The cii recommend between 50 and 100 hours of study, depending on the exam. You need to provide written evidence from an appropriately qualified professional to confirm your condition and how it would affect your performance during an exam, along with recommend solutions such as extra time, large font question papers and anything else to make sure you have an equal chance of passing your exam.

Quiz 2022 CII IF1 Fantastic Insurance Legal and

Included in enrolment plus (if available for the unit):

Cii insurance exams. Any questions which have been amended since the examination guide was first published will appear below. Telephone service mon to fri: Telephone service mon to fri:

Pakistan insurance institute (pii) is pleased to announce that as an affiliate of chartered insurance institute (cii) pii is now. +44 (0)20 8989 8464 email: The cii qualification framework allows you to create your own learning pathway to help you achieve your chosen qualifications.

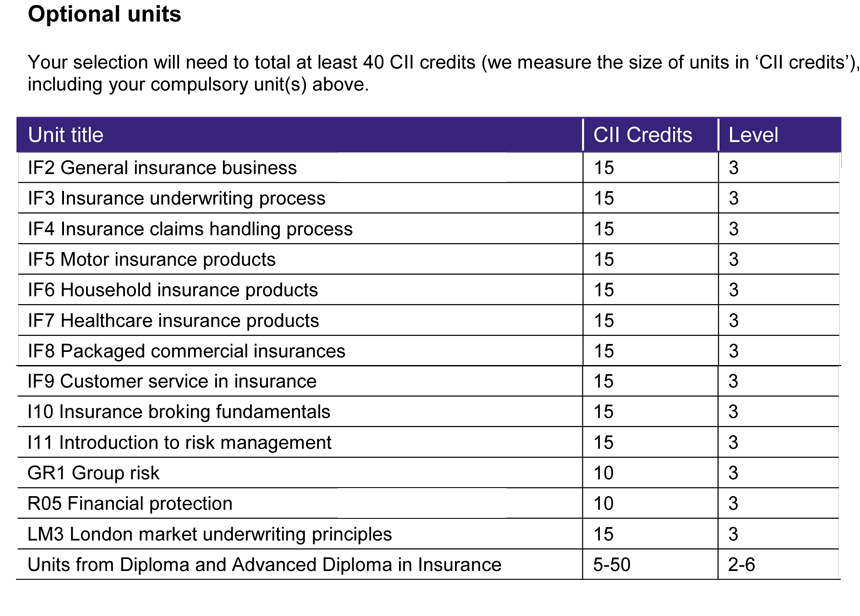

Cii.co.uk our vision our vision is to build public trust across the insurance and Study text, exam entry and additional revision aids. To pass the cii certificate in insurance you must achieve 40 credits including one compulsory unit:

An insurance company has employed an individual from a rival firm to carry out a similar job. Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by. Please contact customer.serv@cii.co.uk as soon as.

Chartered insurance institute (cii) examination fee schedule for the year 2021. 2022 edition (applicable to exams sat 01 jan 22 to 31 dec 2022) revision aids available Please use the filters below to find the area and level relevant to you.

Other available units (you cannot sit both if1 and lm1) are: Your results will be available from our website via the ‘bookings and results’ section of mycii within 24hrs of sitting the exam. Understand contract and agency in relation to insurance brokers and their client.

Our members are able to drive personal development and maintain their professional standing by adhering to our code of ethics and by accessing a range of learning services. The cii have the right to withhold exam results where they suspect exam rules have been violated. Cookies on the cii website by using and browsing the cii website, you consent to cookies being used in accordance with our policy.

Planning your course of study by: Understand the key legal and regulatory issues affecting insurance brokers. The diploma in regulated financial planning is a ‘level 4’ qualification, made up of six ‘r0’ subjects.

+44 (0)20 8989 8464 email: The nominal pass mark is 70%; Understand the conduct of insurance business ;

Included in assessment only (if available for the unit): Lm2 london market insurance principles and practice. The following information is applicable to candidates wishing to sit cii examinations during 2018.

Latest version of the core learning content, in digital. The 2020 pass rate for this unit was 75%; Success in cii qualifications is universally recognised as evidence of knowledge and technical expertise.

The 2020 pass rate for this unit was 76%; Lm1 london market insurance essentials. If you are relatively new to the profession, you will need every minute of this.

Understand the role and responsibilities of the insurance broker in the provision of insurance products and services 20 3. +44 (0)20 8989 8464 email: Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by online webchat service mon to fri:

The certificate comprises one core unit and two option units from the cii insurance qualifications framework, providing a minimum total of 40 credits on successful completion. Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by online webchat service mon to fri: If1 insurance, legal and regulatory.

2022 edition (applicable to exams sat 01 jan 22 to 31 dec 2022) revision aids available Insurance law (m05) provides candidates with knowledge and understanding of the laws which form the background to the operation of insurance, the system within which these laws operate and are administered and apply knowledge and skills to practical situations. Our insurance and personal finance qualifications cater for all levels of knowledge and experience, from new entrants through to seasoned professionals.

The m05 examination guide for exams from 1 may 2016 to 30 april 2017 was first published in february 2016. January 30th, 2018 relevant to units ordered between january 1,. Our insurance and personal finance qualifications cater for all levels of knowledge and experience, from new entrants through to seasoned professionals.

Understand the insurance broking market. The default enrolment option for this unit includes: There is no prescribed order in which units must be taken, but it is strongly recommended that you sit the required core unit(s) first as these provide foundation knowledge upon which the others build.

The cii qualification framework allows you to create your own learning pathway to help you achieve your chosen qualifications. The 2020 pass rate for this unit was 72%; Please signup / login to view this exam, then you will be able to view the entire exam for free.

Online CII (IF4) Insurance Claims Handling Process One

Test Cert CII membership badge Credly

Quiz 2022 CII IF1 Fantastic Insurance Legal and

Management Diploma In Insurance (MDI) The Insurance

CII_Strapline_Standard_DarkGrey Garratts Insurance

IF1 Certification Materials & CII Exam IF1 Reference

PPT How to Study & Revise for your CII Exams PowerPoint

Mastering Mixed Assessment for General Insurance CII

BIMTECH launches dual degree program Post Graduate

CII bats for GSP, says continuation of scheme beneficial

Guest blog post Caspar from CII talks tips for students

The Chartered Insurance Institute CII Certificate in Insurance

New CII Exam Support Programmes Launching in April 2020!

CERM Center for Enterprise Risk Management