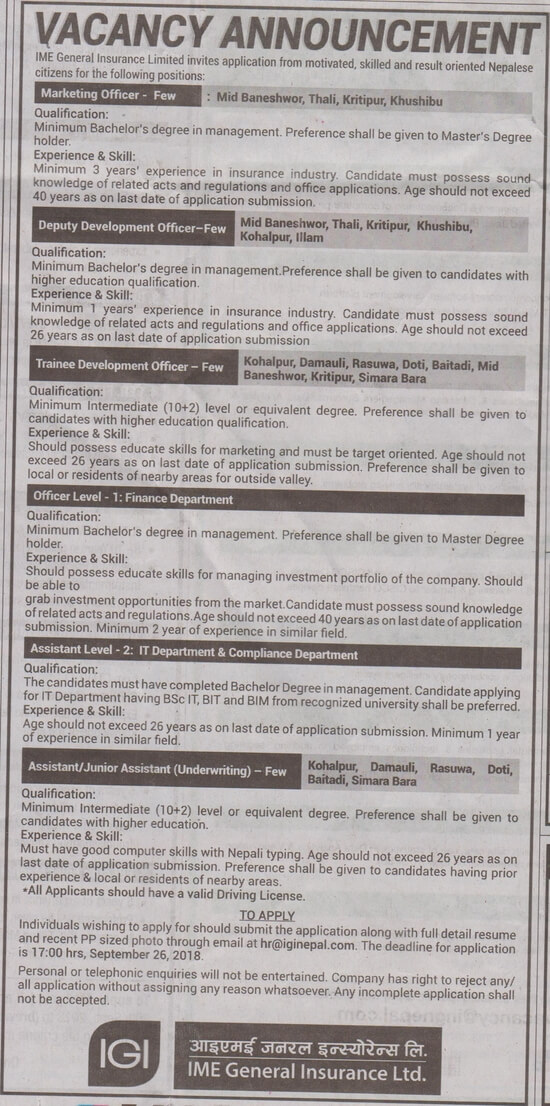

Insurance underwriters work closely with insurance agents who have direct contact with customers and with actuaries who perform complex calculations to determine the likelihood that accidents and other mishaps might befall a category of clients. Learn about the key requirements, duties, responsibilities, and skills that should be in an underwriter job description.

Insurance Underwriter Job Profile Underwriter Job

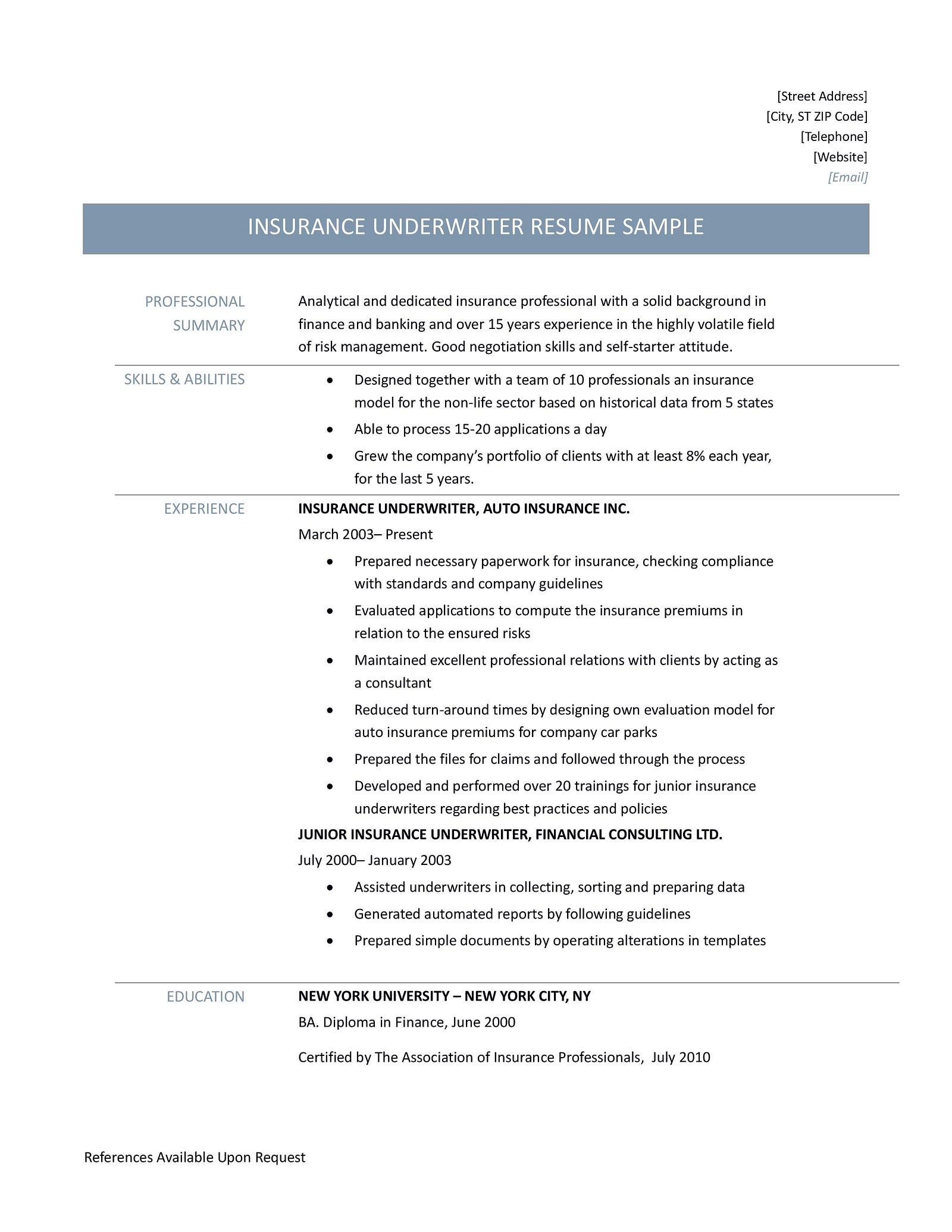

Collecting background information and assessments of risk.

Insurance underwriter job profile. It’s simply a bottom line of application requirements such as relevant work experience and education. ‘insurance underwriter’ might sound like a strange job title. They decide whether to accept the risk and work out how much to.

You may occasionally need to work evenings and weekends during busy periods. In other words, these are the most sought after skills by recruiters and hiring managers. Insurance underwriters use software to help analyze the risk profile of clients and to calculate costs.

Using their analysis of risks, underwriters decide how much money they want to charge an individual for the insurance premium. The ability to work well with others. Insurance underwriters decide whether to provide insurance, and under what terms.

They evaluate insurance applications and determine coverage amounts and premiums. Remember that every job is different. Insurance underwriters assess the risk attached to a client’s request for insurance cover.

Determine the risk involved in insuring a client Knowledge of medicine and dentistry. What all of these roles have in common, however, is the fundamental value that underwriters deliver to the business.

Average salary (a year) £18,000 starter An insurance underwriter works closely with insurance agents to leverage their direct communication with prospective, new, and existing clients. After all, it’s the area of the document with the least amount of content.

Insurance underwriters typically do the following: An underwriter works in insurance agencies utilizing data to determine the risks in creating insurance policies. So try to include them on your resume where possible.

Experience as an l&i industrial insurance underwriter 3 exceptional people skills with the ability to train, coach and mentor staff being a champion of change and coach and mentor staff to follow the standard work approach strong written and verbal communicator with the proven ability to communicate complex issues at all levels of the organization They are found in insurance agencies of all kinds, from general to life insurance. Patience and the ability to remain calm in stressful situations.

The ability to accept criticism and work well under pressure. Underwriters are financial specialists who work in the banking and insurance industries, and stock markets. An insurance underwriter?s job is to assess the risks associated with insuring a person or property and approve or reject applications based on the risks involved.

However, this line of work is actually fairly simple to explain. When a person or company applies for insurance cover, an insurance underwriter is the person who assesses the application, weighs up various factors, analyses the risk of a claim being made, and then makes the final decision on whether or not. It’s easy to underestimate the job qualifications and skills section of your insurance underwriter job description.

To be thorough and pay attention to detail. Analyze information stated on insurance applications; Serving as the link between insurance companies and agents, they must collect accurate customer information to enter into computer software programs that help them.

They evaluate, research and undertake a client’s risk for a fee such as a commission,. Insurance underwriters play an important role in an insurance company because they determine whether or not the insurer should decline the risk of taking on an insurance policy if the chances of payout are too high. Underwriters may work in many areas but the work generally falls into the categories of life assurance, commercial insurance, general insurance and reinsurance.

Here are the keywords and skills that appear most frequently on recent insurance underwriter job postings. Underwriter candidates are likely to have at least a bachelor’s degree in business, economics, finance or business. What does an insurance underwriter do?

Insurance underwriters decide whether to insure a person or company, and set out the details of insurance policies. They evaluate insurance applications, analyze, and process this information using computer software to determine the recommended coverage amount and premium. Insurance underwriters are known by a lot of different names on job search sites today:

An underwriter will analyze statistical data and decide who can be covered through the company and who is not eligible. Insurance underwriters may be employed by insurance companies or by independent insurance brokerage firms.

Junior Insurance Underwriter Job Description ABINSURA

Insurance Underwriter Job Description, Salary, Key Roles

Insurance Underwriter Jobs Description, Salary, and

What Are Insurance Underwriters? Underwriting, Career

Underwriter Job Description and Insurance Underwriter FAQs

Job Profile Insurance Underwriter Master of Finance Degrees

Entry Level Insurance Underwriter Jobs Underwriting

Insurance Underwriter Resume Samples Tips and Templates

Insurance underwriter job description insurance

Life Insurance Underwriting Jobs Awesome

![]()

Insurance Underwriter Job Summary and Professional

Insurance Underwriter Job Profile Underwriter Job

Mortgage Underwriter Jobs Near Me

Mortgage Underwriter Jobs Near Me

Summer 2022 Bond & Specialty Insurance Underwriting

101 reference of Auto Insurance Underwriter Job

Insurance Auditor Job Description and Similar Products and

:strip_icc()/insurance-underwriter-job-description-salary-and-skills-2061796-5d7f9ce3af5543d3afb072ae5ce5b43b.png)

Insurance Underwriter Job Description Salary, Skills, & More