Either you can let your policy expire or you might receive an insurance notice from your carrier advising you that your policy will be terminated. Getting homeowners insurance after your policy gets canceled getting homeowners insurance after your policy gets canceled isn’t as hard as you think, and you can always appeal your policy cancellation if you disagree with the provider’s reason.

Homeowners Insurance Lapse 101 Top Reasons And How To

Homeowners insurance cancelled because of roof

How to get homeowners insurance after lapse. Home insurance after a lapse. If your home insurance policy has lapsed due to unpaid premiums or cancellation, contact your agent to. If your homeowners insurance policy lapses, you will be facing great financial risks.

If your homeowner's insurance has previously lapsed and you're in the market for new coverage, all is not lost. How to get homeowners insurance after lapse: Not all mortgage lenders force place insurance if your personal insurance lapses, but those that do add the cost of the insurance to your mortgage payment or the total amount that you owe on the loan.

You or your insurance carrier can initiate a homeowners insurance renewal. Most homeowner’s insurance policies have a minimum of $100,000 in liability coverage. However, if your coverage lapses and you miss the grace.

Even if you plan on disputing the lapse with the. It is risky to let your home insurance lapse and should be avoided. How can i obtain homeowners insurance after my coverage has lapsed?

While many companies offer discounts for loyalty or for a low number of claims, there are plenty of insurance companies out there. Request a new homeowner’s insurance quote with identical previous coverages to evaluate any cost increases caused by the lapse. You’ll discover that your plan is no longer available at the same rate, but is in fact even higher than before.

How to get homeowners insurance after a lapse in coverage. Your insurance company will send you a letter that will notify you of the policy and you may file for reconsideration. This allows policyholders time to establish a policy with a new insurance company so there is no gap in coverage.

Homeowners insurance lapses when a policyholder is unable to make payments for multiple monthly premiums. Homeowners insurance for high risk customers: Call your insurance company and reinstate your policy.

Yes, it’s possible to get homeowners insurance after a coverage lapse. Visit the lender with proof of your new homeowners insurance policy and ask that the forced insurance be removed from your mortgage. Find several options that work for you before you decide if you want to stay with your current insurer or not.

As soon as you’ve learned that your homeowners insurance has lapsed, call your insurance company immediately. Ask your insurance about retaining the same insurance plan at the same premium rate. If your insurance policy lapses and you aren’t able to get it reinstated, there are a few things that can happen.

You should try to maintain coverage so you have adequate coverage from certain losses and damage. Homeowner’s insurance will cover accidents that happen on your property, so you won’t have to pay expensive medical bills or lawsuits. A lapse in homeowner's insurance results in a loss of financial protection if damage occurs to the home.

Pay your past due insurance bill and your coverage will be restored. The best way to find insurance coverage after a lapse in coverage is to shop around with multiple insurance companies. Even if your homeowners policy is only for a few days, you could lose coverage for any damage that occurs during that period, including fire, windstorm, or burglary.

To get new home insurance after your policy gets canceled, enter your zip code below. How to reinstate your policy. If you miss a payment, the insurance company will give you 30 days to complete the payment before canceling your policy.

Call your most recent insurance company to see if they will reinstate coverage. What happens if you don't have homeowners insurance: Failure to pay the premiums or renew the policy leads to a lapse, as does an insurance company declining to renew a homeowner's policy.

To ensure that your coverage does not lapse, you should start looking for a new policy for home insurance with another company. Rate increases after a lapse. Can i get homeowners insurance after a coverage lapse?

If your home insurance has lapsed, finding coverage immediately should be a priority. Contact your insurance company about your lapse and shop around for new homeowners insurance policies when you have a lapse in coverage. But you should buy at least $300,000—and $500,000 if you can.

Moreover, your home is unprotected against the liabilities that you may face. How to get homeowners insurance after a lapse in coverage. How do i get homeowners insurance coverage after a lapse?

The exact timeframe varies by state, but 45 days is a common time limit. When a customer experiences a lapse in their auto insurance, it makes car insurance companies wary of them. If possible, it’s best to avoid a lapse in coverage to the best of your ability.

Car insurance companies say you will likely be charged a higher premium for having a lapse in coverage. Follow the following five easy steps to get coverage back on the books: How to get homeowners insurance after a lapse in coverage?

Depending on the reason, your insurance company may reinstate your policy after it lapsed. According to one insurance company, your premium could increase as high as 35% to 69% for being high risk. If your homeowners' insurance expires, there could be a number of consequences.

Different events will determine the outcome of an expired policy. Insurance companies are required to give written notice of a nonrenewal prior to the expiration of the policy. If you’re still within your current insurer’s grace period, which is typically 30 days, you can simply pay any unsettled debts to them and your policy will usually continue the date of the payment without a lapse going on your record.

What to do if your policy has already lapse?

How Does a Lapse in Car Insurance Coverage Affect Rates

After short lapse Trump reauthorized flood insurance program

Olympic high jumper in nearfatal fall after letting

What happens if your car insurance lapses?

Why You Still Need Life Insurance After Retirement

Renew Car Insurance On Time To Avoid Financial Loss, Here

What Is Insurance Policy Lapse What Are Your Options After

Lapse In Car Insurance Why You Should Never Let Your Car

How To Get Homeowners Insurance After Lapse / A Guide to

Agent considers the cost of home insurance services

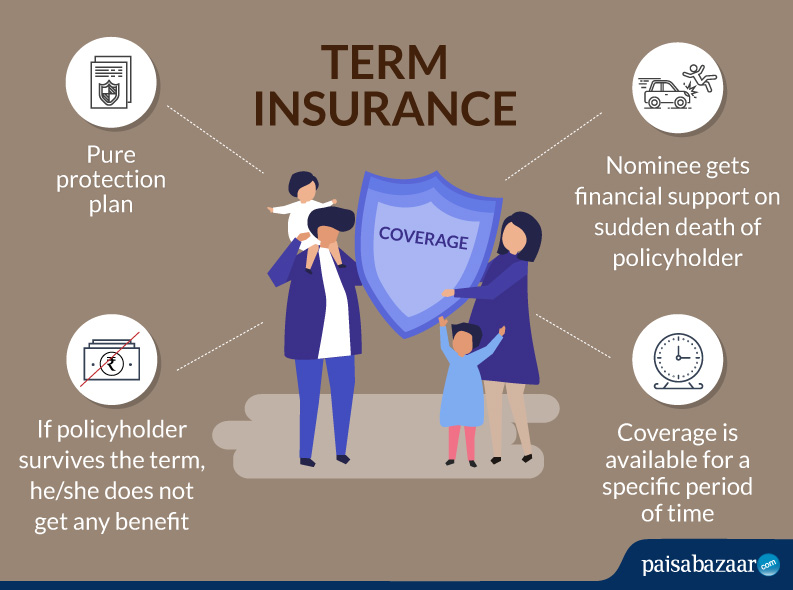

Term Insurance Lapsed How To Prevent Term Insurance Blog

How to Get Homeowners Insurance after a Lapse in Coverage

Lapse in Coverage? Here's How to Get New Homeowners

DMV NY Insurance Lapse Penalty And Costs

How Long Can You Be Without Car Insurance? Insurance Noon

How Does A Lapse In Car Insurance Affect Future Insurance

What Happens If Your Insurance Lapses And You Have An

How To Get Homeowners Insurance After Lapse / A Guide to