It is to protect the business if the movers and shakers of the business were to become disabled or die. Total disability in these policies is typically defined as being unable to perform the material duties of his or her occupation and is not working for the business in another role with similar duties.

The Difference Between Disability Insurance and Key Man

Key man or key person insurance is crucial coverage that provides financial relief and protects your business if one of your critical employees suffers death or disability.

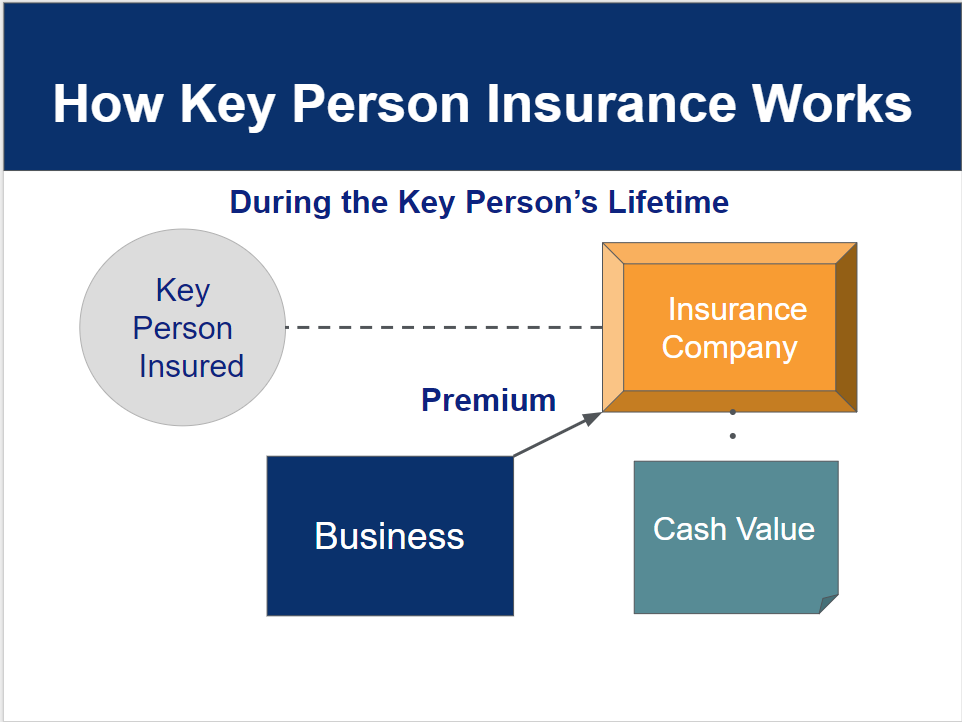

What is key person disability insurance. Disability income insurance is an agreement made between insurance companies and policyholders. Paid for and owned by the business, the policy pays benefits to your business if a key employee becomes totally disabled due to an illness or injury. It can also pay out if they are diagnosed with a terminal illness.

Key person disability is an executive benefit employers use in two ways: Under the key person disability insurance plan, total disability means that because of injury or sickness, the insured person is under the regular and personal care of a physician and is unable to perform the important duties of his or her regular occupation. Key persons can be those significantly impacting operation or generating revenue for the firm.

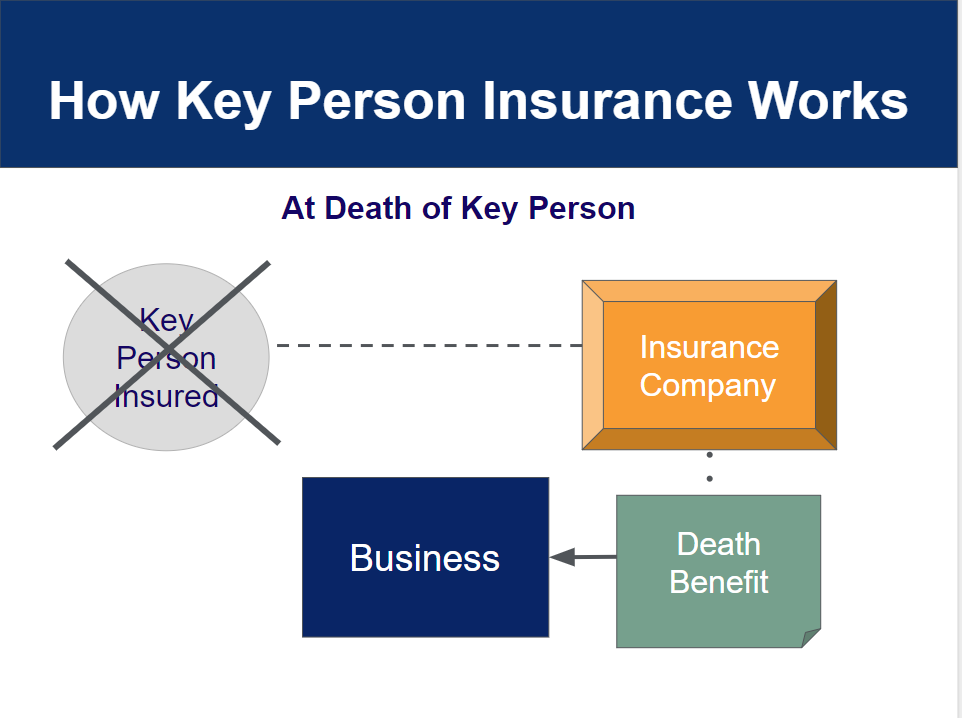

These policies will provide cash to replace the value provided by the key person or to provide monthly income to hire a capable replacement. The goal of key man disability insurance is protect the company from the loss of a key employee or executive do to a disability. It is especially important for small businesses, as the loss of a key person could result in the death of the business.

If that person dies unexpectedly or becomes disabled, key person insurance provides compensation to keep the business running. Key person disability insurance helps your business offset the financial burden of a key contributor being disabled. Disability insurance offers income protection to.

Benefits are payable to the company, are usually tax free and can be used for any purpose. Key man disability insurance is a risk management strategy that can protect any business from a disabling illness or injury to a key employee or executive. It falls under the umbrella of life insurance, and at its most basic form, can be viewed as a life insurance policy taken out by the business on one of its key contributors.

Key person disability insurance provides financial protection for the company if a key person were unable to work due to a disability. A program managed by the social security administration that insures a worker in case of a mishap. Key person insurance helps safeguard a small business if an imperative employee dies or becomes disabled.

By paying the business in those situations, the business is able to stay on their feet until that employee returns or a replacement can be found. It’s also commonly known as key employee insurance or key person insurance. A key person (key man) disability insurance policy is structured to provide your business with funds to help handle the loss of a key employee should that person become totally disabled.

Key person insurance is a life insurance policy that a business takes out on its most valuable employee or employees. Key person insurance is an insurance policy that provides a lump sum if an owner or key employee passes away. Key person disability insurance is crucial if your business depends on one or two key people.

If your business relies heavily on one or two people, one accident can change the prospects of your company overnight! It protects your company if one of your foremost employees—known as a 'key person' in the policy—dies. Key man disability insurance is a risk management strategy designed specifically for the threat of a short term loss of a key person due to a disabling accident or illness.

Key person insurance is life insurance and/ or illness insurance on a key employee of a business. The company buys the insurance and is also the beneficiary of any proceeds should a disability arise. Key person coverage provides cash flow to help companies move forward and maintain a profit in the event that a key employee becomes disabled.

What is key person disability insurance? Key man disability insurance is purchased on one or more key people in a business to protect the business from the economic loss associated with the disability of a key employee. If disability occurs, benefits will be paid, based on the terms of.

Key person insurance is a life insurance policy that a company purchases on an owner, a top executive, or another individual critical to the business. You can take out a key person policy on any member of your team—even yourself. To attract and retain quality employees and to generate income if the key employee is unable to work due to prolonged sickness and/or recovery from an injury.

Key person insurance policies cover the untimely death, disability, or sudden departure of a key person, but they can also provide financial support while the person is recovering from an illness or injury and is unable to work in their previous capacity. In exchange for the monthly payments you make, the insurance company agrees to pay you a monthly benefit amount if you suffer. Alena miles looks at the importance of key person insurance in a business and how it protects the business if there is a key person death, disability, or a serious illness.

This could be the ceo or someone with a specialist trade. A policy can also include a rider for disability coverage to help if a key employee is disabled. It’s designed to cover your most valuable employees.

Keyman insurance, also known as key man or key person insurance, can help protect businesses financially if an individual who is critical to the company dies or becomes permanently disabled. Key person disability insurance has the same premise as key person life insurance. Key person insurance is a risk management strategy, called risk transferring, that deliberately passes on risk to another party.

Key person insurance definition and meaning Market

Key Man Insurance Planning An Essential Part of a

Key Person Disability Insurance YouTube

Key Person Disability Insurance Guide Key Person Insurance

Key Person Life & Disability Vanbridge

Petersen Key Person Disability Insurance The Feigenbaum

Key Person Insurance Business & Life Insurance

BuySell & Key Person Disability Insurance Fortify

Key Person Benefits Key Person Life or Disability

Key Man Insurance What It Is And Why It Is Important

Why Business Overhead Expense Insurance is Critical for

50M Key Person Disability Placement CPS Insurance Services

Key Person Insurance Business & Life Insurance

Business Disability insurance Petersen International

Key Person Disability Insurance YouTube

Key Person Disability Insurance FAQs

Key Person Disability Insurance Guide Key Person Insurance

Key Person Insurance PIC Insurance Brokers

Key Person Disability Insurance Guide Key Person Insurance