He’s taking a risk that he may lose that $10, but also has the chance of earning $10 if he has a winning hand. Typically, events that are considered to carry this level of risk are out of the control of the individual who is assuming the risk, making it impossible to actually make a conscious decision to take on the risk.

Budget 2019 Life insurers want more tax benefits on

Complete loss or no loss at all.

Pure risk in insurance. Pure risks are one of the fastest growing independent specialist professional indemnity insurance brokers in the uk. Complete loss or no loss at all. If the life assured dies during the policy duration, then the nominee gets the sum assured amount by the insurance company as death benefit.

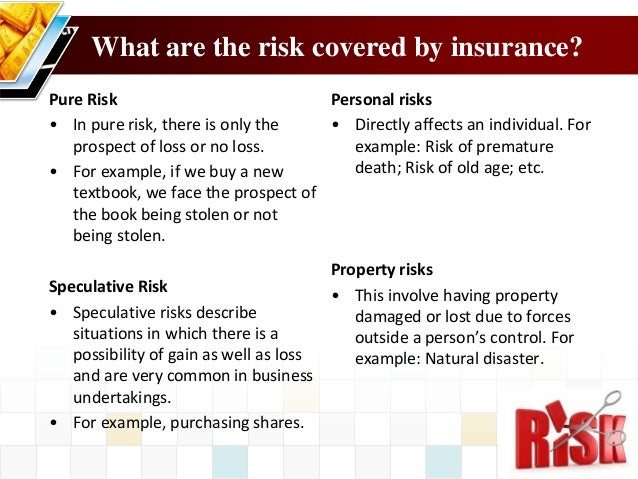

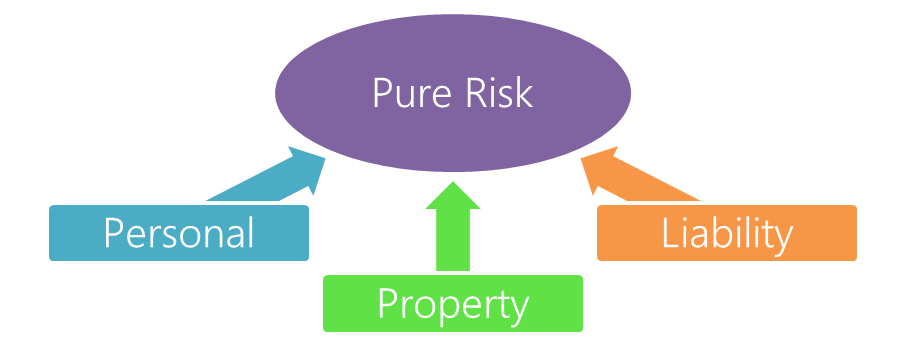

Pure risks are insurable through commercial, personal or liability insurance policies. Risk is defined as the possibility of loss or injury, and insurance is concerned with the degree of probability of loss or injury. Pure risk in life insurance is classified as, an 'only death benefit plan' in which, only the loss of the life is covered.

The benefit of pure risk policies to the policyholder is a potentially large payoff in the event of a catastrophe; || pure risk pure risk is a category of risk that cannot be controlled and has two outcomes: The benefit to the insurance company is the likelihood that the policy will remain active, and premiums will continue to be paid.

Gambling and investing in the stock market are two examples of speculative risks. Pure risks are those risks where only a loss can occur if the event happens. In these policies, individuals or organizations transfer part of the pure risk to the insurer.

Particular risk can be insured. Financial risks can be measured in monetary terms. The insurance company pays the sum assured to the beneficiary named in the policy if the life assured dies during the policy's tenure.

Though if the life assured survives the insurance period. Pure risk is a category of risk that cannot be controlled and has two outcomes: Pure risk is a term that is applied to any situation where there is no potential for any benefit to be realized if a specific outcome should result.

They are pure in the sense that they do not mix both profits and losses. Examples include natural disasters, theft, property damage or death. Fundamental risks are the risks mostly emanating from nature.

There are no opportunities for gain or. Term insurance covers the finances of the family against the untimely demise of the life assured. Pure risk, also known as absolute risk, is insurable.

Only pure risks are insurable because they involve only the chance of loss. Some examples of speculative risks, which you need to know for your test, include gambling and investing in the stock market. Insurance is concerned with the economic problems created by pure risks.

Term insurance plan is one such pure risk protection cover. We're now going to unravel the complexity of speculative risks and pure risks. Something good (gain), something bad (loss) or nothing (staying even).

There are two types of risks: In placing professional indemnity insurance for professionals. 1.4.1 speculative and pure risks.

What is pure risk in insurance? In the case of the life assured's premature death, pure risk insurance provides a financial safety net. Three possible outcomes exist in speculative risk:

Pure risk refers to an unavoidable and uncontrollable event where the outcome eventually leads to either total loss or no loss at all. There is no maturity benefit or an investment component. Insurance provides protection from the exposure to hazards and the probability of loss.

For example, home insurance policies protect against natural disasters by providing money for rebuilding. What is a pure risk protection insurance plan? Speculative risks are not insurable.

Pure risk — the risk involved in situations that present the opportunity for loss but no opportunity for gain. We place over a billion pounds of cover in the professional indemnity insurance market which includes. Pure risks are generally insurable, whereas speculative risks (which also present the opportunity for gain) generally are not.

The term insurance policy efficiently covers the risk that may arise due to an eventuality. Why term insurance is pure risk protection? Insurance companies only want to provide protection in situations where there is a chance of loss only, and no chance for gain (pure risk).

Pure risks are an independent insurance intermediary specialising. Each offers a chance to make money, lose money or walk away even. Damage or loss brought about by pure risk events can be covered by an insurance policy.

2 two dimensions of pure risk killed in accident lose property in. Speculative risk versus pure insurance risk.

Insurance Definition Speculative Risk / Risk And Insurance

Pure Risk Vs Speculative Risk Insurance YouTube

Carrier Partners VTC Insurance Group

Settle health policy claim in 30 days or pay interest

Insurance market in Bangladesh

PPT Principles Of Insurance PowerPoint Presentation ID

Pure Risk Keeps Insurance From Being Seen As Gambling

Insurance Archives Pure Risk Advisors

What Is Pure Risk In Insurance / Pure Risk Keeps Insurance

What Is Pure Risk In Insurance / Pure Risk Keeps Insurance

Difference between pure risk and speculative risk in

Pay Your Bill Daniels Insurance, Inc.

Ashwin wants to buy a Pure Risk Life Insurance cover of Rs

Explained about Pure Risk Protection Plan

Risk Management 7 Steps of Risk Management Process