You’ll need to take clear pictures of everything you want to be covered. They usually are pretty honest about it.

Taking homeowners insurance pictures of a house YouTube

Do the same thing as with a video:

Do insurance companies take pictures of your home. Take a look at the three most costly mistakes that contractors make when taking insurance photos and submitting them to the adjuster. What do home insurance inspectors look for? They might even ask to visit and talk to you personally about your claim.

If you aren’t currently at the property, forward the inspection link to a trusted friend, family member, or tenant. Like any good employee, the adjuster’s goal is to protect the insurance company’s bottom line. However, an insurance company representative cannot.

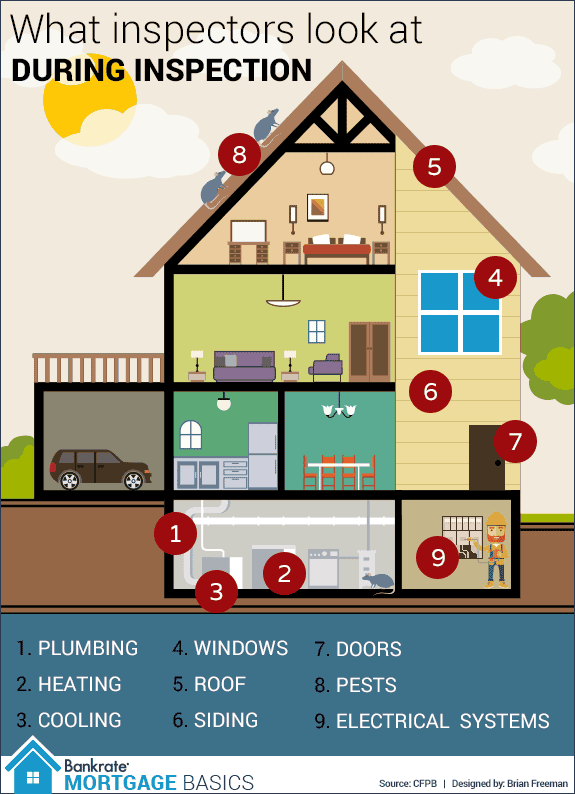

Home insurance companies have to evaluate your house before they can insure it, which means that they will send a representative to take a look at the house. The inspector will likely take pictures and detailed notes about the condition of your: Instead of calling a home insurance company one by one to ask about their rates, log onto policygenius, input your data and have various home insurance companies contact you with their various offers.

There are boundaries they need to adhere, legally speaking. If items have model numbers or serial numbers, take photos of those, then use them to create your home inventory list as soon as you have time. The mortgage broker will nearly always send an appraiser to evaluate a home the company is considering financing.

You might even believe that your own insurance company has an obligation to represent your best interests. No, they won’t enter the property, but they want to make sure that someone is living in the property. Shop around for a home insurance policy:

Frequently, they will send someone out each month for an inspection. Lenders do order drive by photos in order to complete your file. If your home is full of unusual amounts of clutter, has.

If you can’t access parts of the property (e.g., the attic) or the photo isn’t applicable, take a blank picture. They will bill you for it, and the cost will be $15 to $35. They can take pictures of your property to take back to the office.

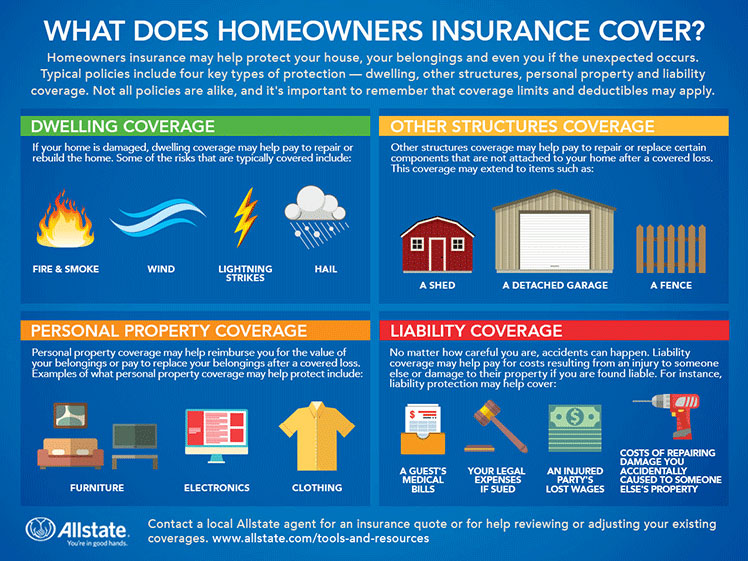

Underwriters at your insurance company will reference these pictures and recommend any necessary changes to your policy — this holds true for an. If you file a home insurance claim, insurance companies will often ask for copies of receipts or pictures of the items you lost as proof that you had them in the first place. Insurance companies need to capture information about the real estate, vehicles, and equipment they insure and underwrite.

First, they will look for opportunities to increase security or safety. The one thing the internet has been great at is making choices more readily available and prices more transparent. This search will include looking for potential fire hazards or liability risks in how you maintain your premises.

Inspections by home insurance companies are generally done when you have a claim or when you’re a new customer. They need pictures or video, fast, which creates an opportunity for you to earn extra dollars per month moonlighting and. As with videos, you don’t need professional photos.

Moreover, they’re not going to do it for free. And while you don’t have to be home for this inspection to take place, it’s in your best interest to understand what exactly your home insurance company looks for. To complete your inspection, you’ll need to take photos of the following.

All you have to do for this is bust out your smartphone, open up the camera app, and begin recording. They don’t work for you. When you print them out, document where the item is in your home and what it is, if it’s not obvious from the photo.

Your digital camera will work just fine for the needs of your insurance company. The photographs taken, along with others of comparable properties that are usually taken from the multiple listing service in your area, are. Unfortunately, they don’t — and they won’t.

That’s why creating a home inventory list is both sensible and necessary. Ask them why they were taking pictures of your home. Part of the appraiser's job is not only to photograph the subject house, but other houses in the neighborhood that are comparable, meaning they are approximately the same size, age and condition.if you bought your house less than a year ago,.

An adjuster’s goal is to evaluate your claim and decide how much money the insurance company is required to pay out. It’s important to note that the home insurance adjuster is a paid employee or independent contractor of your insurance company. The most common type of home inspection is the exterior inspection.

Home insurance inspectors will look for three basic things when they inspect your home. It’s easy to assume that the insurance companies are working hard to “get to the bottom” of an auto accident or to “do the right thing.”. The answer to the question is yes.

Take photos of entire rooms, specific areas, drawers, closets, and items.

Find and Compare the Best Home Insurance in 2020

How To Start Your Own Health Insurance Company Know Your

How Do Insurance Companies Determine Home Replacement

Compare Cheap Life Insurance Quotes MoneySuperMarket

How to Avoid Rejection of Your Insurance Claim

Why do i need renters insurance insurance

When To Get A Home Inspection And Homeowners Insurance

Financial/Insurance Advertising Solutions Insurance

Homeowners Insurance 101 Allstate

Do I need Small Business Insurance? Insurance Agency

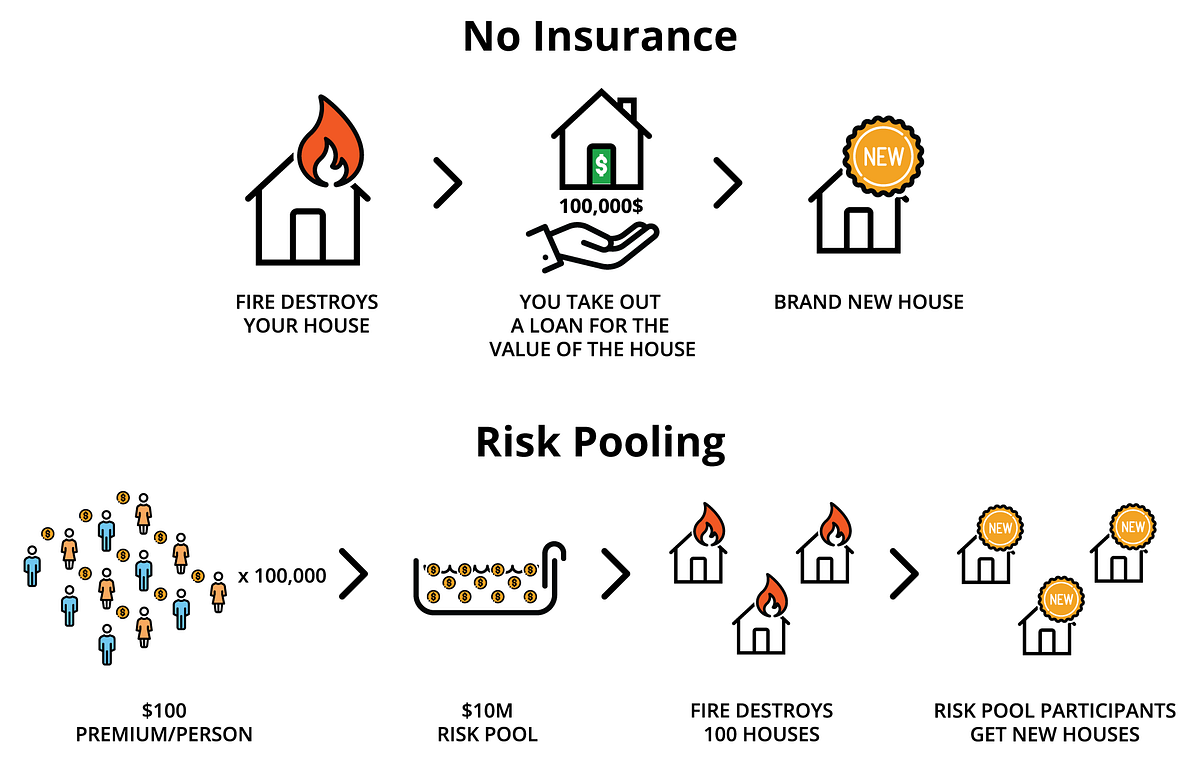

A Beginner’s Guide to the Principles of Insurance

Permanent Life Insurance 101 What You Need to Know Allstate

Computer Fraud and Cyber Crime Insurance—Do Not Let The

Does your home insurance cover storm damage? Toronto Star

How to File a Life Insurance Claim

4 Simple Steps To Managing Your Insurance Policies

Does Aaa Home Insurance Cover Roof Leaks Best Movie

Why do insurance premiums increase every year?