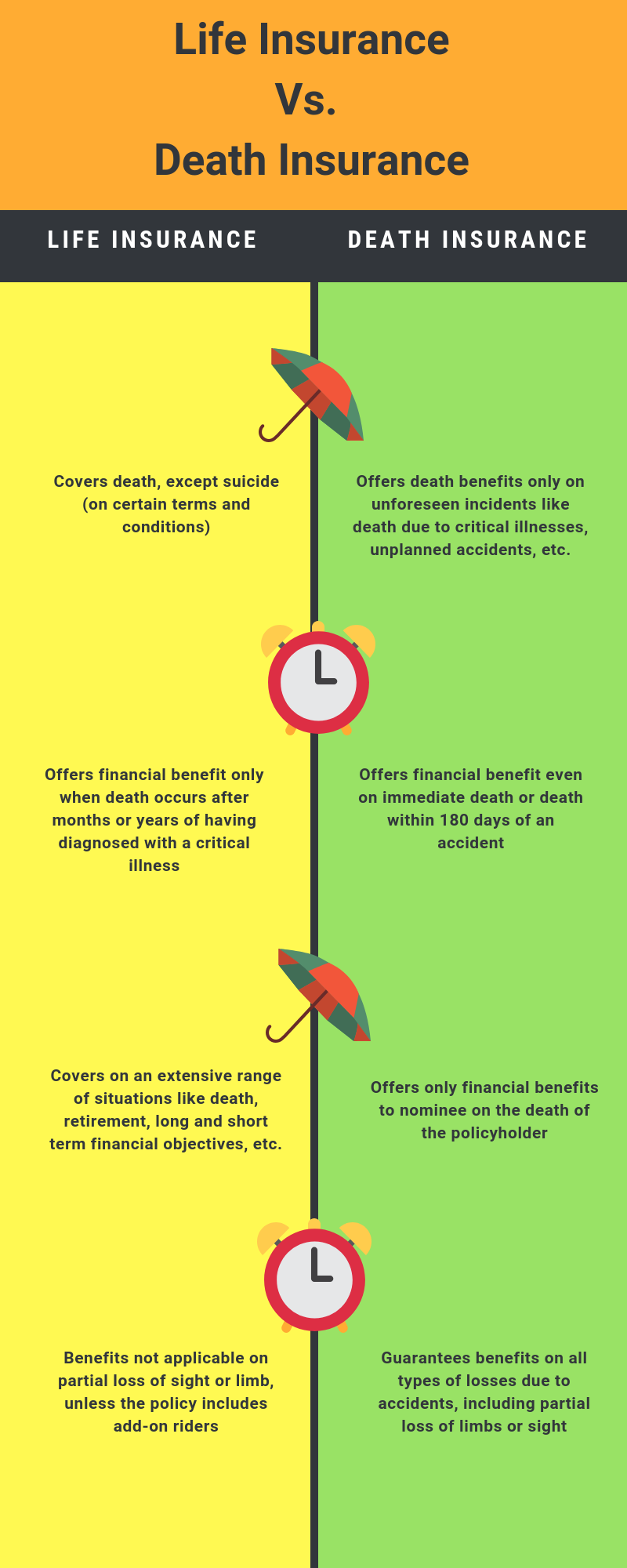

First, it pays the policy owner if they lose a limb or the use of a part of their body. If you pass away and your family lost your income, life insurance will cover you in most all instances whether it is due to an accident or natural causes.

What is Accidental Death and Dismemberment Insurance?

Whereas, an accidental insurance policy offers death cover even if the insured dies instantly or within the specific time frame after the accident.

Accidental death insurance. Accidental death and dismemberment insurance (ad&d) is an insurance policy that offers coverage in case a person dies or becomes disabled. Accidental death covers death from an unexpected and unintentional accident that isn’t the symptom of a disease or illness worldwide cover as long as your main residence is in the uk, you’re covered if you die as a result of an accident anywhere in the world What does accidental death and dismemberment insurance cover?

What is accidental death insurance? In a way, accidental death insurance is an ace under the sleeve that wouldn’t hurt to have around. Secondly, it pays their beneficiaries if the insured dies accidentally (i.e., not from natural causes).

Get a quote online with the convenient application process. However, no benefit is paid for death caused by illness. According to statistics canada , accidents are one of the top 5 leading causes of death in canada *.

Accidental death and dismemberment (ad&d) insurance is an insurance policy that pays a death benefit upon the accidental death of an insured or. You can buy accidental life insurance with rates as low as $7/month. Accidental death insurance is a policy that provides a benefit payment in the event of an insured person’s accidental death.

What is considered accidental death for insurance purposes? Accidental death insurance provides financial support for your loved ones if you die in a covered accident. You should view accidental death insurance as a supplement to life insurance and disability insurance because it is generally considered as having a very narrow scope of coverage.

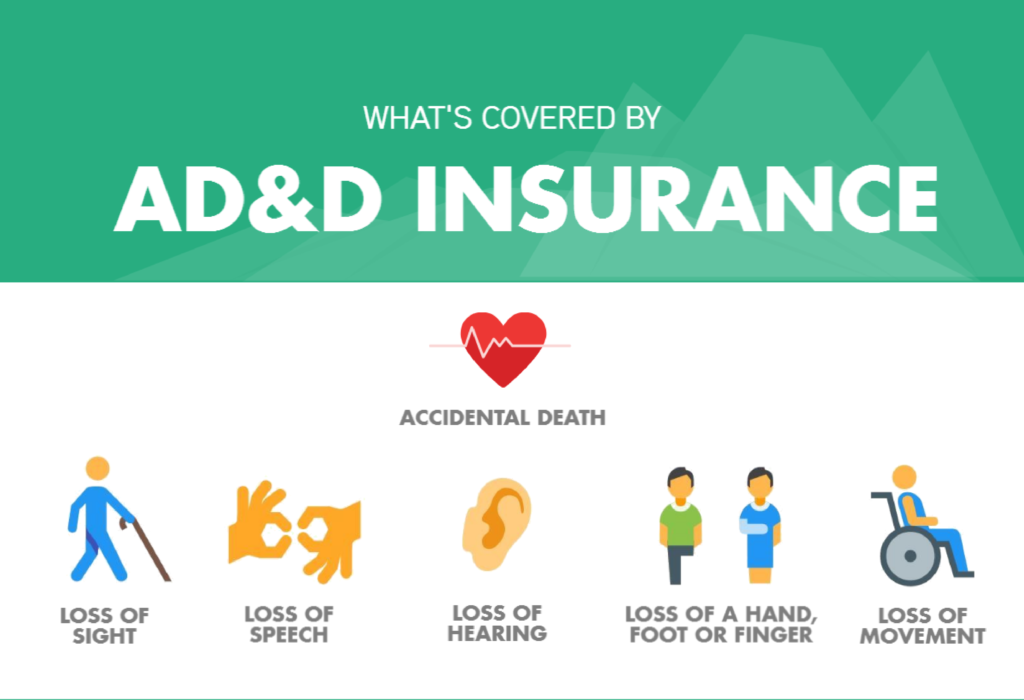

Death in an accident, like a car crash or airplane crash. Think of it in these terms: Loss of limb or finger.

Accidental death life insurance quotes are an inexpensive way to get accidental death and dismemberment insurance (ad&d), which is a policy that pays out a death benefit when the insured dies from an accident. Td accidental death insurance is a coverage option that can provide financial support if you were to pass on from injuries caused by a covered accident. An accidental insurance policy is going to cover you for any type of death associated with an accident.

If you are injured or killed in an accident, you or your family can make a claim with your insurance company. Or lose a limb, suffer blindness, or are paralyzed in a covered accident. Call scotialife financial customer care.

There isn't any type of contestability period associated with these policies, if your death results from an accident, the death. Loss of sight, hearing, or speech. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident.

Accidental death insurance, also known as accidental death and dismemberment or ad&d insurance, is an alternative to term life insurance. Accidental death insurance this benefit is an insurance benefits paid to your beneficiary due to an accidental death. As the name suggests, accidental death insurance is designed to protect your beneficiaries if you were to die accidentally — from a car crash, for example, or a workplace injury.

Accidental death insurance provides an inexpensive safety net for your family. Ad&d insurance is not a replacement for life insurance. Usually, it is 180 days from the accident.

For example, if you take out an accidental death policy and you pass away as a result of an illness, a pay out won’t be made. Just as its name implies, an accidental death and dismemberment insurance policy covers death or injuries that are proven to be the direct result of a covered accident. Dismemberment benefits are paid due to loss of eyesight, loss of hearing, loss of speech, or any loss of two limbs caused by an accident.

It only covers accidents, not natural death or injury from illness. The simple answer would be to consider death insurance policies. What must be taken into account is if your death insurance plan covers accidental death insurance or burial insurance services.

The biggest benefits of accidental death insurance are that it’s easy to qualify for and inexpensive. Accidental death insurance pays a lump sum benefit to your nominated beneficiary or estate if you were to pass away due to an accident. There are various plan options in a life insurance policy retirement solutions, death cover, long and short term financial investment goals, etc.

Not only will you be insured from death as a result of an accident, but many policies also extend coverage to your spouse and children. Accidental death benefit riders provide an additional sum to a life insurance payout in case an unexpected passing leaves your family members strapped for finances. Accidental death insurance is quite similar to life cover;

Accidental death insurance can help with benefits that range from $37,500 to $200,000 in the event of a covered accident. All insurance coverage is subject to certain limitations, restrictions and exclusions outlined in the applicable certificate. But an accidental insurance policy covers.

Accidental death life insurance covers your loved ones in case you die of an accident. Get cheap accidental death insurance quotes online for free. Unlike term life insurance, accidental death insurance does not require evidence of the insured person’s mortality , but.

Accidental death and dismemberment insurance, or ad&d insurance, can provide financial benefits if you are killed; Accidental death and dismemberment (ad&d) insurance is coverage that gets triggered by two specific events. Accidental death insurance, (also known as accidental life insurance) will only pay out money to your family if your death is caused by accident.

Because this is guaranteed protection, you cannot be turned down if you qualify based on age. Accidental death insurance is a form of life insurance that will cover death from an unexpected accident. Your loved ones won’t receive a pay out if you pass away due to any other cause.

Accidental death and dismemberment vs life insurance

Accidental Death Insurance The Physician Network

Carte Accidental Death Insurance Carte Wealth Management

Accidental Death Cover What is it? Smart Insurance

What Does Accidental Death and Dismemberment Insurance

Accidental death insurance global market report 2019

Accidental Death Insurance How to Handle Claims

Accidental Death Insurance Life Trials Insurance Agency, Inc

Accidental Death Insurance Free Quote Capital Gate

Life Insurance vs. Accidental Death Insurance Explained

Buy Accidental Death Insurance In 2019 (Instantly Online

Accidental Death Insurance How to Handle Claims Life

What Is Accidental Death Insurance 2020 Shopper's Guide

Accidental death insurance stock image. Image of privacy

Accidental Death Insurance FACT

Accidental Death Insurance Review AD&D Insurance TermLife2Go

Accidental Death and Dismemberment Insurance Plans for

Accidental Death Insurance (The 4 Absolute Best Policies)