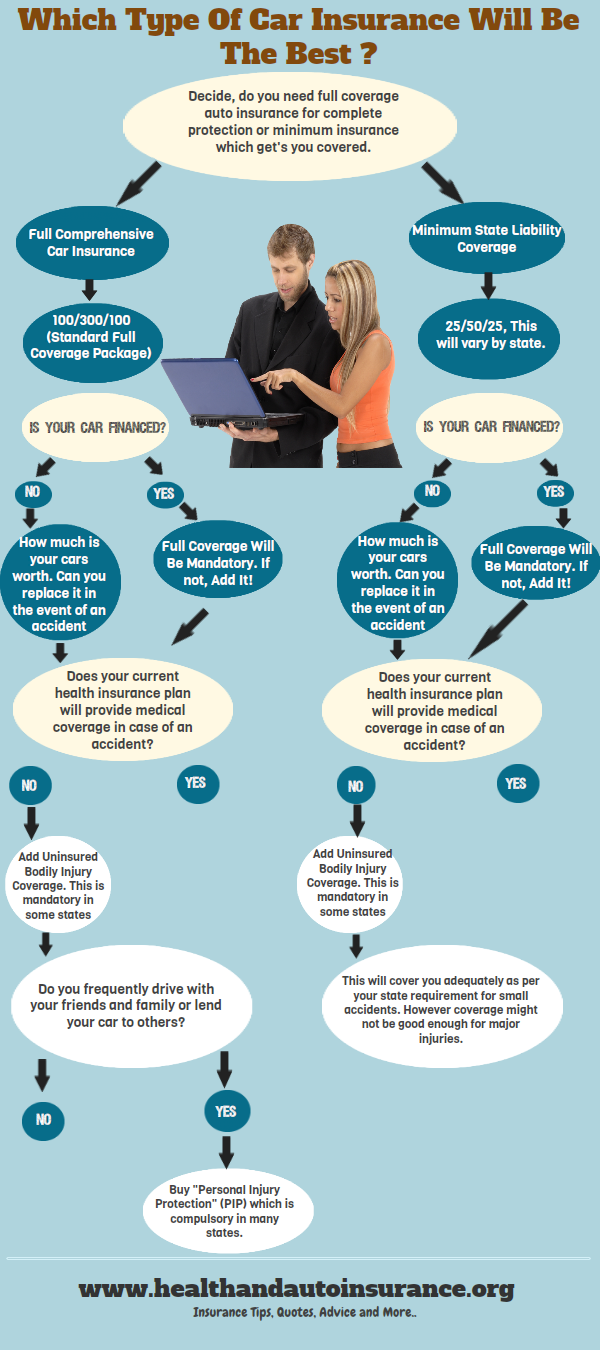

Make sure there are no unfavourable clauses in the contract. Required car insurance coverage in your state can vary, so enter your zip code below to get free car insurance quotes for the minimum required car insurance and a full coverage policy.

What Year Did Car Insurance A Legal Requirement

But when did car insurance become mandatory?

What year did car insurance become a legal requirement. $25,000 for property damage in an accident. Hi, i am living in uk from last 2yrs on t1 gen and have uk driving license since 1.2yrs. Almost every state imposes a minimum amount of car insurance in order for its drivers to be considered legal.

By anasjamil2 » wed jul 11, 2012 8:36 pm. In addition to your compulsory car insurance, you may have taken out a policy which covers you for legal fees if you have suffered a loss which is not covered by your standard car insurance policy. The first state to make auto insurance mandatory was massachusetts and the law went into effect in 1927.

One of these firsts occurred in 1897 when gilbert l. Massachusetts was the first state to make insurance mandatory in 1927. Vehicle, driving under the influence of alcohol or drugs, failing to stop at the scene of an accident, or reckless driving.

An owner may not operate a vehicle in kentucky until insurance has been obtained. I usually tell car insurance companies that i am uk resident and that is what my current car insurance is. Car insurance requirements in nevada.

$25,000 for injury/death of one person. According to the statute, an owner who fails to maintain insurance on his vehicle shall have his vehicle registration revoked. The latest state to mandate automobile coverage was wisconsin which only began requiring drivers to become insured on january 1, 2010.

Within the past two years your automobile insurance has been cancelled because of. In 1927, massachusetts became the first state to have a mandatory insurance requirement. Required proof of self insurance.

According to state law, texas drivers need to have minimum insurance coverages of $30,000 per injured person, up to at least $60,000 per accident. The limit is simply the bare minimum of coverage you are required to have as a driver. When did car insurance become mandatory?

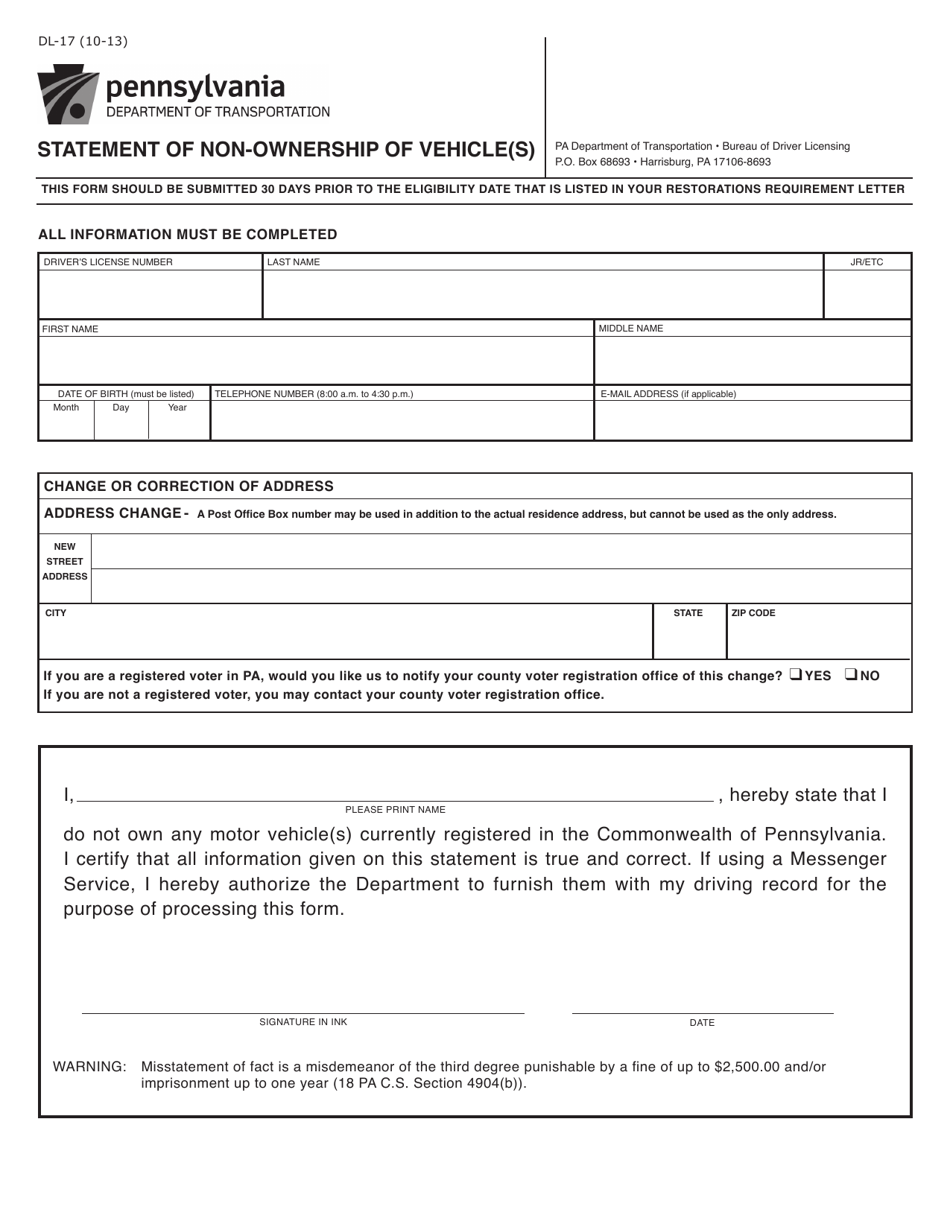

All drivers are required by law (under the road traffic act of 1930) to have in force an insurance policy to cover their liability for bodily injury to or damage to third party property which arises from the use of a motor vehicle. For more information about the pennsylvania assigned risk plan, call: Auto insurance requirements in indiana.

Proof of insurance must be carried while you are driving, and must be shown at the behest of law enforcement officials. Nevada requires vehicle owners to carry liability auto insurance that meets at least the following minimums: In the case of georgia, only liability insurance is required.

This policy is widely considered the first car insurance policy even though it technically was written as a horse and carriage policy. The objective was to keep all drivers financially responsible for accidents on the road, and the concept soon spread to other states. The mandatory requirement for car insurance isn't a federal law but is set by each state.

Required car insurance started in in 1927, in the state of massachusetts. Dana pertanggungan wajib kecelakaan lalu lintas jalan, dpwkllj). Today when i called and insurance company to get a fresh insurance for my new car, they denied me insurance.

It would become the template for future policies. The liability car insurance requirements in missouri are. Self insurance certificate number we issued to you.

By 1950, car insurance minimums were required by law in most states. The car you want to insure does not meet michigan safety requirements. In addition, the vehicle owner, as well as the vehicle driver, are subject to a fine of $500.00 to $1,000.00, up to 90 days in jail, or both.

The minimum insurance limits required by the state of indiana can be seen below: The certificate may be printed on any size document and must include all of the following: Do not sign until you are sure the vehicle is right for you and you know you can afford it.

Any time you operate a vehicle in washington, you must be prepared to show your self insurance certificate to law enforcement. Vehicle insurance, car insurance, or auto insurance in the united states and elsewhere, is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damage. $25,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle.

Car insurance is not mandatory in new hampshire, but residents are still responsible for damages resulting from a car accident: Minimum required for insurance coverage: The contract of sale is a legally binding document.

Effective date of the certificate. Find the minimum car insurance requirements for every state and how to understand liability limits. Up to $50,000 for liability and $25,000 for property damage.

Minimum car insurance requirements by state. $50,000 for injury/death of two or more people. $25,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle.

Most states require a motor vehicle owner to carry some minimum level of liability insurance. Drivers who cannot pay for damages can expect to have their licenses and registrations suspended. Legal expense insurance/motor legal protection.

You’ll often see this referred to asliability limits. Proof of insurance must be shown at traffic stops, accident scenes, and vehicle inspections. Loomis, perhaps spurred by the legal hassles that recent car crashes seemed to be causing, bought an insurance policy from travelers insurance company for his car.

$50,000 for total bodily injury or death liability in an accident caused by the. All owners of motor vehicles in. Posted in car accidents,laws,texas on december 20, 2016.

Texas law requires all drivers to have adequate car insurance. All pa car insurance companies are required to accept applicants through the plan. $50,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle, and.

In order to be considered a legal driver, motorists in indiana are required to carry car insurance. Examples of these losses can be personal injury, hire charges, loss of earnings and medical. This compulsory auto insurance is legally called the road traffic accidents compulsory coverage fund (indonesian:

Additionally, texas drivers must have coverage for property damage of at least $25,000.

Shopping For Car Insurance What's Holding You Back?

/police-officer-making-a-traffic-stop-530828005-586526fd5f9b586e02adbc5a.jpg)

Penalties for Driving Without Car Insurance in California

When Did Having Car Insurance A Law htntdesigns

"BRAINDEATH" IS KIDNAP...MEDICAL TERRORISM/MURDER BEGINS

How To Make 50,000 A Year By Driving For Uber, Lyft, and

7 Useful Tips on How to Read Your Car Insurance Policy

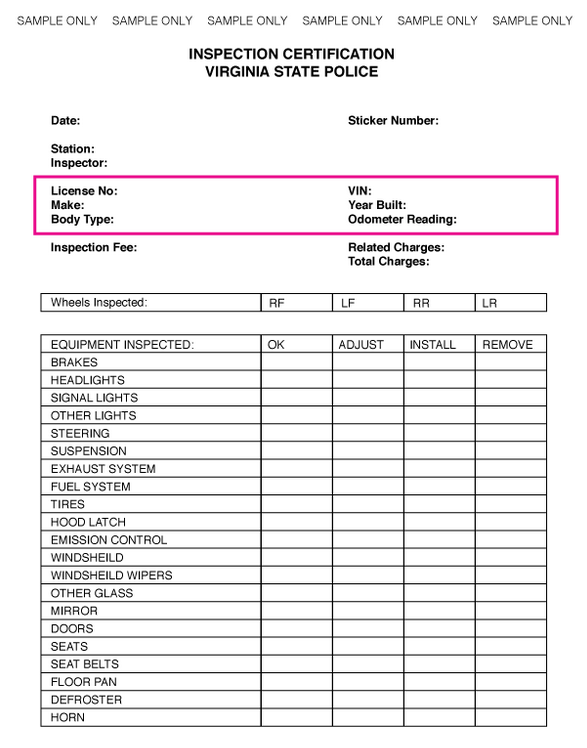

Virginia Driver Information Lyft Help

What Year Did Car Insurance A Legal Requirement

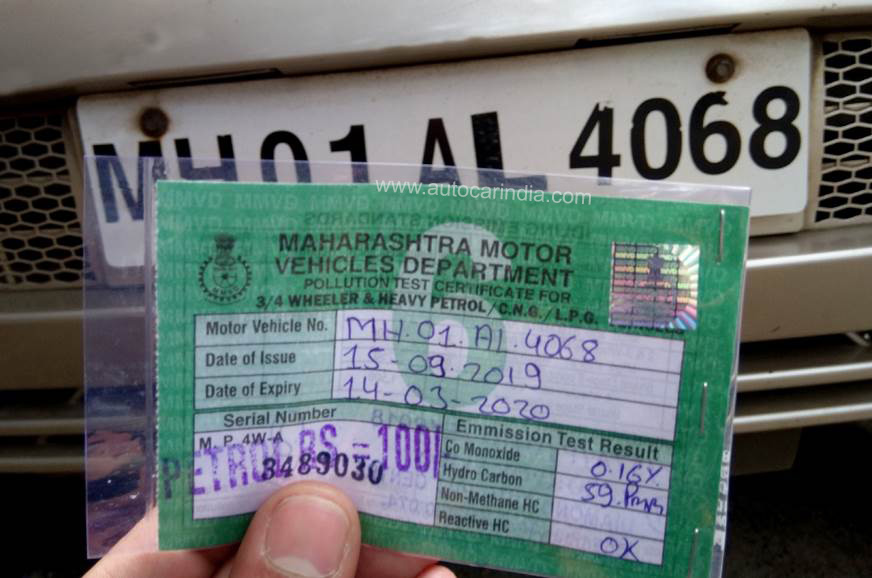

Pollution Under Control Certificate now compulsory for

Requirements for Being a Criminal Investigator Woman

What Year Did Car Insurance A Legal Requirement

What Year Did Car Insurance A Legal Requirement

What Year Did Car Insurance A Legal Requirement

A Guide to The Steps in a Paralegal in Ontario.

7 Useful Tips on How to Read Your Car Insurance Policy

Best Auto Insurance Coverage Comprehensive insurance

What Year Did Car Insurance A Legal Requirement

What year did car insurance mandatory?