In the majority of cantons this type of insurance is also compulsory for anyone who keeps a dog. It covers yourself and your family against minor acts of carelessness with major financial consequences.

Marine Defence Insurance EFmarine

Allianz suisse offers basis, plus and top policies, with the plus version extending coverage and the top version providing optional coverages.

Liability insurance switzerland. Also known as workers’ compensation insurance or employers’ liability insurance, this is mandatory for all businesses in switzerland with employees to cover accidents, illness, maternity leave, unemployment, serious injury, and swiss pension payments. Third party liability insurance contracts in switzerland generally provide cover for defence cost (against covered claims against the insured). Buy general liability insurance online!

Personal liability insurance is the most important type of insurance in the life of every swiss person. It protects you and your loved ones against high costs if you accidentally cause damage to third parties or their possessions, either because your dog leaves a memento on a hotel carpet or your perfume bottle falls into the washbasin in your rental apartment. Obligation to be covered by insurance.

Which swiss insurance providers offer commercial general liability insurance? B finsa in conjunction with art. Commercial liability insurance protects your business against the financial consequences of liability suits.

Contents and personal liability insurance in switzerland contents insurance covers damage to your personal belongings caused by fire, water or theft. Thanks to the expertise of our specialists in switzerland, lawyers, fiduciaries and management consultants and their employees are fully protected against claims for damages. Most cantons in switzerland require dog owners to take out liability insurance.

What is personal liability insurance in switzerland ? All registered vehicles with swiss license plates (including those with cd diplomatic plates) must have third party liability insurance. We provide liability protection that is suitable for businesses in the manufacturing, construction, transportation, chemicals, oil and gas, healthcare, food and beverage, utilities, wholesale and retail sectors.

We offer risk and insurance management up to a capacity of chf 50 million, both as a primary and excess liability insurer. In the following overview you will also find insurance brokers who offer professional liability insurance pursuant to art. Personal liability insurance protects you financially if you cause injury or damage to other people or their property.

Commercial general liability insurance is offered by most major swiss universal insurance companies. Elvia personal liability insurance covers personal injury and property damage of up to chf 3 million, or even up to chf 5 million or chf 10 million on request. Professional liability insurance normally covers individual professionals against the financial consequences of liability suits.

Ad handyman, carpenter, electrician & more. Is liability insurance mandatory for dogs? The owner of a vehicle must be covered by insurance with a company based in switzerland so that the vehicle can be registered with swiss plates.

Young adults up to 30 years old save money thanks to attractive terms. Personal liability insurance is not compulsory, but in switzerland it is one of the most important types of insurances to have in place. Insurance companies that offer professional liability insurance and would also like to be included in this overview can contact office@regservices.ch by email.

Premiums vary depending on factors such as car value, driver profile, and swiss region. Generali offers commercial general liability insurance as. Liability insurance typically covers up to chf 1 million of damages in switzerland.

The cover for defence costs is usually limited to reasonable and necessary costs and expenses, which are incurred with prior written consent of. Liability insurance is compulsory in switzerland. Family members in the same household travel more cheaply with a joint policy.

Buy general liability insurance online! Swiss personal liability insurance covers the financial repercussions of a physical injury a person inflicts on a third party or of damage the policyholder causes to a third party’s belongings or property. View product descriptions on our country websites.

In practice, you may struggle to rent an apartment without it. At the latest one week before the planned date of your accommodation handover, you need to have proof that you have third party liability insurance. In switzerland, a difference is often made between professional liability insurance and commercial liability insurance.

Vehicle liability insurance covers any damage or injury you cause to others. In theory, personal liability insurance is not mandatory in switzerland. Ad handyman, carpenter, electrician & more.

This is often provided through separate channels (accident insurance, unemployment insurance, etc.) but. Damage to someone else’s vehicle.

Revision of the Swiss Insurance Contract Act (SICA

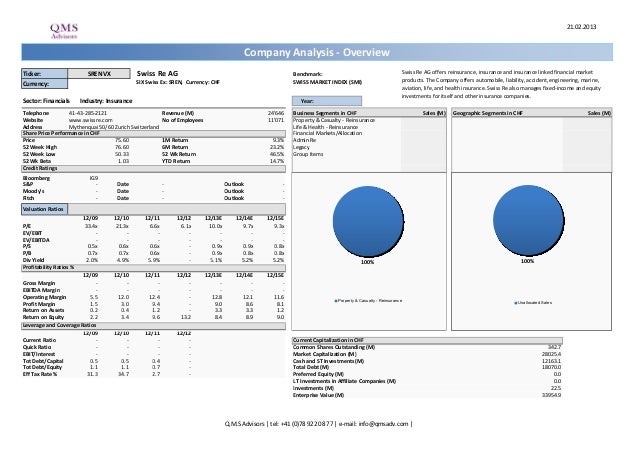

Financial Analysis Swiss Re AG Swiss Re AG offers

![]()

Zurich Insurance nears 4B deal for MetLife unit

Liability insurance Switzerland

General Business Liability Insurance Zurich Switzerland

All You Need To Know About Car Insurance In Switzerland

Liability insurance Private liability insurance

Best car insurance deals in Switzerland

Liability Insurance Switzerland

Praedicat Signs Swiss Re to New Liability Insurance Risk

Products & Services Professional Liability (Errors

Car insurance in Switzerland Expat Guide to Switzerland

Personal Liability Insurance Zurich Switzerland

Liability and Financial Lines Insurances Gallagher

Dog owner's liability insurance in Switzerland Helvetia.ch

Public Liability Insurance Zurich Switzerland

Insurance Coverage & Solutions Gallagher Switzerland

Liability insurance Switzerland

Casualty Insurance from AIG in Switzerland