What is an insurance binder? An insurance binder is very simple.

What Is An Insurance Binder For A Car?

The time it takes to finish underwriting policies varies, but generally it should take around 10 days.

What is an insurance binder for a car. What is an auto insurance binder for a car? What is a car insurance binder? Insurance binders and car buying.

A car insurance binder is often used to prove that you've insured your car. Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. Your insurance policy is an official contract between you and your insurer — and breaks down all the terms and conditions of your insurance.

An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. An insurance binder may also be called an insurance policy binder, title binder, interim binder, insurance card, or certificate of insurance. If your normal car insurance policy is still being processed, an insurance binder allows you to drive legally in the meantime.

An insurance binder is a temporary insurance policy. A binder will act as your insurance until the underwriting process is through and your car insurance company issues you your actual policy. A typical binder consists of just a page or two of information, but it's a valid insurance contract.

When you purchase an insurance policy, whether it’s homeowners insurance or car insurance, you’ll agree to terms with an insurance agent on everything about your policy. A car insurance binder is temporary proof of insurance that allows you to provide the evidence of coverage required by law that may allow you to legally drive your car if your policy is still being processed. You should see coverages such as liability, collision, or comprehensive coverage, along with each of their deductibles.

An insurance binder includes all applicable to all of the terms. It can be useful to have before your actual policy document is prepared. It binds them to provide you insurance through the binder's expiration date.

An insurance binder only covers the key liability, bodily injury, and property damage amounts in most cases. The same terms that are specified in your policy are also legally enforceable as part of an insurance binder. Here’s how it can help when you’re purchasing a vehicle.

It may be required by a dealership, a leasing firm, or a finance company when you're purchasing a new car. What is a car insurance binder? This gives you proof of insurance on a temporary basis so that you can legally drive your vehicle.

In comparison, an insurance binder is proof of insurance and an actual temporary legal document. It's usually replaced by a policy within 30 to 90 days and dissolves once the policy has been issued. It's a temporary legal placeholder until your official insurance policy is issued.

While your policy will contain all the details of your insurance, your binder will provide an overview of the important points. It serves as proof of insurance, but only for a given period. An insurance binder is a legal document that provides proof of temporary coverage.

People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. It also allows you to drive your new car off the lot or close the deal on your new mortgage. An insurance binder basically proves that there’s a formal agreement in place between you and the insurance company.

At its simplest definition, a car insurance binder is temporary car insurance. It provides you with a document showing evidence of insurance (link). It is often not known exactly what binder insurance includes.

Only a certified insurance professional may prepare an insurance binder, and you can receive it upon request within one to two days. An insurance binder is a temporary insurance policy that allows you to drive a recently purchased vehicle until your actual coverage starts. A car insurance binder serves as a temporary form of insurance as your policy is being processed.

Insurance certificates or cois are only proof that you have insurance for some time. A car insurance binder or an auto insurance binder will provide proof of an insurance policy purchased of your car. An auto insurance binder is not an insurance policy.

Due to the underwriting process sometimes taking a longer period, an automobile insurance company can issue a car insurance binder. An auto insurance binder is a legally binding albeit temporary proof of insurance that you can present when you need to. It’s a confirmation from the insurance company that you have temporary coverage.

The association for cooperative operations research and development is mainly issued by acord. Even though the binder is only an interim certificate of insurance, it is a fully enforceable contract of insurance. If you’re about to buy a car, but you haven’t chosen an official insurance policy, it could mean trouble.

The basic conditions, coverages, deductibles, and named insureds that will appear in your insurance policy will be specified in your insurance binder. Learn more about insurance binders and what you need to hit the road. A car insurance policy is an official contract between a driver and insurer and includes all the terms and conditions of your insurance.

A car insurance binder is a temporary form of insurance. An insurance binder solves this problem. What is an insurance binder?

An insurance binder summarizes the details of your insurance policy, such as the coverage, deductible amount, and listed drivers. An insurance binder is a provisional document provided by an authorized insurance professional that acts as proof of insurance. In other words, when you obtain a binder, you have proof of coverage that your proper insurance is being prepared.

When purchasing a new home or car, you'll typically need insurance that begins the day you assume ownership. All it is is a few pages of paperwork that serves as temporary evidence of insurance. An insurance binder is a temporary contract that is fully enforceable insurance, proving that you have insurance coverage while waiting for the official insurance policy document.

That will be sufficient to complete the deal, enabling the full insurance policy to get put into place. An insurance binder is just meant to allow for temporary insurance for a few days as someone transitions a new car or adds insurance to their policy. It incorporates all the terms and limitations in the policy, including the conditions.

What's the difference between an insurance binder and a policy? The insurance binder specifies all the protections for which you are covered while you wait for a new policy, as well as any coverage limits, deductibles, fees, terms and conditions.

Insurance Binder Template 9 Images Home Inventory

Car Insurance Binders Explained What Is a Car Insurance

Insurance binder form insurance

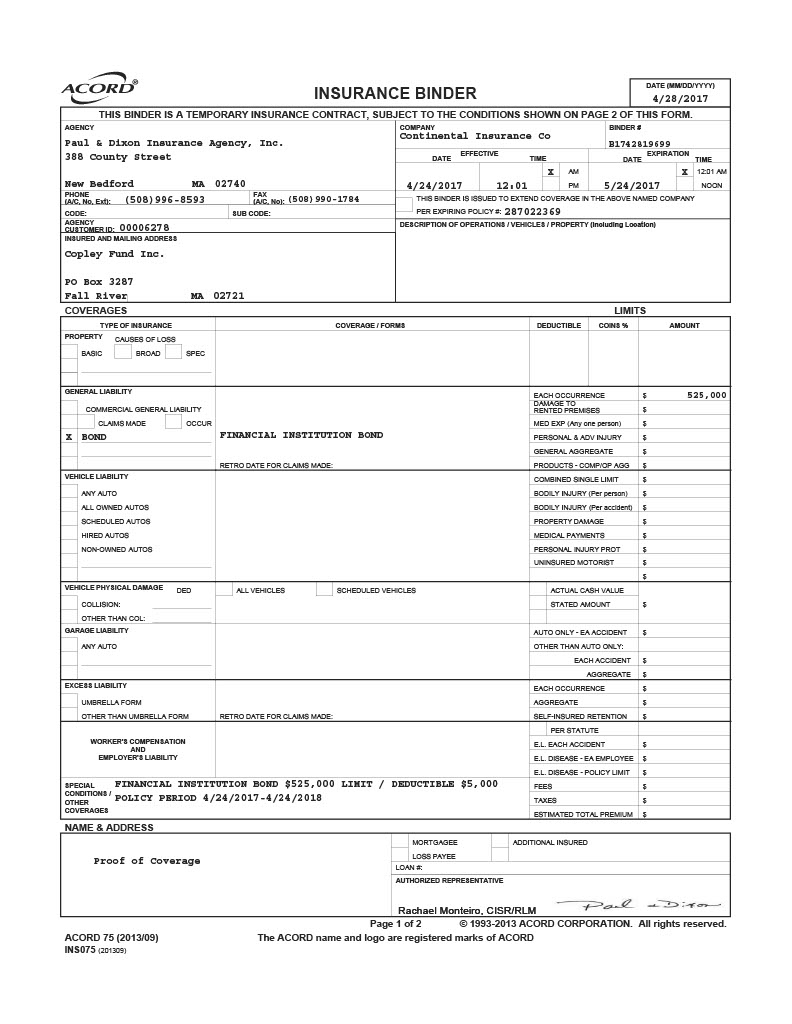

Acord Insurance Binder Example inspire ideas 2022

Acord Insurance Binder Example inspire ideas 2022

Acord Homeowners Insurance Binder inspire ideas 2022

Acord Insurance Binder Example inspire ideas 2022

Insurance Binder What it is, How it Works Honest Policy

Insurance Binder What it is, How it Works Honest Policy

Homeowners Insurance Binder (Simply Explained)

Evidence Of Property Insurance Vs Declaration Page Awesome

Auto Insurance Binder Form Universal Network

Acord Homeowners Insurance Binder inspire ideas 2022

What Is a Binder In Insurance And When To Use It

What is an insurance binder insurance

Acord Insurance Binder Example inspire ideas 2022

8 Images Home Insurance Binder Acord And View Alqu Blog