We are a residual insurer of. Ed cantu insurance agency provides alternative insurance companies that will provide windstorm insurance.

Methods to Make a Declare With the Texas Windstorm

Finding alternate windstorm insurance after twia rate hike.

Alternatives to texas windstorm insurance. In coastal areas, you used to have to buy windstorm, hail and hurricane coverage as a separate policy with twia texas windstorm insurance association. Since 2014, insurance agency began offerring private market flood insurance, and private windstorm insurance, lower cost and great alternatives to fema flood insurance for some flood insurance risk, and a lternative to twia for texas windstorm & hail insurance association on the texas gulf coast operating territory. The texas windstorm insurance association is not your only answer.

Each proposal for an alternative to best windstorm insurance texas will be enclosed with links around the result for best windstorm insurance texas , those links will lead you to the source of the site, you can get more information about best windstorm insurance texas at that source. We insure the texas coast so it can remain a vital part of our great state. The texas windstorm insurance association (twia) was established in 1971 by the texas legislature to provide insurance coverage to texas’ 14 coastal counties frequently affected by hurricanes and other similar storms.

The average cost of windstorm insurance in texas is around $1,600 a year. Twia is proposing a new, optional endorsement for additional premium to provide separate and supplemental coverage for appurtenant structures as an alternative to the current policy provision. If twia says your loss is covered by your windstorm policy, you either get a check from twia or a notice that the loss is less than your deductible and there will be no payment.

In texas, windstorm, hail and hurricane insurance sometimes is confusing. Texas windstorm insurance association (twia) you have one year from the date of loss to file a claim with the texas windstorm insurance association (twia). The texas windstorm insurance association considered potential rate increases as well as possible alternatives to reinsurance at its recent quarterly meeting.

There are alternative insurance companies that are willing to provide just the windstorm insurance. Mail or email to austin office: Texas windstorm insurance association 5700 south mopac expressway, building a, austin, texas 78749 p.o.

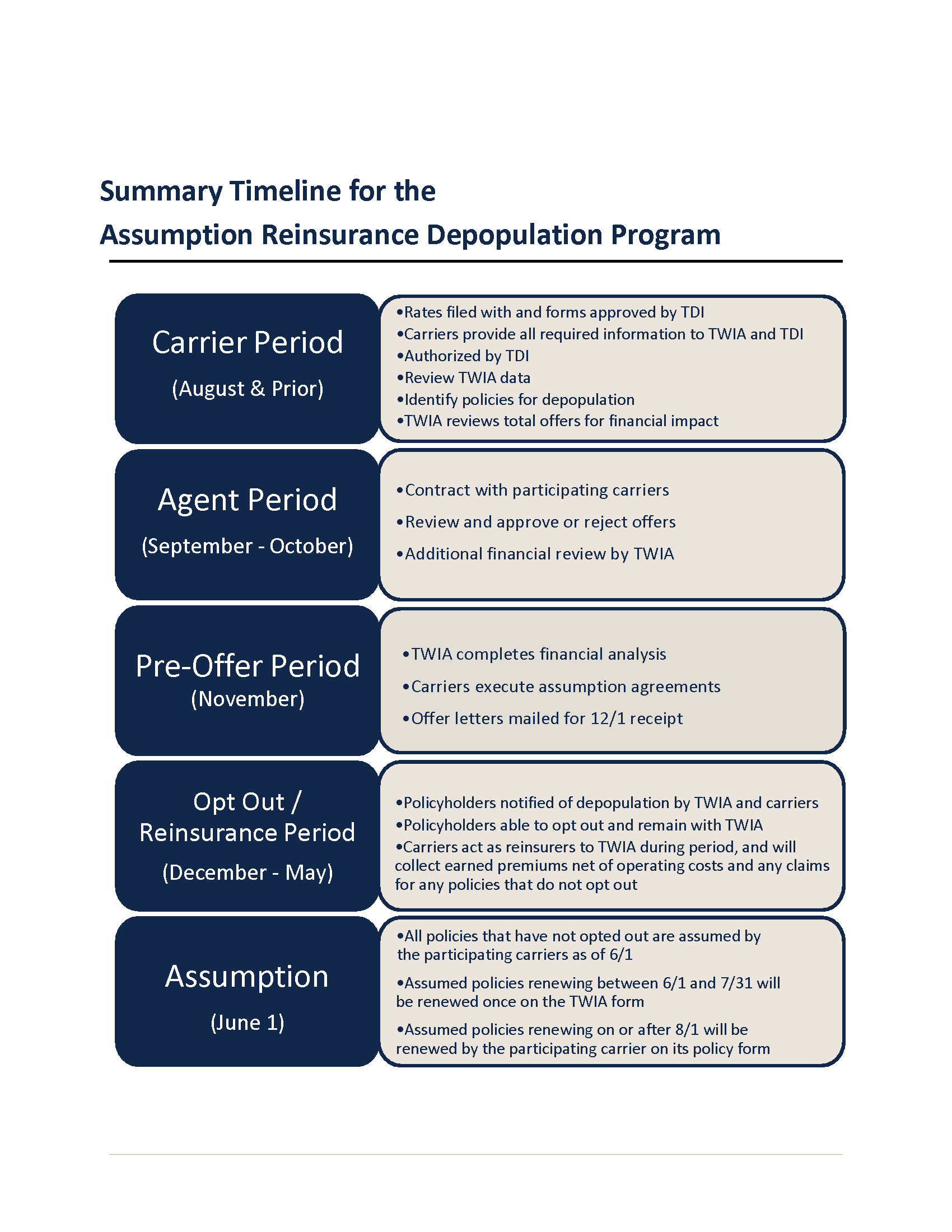

As with all fair plans, consumers are urged to try to find coverage in the private market and we can help you find an agent that can help you find alternatives to the fair plan. The association said in a statement it will help lawmakers in any way it can in considering windstorm insurance options for policyholders along the texas coast. In 2015, the 84th texas legislature, regular session passed senate bill (sb) 900 which authorized the creation of two new depopulation programs:

The committee considered shifting some of the risk to the catastrophe bonds, but the. Texas department of insurance & texas windstorm insurance. Alternative certification update please read and route to interested personnel in your agency!

According to the twia’s website, its average residential policy currently costs $1,500 annually. The deductible can be a percentage of your. Each proposal for an alternative to texas windstorm insurance association will be enclosed with links around the result for texas windstorm insurance association , those links will lead you to the source of the site, you can get more information about texas windstorm insurance association at that source fastly.

Our purpose is to provide wind and hail insurance to the texas coast. This puts texas as having the seventh highest windstorm premiums in (6). Texas department of insurance | www.tdi.texas.gov 1/2

How to get more details about each alternative proposed for best windstorm insurance texas ? But now, those requirements are changing. The one potential downside to wind insurance is the added deductible.

If you have a wind insurance policy, you may need to pay a separate deductible to cover storm damage. This allows the property owner to purchase the more comprehensive coverage from the private market and then add the wind coverage through the texas windstorm insurance association. There have been recent changes to texas law.

1 weather alerts 1 closings/delays The fences do not have replacement cost coverage under the twia policy. It is funded through premiums paid by its policyholders, just like any other insurance company.

Also in writing the policy outside texas windstorm association we can save you as much as 10% on your annually premium. Twia is not the only answer. Designed to provide twia policyholders with alternative options for wind and hail insurance in the private market.

Most of the windstorm alternatives we have include replacement cost coverage on fences as well as the roofs. Twia was established by the texas legislature in 1971 in response to regional market conditions following hurricane celia in august 1970. A policyholder will be able to choose the new optional endorsement or choose to write a separate policy to cover the specific appurtenant structure.

A windstorm insurance policy is ideal for people who live in states prone to high winds, especially from tornadoes and hurricanes. Windstorm@tdi.texas.gov texas department of insurance windstorm inspections program p.o. A voluntary market depopulation program and an assumption reinsurance depopulation program.

Twia is governed by texas insurance code chapter 2210. Earlier this year, twia purchased $636 million in reinsurance protection for the hurricane season. Our agency can now write windstorm policies through a company other than texas windstorm insurance association.

Some of the alternatives have lower deductibles available, often at a lower cost than the twia policy. Did you know that there are alternatives to texas windstorm insurance. They are a little more selective on what they will take, but because of that, their rates are actually up to 15 percent less than twia rates.

Texas Windstorm Insurance Association TWIA

Texas Windstorm Insurance Association TWIA

Texas Windstorm Insurance Association TWIA

Texas Windstorm Insurance Association TWIA

Texas Windstorm Insurance Association Information

Texas Windstorm Insurance Association TWIA

Texas Windstorm Insurance Association Information

Lawsuits Arise After Winter Storm Uri MehaffyWeber

Texas Windstorm Insurance Association TWIA

Proposed Wind Farm off AC Coast Revived by Court

Texas Windstorm Insurance Association TWIA

Texas Windstorm Insurance Association TWIA

Texas Windstorm Insurance Association TWIA

Ed Cantu Insurance Agency Home Insurance Agency in

Texas Board Of Cpa Search and Similar Products and

/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F602c526f62977764fb694b53%2F0x0.jpg%3FcropX1%3D0%26cropX2%3D5233%26cropY1%3D306%26cropY2%3D3249)

Wind Power Isn’t To Blame For Texas’ Electricity Crisis

Texas Windstorm Insurance Association TWIA

Texas Windstorm Insurance Association TWIA