Different aspects of medicare cover specific healthcare services, such as inpatient hospital stays, doctor’s services, medications, and even outpatient care. Health insurers are cost conscious and concerned about rising healthcare costs.

Why an Annual Health Plan Audit is Critical to Your

These tactics are also being employed by pharmacy benefits managers, like cvs caremark and express scripts.

Audited for health insurance. Responding to an insurance audit Being audited by an insurance company is like being called for jury duty. Pwc, with 683 (18%) insurance clients, audits the most number of companies.

The goal of care and quality improvement audits for both health plans and health providers is to use findings from case review to enroll members into preventative care programs before their conditions progress and hospital admission is required. Healthcare providers need to (1) be ready to produce accurate and complete records, or (2) be. If the health system does not currently have an audit function, then hospital management and the board must decide whether to accept all the risk identified without a call to action, or to bring in outside help to perform the internal audit work and/or develop an internal audit department.

Both provider and payer are often looking at the same cases during these reviews. An audit is an examination of your operation, records and books of account to discover your actual insurance exposure, including premium basis, classifications and rates that apply, for a specific period of time coverage was provided. The timing of an audit is dependent entirely upon the insurance company, medicare or medicaid.

With many health plans available in the insurance sector, selecting the best one can be slightly confusing. The insurance audit & role of insurance auditors. Overview • the city of west palm beach, through the human resources department, offers health insurance to all eligible employees across all departments.

It’s not a matter of if it will happen—it’s simply a matter of when. The following is a list of the 10 common insurance audit risk areas that health care providers should focus. We have audited the accompanying financial statements of the new mexico health insurance exchange (the “exchange”), as of and for the years ended december 31, 2020 and 2019, and the related notes to the financial statements, as listed in the table of contents.

7 things to audit in your health insurance plan. Healthspring life and health insurance company, inc., a medicaid star+plus managed care organization. The process includes six stages:

As per section 12 of the insurance act, 1938, the financial statements of every insurer are required to be audited annually by an auditor. Many provider agreements give health insurers the right to audit practitioners’ records. Together, the big four audit almost 60% of the market.

A retrospective audit is initiated by a letter from the health insurer or a third party acting on its behalf, usually requesting medical records from the. Buyer’s awareness will make a. According to irda act, 1999, every insurer, in respect of insurance business transacted by him and in respect of his shareholders ‘funds, should prepare, a balance sheet, a.

How does an audit work? You should wait to file your income tax return until you receive that form. Unfortunately, it seems that when the new mental health parity laws kicked into effect february 10, 2021, it had an unexpected consequence.

If transactions are occurring between a hospital and an insurance company or government medical care coverage program, audits are guaranteed. Effective audit programs often provide them with significant returns compared with their costs. There are 261 auditors who audit these insurance companies.

They made an appointment that can be canceled if it is found that the appointment of auditors by the insurers is not as per the proposed guidelines. 1) the new york insurance law does not address the auditing of a health care provider by an insurer. There are two types of general categories for health insurance audits:

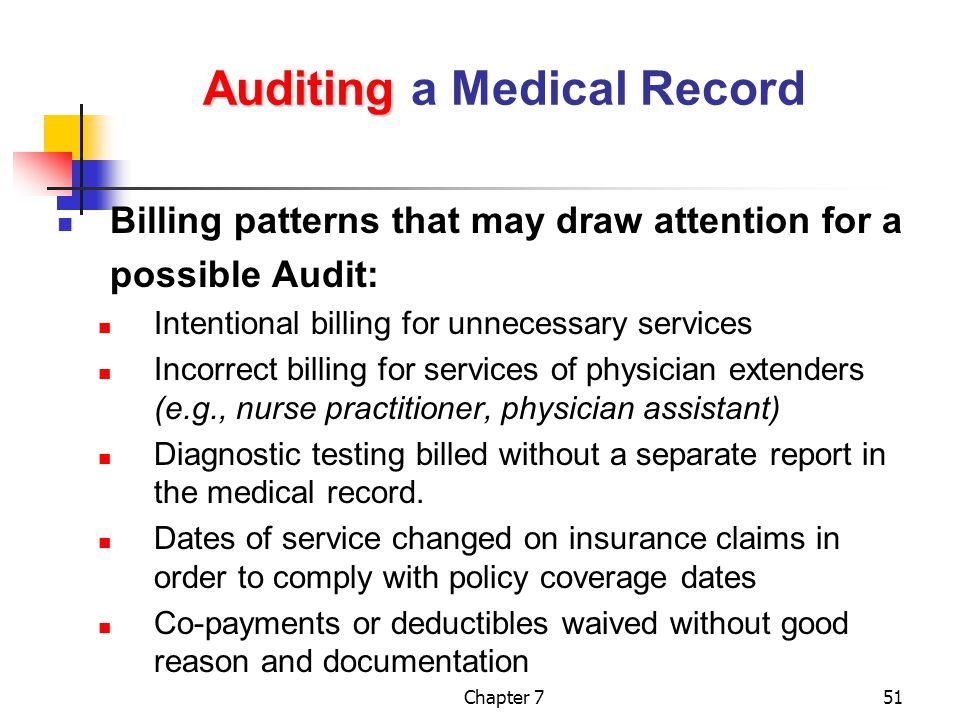

This audit was conducted in accordance with texas government code, sections 321.0131, 321.0132, and 321.013(k)(2). A clinical insurance audit is a review of treatment that is meant to root out fraud, abuse, and waste in the health care system. Audits are a regular part of working in healthcare and with health insurance.

The audit is done to obtain insurance rating. “exposure” means your payroll, receipts or sales, units, number of employees or contract cost. ‘b’ priority processes with significant,

A close second is ey with 628 (16%) clients.

Benefits of Performing Medical Claim Audits for Your Business

How to Do an Audit on Medical Claims eHow

RAC Audits Infographic Healthcare IT Today

How to do Internal Audit for Healthcare entities

When and Why You Should Conduct an Insurance Audit Sabre

Did You Know The DOL Audits Health Plans HR Daily Advisor

An effective guide for Auditing Healthcare Entities

Medicare Rac Audit is Coming to Your Observe Are You

Effective Healthcare Audit Auditing Professionals

Types of Health Care Fraud You Need to Avoid At All Costs

Understanding Insurance Audits — Jackson LLP Healthcare

Why is Healthcare Auditing so important? Affluent CPA

The current state of clinical audit in health & social

Employee Benefit Plan Audit Services MHM

Patient Information — Royal College of Surgeons

Healthcare Cost Management The Health Consultants Group

Things to remember while planning Healthcare Audit

Healthcare Audit Guide Professional CPA Firms