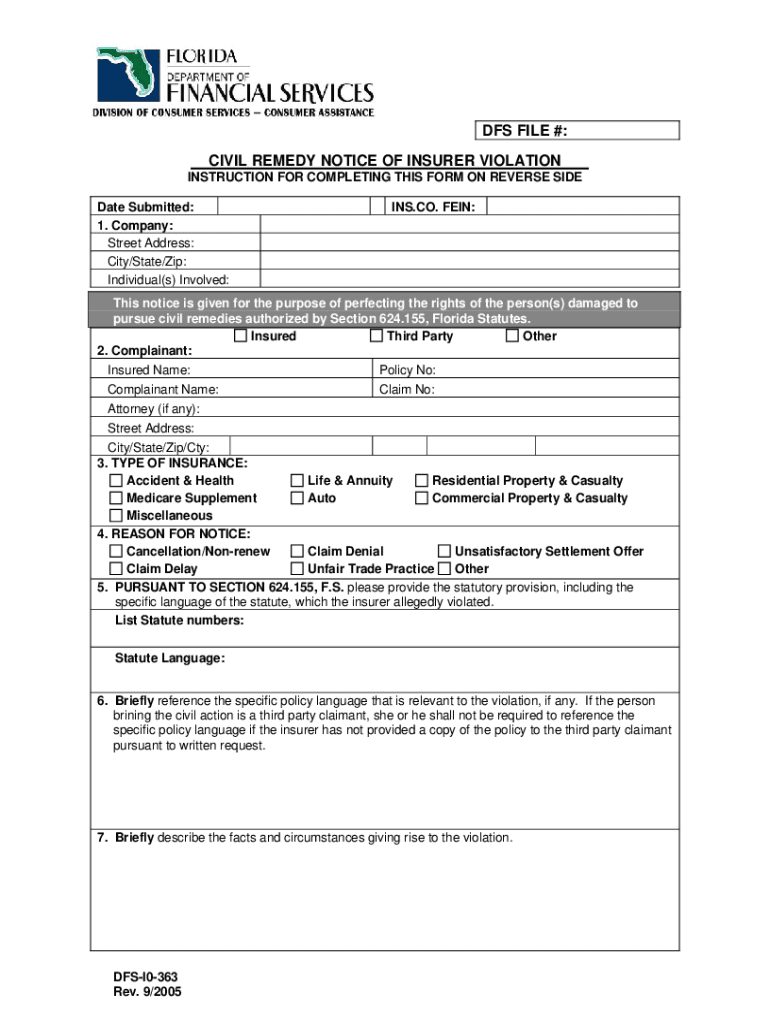

The third requirement is the filing of the civil remedy notice pursuant to s. Civil remedy notices are filed pursuant to fla.

20 Questions Insurance Adjusters Don't Want You to Ask in

Filing a lawsuit on behalf of the policyholder.

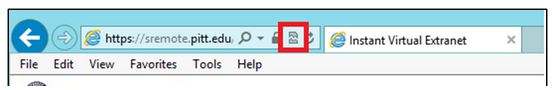

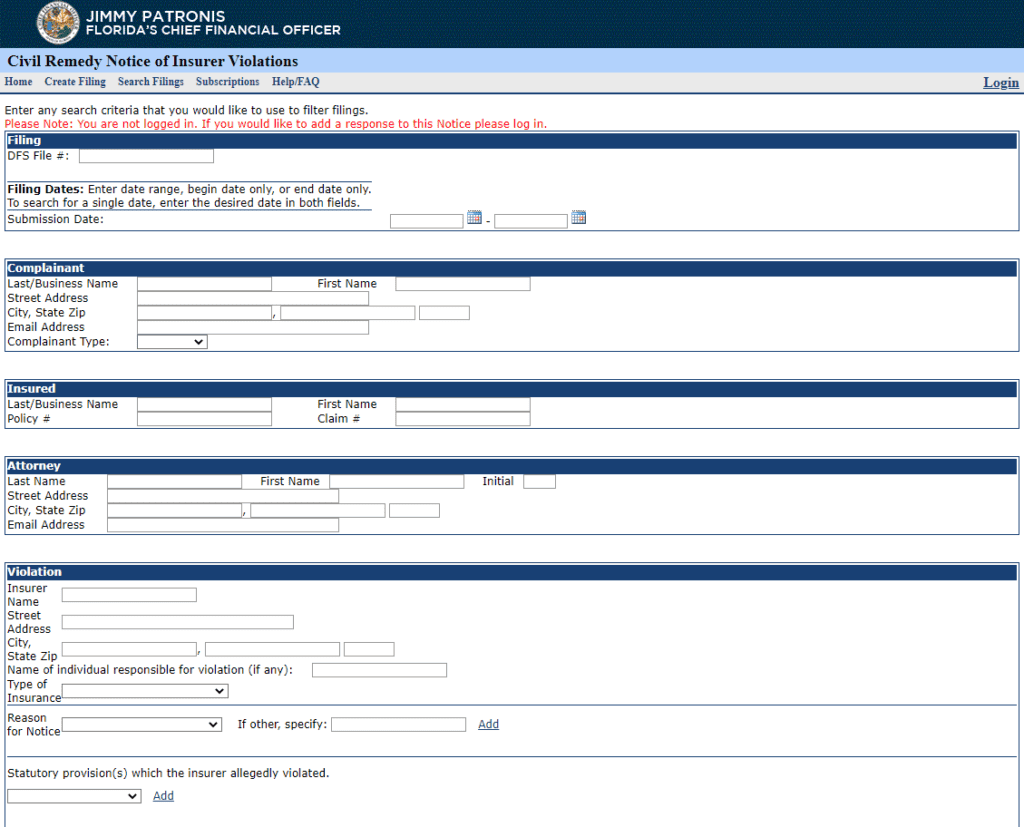

Civil remedy notice of insurer violation. The first and second requirement are oftentimes determined in litigation, arbitration,. Civil remedy notices must file civil remedy notice (crn) as a condition precedent to a bad faith lawsuit.s. A crn is not ripe until damages are determined.

Florida statute §624.155 mandates that any person may bring a civil action against an insurer when such person is damaged by the insurer’s violation of various statutory provisions. (a) by a violation of any of the following provisions by the insurer: This system is intended for use by parties who are beginning the process of filing suit against an insurer when they feel they have been damaged by specific acts of.

Civil remedy notices of insurer violation; 624.155 civil remedy.— (1) any person may bring a civil action against an insurer when such person is damaged: This form should be completed in its entirety and the applicable items checked.

The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. Return this form to the florida department of insurance at. The insurer raised a ‘technicality’ under the statute to avoid the claims of bad faith.

A civil remedy notice of bad faith may have been sent to the wrong address for the insurer. 416, 485, 378, 363, 1,202, 2,209, 1,504. This form should be completed in its entirety and the applicable items checked.

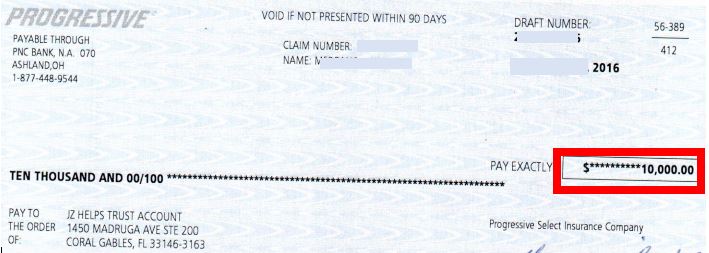

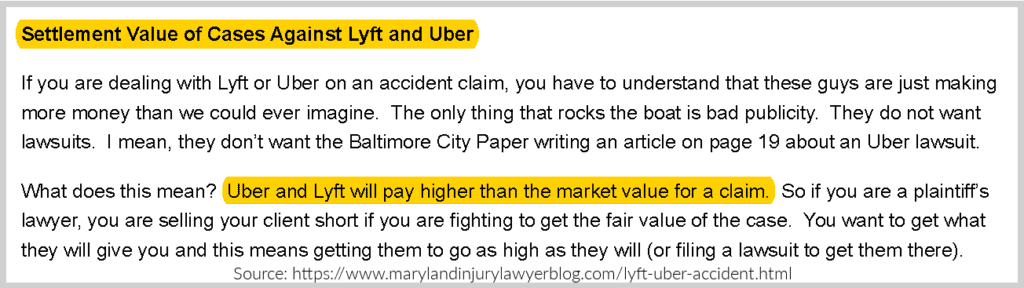

No bad faith action shall lie “if, within 60 days after the insurer receives notice from the department in accordance with this subsection, the damages are paid or the circumstances. The first way lawyers can help public adjusters and insureds is by filing civil remedy notices of insurer violation (or crns). A crn is a critical tool that should be used more often to maximize the benefits under the insurance policy.

Add statutory provision(s) which the insurer allegedly violated. The crn serves as notice to the insurance company that a bad faith claim is forthcoming. A request for insurance assistance is different than filing a civil remedy notice (crn) of insurer violation.

The department of financial services explains, Partners (through sponsor auto finance holdings series) 25%; Section 626.9541(1)(i), (o), or (x);

If the insurer pays the damages or corrects the violation, then the insured is prevented from pursuing a bad faith action under this statute. This notice is commonly referred to as the civil remedy notice, or “crn.” the crn must contain the following specific information: The requirement that the insured provide a proper civil remedy notice is strictly.

The notice is intended to meet a portion of legal requirements set forth in section 624.155, florida statutes, which requires a party to file notice with both the insurer and the department. The carrier argued that the claimant could not prove they had actually sent a. Procedures regarding the civil remedy notice (“crn”), which is required by florida law for prosecution of a statutory bad faith claim against an insurer.

As a condition precedent to filing a first party bad faith civil action under §624.155, the insured must give the florida department of financial services and the authorized insurer sixty (60) days written notice of the violation. The notice is intended to meet a portion of legal requirements set forth in section 624.155, florida statutes, which requires a party to file notice with the department of financial. Is a consumer complaint different from a civil remedy notice (crn)?

624.155 giving the insurer a safe harbor to cure the claimed violation. A difference is that a statutory bad faith action under s. If you are a new user, please read the information below before you submit a civil remedy notice of insurer violation.

624.155 requires what is known as a civil remedy notice identifying the insurer’s violation to be submitted to the florida department of financial services as a condition precedent to initiating the bad faith action. (3)(a) as a condition precedent to brining an action under this section, the department and the authorized insurer must have been given 60 days’ written notice of the violation. Insurer has 60 days from receipt of crn to pay claim or correct violation.

The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. One of your options is to file a civil remedy notice of insurer violation, or crn, with the department of financial services. If you are having issues with an insurance company and a florida insurance policy, you (or your lawyer) can file a crn against the insurance company.

Exposing Fraud and Deception for

Practice Areas Tomlinson Law Group Property Attorneys

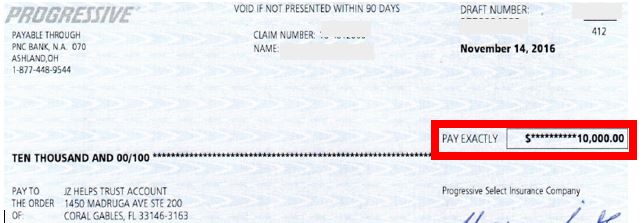

Progressive Insurance Settlements and Claims (Pain

SixtyDay Cure Period for Florida Civil Remedy Notice

First Protective Insurance Company Digitalflashnyc

Exposing Fraud and Deception for

First Protective Insurance Company kenyachambermines

Florida Insurers Property Insurance Coverage Law Blog

Florida Civil Remedy Notice Pdf Fill Out and Sign

Florida ExtraContractual Damage Claims KS Law Group, PLLC

Progressive Insurance Settlements and Claims (Pain

Why Civil Remedy Notices Are Important After Claim Denial

Exposing Fraud and Deception for

20 Questions Insurance Adjusters Don't Want You to Ask in

Fill Online, Printable, Fillable, Blank

Offer In Compromise Offer In Compromise Blog

Universal Studios Orlando Injury and Accident Settlements