Your declarations page of your auto insurance policy may include an annotation that looks something like 250,000/500,000/250,000, for example. If your policy limits are 100/300/100, you have a split limits policy.

Split Limit Insurance Everything You Should Know

In a split limit automobile policy, you will purchase a limit of liability insurance that will have three numbers.

Split limits insurance. A split limit liability is the method used in determining the liability coverage of maximum amount that can be paid. Bodily injury to the other driver. You can have those limits written either as what is referred to as split limits or a combined single limit.

This policy has three coverage limits. These policies are usually written as 25,000/50,000/20,000 or 25/50/20, for example. If you’re looking for something that looks and feels like a homeowners policy, the split limit earthquake insurance policy is the solution for you.

They have separate limits for bodily injury and property damage. All three can have individual. Split limit coverage splits the coverage amount into three limits, such as 50/100/25.

Single person bodily injury limit (x) by having 100/300/50, you will have a maximum of $100,000 that can be applied toward a single person (not yourself) after an accident. Typically, um and uim limits are split limits written the same as your liability limits, per person and per incident. For instance, in addition to receiving a quote for a $1,000,000 limit you may also be offered a quote for a $1,000,000/$2,000,000 limit.

Split limit liability is the most commonly used form of liability, but is broken up differently than combined single limit coverage. Most people are familiar with and purchase split limit liability insurance and you can determine what you have by looking at your declarations page that comes with your automobile insurance policy and see how that is represented. A third limit applied to property damage in each accident:

The split limit provides an added aggregate limit that is a multiple, typically 2 or 3 times the per claim limit you select. These policies are usually written as 25,000/50,000/20,000 or 25/50/20, for example. Split limits vs combined single limits.

A limit applied to each person injured: Enterprise billing software for property & casualty insurance. Combined single limit, bodily injury, property damage and split limit liability insurance are all types of automobile liability insurance available to consumers.

This type of liability limit is expressed in three numbers, such as 250/500/100. Learn more about split limit here. Split limit liability coverage explained.

Many auto insurance policies use the split limits approach, which combines the per person and the per occurrence approach. In this approach, there are advantages and disadvantages that should be considered before purchasing car insurance. This does not mean that $100,000 will be available, but only that it can be.

There are three areas you need to be aware of when it comes to split limit coverage and they are bodily injury per person, bodily injury per accident and property damage coverage. With split limit coverage there are multiple limits that apply per accident. So, if you have 100/300 coverage, it means $100,000 per person and $300,000 per incident.

The maximum amount that will be paid to any one injured person. This insurance policy divides your earthquake coverage into individual limits, unlike the single limit policy, but sets guidelines around how much each of those limits include. What does split limit eq cover?

The limits are broken down differently than combined single limit. Split limit liability is the more commonly used type of liability coverage. It specifies limits for three specific types of claim:

A second limit applied per accident: With split limits, three separate dollar amounts apply to each accident. This video shows the difference between a split limit and a single limit auto insurance policy.

Per person bodily injury limit, per incident bodily injury limit, and property damage limit. Under the split limit coverage these numbers would mean that you have $50,000 of bodily injury coverage per person per accident, $100,000 total for all injuries per accident and a $25,000 limit for property damage done in one accident. They also slice bi coverage into a limit per person and per incident.

If you buy combined single limits, it would be of $300,000 and you could split that among one or multiple people as need be. A split limit liability is the type of liability insurance that most of us are familiar with. Under a split limit policy, up to three different liability limits could apply to this accident:

A comprehensive example is provided to show how a split limi. Split limit liability policies are easy to identify. Using this example, the first number means that $250,000 would be paid for bodily injury to each person, $500,000 is the.

Split limits coverage is a set of limits on payments for auto insurance claims that is split into different categories. Learn more about split limit here. This means that the policy holder has limits of $50,000 us dollars for each person injured in an accident, $100,000 usd for all persons injured in the accident, and $10,000 usd for any property damage suffered by the other vehicle.

The first limit is a per person limit: Many individuals don’t realize that liability insurance is the minimum required insurance in most states. Your insurance company details how much it will pay for each coverage type.

A typical split limit policy might provide coverage of 50/100/10. Bodily injury per person, bodily injury per accident, and property damage per accident. This coverage pays a certain amount for each injured person and a total amount per accident for all injured persons.

Split Limits vs. Combined Single Limits Perkins Law Firm

Split Limit vs Single Limit (Auto Insurance) Newyork

Understanding Combined Single Limit (CSL) and Split Limit

Understanding NY Split Liability Limits

How To Compare Car Insurance Quotes Online Get The Best

Split Limit Studios Announces Latest TRUPAY® Release

Split Limit vs Single Limit (Auto Insurance) YouTube

Property Damage Split Limit STAETI

Legal Concepts Of Liability Insurance 2010

Split Limit Insurance Policy What do the Numbers Mean

What are combined single limits on auto insurance policies?

Single vs Split Limit Liability Auto Insurance Cheap

Split Limit vs Single Limit (Auto Insurance) Newyork

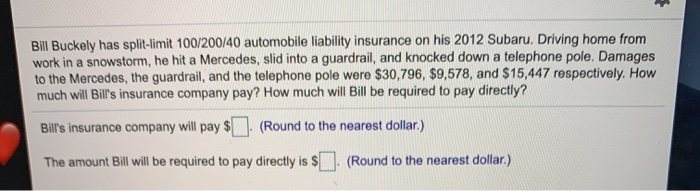

Solved Bill Buckely Has Splitlimit 100/200/40 Automobile

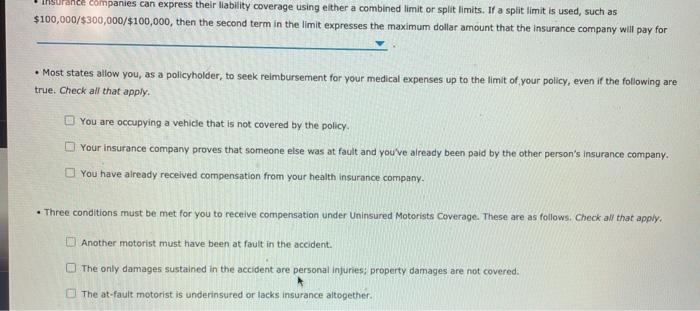

Solved Insurance Companies Can Express Their Liability Co

Auto Insurance Combined Single Limit vs. Split Limits

Single Limit vs. Split Limit Auto Insurance

All You Need to Know About Combined Single Limit (CSL) and

Understanding NY Split Liability Limits