If you did not get a police report at the scene, you can still go to a local police station to file a report. The role of social media.

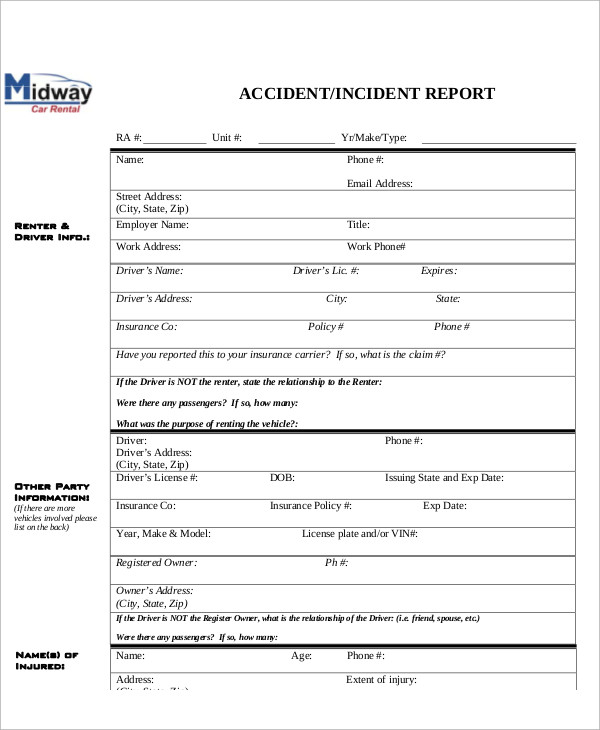

How To Write Accident Report Sample

If the car insurance company is trying to pay less on your claim because they say you are partially at fault, the police report can prove your innocence and force them to pay a full claim.

Do car insurance companies check police reports. But insurance companies don’t just hand over their money. Most insurance companies will do anything to increase their profits. Drivers’ motor vehicle records and clue reports are most commonly pulled by insurance companies when determining rates.

As stated earlier, it is important to understand that police reports and determinations of fault by insurance companies do not control the outcome of a court case. Regardless of what's included in the police report, the insurance company, through its own investigation, will come to its own conclusion (also an opinion) as to who was at fault for the accident. Insurance companies don’t operate on the honor system when you tell them how long your commute is or whether you’ve gotten any speeding tickets.

The main thing that the claims adjuster and insurance provider are looking for in a claim is proof of damage and/or injury. The police reports are used to learn about whether you have been involved in an accident or not, towards an investigation when you file a. They know which reports are pulled about you when you request a car insurance quote.

They may go to facebook, twitter, or other social media sites to make sure that you are not lying. Reports because the most popular one is the comprehensive loss underwriting exchange (maintained by lexisnexis risk. Auto insurance companies examine your driving record they also might look at your credit report and criminal history your criminal record goes back further than your driving record

The information required for filing a car insurance claim that occurred on private property is very similar to the information usually included on a police report. They can then notify the other party's insurance company if the other insurance company wasn't notified by the other party. Most insurance companies are no signatories to an agreement with police forces which allows them to obtain this information from us directly (but usually only with the consent of their insured).

It may be clear to you that the other driver caused the crash, but you have to prove it to the claims adjuster. Identifying the insurance company that insures a vehicle involved in a crash is easy. But that doesn’t mean the dmv isn’t aware of an accident you were involved in.

“do insurance companies report accidents to the dmv?” the short answer is “no.” insurance companies do not report accidents to the dmv. The rules of evidence may prevent certain evidence from being introduced during trial, including police reports, which are generally considered hearsay. The officer usually obtains this information when the driver produces an insurance card at the scene of the crash or by running the vehicle through the.

After the claims adjuster files their report, the car insurance company issues a check for that amount to the policyholder for the repairs to the car. The reports can be obtained in a variety of ways. Most insurance companies “subscribe” to a service and purchase reports one at a time for underwriting and pricing purposes.

If the car accident is minor, do i need a police report for insurance? Car insurance companies can access police reports. Police report and eyewitness accounts that support your position.

After a car accident, when a claim is reported, the insurance company will conduct its own investigation. How do insurance companies use police reports? Then, call your insurance company and tell your insurance agent or a representative about what happened.

Yes, insurance companies share information. When you apply for auto insurance you give the new insurer to permission to check these loss reports. Several car insurance companies are quick to support their own policyholder.

Do i have to tell my insurance company if the damage is minor? You might have heard of the reports referred to as c.l.u.e. In that case, it's up.

Instead, it’s up to your insurance company to do its due diligence, verify your driving history, and check your motor vehicle report. Make sure to call the police and file a report. However, it’s generally a good idea to be honest with your insurer about your dui conviction.

With most minor car accidents, no police report is needed for insurance. Accidents that generate a police report are filed with the dmv. It can help your insurance company better understand how the accident occurred and who is at fault.

If your car insurance company wants to pay less for damages than is required, the police report along with other documentation such as medical bills and body shop estimates can help. In addition to reviewing your claims history, car insurance companies are also likely to look you up online. Car insurance companies report claims to property loss databases.

Whether or not you are legally required to file a police report depends on your state’s laws, however. Having a police report is helpful and can simplify the claims process, but it’s not required to file or authorize a claim. Yes, you can file an insurance claim with no police report after a car accident.

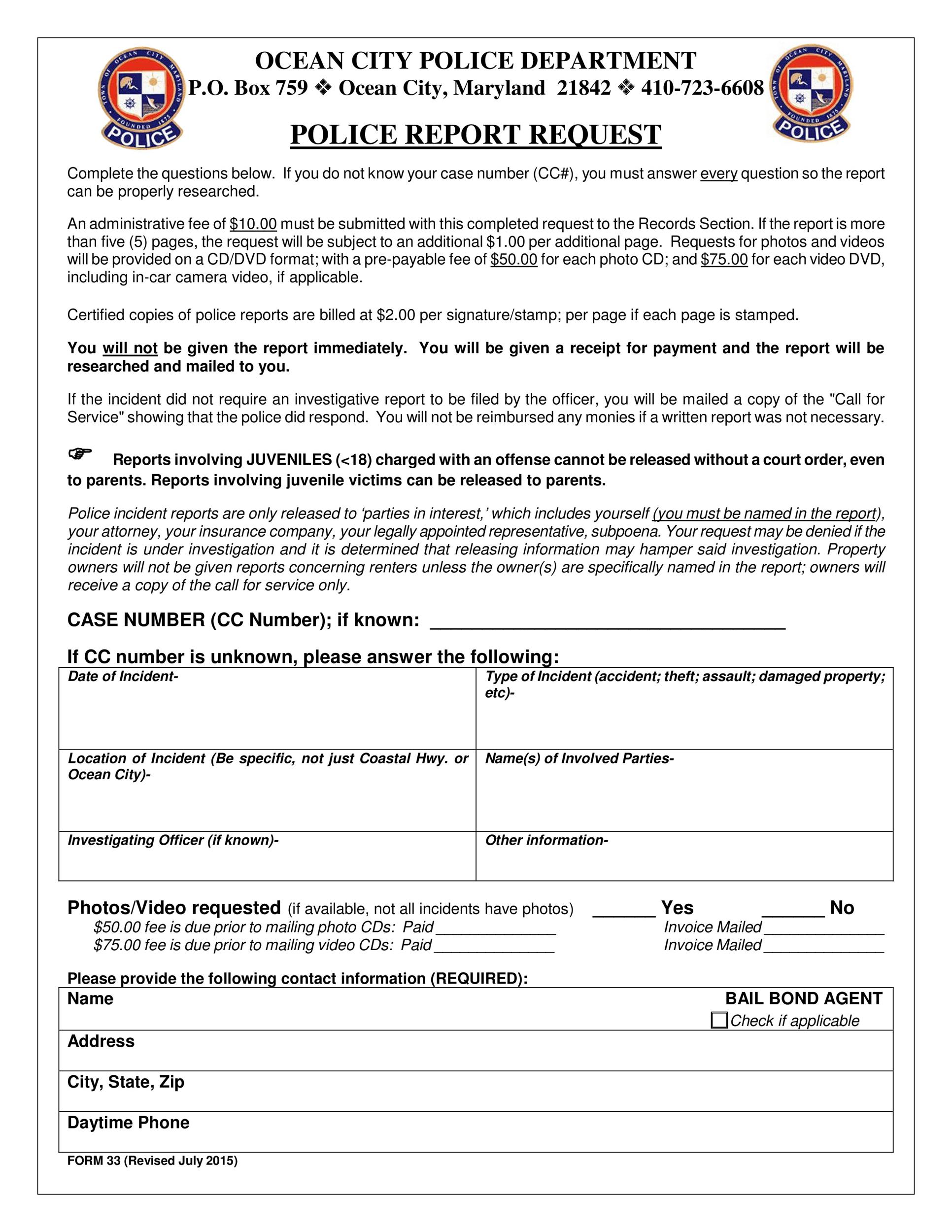

In most states, you are required by law to. Your insurance company will request a police report number. Police reports are powerful evidence that can help you meet your burden of proof.

Here are some of the things agents know that customers typically don’t. For example, if you are found 30% responsible for a collision, your insurance company might only pay for 70% of your bills. Police accident reports are usually available within a week or two of the accident.

If you've been involved in a car accident, obtaining a police report is always a good idea. Do insurance companies share information? If you don’t make any progress, ask the insurer to explain as to how it believes the accident occurred.

In some states, however, police reports aren’t necessary generated for. While you might not have a police report form, be sure to include all of the same information in. The adjuster will investigate the claimant (you).

One of the first things that. What are the basic steps to filing a car insurance claim? Ultimately, a police report helps the insurance adjustor review your case and determine how much money you’ll receive from the insurance company.

However, having a police report is usually not required, unless your accident resulted in injury, death or substantial property damage. The responding officer will obtain the information in the process of preparing a police or collision report. The information that can be disclosed includes basic crime details, complaint and investigating officer's details, crime assessment and how the crime is.

RPU Surrey Police on Twitter "This car was purchased by

LPT After a car accident, stepbystep checklist. Getting

Malaysian Police Report Sample

How to handle car theft What should I do if my car is stolen?

Do car insurance companies check police reports?

Do I Need a Police Report After a Car Accident in Texas

Do I Need To File A Police Report After A Car Accident

🔥 Does insurance cover stolen car [Well Detailed

License, Registration, Insurance Springettsbury Township

Do I Need To File A Police Report After A Car Accident

Nebraska Car Accident Laws The Ultimate Plain Language

Do I have to use an insurance check to fix my car?

Do car insurance companies check police reports?

What To Do After A Car Accident An 8Step Guide Allstate

Car Accident Checklist Gerard P. Smith Insurance Agency

How To Check Your Car Insurance History

Michigan Car Accident Police Report FAQs Michigan Auto Law

Accident Reports • Always get a copy of your police report

Leaving Scene of an Accident What Can Happen? InfoTracer