When do i have to let my insurance provider know about the penalty points? If you don't, you'll be required to produce your licence to the police within seven days to have the points added.

Freeway Insurance Company Near Me inspire ideas 2022

You should tell your insurance provider about any points you accrue on your licence as soon as possible.

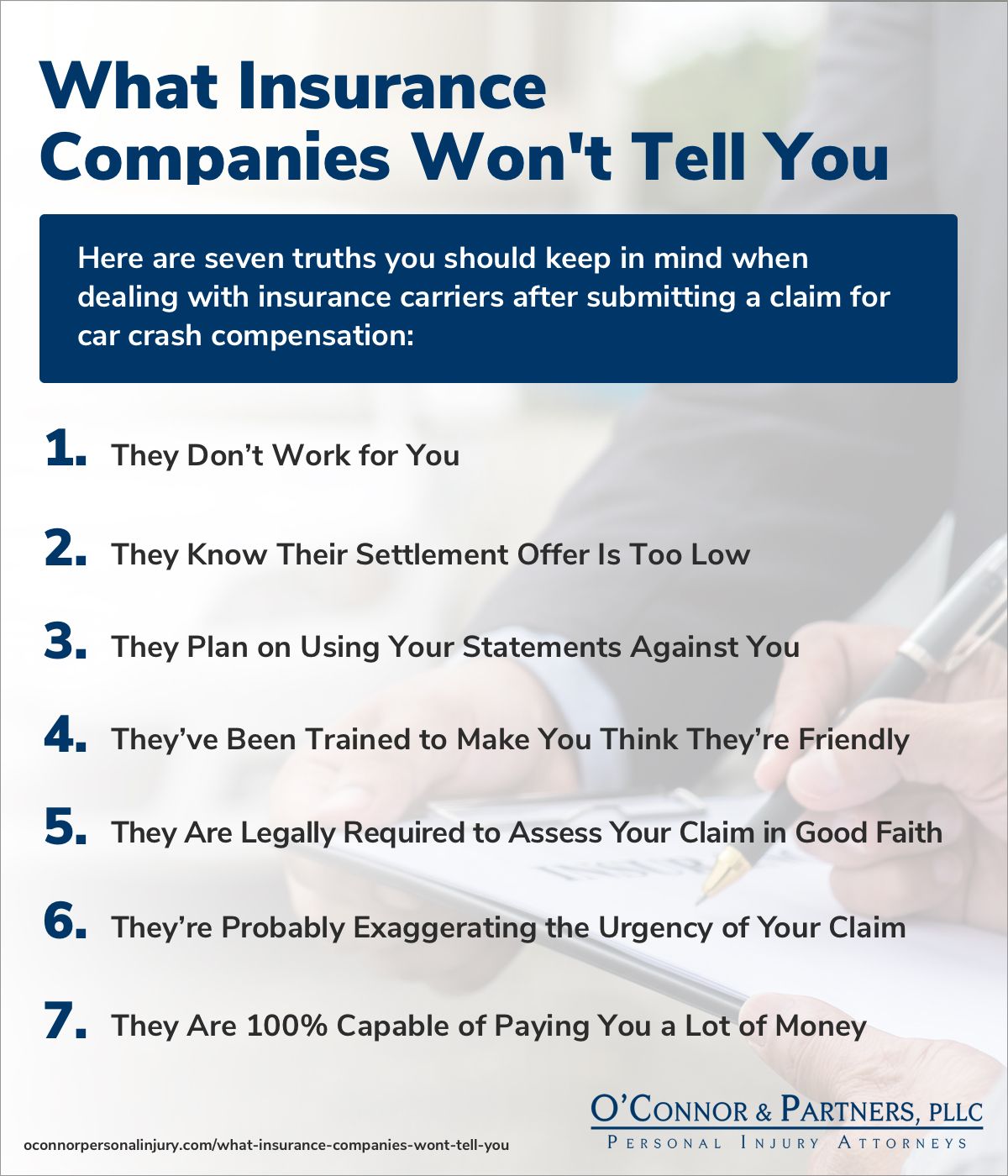

Do you have to tell insurance company about points. As a broker, we can get quotes on your behalf from these insurers and find the best deal for you. Because when you do, you’re talking to someone who is actively working against you. The benefits of declaring attendance on a speeding awareness course

So even if your penalty points expire, you might still have to declare them when you’re taking out insurance. Some moving violations that usually have points assigned to them include: Choosing to attend a course will avoid penalty points being added to your licence, maintaining a clean licence in some cases, and because course data isn’t held by the dvla, it can’t be checked by insurance companies.

How long do you need to tell your insurer about conviction points on your driving licence? But research by rac insurance found that nearly a fifth of motorists would not inform their insurer if they picked up penalty points while driving. You must also declare attending any driver awareness courses.

Do i have to tell my insurer how many demerit points i have? It all depends on what insurance company you have though. You'll probably find that the t&cs of the insurance state that you have to inform them of any changes in details as soon as possible.

If you’re unsure what to do once you have reached the end of your conviction, you can find more information under the rehabilitation of offenders act. Yes, it’s important to tell your insurance provider if you receive points for a motoring conviction or a fixed penalty notice. Leaving the scene of an accident;

While you do have an obligation to talk to your own insurance company after an auto accident and to reasonably cooperate with their investigation of the claim, you should be careful about talking to the other drivers’ insurers. Most insurers only ask you to declare any points received while you’ve been covered by them at renewal time, but some state in their terms that you must tell them as soon as you. The car insurer you're requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years.

You are legally required to inform insurance providers if you have any points on your licence before you get a quote. Penalty points if you or any named drivers receive a fixed penalty, motoring conviction or are disqualified during your policy term you must tell your insurer at renewal, using the dvla conviction code. A number of insurance companies are still happy to provide quotes to convicted drivers, and there are others who offer specialist insurance.

Progressive insurance doesn’t have any information about a point system on its official website. Points are usually marked against your licence for four years. If you have points on your licence, you are legally obliged to tell your existing insurer and you must declare it when shopping around for a new policy.

The data also shows that a quarter of car owners who already have penalty points did not inform anyone of this. This means that even if the points no longer show on your licence record, insurers may still expect you to declare the conviction, so be careful to check the number of years that the insurer specifies for a driving conviction to be. Passing a stopped school bus;

Not only do defensive driving courses take away points, but it could qualify you for an insurance reduction, which may be needed if you see a rate increase due to your points. This means that you’re legally obliged to tell a prospective (or current) insurer of any penalty points you receive. Her insurance could be invalidated by not declaring it.

Not only that, but this could prove a costly mistake if you’re involved in an accident and your insurance company is unwilling to pay out because you didn’t tell them about the penalty points. Now that you know the important type of insurance, let’s talk about why do you need insurance. Traffic offences are only rehabilitated after 5 years.

You don't need to mention parking fines. However, this depends on the driving conviction. You can reduce points off your license by taking some certified defensive driving courses.

Auto insurance companies have access to some of the biggest and best data reports available, specifically, your motor vehicle record (mvr) and comprehensive loss underwriting exchange report (c.l.u.e), both of which will tell your car insurance company. If you don’t, your insurance policy will be invalidated, meaning any future claims could be turned down. Talking to insurers can be tricky.

Your insurance company will take these tickets and accidents into account but will incorporate them into their own point system. Failure to stop or yield Depending on the insurer, they may even reduce or refuse to pay a claim if you give the wrong information.

Your insurer may ask you how many demerit points you've accrued and under australian insurance law you have a duty to answer accurately. You do not have to tell your insurance company about tickets, but they're going to find out regardless. If you have penalty points and you are looking to get your car insured, call us today and we can help you.

Declaring penalty points to your car insurance. Many insurers and insurance brokers will request any conviction details from within the last five years, regardless of if they’ve been spent or not.

How Long Does It Take For An Insurance Adjuster To Contact

Does The Car Insurance Policy Holder Need To Be The

What To Do If Insurance Company Denied Roof Claim Ideas 2022

Why Do You Need Digital Marketing for your business (9

Do Any Companies Have Cheap Car Insurance in Manchester

How To Tell If Your Mac Has Been Hacked 2018

Do You Have To Tell Car Insurance About Accident Do You

TrustLayer Why Does Your Insurance Company’s Rating Matter?

How Does Insurance Underwriting Work? Vio Insurance

Can You Sue An Insurance Company For Lying inspire ideas

6 Best Homeowners Insurance Companies

How Long Does It Take For An Insurance Adjuster To Contact

Can A Parking Citation Affect Your Insurance Awesome

Does Instacart Have Insurance NSD Official

Do Any Companies Have Cheap Car Insurance in Manchester

How Long Do You Have To Pay A Speeding Ticket In Florida

How Long Does It Take For An Insurance Adjuster To Contact

How To Appeal Insurance Claim Denial Sample Demand Letter

How To Tell If Someone Has Hacked Your Computer Mac