These standards are effective on april 26, 2021 for purposes of federal tax administration only. Cost of housing and utilities.

Excel Spreadsheets Help Shared Apartment Expenses Spreadsheet

Enter the number of vehicles for which the debtor can claim an expense for operation, ownership, or lease.

Housing and utilities insurance and operating expenses. Depending on the nature of the commercial space and your market, the operating expenses tenants are responsible for may vary greatly and may include the following: Based on information from the irs, the u.s. Number of people in the household.

This amount is determined by the debtor's gross monthly income in the table on the irs local. These costs are part of operating expenses because incur due to the main business activities. Utilities such as gas/electric heating, water, and electricity.

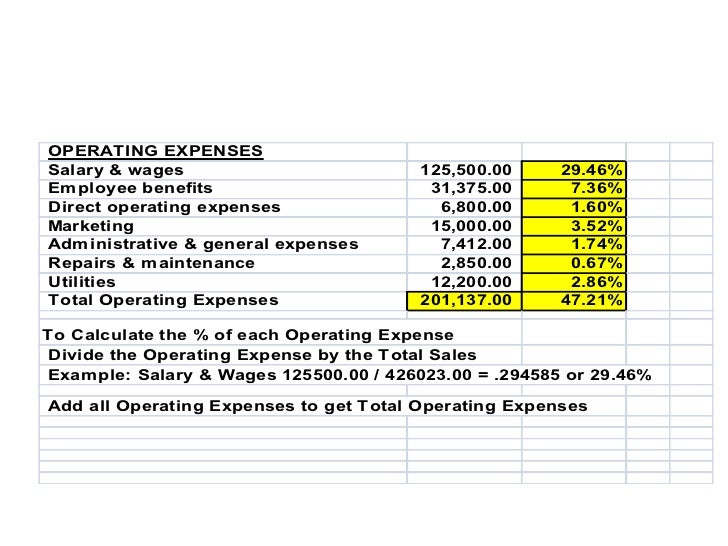

Broken down, operating expenses/unit were: The tables include five categories for one, two, three, four, and five or more persons in a. The irs allowable expense guidelines will limit your housing/utilities based on the county you live in.

The housing and utilities standards are published by the irs by state (including guam, the northern mariana islands, puerto rico, the virgin islands, and the district of columbia), county, and family size. Within housing and utility standards, the irs includes the total cost of housing, such as: Expense information for use in bankruptcy calculations can be found on the website for the u.s.

While, for mid/high rise apartments, operating expenses/unit were, $8,134, while gpr was $20,694 and noi was $12,069. Using the number of people you entered in line 5, fill in the dollar amount listed for your county for insurance and operating expenses. Download the housing and utilities standards (pdf) pdf in pdf format for printing.

Property taxes and utility costs, such as telephone, water, electricity and maintenance costs. Housing and utilities standards include mortgage or rent, property taxes, interest, insurance, maintenance, repairs, gas, electric, water, heating oil, garbage collection, telephone and cell phone. The sum of all expense categories must balance with this line, using total net utility expenses only.

With minimum liability insurance, coverage is. For example, if you have a family of four and live in harris (houston) county, texas, the irs will allow you. Trustee program has divided the irs local standard for housing for bankruptcy purposes into two parts:

Housing and utilities insurance and operating expenses for a company owned and operated vehicle. Sum of all operating costs. Using the number of people you entered in line 5, fill in the dollar amount listed for your county for insurance and operating expenses.

Please note that the standard amounts change, so if you elect to print them, check. Based on information from the irs, the u.s. Total housing expense is an expense that comprises a homeowner’s monthly mortgage expense (principal and interest), operating expenses, such as property taxes and insurance, utility bills utilities expense utilities expense is the cost incurred by using utilities such as electricity, water, waste disposal, heating, and sewage., and property management.

This calculation is done automatically using various pieces of data: The irs maximum is 2 vehicles. Trustee program has divided the irs local standard for housing for bankruptcy purposes into two parts:

Number of people in the household. A typical policy for an individual in this category is $50,000. Housing and utility standards can vary widely, depending on location.

Expenses as listed in an apartment building offering memorandum (brochure) apartment building offering memorandums (sales listing brochures) typically list property operating expenses in general, broad categories almost always like this: Maintenance costs to keep the building insured, functioning, and structurally sound. 22 rows housing and utilities standards include mortgage or rent, property taxes, interest,.

This calculation is done automatically using various pieces of data: Total housing expense is the sum of a homeowner's monthly mortgage principal and interest payments plus any other monthly expenses associated with their home such as insurance, taxes or utilities. These expenses include telephone expense, traveling expense, utility expense utility expense utilities expenses are the prices incurred by a company for the usage of utilities like sewage, electricity, waste disposal, water, broadband, heating, & telephone.

Here's a brief overview of the types of costs you want to include as an operating expense, as well as those expenses that you want to exclude. Adjustment view, type your rationale in the text box. This table shows your estimated monthly carrying costs for a $350,000 home with a $300,000 mortgage at 3.24% amortized over 25 years.

It is not uncommon to have coverage of $50,000 in general.

Utility costs are the largest operating expense in

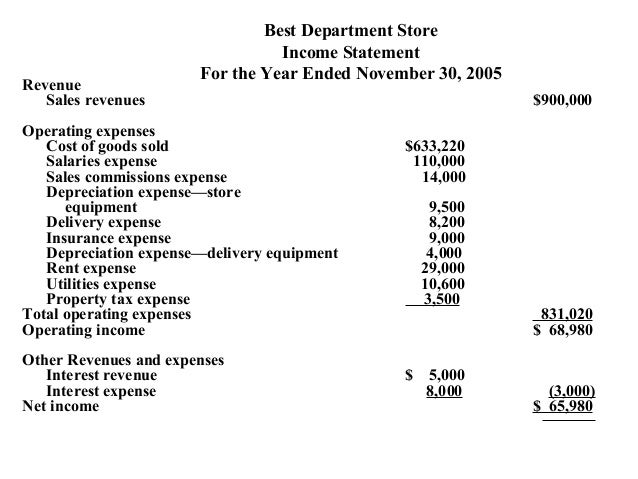

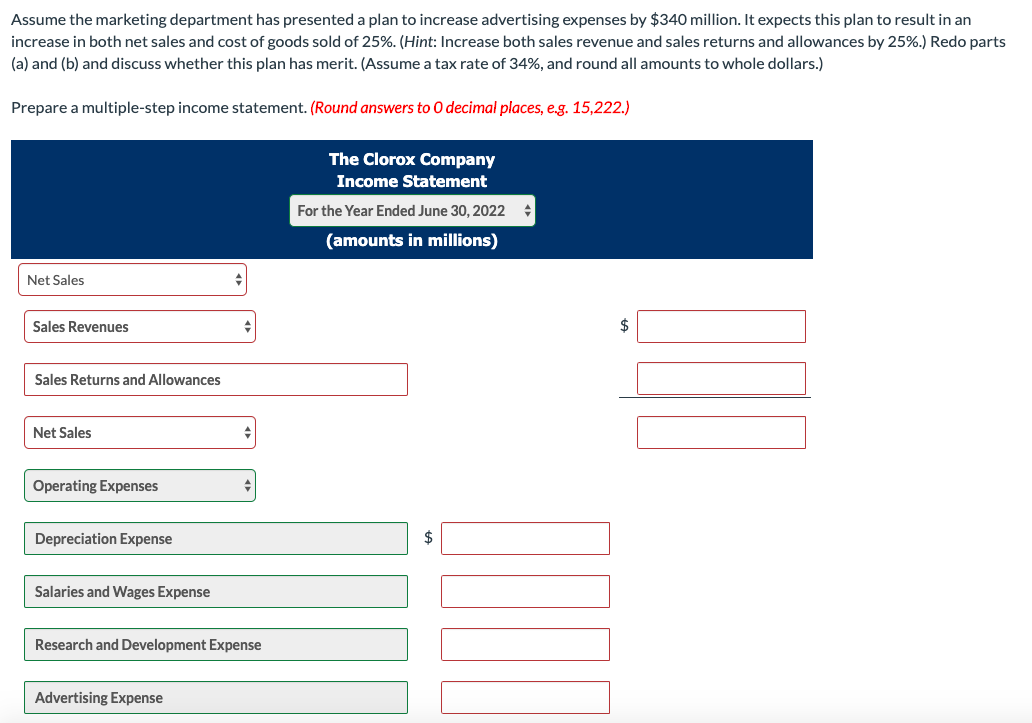

Financial Statement Preparation (2)

Pin by Joel Reed on Atlanta News Rental apartments

Average UK Household Budget 2020 NimbleFins

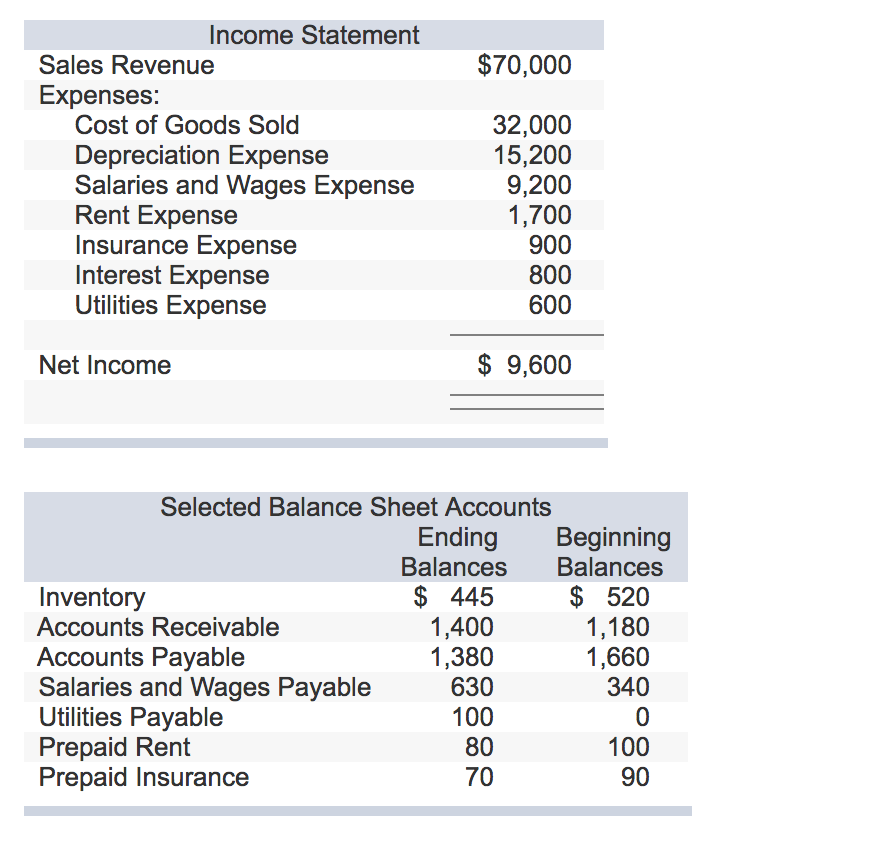

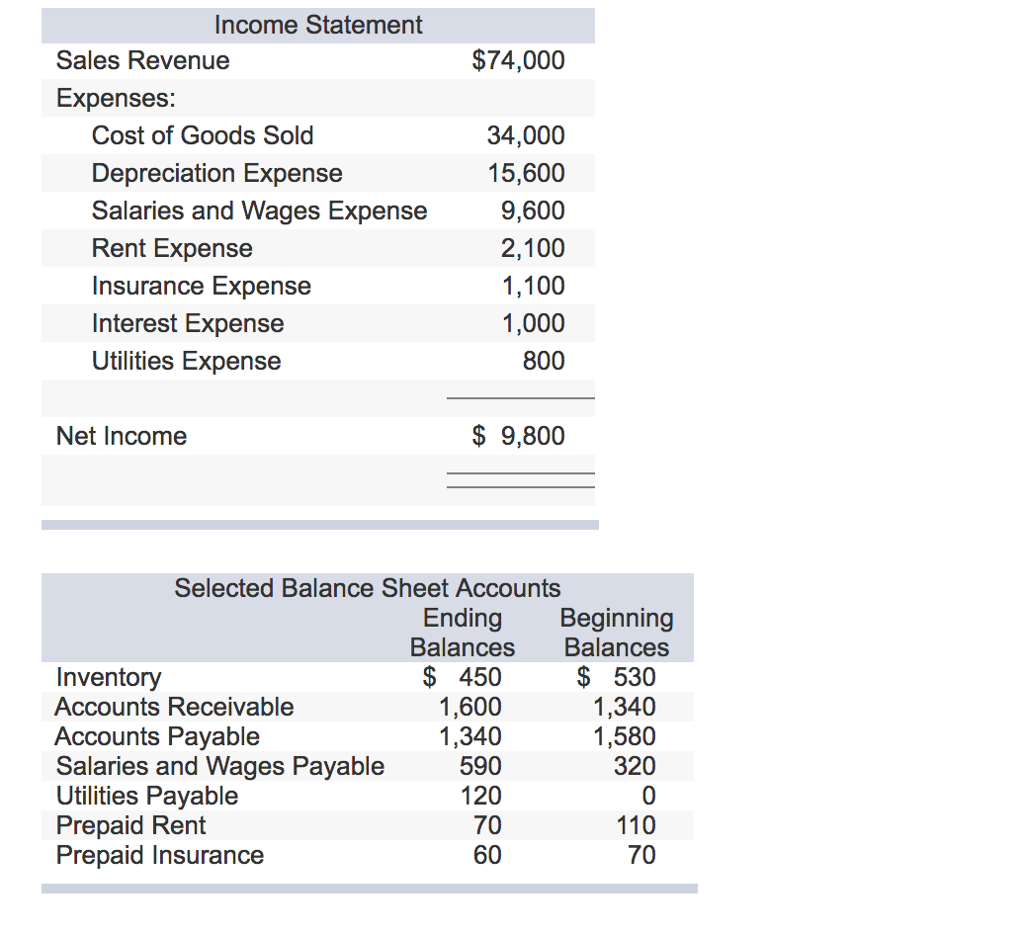

Solved The Statement And Selected Balance Sheet In

Rental Property Analysis Excel Spreadsheet

Facilities Management W.B. Guimarin & Co., Inc.

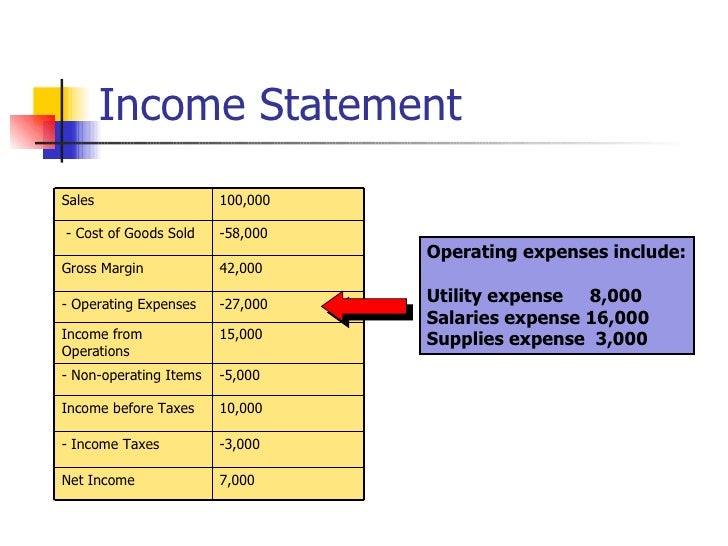

Solved Rent Expense Utilities Expense Total Operating Exp

Everything you should know about the operating expense

Utilities Expense Double Entry Bookkeeping

13 Ways to Cut Administrative Overheard Costs in Your

Rental Operating Expenses by Age of Property of Gross

Download Budget With Charts Excel Template ExcelDataPro

Solved The Statement And Selected Balance Sheet In

Average UK Household Budget NimbleFins

NAHB Lower Operating Costs Mean Buyers Can Afford a