If you change your car during the term of your car insurance policy, you’ll need to let your insurance provider know. Different makes and models have different repair costs

Car Insurance Premium Increase After Claim flipsdesigns

You could face problems submitting a claim if you have failed to tell your insurer about the ownership change.

Car insurance premium increase after address change. You can receive senior discounts or pay a higher premium as an elderly driver. Age can affect insurance rates in several ways; Speeding tickets may increase your premium;

Car insurance rates can also change due to the age of the driver, driving violations and accidents, adding a young driver to the policy, and increasing coverage. For motor insurance, new customers paid £285 while people who have been with their provider for more than five years paid £370, according to the fca's example. Almost all insurance providers allow you to transfer your policy from one car to another, and they’ll amend the policy to reflect that.

Or worse, the auto insurance company could say you hid the change as a scheme to get lower car insurance rates, which would qualify as insurance fraud and a reason for it to deny claims and cancel the policy. Your car’s make and model: To use the tool, enter the zip code you are moving from and the zip code in which you're relocating.

When the world around us changes, those changes can have a significant effect on car insurance rates. Yes, progressive does raise rates after 6 months in some cases. Car insurance prices fell by an average of £74 this year compared with last year owing to a drop in car insurance claims, according to comparison site comparethemarket.com.

The latest cpi showed the auto insurance prices up 16.9% in may, following a 6.4% increase in april. Along with updating your insurance and registration status, you have to get a new driver's license when you move to a new state, too. Auto insurance rate increases are usually related to increases in the.

If a spike in claims of your car’s make and model. The change of address car insurance increase or decrease will show after you click the find out button. Just as with your registration, you risk fees and other penalties if you wait too long to update your driver's license after moving.

The amount of accidents around you goes up or down. Marriages, newly licensed drivers, or birthdays can all change your rates; Insurance providers like this because it means your car is less likely to be stolen or exposed to accidental damage from passing traffic.

Lowering your annual mileage estimate can help to cut costs. For example, the number of drivers filing auto insurance claims has risen sharply over the past few years. If you don't know, leave it blank.

Your car insurance rate vs. If you know the annual amount of your car insurance, you can enter that, too. Heavy snow and ice) has resulted in a rise in total claims paid out for damages • rise in home, auto and medical costs for claims • government regulation of insurance • insurance fraud (e.g., increases in claims paid out, legal fees) history there are many factors that are considered when increasing premiums.

Though it may not completely change your decision to move, you can at least prepare for any sudden higher bills that may be in you and your family’s future. Auto accidents and traffic violations are common explanations for an insurance rate increasing, but there are other reasons why car insurance premiums go up including an address change, new vehicle, and claims in your zip code. If you move, your premium could increase or decrease;

Maria riddle, 46, who lives in a small village near colchester, contacted the rac ahead of her house move in november to log a change of address. However, it might change your premium and you may be charged an administration fee. With our great car insurance rate change calculator, you can see by how much your current car insurance rate will spike (or plummet) depending upon just where you are relocating to.

Retirement can be a major change in life. Apply for a new license and change your plates. Retirement can lower your premiums if you now drive for pleasure rather than for work.

There are larger factors that impact the auto insurance industry overall. Some rate increases can be attributed to things outside of your control as a consumer. If your rates go up due to your zip code, look for other ways to save such as evaluating current coverage, raising deductibles, and shopping for quotes.

But know that insurance premiums aren't raised on a whim, and the reason for a rate increase is almost always tied to insurance risk. $58 x 3 years (the length a point stays on a ca driving record) = $174. Minor changes shouldn't impact on your insurance premium.

Here we’ll explain the role zip codes play in how much you pay for car insurance. But points lose their strength after each year. But if the change fundamentally increases the risk of you claiming your premium might rise.

Your qualification for discounts may also change based on your record;

![]()

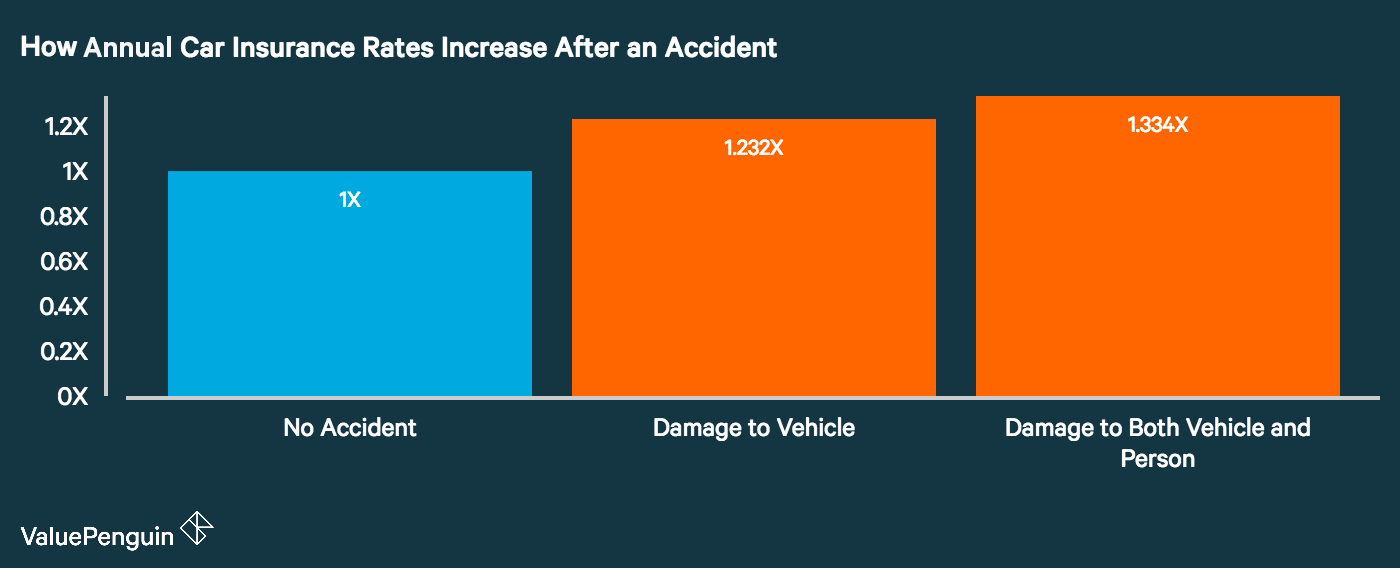

How Much Car Insurance Premiums Increase After an Accident?

Car Insurance Premium Increase After Claim Singapore 2021

What Is Insurance Endorsement Type, And Its Coverage

Will My Car Insurance Go Up After an Accident?

Will My Car Insurance Premiums Increase After an Accident

How Does an Accident Affect My Car Insurance Rates

How Accidents Affect Your Auto Insurance Coverage & Premiums

Brace Yourself for Higher Car Insurance Rates NerdWallet

Car Insurance Premiums Could Increase After Coronavirus

Highway Code Car insurance prices could rise as a result

Insurance Premium After Accident Five Ways to Reduce

Insurance Premium After Accident Five Ways to Reduce

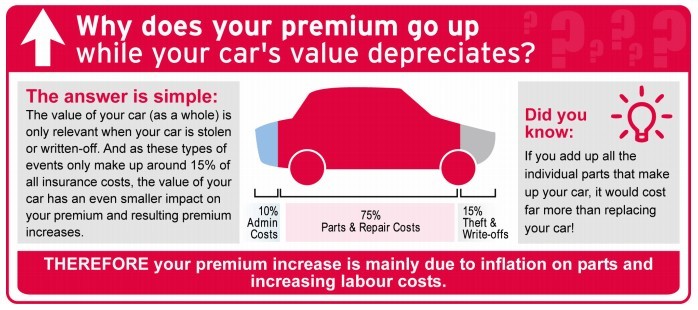

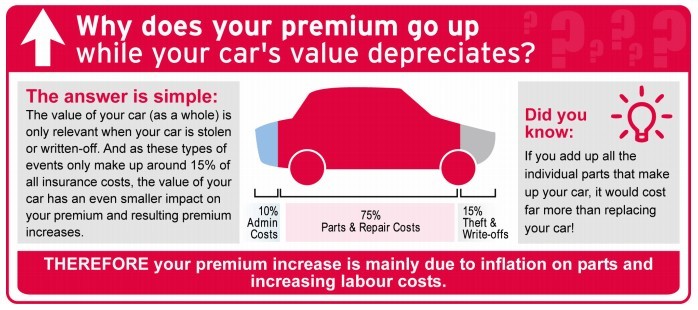

Why your insurance premiums don't decline as your car gets

Your Car Insurance Going To Go Up After An Accident

How Much Does Car Insurance Go Up After an Accident

Insurance Premium After Accident Five Ways to Reduce

How Much Do Car Insurance Premiums Increase After an

Your Car Insurance Going To Go Up After An Accident

Insurance Premium After Accident Five Ways to Reduce