Accelerated death benefit (adb) riders let you access a portion of your policy’s death benefit during life to cover medical expenses; An accelerated death benefit (adb) allows a life insurance policy owner to receive a portion of their death benefit from their insurance company in advance of their death.

Life Insurance Riders Accelerated Death Benefit

The money you use from your accelerated death benefit gets deducted from your policy’s death benefit.

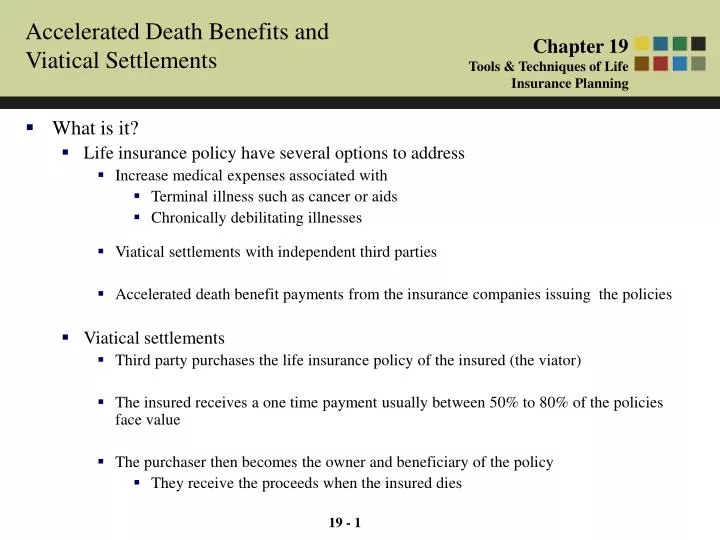

Life insurance accelerated death benefit. While the primary purpose of life insurance is to ensure your loved ones will never struggle financially after you’re gone, an “accelerated death benefit” can help renovate your home or even pay for a trip around the world. Life insurance proceeds paid in the form of an accelerated death benefit when the insured has become chronically or terminally ill, and is otherwise eligible for benefits, are intended to receive favorable tax treatment under section 101(g) of. In other cases, policyholders can add the coverage as a rider to their life insurance policy.

An accelerated death benefit lets you access a portion of your life insurance policy’s death benefit while you’re living. The accelerated death benefit rider is usually included in your policy at no extra cost to you. Some insurance companies automatically include an accelerated death benefit rider in your life insurance policy at no added cost.

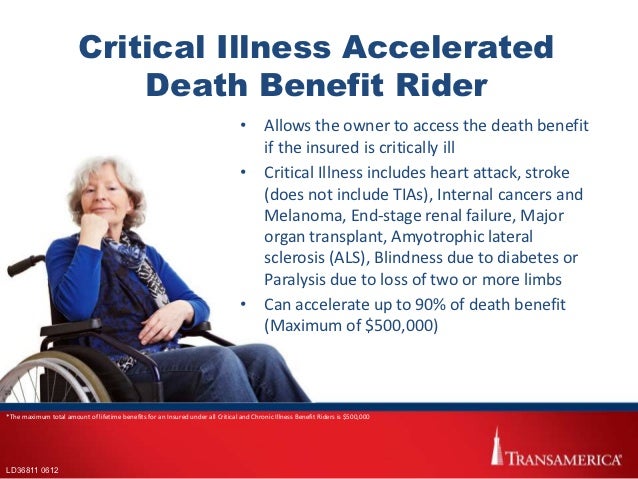

An accelerated death benefit, or adb, allows you to access a portion of your life insurance policy’s payout early if you’re sick. This accelerated death benefit rider can be added to a permanent life insurance contract and a claim can be filed by the policyholders if the insured suffers from a critical illness such as a heart attack, stroke, organ transplant, kidney failure, aggressive cancer diagnosis, and/or treatment, etc. What most consumers don’t know is that a common rider on life insurance policies can let you tap into your death benefit before you die.

However, there is a major drawback. The company may need proof of life expectancy from a medical provider in order to accelerate the death benefit; With an accelerated benefit, you receive a payment from your life insurance company and, if accelerating only part of your death benefit, some percentage may be left for your beneficiary.

If you have a life insurance policy that includes one, you can potentially obtain a portion of the death. The money you receive via the rider will be deducted from your death benefit. What is an accelerated death benefit rider?

An accelerated death benefit is a life insurance policy feature that lets you access some of the policy benefits while you’re still alive. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Typically, you must be diagnosed with a.

In most cases, the policyholder must be terminally ill, usually with a life expectancy of two years or less. An accelerated death benefit rider (adb) is a living benefits rider that lets you withdraw from the life insurance death benefit when you have a terminal illness. A life insurance accelerated death benefit may also be called a living benefit rider or a terminal illness benefit.

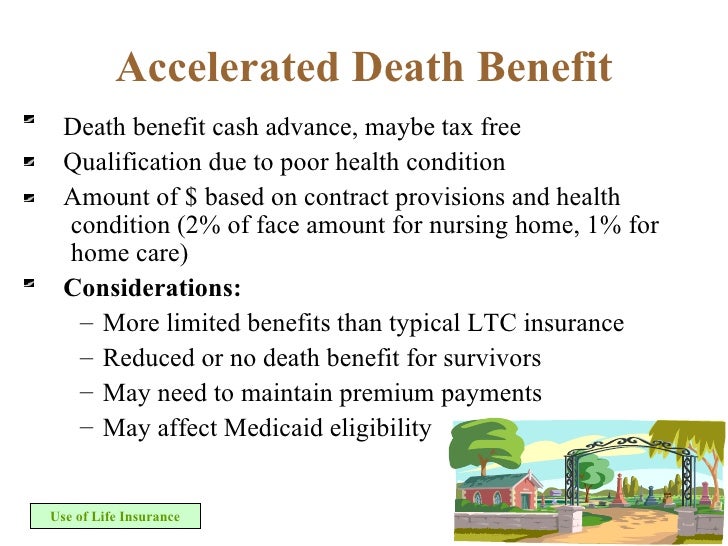

An accelerated death benefit (adb) is a benefit that can be attached to a life insurance policy that enables the policyholder to receive cash advances against the. The accelerated death benefit is a way to access some of your life insurance benefits while undergoing medical care near the end of your life. The accelerated death benefit (adb) provides for the life insurance company to advance a portion of the death benefit to the policyholder and not the beneficiary.

However, you have to meet certain criteria in order to use the rider. Generally, you can use an accelerated death benefit after getting diagnosed with a terminal illness. With an accelerated death benefit, you can pay for your own medical bills instead of leaving them unpaid after you die.

What is the accelerated death benefit The accelerated death benefit is common and can often be. Each insurer that offers this benefit sets specific guidelines on when it will be paid and how much will be paid.

An accelerated death benefit (adb) allows a life insurance policyholder to get cash advances against the death benefit if diagnosed with a terminal illness. An accelerated death benefit (adb)—also referred to as a living benefit—is a feature of a life insurance policy that pays a percentage of the death benefit early (up to the full benefit in some cases) if qualifying conditions are met. Accelerated death benefits are life insurance policy riders or provisions that can be added to your insurance and allows you to access death benefits while you’re still alive.

Accelerated death benefits can help policyholders pay for needed medical care. What is an accelerated death benefit?

Accelerated Death Benefit [What is it and Why It Matters

"Accelerated Death Benefit" or "Living Benefit" Rider in

Life Insurance Policies with Accelerated Death Benefits

Accelerated Death Benefit Rider [Top 5 Ways to Qualify for

What is an accelerated death benefit?

PPT 19 1 Accelerated Death Benefits and Viatical

Protected Life Insurance Accelerated Death Benefits Life

Accelerated Death Benefit… Is it Worth Buying?

Why You Need Life Insurance With Living Benefits In 2020

Accelerated Death Benefits in Life Insurance and What it

Explaining the Life Insurance Accelerated Death Benefit

Điều khoản về trả trước quyền lợi bảo hiểm (Accelerated

Accelerated Death Benefit (ADB) Life Insurance EINSURANCE

Accelerated Death Benefits Panichelle Insurance

Looking for Life Insurance with Long Term Care? We've got

Midland National Life Insurance Introduces Accelerated

Accelerated Death Benefit Rider True Blue Life Insurance

Accelerated Death Benefit in Life Insurance