Master's degree programs in insurance. This unit standard will be useful to people who are involved in the risk management and insurance field.

A bachelor's degree in insurance program will prepare you for a career in an industry that offers a variety of career opportunities.

Insurance degree. This whole effort cost $60k, took 5 weeks, and carried zero risk to the institution while delivering $250k in positive net revenues in the first year, and an anticipated total value of nearly $750k. The purpose of the module is yo equip learners with the necessary competencies (knowledge, values and skills) to be able to apply the fundamental. Building on this core curriculum are courses that provide the opportunity to explore all lines of insurance, including personal lines, commercial lines, life and.

With a bachelor's degree in insurance and risk management, your career choices may include sales and marketing, risk management, loss control, auto damage appraisal, professional managerial, administrative support, claims and underwriting. Graduates from this program will be well armed to face the highly. So, you may have to do some digging around to find quality schools that offer the degree program.

At some levels, insurance can be an area of concentration or specialization in a management or business administration program. This degree will also prepare you to succeed on national licensure exams, as well as introduce you to the variety of jobs in the industry. Students must consult with their advisors to plan a program of study and ensure course prerequisites are satisfied.

Insurance degrees and career paths workers can enter the insurance industry with anything from a high school diploma to a graduate degree. In a 5 week pilot this summer, we helped augustana college overcome an unexpected 28% melt to deliver an overall 20% increase in transfer enrollments. To be more precise it ranks #206 in popularity out of 368 majors in the country.

Some schools may offer an online insurance degree as well. Normally, these courses do not lead to a degree, and a certificate is granted instead. Our 2022 best insurance schools ranking.

However, there are also associate's, master's and doctoral degree programs available. The range in academic qualifications needed means there is a corresponding range of salaries available in the subsector. According to an o*net survey, 35 percent of claims adjusters who responded had a bachelor’s degree compared to 81 percent of underwriters.

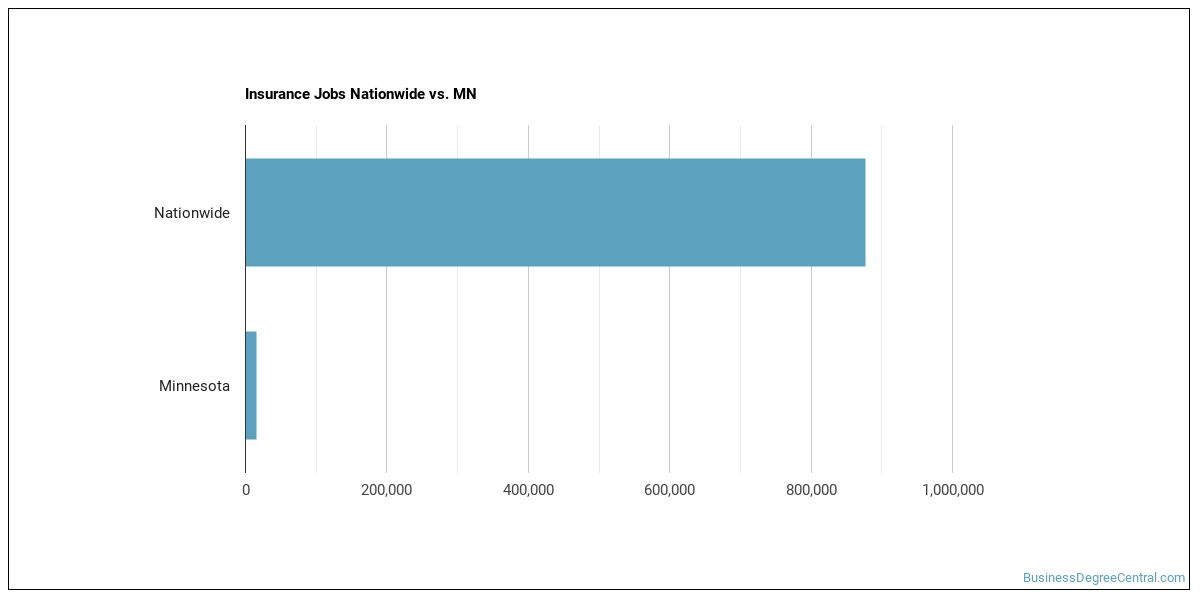

This is a difference of 285 over the prior year, a growth of 15.7%. 21 rows in 2019, 1 insurance students graduated with students earning 1 bachelor's degree. Programs are usually titled risk management and insurance, and successful students receive a bachelor in business administration.

Insurance underwriters who wish to obtain associate in commercial underwriting (au) or associate in personal insurance (api) credentials or similar designations are often required to. Alternatively, students can opt to study insurance alongside another subject, such as finance or economics, as part of. Normally, these courses do not lead to a degree, and a certificate is granted instead.

Colleges in the united states reported awarding 1,811 degrees in this year alone. While you can't specifically earn a master's degree in insurance, you can find plenty of programs that cover risk management, insurance and actuarial science. As a student in insurance studies, you will learn about all of the facets of the insurance world and be prepared to tackle any challenges awaiting the industry as a whole.

The united states has 73 different schools where you can get a degree in insurance. Insurance isn't the most popular major in the world, but it's not the least popular either. The program contains a comprehensive set of offerings and students gain rigorous training in data science, actuarial science, finance, and fintech.

Insurance courses help prepare individuals pursuing a license through different programs, including those that feature practical training. Insurance courses help prepare individuals pursuing a license through different programs, including those that feature practical training. The mfi is a professional program that provides students with a sophisticated understanding of this complex interaction of the financial and insurance fields.

Data Science Careers in Insurance MyPath

National Insurance Company Limited Career Opportunities

Quiz Match Your Skills to an Insurance Career CIWA

Arkansas Executive Career Life Coaching Insurance Cost

Lew Nason on LinkedIn How To Build A Solid Build A Solid

Insurance Agent Admissions, Courses and Scholarships

Get free home insurance quotes at

Why choose a career in insurance? We have gathered a few

Insurance Advisor Career Portal

Sbi General Insurance Career Awesome

Arkansas Executive Career Life Coaching Insurance Cost

What Degree Do You Need To an Insurance Analyst

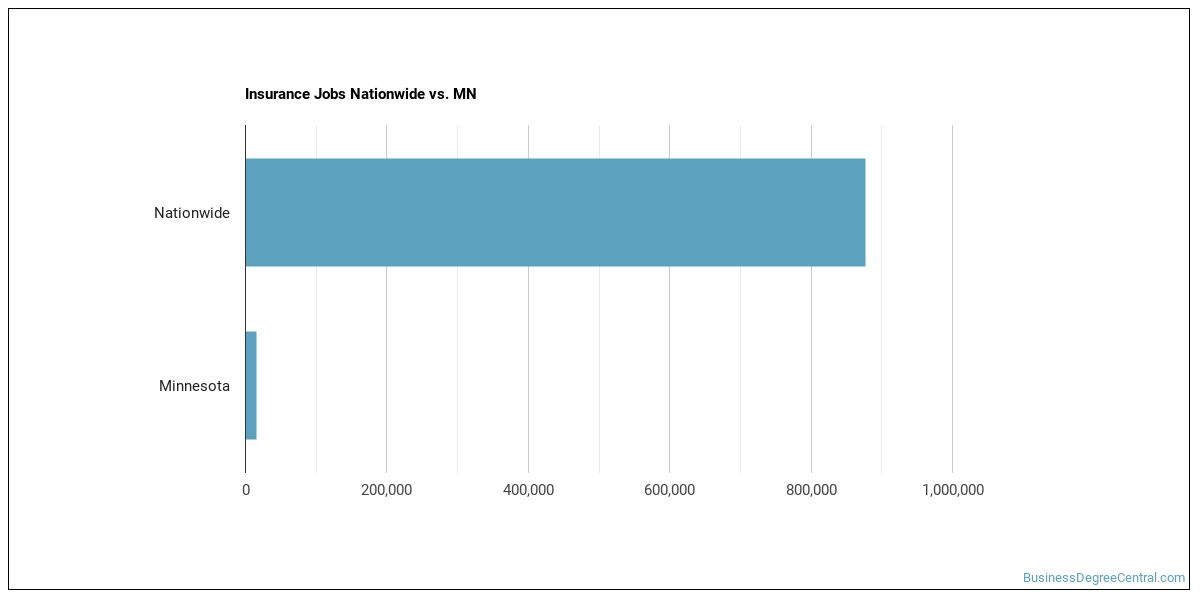

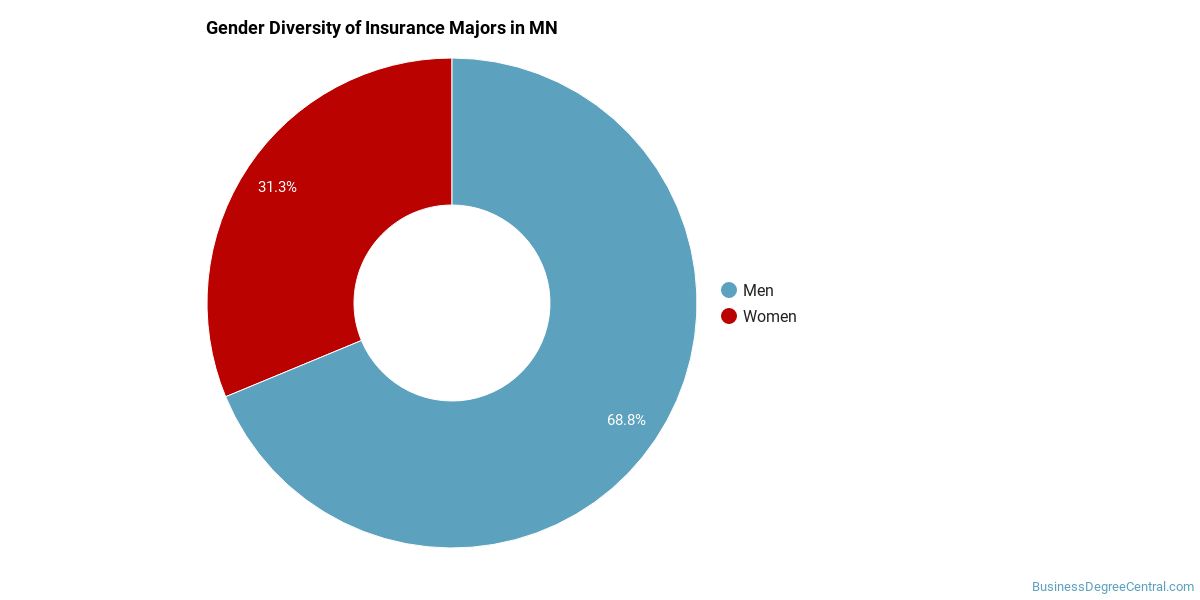

Insurance Majors in Minnesota Business Degree Central

Insurance Majors in Minnesota Business Degree Central

Empower Insurance Agents with a 360degree View of the

Sarah Tung on LinkedIn insurance career development