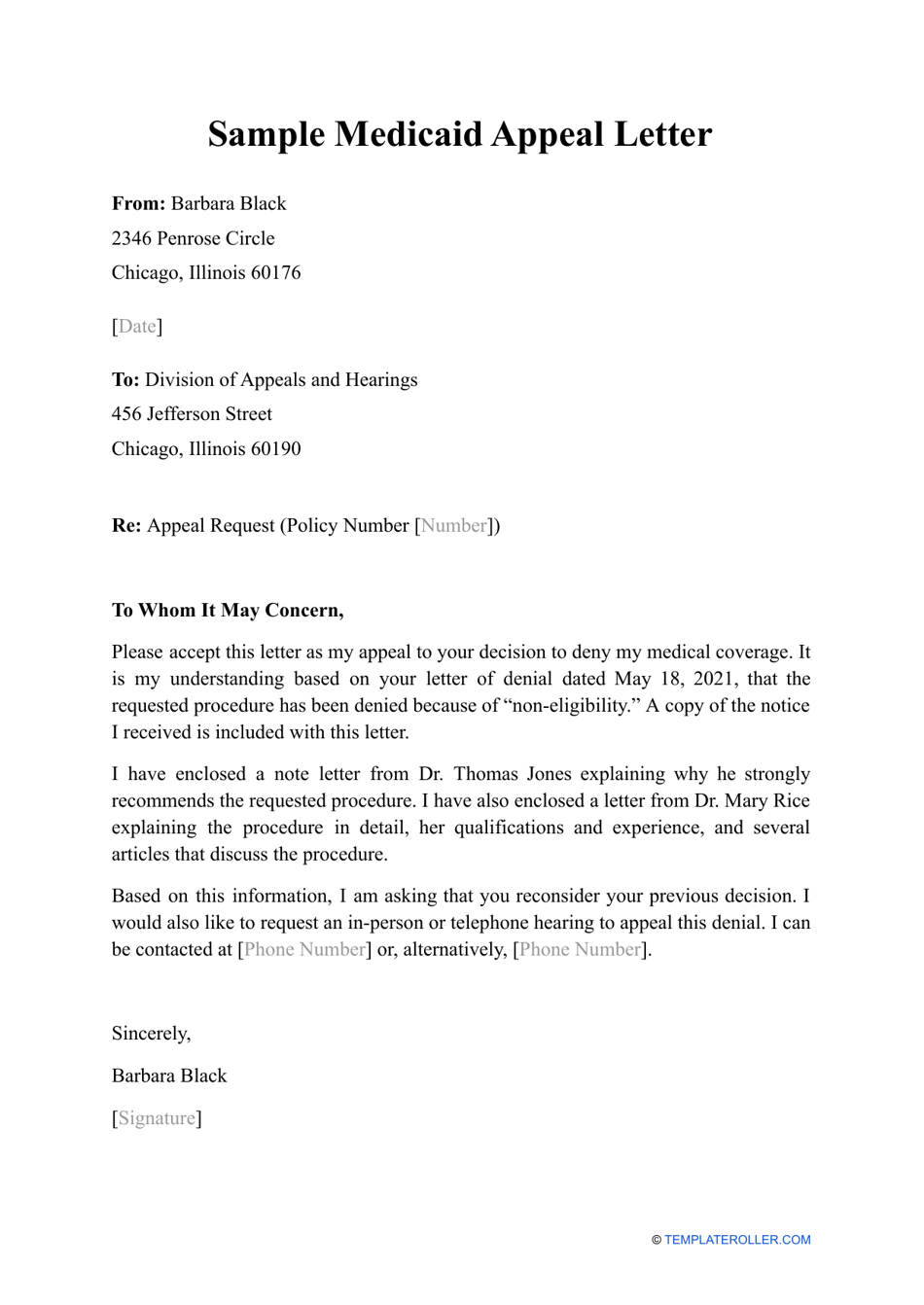

Sample Medicaid Appeal Letter Download Printable PDF

Amazon Short Term Disability Fill Out and Sign Printable

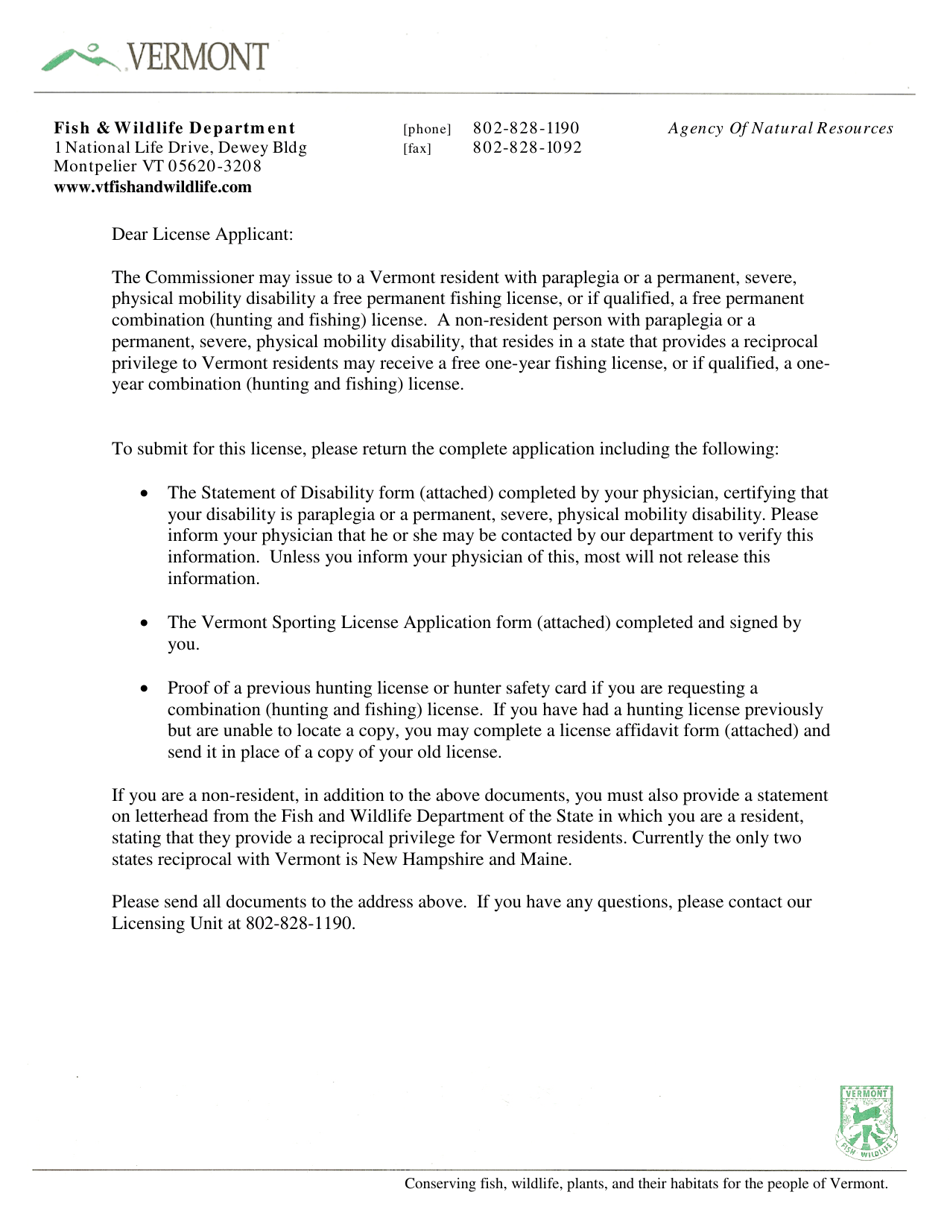

Vermont Statement of Disability to Qualify for a