Gap cover from chris knott insurance starts at just £147 for 3 years’ cover on vehicles less than 10 years old, with fewer than 100,000 miles on the clock. If you bought your vehicle under a finance agreement (except where the policy is transferred) and.

Rti or return to invoice cover is essentially an additional option provided by your car insurance provider.

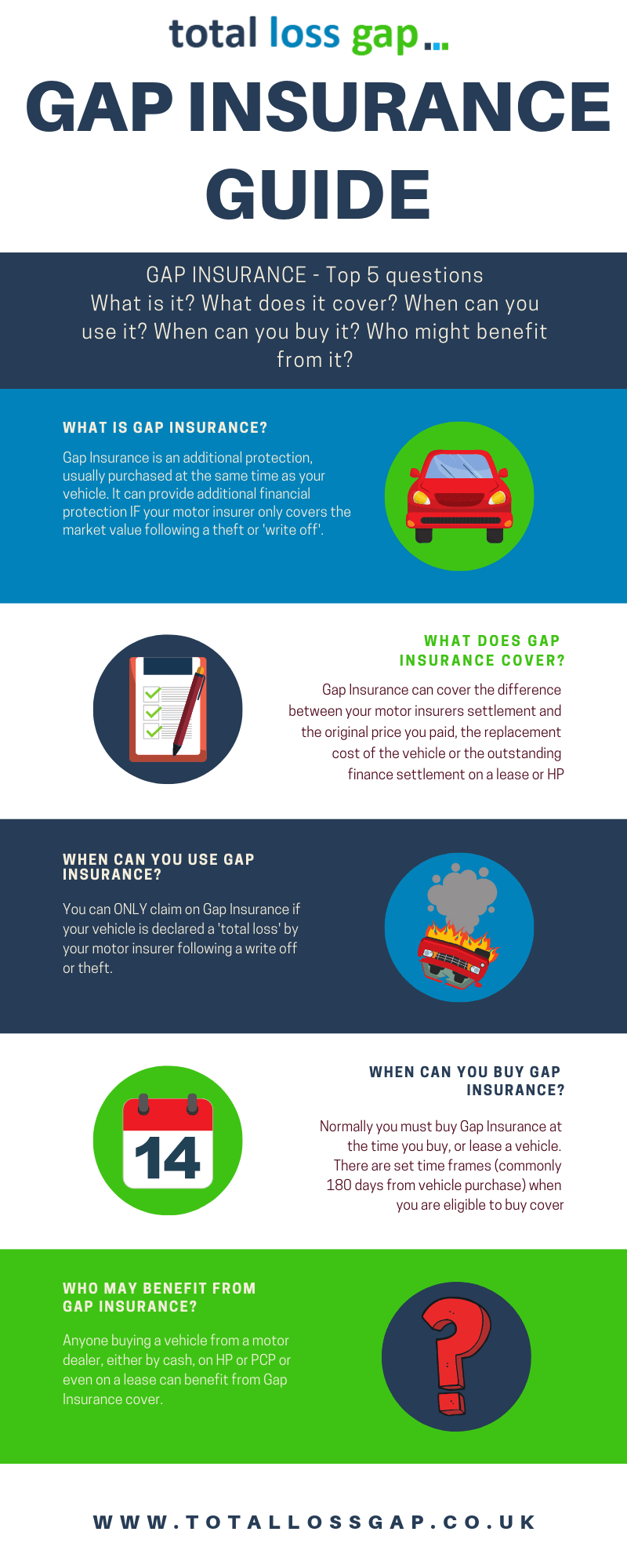

What is rti gap insurance. Gap insurance covers the difference between the early settlement balance of your contract and the market value in the event of the vehicle being considered a total loss because of accidental damage, fire or theft. Example of return to invoice gap insurance Gap insurance is a type of cover you can buy to protect you when you buy a new car.

*motor insurance claim payout value based on vehicle being 2 years old at the time of loss. This includes any outstanding finance. Rti gap covers you for a maximum of 36 months.

Gap cover must be arranged during the first 100 days of ownership. What is rti in car insurance ? Incorporates return to invoice cover (rti) and guaranteed asset protection (or gap).

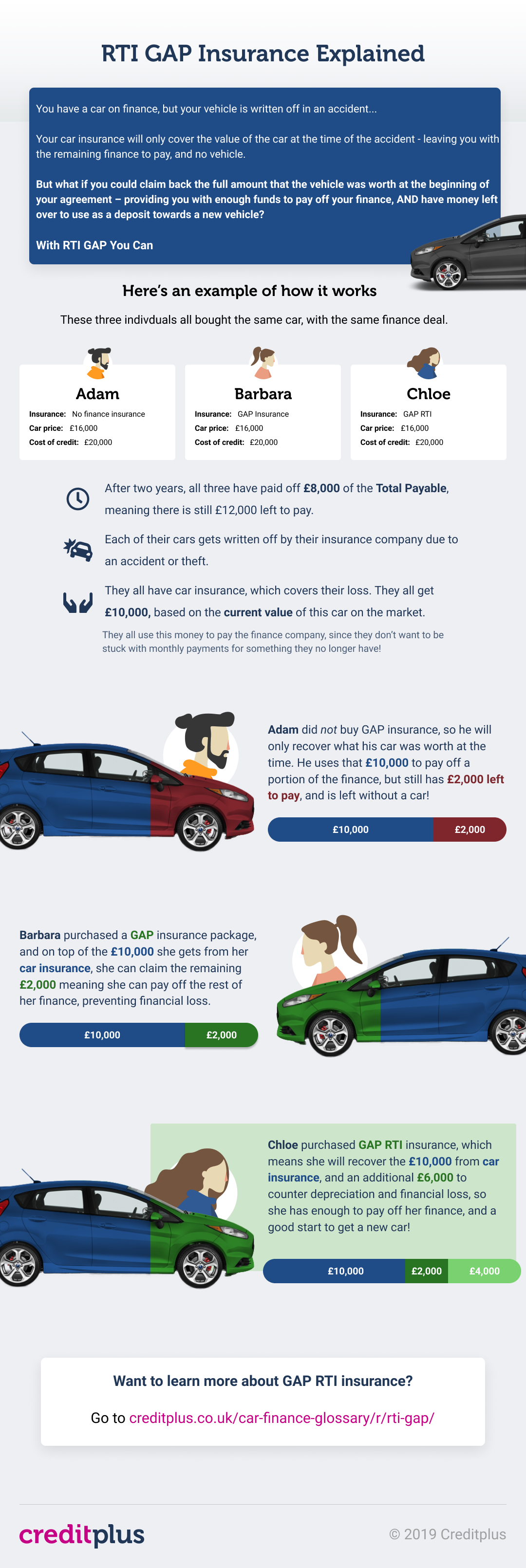

To explain rti gap insurance in more detail, let’s take an example. Gap is suited to customers taking out a finance agreement and may pay the difference between the road risk insurance settlement and the amount your customer still owes. You’re covered for the price you paid for the vehicle or the outstanding finance, whichever is higher.

About your insurance welcome to your ultimate protection combined rti/gap insurance policy. We’ll negotiate with your insurer on your behalf to get the best settlement price for your vehicle. It covers the difference between your insurer’s payout and either the price you originally paid or the amount needed to settle your outstanding finance balance, whichever is the greater.

Return to invoice gap insurance covers the difference between your insurer’s payout and either the price you originally paid or the amount needed to settle y. Our policies protect you for up to three levels of cover. Return to invoice (rti) gap insurance covers the value of your vehicle when you bought it.

Finance & rti gap insurance what is gap insurance? Return to invoice (rti) gap cover is available for new or used cars purchased within the last 6 months. Subject to the claims limit as shown on your policy schedule , if your vehicle is declared a total loss by a vehicle insurer as a result of a fire, theft, or the vehicle sustaining damage (following an accident, or due to malicious damage or a flood),

In the event of your vehicle being declared a total loss, return to invoice (rti) or back to invoice gap insurance pays the difference between the motor insurer’s settlement and the purchase price paid for your vehicle. This pays you the difference between what the insurer will pay you and what you would pay if you bought the car today brand new, or if it was a used car, how much it was when you originally bought it. You can buy rti gap insurance for cars aged from new to 7 years old.

Rti/finance gap insurance covers you for 3 years and gives you back the difference between your motor insurer's payout and the net purchase invoice price or the outstanding finance amount (whichever is greater) so you can buy another car for the original value. Gap insurance, also known as guaranteed asset protection insurance, covers the difference between the value you bought your car for, and the amount. We explain everything you need to know.

Rti stands for 'return to invoice'. It is designed to cover the difference between the amount your car insurer would pay out if your car was stolen, or written off, and the price you paid for your car. This is only available for those who lease their car, with no option to buy it.

Includes £250 towards your motor insurance policy excess. Return to invoice gap insurance. The purchase price of his vehicle was £26,000, and his total amount payable with interest, is £29,510.

Return to invoice gap insurance pays the difference between what your motor insurer pay you** in the event of a total loss claim and what you originally paid for the vehicle. They can also cover you for replacement vehicle insurance (rvi). Suppose you’ve just lavished £15,000 on a car, or have taken out finance to that amount.

What is rti in car insurance? For context, the idv is lesser than the invoice value of your car because of depreciation that happens over years. It pays the difference between your car insurance claim settlement amount and the amount you paid for the car, the invoice amount for the car.

All our policies cover you for guaranteed asset protection (gap) and return to invoice (rti). However it can only be bought within 3 months of buying the car. Rti cover could reimburse any difference between the road risk insurance settlement and original vehicle price.

Rti gap insurance (return to invoice) pays the shortfall between the price of your car and the value at the time of loss. It ensures that if your car is declared a total loss, the difference between your insurer’s payment and the purchase price of your vehicle is covered.

RTI Gap Insurance Return To Invoice Click4Gap

RTI GAP Close Brothers Motor Finance

RTI Gap Insurance Return To Invoice Click4Gap

Autoprotect Combined GAP & RTI Insurance YouTube

GAP & RTI Insurance New Vehicle Solutions

GAP Insurance Explained in a Complete Guide TotalLossGap

What is GAP Insurance? Gap Insurance Explained and the

How can RTI GAP insurance benefit you?

RTI Gap Insurance Return To Invoice Click4Gap

RTIGAP insurance now available in Malaysia for Nissan

Gap Rti At Williams Group Ltd In Maidstone Kent

How can RTI GAP insurance benefit you?

Dealer RTI GAP Close Brothers Motor Finance

Gap Insurance Quotes from £188 Oakland Insurance

RTI GAP Close Brothers Motor Finance

Replacement GAP Insurance GAPinsurance.co.uk Blog

What is Combined GAP and RTI Insurance? YouTube

GAP Insurance Wiltshire, Somerset, Dorset Platinum