The coverage must protect against loss or damage from fire, windstorm, hurricane, hail, and other hazards covered by the standard extended coverage endorsement. Condo insurance rates depends on various factors like your credit score, age of condo, location and claims.

Real Life KETO RESULTS After 6 Months... Isa's World

A total of 5 outcomes were assessed during the 6 months after an eviction:

6 months rent loss insurance coverage. How much coverage you choose to buy and what deductibles you select affect the price of your policy. The payment of the indemnity insurance would be in the form of cash or payments to the. Renters insurance with geico can cost as little as $12 per month.

Can be taken out to cover specific rental policies. Up to 6 months reimbursement of lost rent when tenant default is due to nonpays including skips or eviction. It states the insurance company will pay thirty days after reaching an agreement on the amount of loss , not thirty days after claim submission.

Some lenders require certain landlords to maintain rent loss insurance coverage equal to gross rent coverage for six months. If it does not, then coverage that does provide the minimum required amount must be obtained. Check with your lender to clarify what rent loss insurance, if any, you need to carry for your rental unit.

Usually the policy covers minimum of 6 months of gross rental income when your rental unit is unsuitable for habitation due to hazards such as fire or other damages. You will need insurance to cover your rental units for liability and property damage. Loss of undamaged portion, in an amount equal to 100% of the insurable value of the property property multifamily residential property securing the mortgage loan and including the land (or leasehold interest in land), improvements, and personal property (as defined in the uniform commercial code).

Loss of rent insurance, also called “loss of use” coverage, protects you in the event your property is no longer a viable income stream due to damage or loss. Rental guarantee insurance protects landlords when tenants are unable to pay their rent. The policy pays up to 6 months reimbursement when a tenant default is due to abandonment or eviction and up to 3 months when a tenant vacates the unit due to court order, military status or their own death.

Business income insurance, also known as business interruption coverage, helps cover lost income and additional expenses when your business is shut down from a covered loss. Typically, an indemnity period will have a time limit stated within the policy, such as 12, 24, or 36 months. Covers up to six months of rent due to renter nonpayment.

Rent loss insurance, sometimes called fair rental value coverage, covers a loss of rental income if your property becomes uninhabitable to a current tenant due to covered damages beyond your control. Condo insurance covers personal liability, personal property, dwelling, loss assessment, and additional living expenses. An emergency department visit immediately followed by a hospital admission.

$1 to $15 per $1,000 of coverage, based on geographical area. Since even minor business income claims take a long time to come to agreement, Coverage limits vary, and you will want to select an amount that safely protects your belongings.

$708 to as much as $5,000 or more in areas in a known flood zone. So, just like you protect your own home with the right insurance coverage, you want to do the same for your rental. The most the insurer will pay for any one claim in any one period of insurance is a.

$700 for real estate businesses. Property is a 2‐4 unit primary residence, the borrower must obtain rent loss insurance to cover at least six (6) months of gross monthly rent. Mortgage or rent (estimate 6 months of payments.) $ credit card payments (estimate 6 months of payments.) $ loan and.

For suntrust internal employees only Dollars), number of ambulatory care visits, number of acute care visits (emergency department visits plus hospitalizations; Loss of rent all risks section definitions business interruption loss resulting from interruption of or interference with the business carried on by the insured at the.

How rent default insurance works · up to 6 months reimbursement of lost rent when tenant default is due to nonpays including skips or eviction · up to 3 months (23). $240 for $25,000 in coverage, up to $5,000 per million in coverage. The unpaid principal balance of the mortgage, as long as it at least equals the minimum amount—80% of the insurable value of the improvements—required to compensate for damage or loss on a replacement cost basis.

It’s designed to protect you against loss from damages — to your building and its contents while it's. A state farm ® rental dwelling policy can help pay for property damage, injury and liability claims made against you, even loss of rental income if your property is damaged by a covered loss. Medicaid disenrollment (i.e., loss of coverage), total medical spending (u.s.

Any situation where you cannot collect rent becomes very stressful, so having insurance in place to reduce that burden can be a very smart move. Average additional annual coverage costs. (estimate a minimum of 6 months salary, but account for any disability coverage you have.) $ loss of income from spouse's job (estimate a minimum of 3 months salary for your spouse to take a leave of absence.) $ monthly expenses:

The insurance premium provides coverage for damages to the property as well as if you lose rent on account of the damage. Remember how rent guarantee insurance can help you: However, landlords who still have a mortgage on the rental unit may be subject to extra restrictions.

Typically, the business income covered is classified as taxable income. This is very frustrating because the insureds misread this statement. 200% of the rent sum insured

In this article we cover everything you need to know. This could include a tree damaging the roof or a. $19 to $49 per million.

This includes any income that results from business activity. The requirements of a property insurance policy for the insurable improvements of the property securing a mortgage loan are as follows: Some insurers sell rent loss insurance separately, but it is included in many general landlord insurance policies.

The average cost of condo insurance is $625 per year for $60,000 personal liability coverage and $1000 deductible. The deductible is the amount you are agreeing to pay before your benefits apply. Up to 3 months reimbursement of lost rent when default is due to court order, military deployment or the death of a sole tenant.

Short Term 6 Months Car Insurance Toyota Estima Aeras 8

Short Term 6 Months Car Insurance Toyota Estima Aeras 8

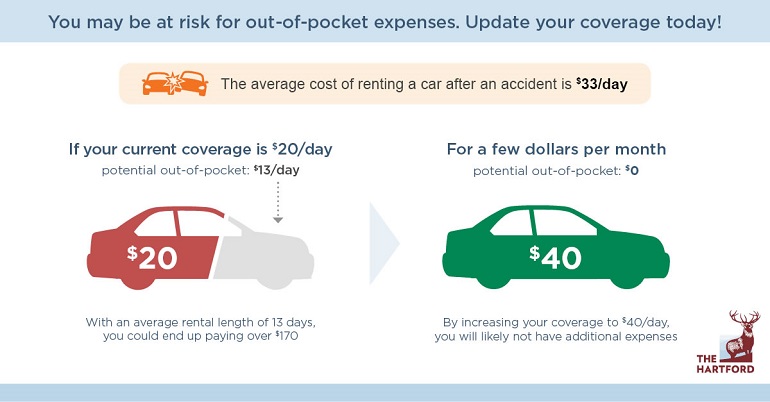

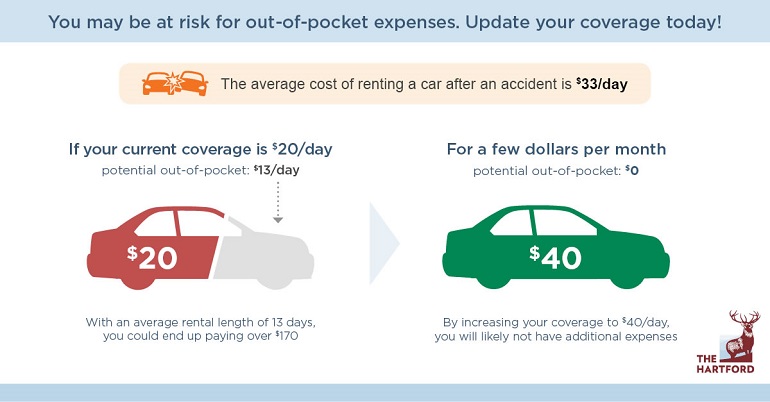

Most auto policies are for six months to a year. A basic

HOW I LOST 60 POUNDS IN 6 MONTHS! MY WEIGHT LOSS JOURNEY

Rental Property Profit/Loss Numbers after 6 Months. YouTube

How to Lose Weight in 2022 Lost 100 Pounds in 6 Months

Is It Healthy To Lose 60 Pounds In 6 Months

How Do I Lose 50 Pounds In 6 Months

How Many Calories To Lose 50 Lbs In 6 Months inspire

Pin on 6 Month Weight Loss Plan

How Do I Lose 50 Pounds In 6 Months Ichigokids

Car Insurance Challenge Save Money by Calling Your

Rental Car Insurance Insurance for Rental Cars

Loss Of Rent Insurance Coverage saintjohn

Pin on 6 Month Weight Loss Plan

Best Renters Insurance for Apartments 6 Month to Month

Pin on 6 Month Weight Loss Plan

Loss Of Rent Insurance Commercial Property Awesome