In most cases, your home insurance won’t cover a sewer line. It depends on the location of the damage and how the sewage line was broken.

Does State Farm Homeowners Insurance Cover Sewer Line

A broken water or sewer line can cost thousands to repair.

Does house insurance cover sewer lines. No, sewer line replacement is not included in a standard home insurance policy. Homeowner’s insurance policies routinely exclude sewer line repairs from coverage as the insurance industry interprets this as a maintenance issue. After you’ve paid the deductible, you’ll be covered up to the policy limit.

How much does sewer line insurance cost? That said, if you have a good insurance policy, you may have an endorsement that provides coverage. The company even offers coverage for the breakdown in the sewer line from external forces, such as root invasion or movement of heavy objects.

If sewer lines aren’t covered, you should purchase service line coverage through your insurer to extend coverage to the sewer pipes that connect your home to the larger sewer. The line is damaged by a third party, such as a neighbor or a contractor. You can call your agent or check.

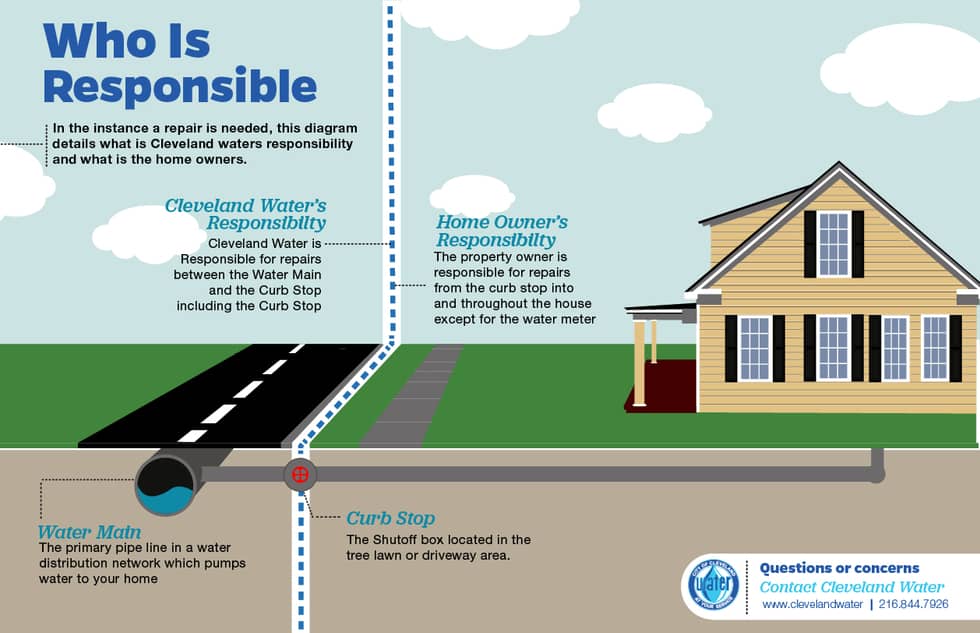

While this happens frequently, a common exclusion on home insurance policies is water damage and sewer back up. A homeowner is responsible for the sewer line under the house and to the street. Homeowners insurance may cover your sewer line if it is suddenly or accidentally damaged, but in many cases, a standard policy won’t automatically cover the utility lines that connect your house to the outside world unless you’ve specifically added service line coverage.

They also do not cover damage due to poor maintenance. Homeowners insurance will not be cover the lack of sewer line maintenance. How do you pay for sewer line replacement?

But there are some exceptions. In select circumstances, though, homeowners insurance can cover damage to sewer lines under and inside your home that's caused by a covered loss, such as an explosion or. For example, if there were an explosion in your yard and that causes the sewer line or sever, the damage would be covered by your homeowners insurance policy subject to your deductible.

What is a sewer line? One common question we get is, “will insurance cover a broken sewer line?” it’s not a straightforward answer but allow us to explain. Usually, the sewer lines can be fixed in $3,000 to $6,000 if the damage is average.

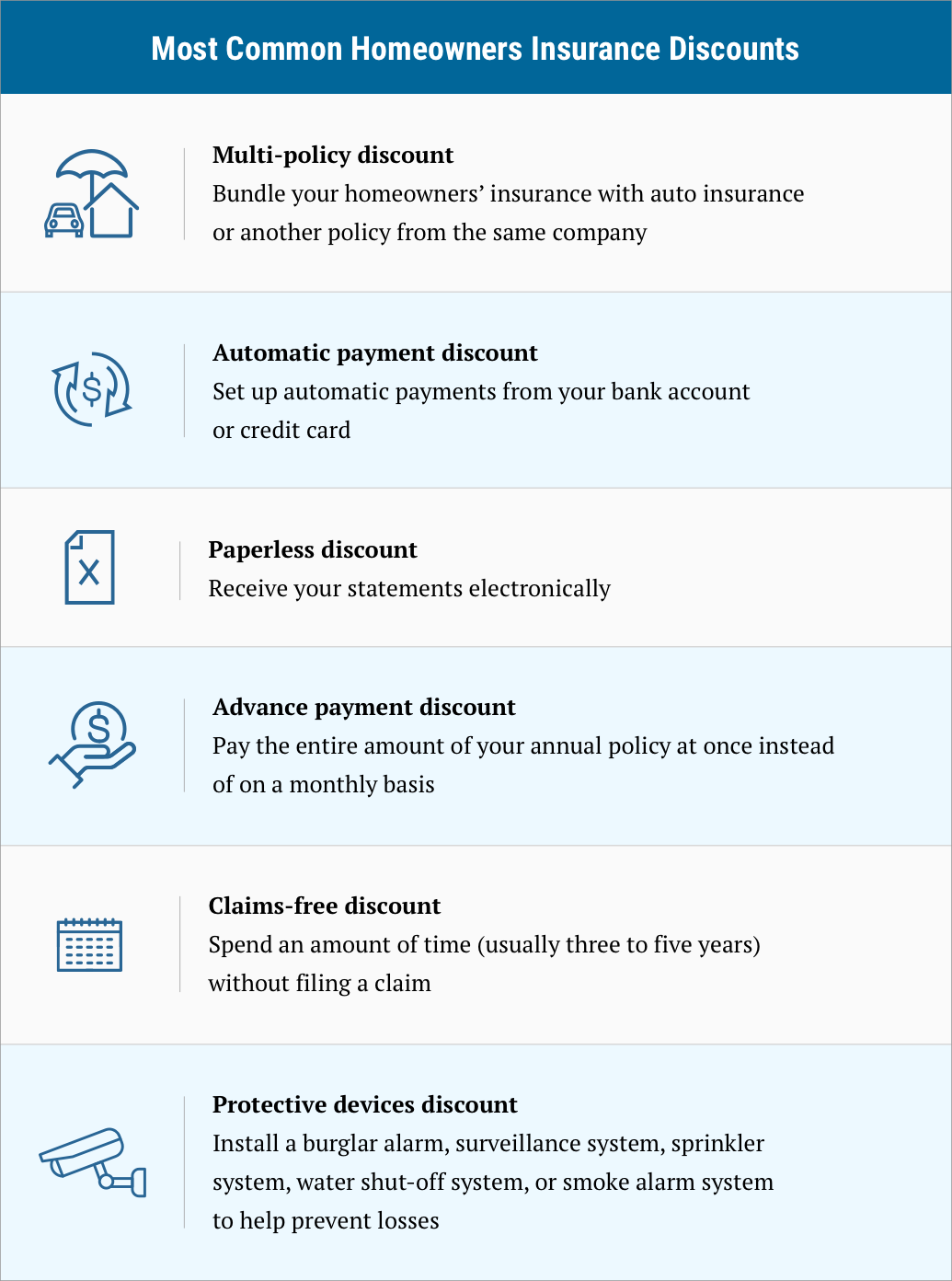

The small cost of service line insurance can really pay off if you ever need to repair or replace a damaged line. Sewer line coverage varies in cost but can generally be obtained for $5 to $15. A more comprehensive coverage policy for repair or replacement of your sewer lines.

These policies typically cover any necessary repair or replacement of pipes but don’t cover the cost of repairing any damage to your home or property. Service line warranties of america offers water line coverage, sewer line coverage, gas line coverage, and electrical coverage. Homeowners insurance doesn't cover sewer clogs at all, and a backup rider only covers the water damage to the home.

If you see that you have sewage backup rider in your home insurance policy, then you should be covered well in the event of a main sewer line clog. Do you need water, sewer and power line insurance? The home insurance company will cover it all.

It’s more common that homeowners insurance will not cover you, because most of the damage to a sewer line usually occurs through preventable means. Coverage is very affordable with additional service line coverage cost starting from $20 annually. However, homeowners insurance doesn’t cover everything.

To know if homeowners insurance will cover your sewer pipes for sure, you should contact your home insurance provider or review your policy to see if sewer line damage is listed as an exclusion. These plans may differ slightly depending upon the area you reside. Your insurance policy will cover damage caused by events that are outside of your control.

Contact your home insurance company you can also figure out if your main sewer line clog is covered by your policy by contacting your home insurance provider. You might be surprised to learn that your homeowners insurance policy probably doesn’t cover sewer line repairs. A covered peril damages the sewer line.

A homeowners policy may cover your sewer line if: Older homes often have sewer line breaks or tree roots invading the interior of the line. Any time you flush a toilet or wash something down a drain, that wastewater will end up in the sewer line.

This includes flood, hurricanes, and earthquakes. Protect your home and your bank account with the right insurance coverage. If your sewer line is damaged by a storm or a fire, for example, your homeowners insurance should cover it.

Homeowners insurance does not cover the cost of many dangers that can happen to your sewer line. For example, damage to the pipe because of poor upkeep, faulty construction or a preventable error will not be covered. You can check with the homeowner’s insurance provider to ensure whether it offers additional cover for sewer lines.

Most sewer line insurance policies exclude damage due to natural disasters. Sewer line repair and replacement are rarely covered by homeowners insurance policy. Does home insurance cover sewer line replacement?

Whether sewer lines under your house are covered by your homeowners insurance depends on the attributable cause of damage. If something were to happen to your sewer lines, you might have to pay out of pocket to repair or replace them, which could cost thousands of dollars. Most home insurance policies do not cover sewer line replacement.

Sewer backups are typically never covered by home insurance, being a separate policy. If your sewer lines are covered by your insurance service, then you don’t have to worry at all. However, if you need to replace all the sewer lines, then your cost can drastically increase to $10,000 or even above.

The source of the damage needs to come from something outside of your control. In most cases, damage to sewer lines isn't eligible for coverage. Home insurance will only cover certain damage to your sewer line.

Damage to the sewer pipe from natural disasters such as flood, earthquake, and hurricanes are not covered by standard home insurance.

Does Insurance Cover Broken Sewer Pipe inspire ideas 2022

Does Insurance Cover Broken Sewer Pipe inspire ideas 2022

Does Home Insurance Cover Sewer Line Replacement All

Does Usaa Homeowners Insurance Cover Sewer Line

Does State Farm Homeowners Insurance Cover Sewer Line

Does Usaa Homeowners Insurance Cover Sewer Line

Does Home Insurance Cover Sewer Line Replacement / Does

Does Allstate Homeowners Insurance Cover Sewer Line

Does State Farm Homeowners Insurance Cover Sewer Line

Does Home Insurance Cover Sewer Line Replacement All

Does Home Insurance Cover Sewer Line Replacement / Does

Does Insurance Cover Broken Sewer Pipe inspire ideas 2022

/cdn.vox-cdn.com/uploads/chorus_image/image/68996852/rsz_adobestock_152980850.0.jpg)

Does State Farm Homeowners Insurance Cover Sewer Line

Does Aaa Homeowners Insurance Cover Sewer Line Replacement

Does State Farm Homeowners Insurance Cover Sewer Line

Does Home Insurance Cover Sewer Line Replacement / Does

Does Home Insurance Cover Sewer Line Replacement / Does

Does Insurance Cover Broken Sewer Pipe inspire ideas 2022

Does State Farm Homeowners Insurance Cover Sewer Line